In general, Forex merchants regard Bollinger Bands to be a definitive indicator that gives them the exact measurements of volatility in a specific market.

If you are a novice trader, you might be thinking about using it to place your trades and what trading strategies will be most advantageous for you. Using a proper strategy can give you a much-needed edge in the market.

What are Bollinger Bands?

Bollinger Bands were introduced in the 80s by American financial analyst John Bollinger. They elucidate the high and low values of a pair in the Forex market. While the upper BB illustrates the high values, the low values are represented by the lower BB.

In the midst of the upper and lower bands, there lies a middle band, depicting the Simple Moving Average (SMA) between the other bands.

By analyzing the bands, you can recognize specific paradigms and make a comparison between price actions. You can also use other oscillators in tandem with this one to find out what the future holds for the market.

Once the worth of a pair reaches the lower BB, merchants generally enter long trades, and when the prices stick to the middle band, they take it as a sign to make their exit. If there is a wide gap between the upper and lower BB, it is a signal of high volatility. Conversely, when the gap is narrow, it designates low volatility.

How are they calculated?

Although calculating the Bollinger Bands may seem like a mountain to climb at first, in reality, it is not so strenuous.

In order to build the Bollinger Bands chart, you must take into account the closing prices of a particular currency pair. As a general rule, Forex merchants consider the previous 20 periods for drawing out the charts.

Here, you will need to compute the mean of the closing prices for a pair for the previous 20 days. After that, you need to compute the standard deviation. The upper BB’s boundary is ascertained by appending the MA to the SD. Conversely, the lower BB’s boundary can be ascertained by subtracting the SD from the 20-period SMA.

Bollinger bands trading strategies

These trading strategies based on BB can help you become a successful trader:

- Bollinger bands and RSI

This trading strategy involves watching out for instances where the Relative Strength Index (RSI) reaches the oversold area, and the prices touch the lower BB. This is a great opportunity for a trader to make a long entry.

Those looking to go short should wait for the RSI to reach the overbought region and the price to reach the upper BB.

However, you should keep in mind that the price of the pair may persist in the oversold and overbought regions for a while.

In the same way, the prices may float around the lower or upper BB for some time. This does not indicate that the price will reverse as soon as it reaches the upper BB or as soon as the RSI reaches the overbought area.

As seen in the chart, no reversal occurs when RSI is more than 70 and when the price is floating around the upper BB.

Rather, it keeps rising along the upper BB, and the Relative Strength index keeps hovering above 70. Correspondingly, no rebound occurs when the RSI is beneath 30, and the price is floating around the lower BB.

- Bollinger bands squeeze

The following strategy entails measuring the extant trends in volatility and forecasting specific changes in the indicator.

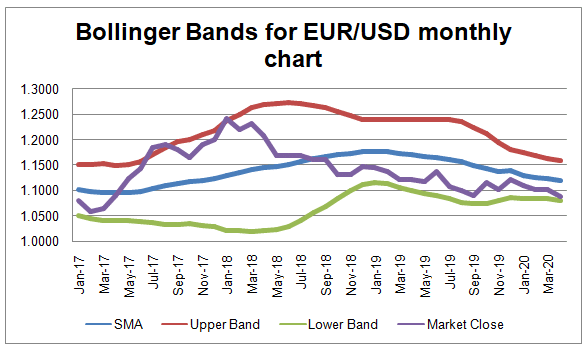

As you can see above, the gap between the upper and lower BBs does not remain the same. For this particular pair, the gap was larger during 2017 and 2018, with respect to the current state of affairs.

When the market loses volatility, the gap between the bands starts getting smaller, and this phenomenon is known as a squeeze. This is clearly shown in the chart, where a low discrepancy between the bank rates of USD and EUR causes the gap between the two bands to shrink.

While this does not denote an uptrend or a downtrend, it stipulates that the market will become highly volatile soon. The converse also holds true.

- Reversal

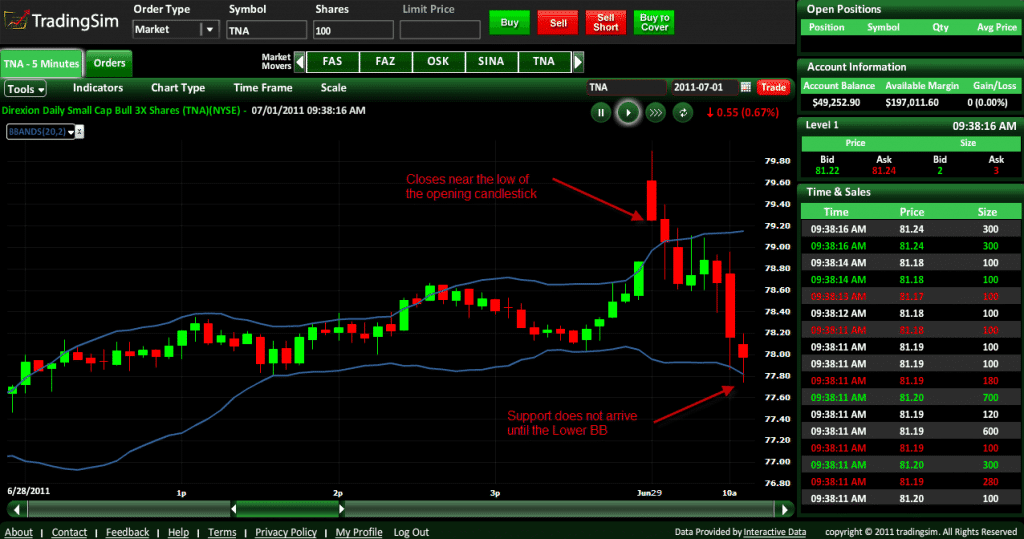

Here, you start trading in pairs when their prices exceed the bands.

So rather than selling a pair as its price crosses the upper BB, you can stand by and monitor its performance.

If the price closes near the low while remaining beyond the bands, you get the indication that a price correction will occur in the near future.

You can then choose to sell while earmarking the lower, middle, and upper bands as exit points.

- Double bottoms

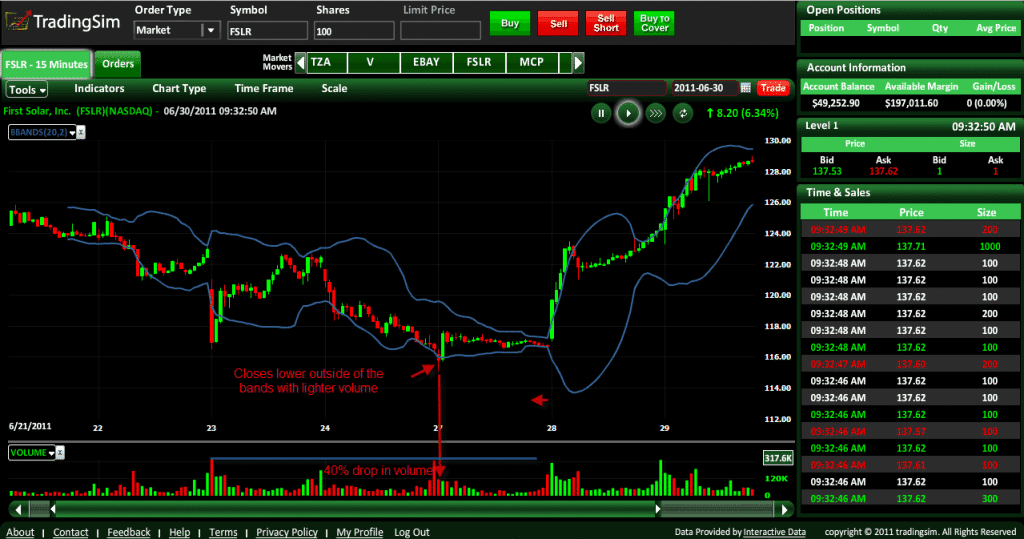

In this trading strategy, the foremost bottom has a huge volume and undergoes a sudden price pullback, closing beyond the lower BB on a big volume.

This, over time, causes an automatic rally, where the rally’s high functions as the primary resistance level in the core building movement. Subsequently, the price surges upwards.

After the initiation of the rally, the most current troughs test the strength of the buying force. The price in turn retests these troughs. Forex traders take this as a sign that downward force has worn itself out, and the market is turning more favorable for buyers. In this regard, you must make sure the volume dips suddenly.

Wrapping up

Thus, you gained some knowledge about the most enterprising strategies comprising Bollinger Bands. Remember, using these schemes does not mean you will strike gold overnight since numerous economic events influence the market patterns. For best odds of success, you ought to integrate fundamental analysis with Bollinger Bands.