It is a known fact that most forex traders end up failing. Multiple blogs and websites even go on to say that about 90% of the traders, which is a healthy majority, end up losing money and quitting. In this article, we focus on how successful traders manage their way in this market and why it may be tough for beginners to gain ground.

Forex easy money fairy tales

Traders and brokers are attracted to the Forex market, believing that they’ll quickly make a fortune using a few simple strategies. There is a lot of greed involved that pushes past the concepts of learning and hard work.

Many forex traders believe that buying a trading system will be enough for them to make money. But, in reality, that is not the case. Similarly, traders also fall prey to having unrealistic goals about what they can do with the forex market. For instance, many of them think of target returns of more than 20%. However, in the financial market, this is unheard of.

Beginner traders also fail to manage risks and get wiped out because of this. They ignore stop-loss orders and do not get out of the trade when it ceases to make any sense. Many traders also refuse to be wrong. Leadership, ambitions and human nature wants to be right, but sometimes it just isn’t. Unsuccessful traders cling to the idea of being right even as they head towards a zero-balance account.

It can be hard to admit that one has been wrong, but that is what separates the successful from the unsuccessful traders. Whatever the reason may be, the best thing to do is to admit the fault, dump the trade, and move on to the next one. Some other reasons why traders fail include:

- Trading without any plan

- Having unrealistic expectations

- Poor risk management

- Not having a trading discipline

- Giving in to emotions

Forex brokers’ wants vs. Forex traders’ needs

Both forex brokers and forex traders are a means to trade in the forex market. But, sometimes, they inspire nothing but confusion. What works for one may not work for another. Let us take a look at the chief differences between them.

Brokers work in brokerage firms, which fix the prices and the fee. They collaborate with other brokers and hold assets to keep the supply of that asset intact. In order to sustain demand and attract customers, they maintain similar prices for their services in the market.

Traders go through forex brokers to execute trades. It doesn’t matter if traders make gains or losses, brokers will make money through fees and commissions. Brokers who have high leverages, make fast executions, and are networked with large forex dealers tend to get competitive quotes in day trading. But, traders do not need to have high leverages or small minimal deposits that work for brokers.

Losses are given in forex trading. A lot of trades are going to be nothing but losses for you before you have a chance of accumulating profit. For that reason, it is important to have some capital beforehand – you need money to make money. But, what’s more important than having a lot of capital is keeping trade sizes small, relative to your capital means having low leverage. This way, you will be able to take the brunt of higher trade multiples bound to occur in losing streaks or drawdown.

Speculators, who use positive carry trades should keep in mind that brokers are also interested in these spreads, making most speculations unprofitable except the highest yielding trades. Trade sizes also need to be big in relation to your capital for the carry interests to make a difference to the result.

Small bet matters

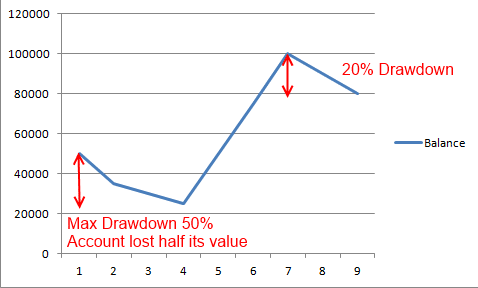

Traders who keep their risks small ensure that if they lose, they lose small. Whatever reduction of capital they experience after losing trade is known as drawdown. It is important to keep the proportion of the drawdown to the account capital low if one is to survive in the forex market for long. Traders tend to experience drawdown from time to time and one must keep its percentage to a minimum.

That is why successful traders stick within 0.5% – 2% range of the trading account per trade. That way, even if they land in a long losing streak, they are still fine and can recover their losses quickly once the range reverses. This is one rule that traders ignore at their peril. Plus, maximum losing streaks depend on the win rate.

Many traders believe that their future probabilities change based on what has occurred in the past when in reality, they remain unchanged. This is called ‘The Gambler’s Fallacy.’ As human beings, we sometimes tend to ignore simple probability and believe that if something has occurred multiple times, it couldn’t occur again.

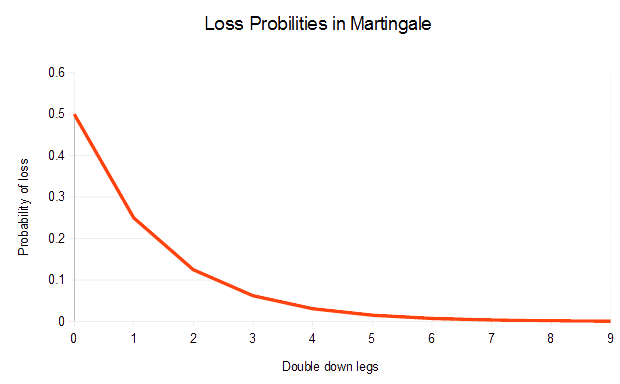

One trading system that works quite well for traders is the Martingale System. This strategy relies on the theory of probability and it was most commonly practiced in Las Vegas casinos. This is why casino biases, like minimum and maximum betting amounts, exist.

Under certain conditions, the Martingale System allows traders to have a predictable outcome without predicting the market directions. If you have enough capital and keep the percentage of your trade value low relative to your total capital, then this system can work for you even if your trading skills are no better than chance.

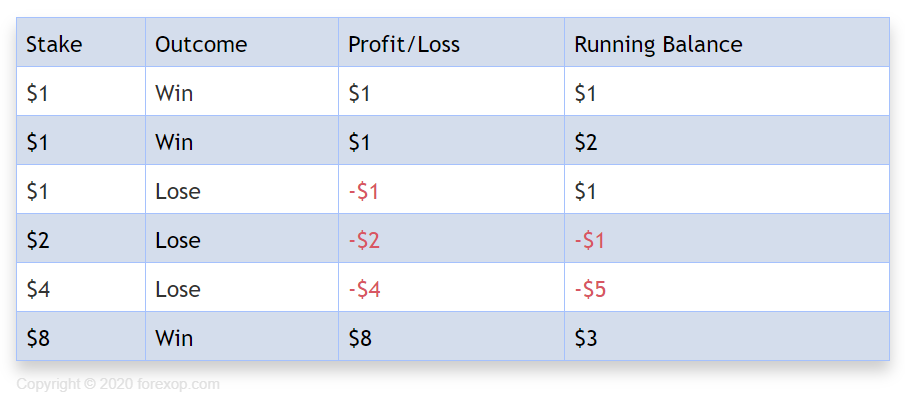

The main idea with Martingale is that you double your trade size until you hit upon a winning trade. Due to the doubling effect as soon as you get a profit, you can exit the trade. The table below shows this idea with a 50:50 chance of winning and losing.

The main thing to keep in mind about this system is that it doesn’t improve your winning odds and is only governed by successfully picking up the winning trades.

Conclusion

Those who are looking to start trading in the forex market should be cautious and aware of the reasons why the majority ends up losing. Most people lose because they have unwarranted expectations, greed, and do not know enough what the forex market can do for them. Many believe that simply getting a system will make them rich. But, trading in the forex market is a skill that requires understanding, patience, some capital, and a sober mind.