Amaze is a Forex trading tool developed by Anton Kondratev. It works by identifying and taking advantage of the market vulnerabilities. As per the developer, the FX EA uses a fixed SL and TP level for every trade it executes. This EA is a multi-currency system that supports the AUDUSD, USDJPY, EURUSD, and GBPUSD pairs.

Amaze: to trust or not to trust?

For a Forex robot to be effective it has to satisfy certain important criteria including a proper strategy, good performance, reputability, and reliability. We have evaluated this ATS using these criteria. From our assessment, our initial conclusion is that this is not a reliable trading tool. Let us first look at the features of this FX robot before analyzing the significant factors that make it untrustworthy.

Features

According to the developer, this EA does not trade during the night. The default settings are for the EURUSD pair using the H1 timeframe. Other than the fixed SL and TP, there is the option of activating trailing stop and virtual SL. Optional activation of Grid with SL and averaging is also present. As per the developer, this ATS does not employ indicators or integrated methods for averaging historical quotes. There is no mention of the approach used which raises a red flag for this EA.

Recommendations for using the FX EA include a minimum deposit of $100, the leverage of 1:500, and the default settings for the EURUSD pair. The developer claims that this system has protection from broker slippage, large spreads, gaps, and repeated levels. Upon evaluation of the features here are the main factors that affect the effectiveness of this EA.

Absence of real trading results

We could not find live trading results for this FX EA on reputed sites like Myfxbook, FXBlue, FXStat, etc. The lack of a verified trading performance raises a red flag for this system. Without live results, it is difficult to trust a system irrespective of the tall claims that the vendor/developer makes. With this EA, the developer fails to provide verified results. There are a few backtesting reports and trading result samples that do not have any significant value concerning the performance.

Backtesting results

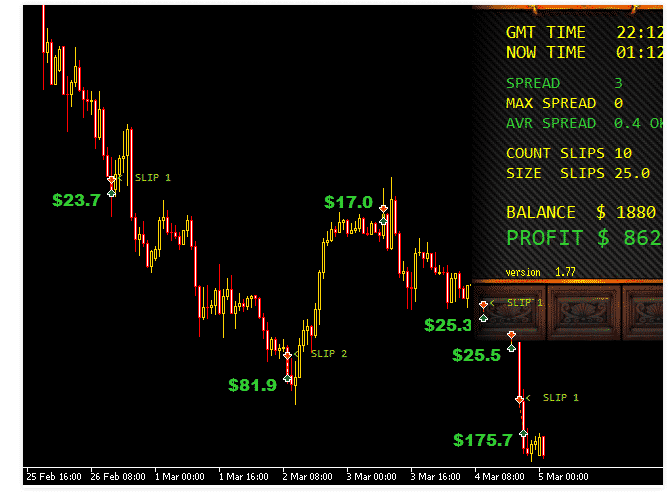

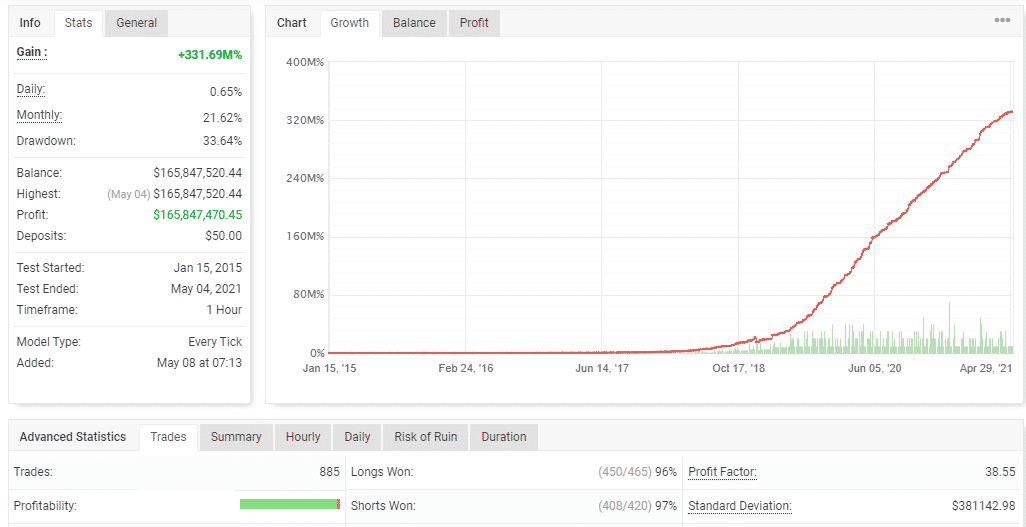

A backtesting report for this FX EA is present on the myfxbook site. Here are screenshots of the report.

From the backtesting, we can see the test started in 2015 and ended in 2021. It used the Every Tick model on the H1 timeframe. A daily and monthly profit of 0.65% and 21.62% was present for the account with a drawdown of 33.64%. The high drawdown indicates that the strategy used was of high-risk type.

Further, analyzing the advanced stats, we find that the total number of trades executed was 885 with a 97% profitability and a profit factor of 38.55. While the profits look good, we need to remember that the test was based on historical data and hence cannot be used to predict future performance. Backtests generally provide a better insight into the approach used and, in this instance, the test result indicates a high-risk approach.

Negative user reviews

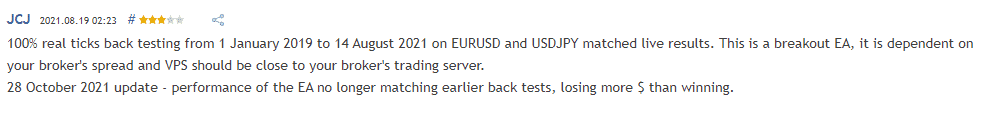

We found 19 reviews for this FX EA on the MQL5 site with a rating of 3.61/5. Here are a few of the feedback from users.

From the reviews, it is clear that the system does not show a profitable performance as seen in the backtests. The reviews indicate that the losses are more than the winning trades which indicates poor performance and unreliability.

Expensive price

This FX EA is sold for $325. A free demo is offered for the product. However, there is no further info on the features available with the package like the support, updates, number of real accounts, etc. The lack of info makes us suspect the reliability of this system. Further, there is no mention of a money-back guarantee which is another indicator that this is an unreliable trading tool.