The pursuit of riches in the highly competitive $6 trillion currency marketplace is the trigger behind the increased use of advanced technologies. Gone are the days when people had to call brokers to place trades, let alone spend hours glued to the screen trying to gain a competitive edge. Technological advancement has transformed the trading landscape, making it a lot easier and faster.

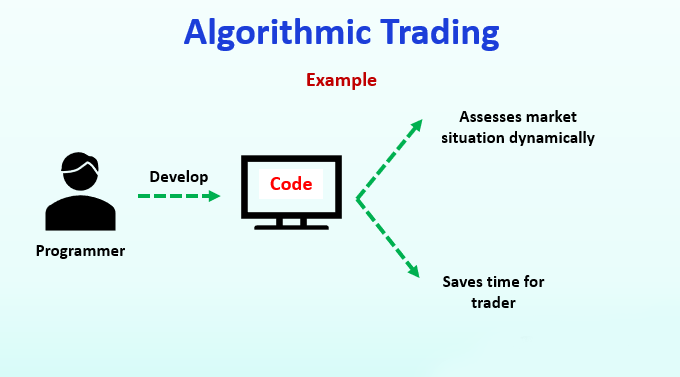

Algorithmic trading is one of the strategies that has come about thanks to technological advancement. With computer programs now part and parcel of human activities, they increasingly find excellent use in trading.

Algo trading or computer trading entails the use of computer programs to trade. Such programs come with pre-set instructions that govern how trades are opened and closed. Likewise, all trading activities are carried out automatically without any human intervention.

In the fast-paced digital world, most transactions in the markets are carried out by computer programs programmed to place trades and take profits while managing risk. The rules that govern the opening and closing of positions are based on time, price, volume, and other mathematical models.

Algo trading in action

Algorithmic trading is based on instructions that computer programs are required to execute. For instance, a programmer could program an automated trading system to buy 100 shares of company stock when the 50-day moving average crosses the 200-day moving average below and continues moving lower.

Similarly, a programmer could program a system to sell EUR/USD pairs as soon as the 50-day moving average crosses the 200-day moving average from above and continue moving lower. The crossover often signals increasing selling pressure.

With the two sets of instructions integrated with a computer program, an automated trading system will monitor the stock price and the currency pair price all day long, waiting for the crossovers to occur. Once the conditions are met, the program would enter a position as per instructions.

In this case, a trader would not have to spend hours on the screen, waiting for the crossovers to occur to place traders. All action occurs automatically and requires no human intervention.

When is algorithmic trading used?

Algo trading is finding great use among people looking to profit from short-term price fluctuations. Institutional investors who are usually investing for the long haul leverage automated trading systems to analyze the market spot opportunities and execute trades.

Short-term traders are also increasingly leveraging Algo trading to take advantage of short-term price swings in the stock, currency, and commodity marketplace. Such systems eliminate human emotions, making it easy for traders to enter and exit trades as fast as possible, based on a predetermined set of instructions.

Systematic traders fond of following long-term trends are also profiting a great deal from Algo trading. Computer programs can detect long-term trends and price patterns that the naked eye would often struggle to identify.

Top algorithmic strategies

Trend following

Trend following is one of the key strategies leveraged by automated trading systems as part of Algo trading. In this case, trading systems are programmed to leverage moving averages, channel breakouts, and technical indicators to identify long-term trends.

In return, the systems open trades in the direction of the primary trend, which could be long or short. Trades are often closed as soon as a reversal occurs. In most cases, the computer programs leverage the 50 and 200-day moving averages to identify long-term trends.

Range trading

Algo trading has also given rise to computer programs that identify whenever markets are range-bound. Similarly, the computer programs open long positions at a support level and close as soon as the price rises to the resistance level in a tight range. Likewise, the program would open a short position on the resistance level and close it as soon as it hits the support level.

Besides, such systems also identify whenever asset prices break out of ranges and open positions in the direction of the new trend from the range.

Arbitrage opportunity

Arbitrage is a trading strategy whereby traders profit from market inefficiencies when it comes to asset pricing. In this case, a trader could buy a security in one market and simultaneously sell it in another market. Given that the strategy looks to exploit short-lived variations in the prices of identical financial instruments, the trading action must take place fast before the inefficiencies are acted upon and the opportunity eliminated.

An Algo trading system should identify such pricing inefficiencies, open a long and a short position, conversely allowing a trader to profit before any adjustment takes place.

Why algorithmic trading?

Algo trading offers some of the best ways of gaining a competitive edge in highly competitive marketplaces. The computer programs in use can execute trades at the best possible price that a normal human would struggle with. Also, such systems are known to execute orders instantly and accurately.

The rule-based trading strategy eliminates the human emotion aspect in trading. Such systems execute trades based on pre-set instructions, thus averting the risk of opening and closing trades simply because the price is threatening to move in a given direction. Similarly, the strategy reduces the possibility of mistakes that are common with human traders.

Leveraging computer programs in trading also averts the need to spend hours on the screen in search of trading opportunities. Such systems analyze the market on behalf of traders and place trades with a high probability of generating significant returns.

In addition, Algo trading comes with the ability to backtest. It is difficult for human traders to know the exact parts of their working strategies and those that are not. However, it is much easier and faster to test the strategy with past data with computer programs and see if it works.

Bottom line

Algo trading is an effective way of trading the financial market while following a tested set of rules. Computer programs to initiate trades eliminate human emotion in the trading activities and allow traders to take advantage of all opportunities that crop even when away.