Currency pairs in the forex markets are susceptible to many factors that affect the rate of price changes. Economic releases and geopolitical developments are known to sway sentiments, consequently influencing exchange rate variations. How volatility affects a financial instrument is an essential factor commonly looked at by people looking to profit from the rate of price changes.

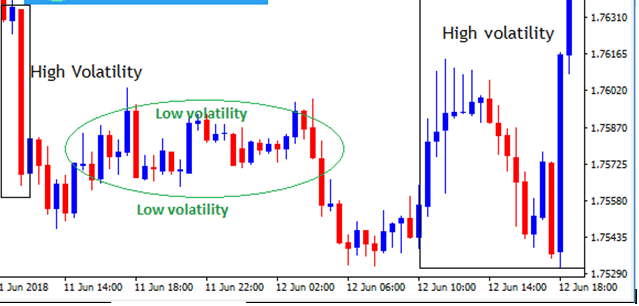

What is volatility?

Simply put, it is the extent to which the exchange rate of a given currency pair changes. While some are known to exchange rapidly over a short period, some take an eternity to move even the smallest pips. In addition, some pair’s exchange rates can change significantly on the smallest of news or fundamental developments.

Volatility is observed as it provides valuable insights on breakouts and potential investment opportunities.

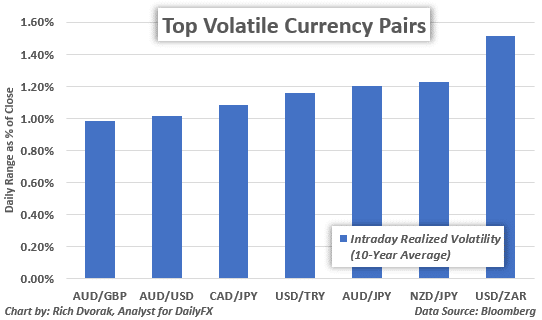

Most volatile pairs

Additionally, the metric allows people to know in advance the profits or losses they are likely to incur depending on the level of oscillation that comes into play on a given day.

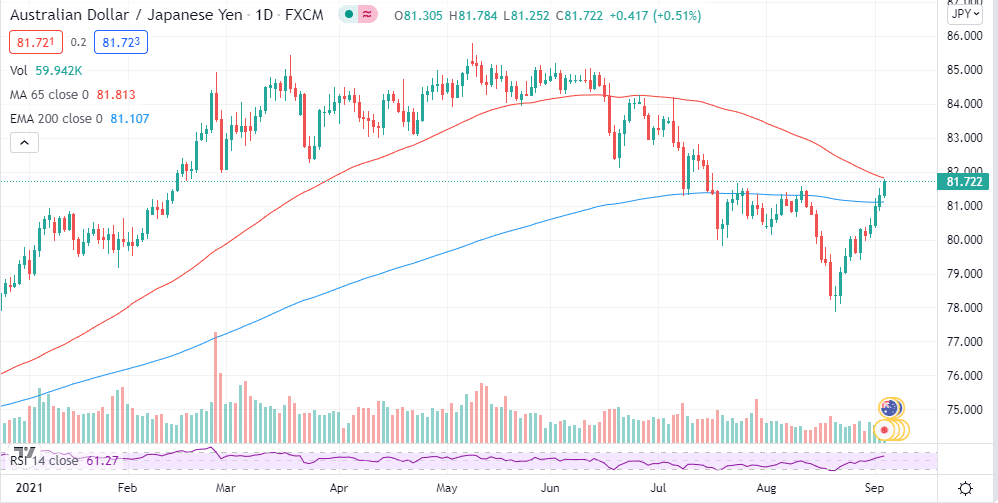

AUDJPY

It is one of the most volatile pairs, given the nature of the currencies involved in the combination. The Australian dollar, the base, is susceptible to commodity prices as a net exporter of minerals, metals, and agricultural products. Consequently, any development that significantly impacts the demand and supply of certain commodities tends to have a substantial effect on AUD strength, triggering significant swings on the AUDJPY pair.

Additionally, the Japanese yen is the least volatile among the majors. This is partly because of its role in the global financial system, given its safe-haven status. Consequently, people often turn to it in times of global uncertainty. The increased demand often impacts its sentiments and strength in the AUDJPY. Japan being a net importer of oil also means the yen is always susceptible to fluctuating oil prices.

The inverse relation between the AUD and JPY gives rise to heightened volatility on the combination. Depending on how the global economy is doing, price movements on the AUDJPY pair can be dramatic; thus, the pair should be handled with caution on the risk-reward front.

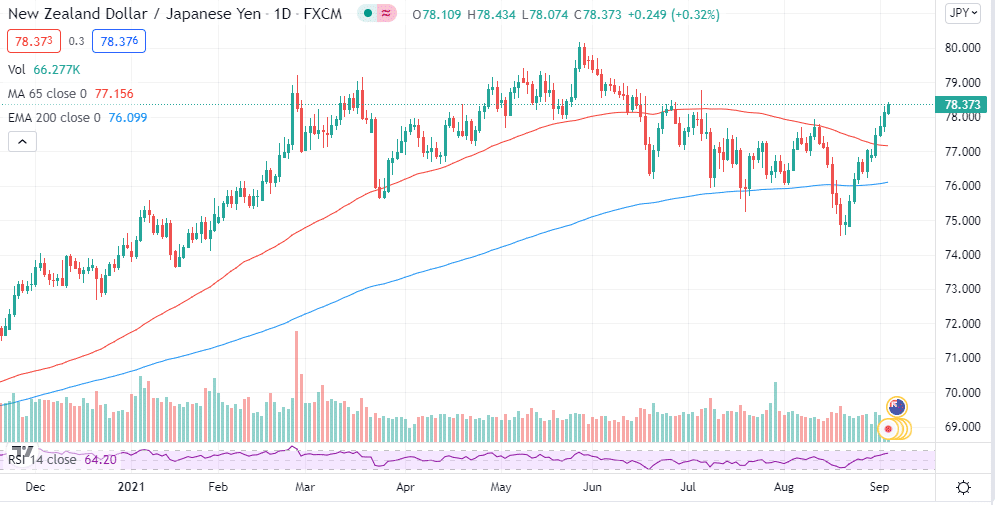

NZDJPY

NZDJPY is also extremely volatile when compared to other crosses in the forex market. The increased volatility has to do with the fact that the New Zealand dollar is a commodity currency. This means the currency value depends greatly on the fluctuation of commodities.

The NZD sentiments are especially dependent on the demand and supply of meat, dairy products, eggs, and honey in the export market. Given that these products are at the heart of people’s day-to-day lives, a significant price change tends to trigger extreme levels of volatility on the pair.

The Japanese yen, as discussed above, is relatively stable and immune to extreme levels of volatility. The safe-haven status gives it an inverse relation to the NZD, thus the increased levels of volatility. In times of uncertainty, on the global scene, the NZDJPY price could tank as people buy the yen and shun the NZD. Similarly, in times of booming international trade resulting in strong demand for NZD exports, the NZD tends to strengthen, increasing the exchange rate.

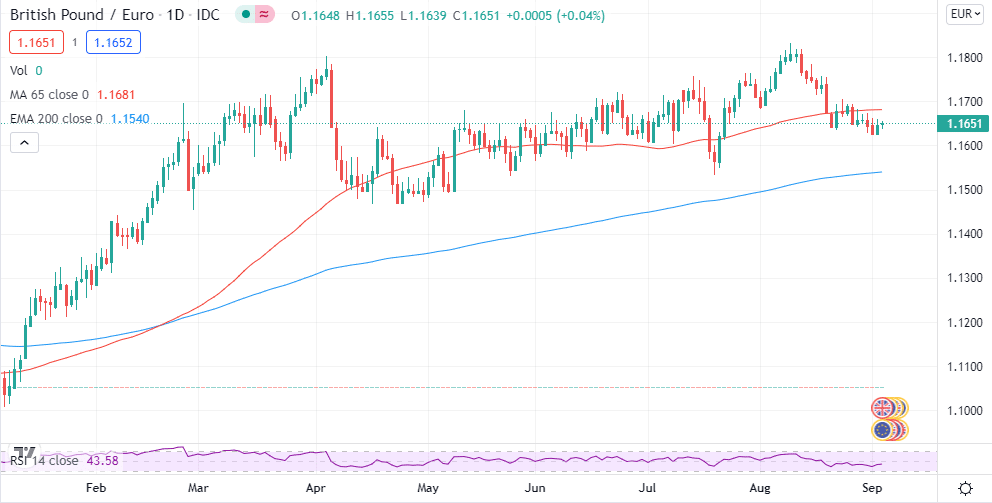

EURGBP

The amount of volatility was not that high on the EURGBP pair until the UK pulled the plug on being part of the European Union. The BREXIT has triggered extreme levels of volatility on the instrument making its price fluctuate rapidly even with the smallest of developments in the region.

Given its exit from the block, the pair tends to fluctuate significantly as market participants react to key policy announcements touching on how the UK will associate with the European Union. Crucial votes in the House of Commons are also known to trigger wild price swings on influencing people’s sentiments on the pound.

Following BREXIT deal defeat in the House of Commons, the sterling fell by as much as 7% in 2018 as the uncertainty around Brexit unraveled

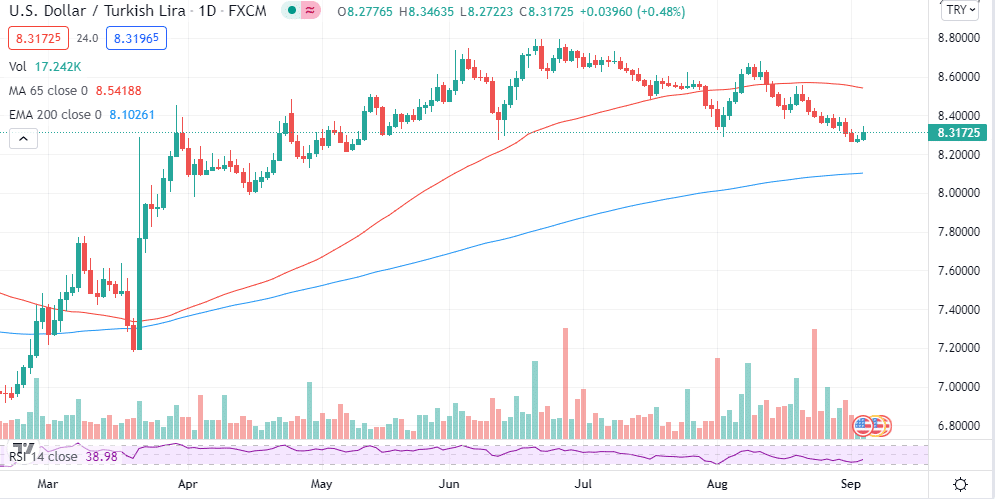

USDTRY

USDTRY is one of the most volatile pairs whose exchange rate can fluctuate by as much as 7% on a single day. The increased volatility stems from the political instability in Turkey despite it being one of the fastest-growing economies in Europe.

Aggressive monetary policy measures implemented by the Turkey central bank have also left the Turkish lira susceptible to heightened levels of volatility. On the other hand, the US dollar is known for its relative stability as one of the safe-havens in the global financial system. The inverse relation between the two should continue to trigger wild swings on the pair. Additionally, USDTRY looks set to remain volatile until the political instability in Turkey is sorted out.

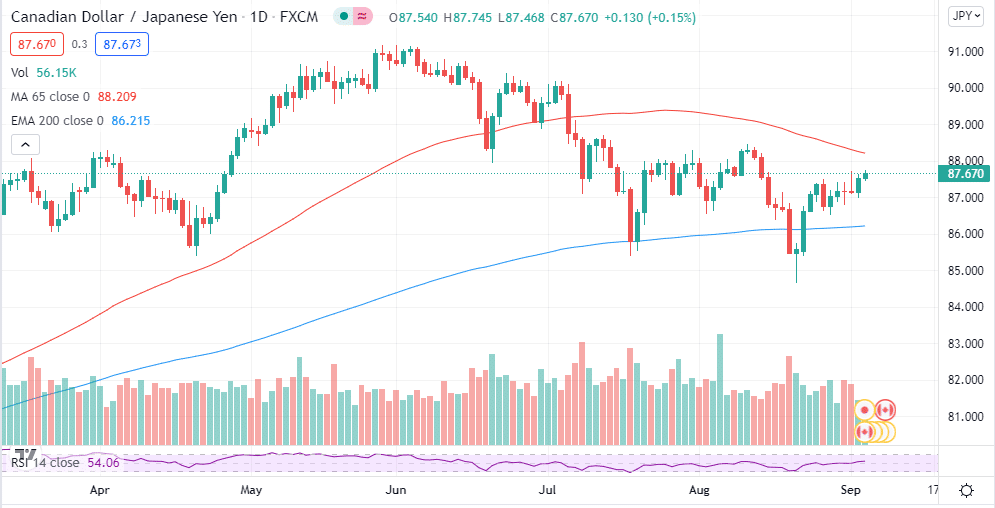

CADJPY

CADJPY sums up the top five most volatile pairs, pitying the commodity price-dependent Canadian dollar and safe-haven Japanese yen. Canada is a net exporter of oil; thus, the value of the CAD is heavily reliant on the prices of oil in the market. In contrast, Japan is a net importer of black gold.

Whenever the price of oil increases, the Canadian dollar tends to strengthen, given the increased prospects of generating more revenue from the oil business. Consequently, the CADJPY rate tends to increase. In contrast, the yen weakens as more yen must be converted to CAD to finance oil purchases. Additionally, higher oil prices mean the increased cost of purchasing the commodity.

Bottom line

Volatile currency pairs are known to offer enticing trading opportunities, given the wild price swings that often come into play. However, the heightened volatility levels can be a double-edged sword that can result in significant profits and losses in equal measure.

Additionally, volatile instruments are not as liquid as the major currencies. This is because people tend to shun them to stay clear of the dramatic price changes. The reduced liquidity can make it difficult to open and close positions in the forex market at the desired price points. However, it is still possible to profit from these pairs with a well-thought plan, given the significant price swings that often come into play.