Emerging markets (EM) are countries that are between developed and developing countries like the United States and the UK. These countries tend to have relatively higher risks and faster economic growth. A good example of an EM country is China, a country that is seeing strong growth in technology and manufacturing.

Emerging market currencies tend to be great for day trading because of their significant volatility. However, many forex brokers tend not to provide some of these currencies on their platforms. In this article, we will look at some of the best emerging market currencies that you can day trade.

South African rand

South Africa is the biggest and most industrialized economy in Africa. The country’s key sectors are manufacturing, mining, and retail. In mining, South Africa is well-known for its key commodities like gold, platinum, and palladium. In the past, mining was the biggest part of the economy. Nowadays, however, its role has declined as the number of shipments has declined.

The South African rand is a good emerging market currency to trade in for several reasons. First, the currency tends to be a bit volatile because of several factors such as politics and high national debt. Second, unlike several emerging market countries, South Africa has an independent central bank that makes its decisions well. This is unlike Turkey, where the president has an important role in monetary policy.

Third, the South African rand is offered by most forex brokers. The most popular pairs with the currency are the USDZAR, GBPZAR, and EURZAR. Fourth, South Africa has a floating currency, which means that its movement is usually determined by the market. This is unlike in Hong Kong, where the currency is pegged to the US dollar.

There are several catalysts that tend to have an impact on the South African rand. First, like in most democratic countries, there tend to be significant political issues in the country. For example, in 2021, the country experienced riots when a court sentenced the ex-president to prison.

Second, South Africa tends to be in focus by rating agencies like Moody’s, Fitch, and S&P Global. This focus is mostly because of the debt situation among some of the biggest companies in the country like Escom and South African Airlines. Therefore, the currency tends to react whenever these companies deliver their ratings.

Third, the currency is affected by the decision by the South African Reserve Bank (SARB), which usually meets 8 times per year.

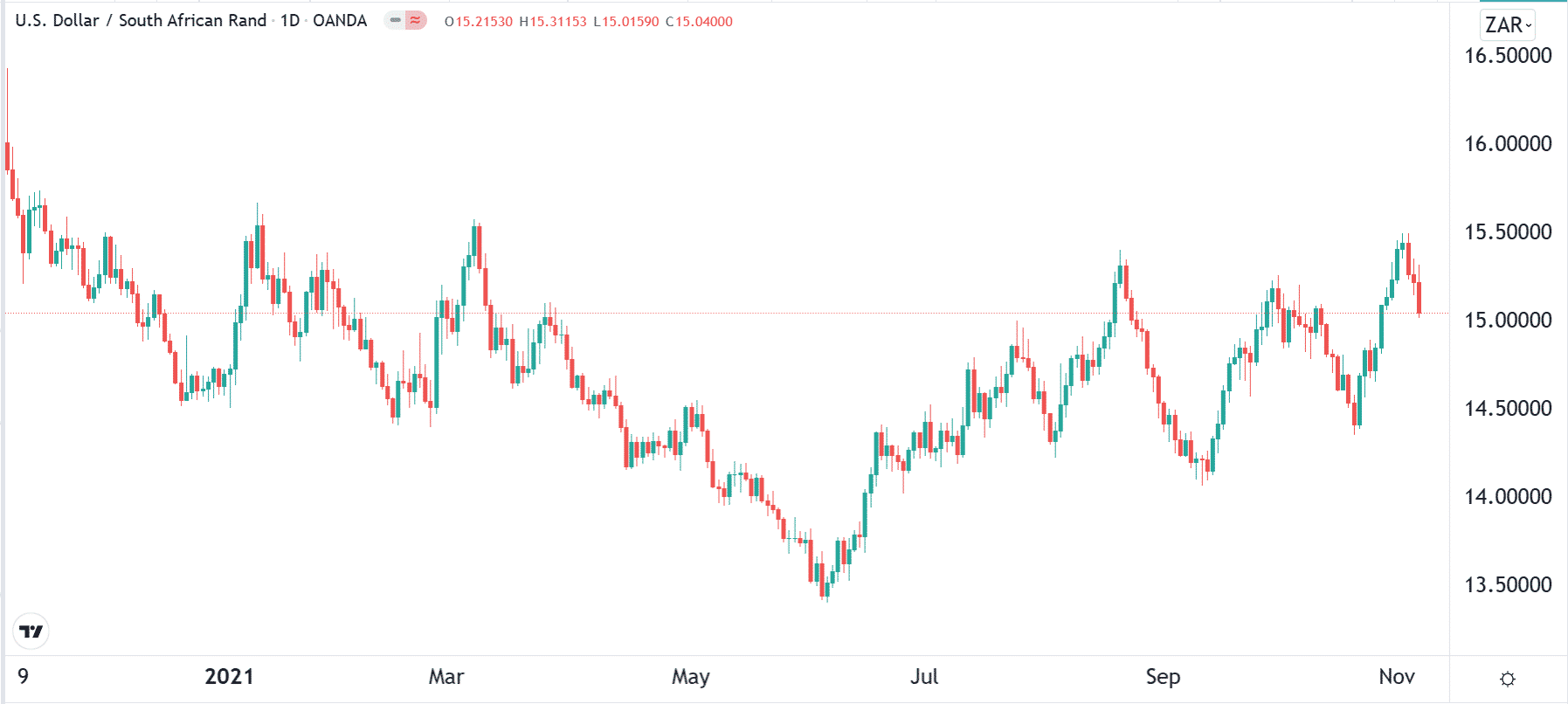

The daily chart above shows USDZAR last year’s price action. As you see, the pair is volatile while still quite smooth compared to other exotics.

Brazilian real

Brazil is a country with a GDP of more than $1.4 trillion, making it one of the biggest economies in the world. It has a population of more than 188 million people.

Brazil is known for several reasons. In addition to its strength in soccer, the country is home to the Amazon rainforest and is one of the biggest sources of agricultural products.

Brazil’s economy is made up of key sectors like services, agriculture, and industrial. Its central bank meets about eight times per year. The central bank is relatively independent. The most common currency pairs with the Brazilian real are USDBRL, EURBRL, and GBPBRL.

Trading the Brazilian real makes sense for several reasons. First, the currency’s movement is driven by several external factors. For example, it is influenced by the performance of the agricultural sector since Brazil is one of the biggest producers of corn and soybeans.

Therefore, in most cases, the movements of these commodities tend to have an impact on the currency. For example, the real does well when their prices rise because it means that the country will have more foreign exchange.

Second, the country is affected by geopolitics, especially between the United States and China. When US and China relations worsen, soybeans prices tend to be affected. For example, during the Trump era, their prices rose when China added tariffs on US soybeans.

In addition, the real is a good emerging market currency to trade because of the decisions by the country’s central bank and the tough political environment.

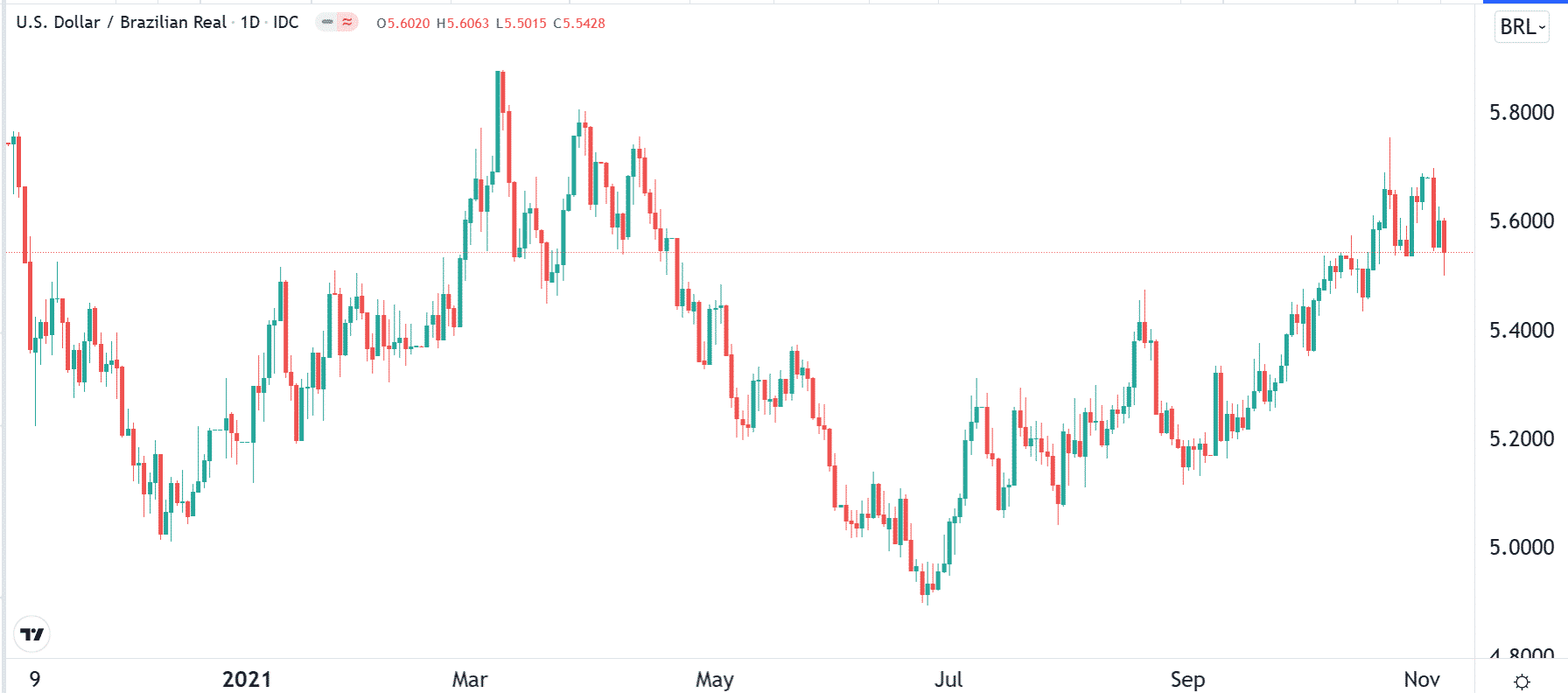

In the daily chart above, the USDBRL can be considered trending. However, the pullbacks are usually sharp, making the overall price action quite choppy. Traders should employ wide stop losses when trading this pair.

Mexican peso

Mexico is a country with a GDP of more than $1 trillion and a population of more than 128 million people. The country is known because of its close relationship with the United States, the biggest economy in the world. The Mexican peso is widely traded alongside the US dollar and the euro.

Mexico has a relatively diverse economy. Because of the United States, Mexico, and Canada (USMCA) trade agreement, the country is a major manufacturer. Indeed, the country manufactures items for leading companies like General Motors and Ford.

Second, Mexico is a leading player in the oil and gas sectors. It drills and imports millions of barrels every day. Also, it is a richly agricultural country.

The Mexican peso makes a good currency to trade for several reasons. First, it is affected directly by the performance of the American economy. When the US does well, Mexico also benefits due to the exports increase. Second, as a leading oil company, the peso is affected by the performance of the commodity. Third, the currency is usually impacted by the regular interest rate decision by the Mexican central bank.

![USDMXN performance]](https://fxeareview.com/assets/2021/11/Emerging-Market-Currencies2.png)

The daily USDMXN chart above reveals a ranging character of the pair for the last year. The mean reversal strategies might work well in this market environment.

Turkish lira

The Turkish lira is one of the most volatile currencies in the world because of the lack of independence by the central bank. In the country, the president can fire and hire anyone to become governor. In the past few years, the president has hired and fired more than 5 governors. As a result, the Turkish lira has been in a major sell-off, as you can see below.

Therefore, since volatility is a good thing for traders, you should always have the Turkish lira on your radar. The country also publishes regular economic data, including closely watched inflation numbers. Also, the Central Bank of the Republic of Turkey usually holds regular meetings that tend to have an impact on the currency.

Considering the USDTRY chart above, traders can do well if they follow the trend and use stop losses according to the market volatility.

Summary

Trading in emerging market currencies can be a highly profitable thing to do. In this article, we have looked at some of the best emerging market currencies that you can trade. Other notable mentions are the Singapore dollar and the Russian ruble.