What is Scalping?

Scalping is the trading of currencies based on immediate examination of the market. Traders who use this style of trading enter and exit the market quickly. Traders buy or sell currency pairs to seize the spot for a very small period of time and close it for a small profit. The motivation behind scalping is doing multiple trades in bulk to multiply the profit earned from minute changes in the price. The most significant part of scalping is liquidity as it ensures access to the best prices while entering and exiting the market. Since it is a very intense process, it is better to put all the time and energy into pairs that give the most optimal spreads. For example, making use of EUR/USD, GBP/USD, and trading them during the busiest time of the day. Scalping involves dealing with multiple traders every day and since you need to capture small price movements for earning a profit, you must learn to handle small risks. These movements can lead to earning more money with leverage and large position sizes in due time.

There are different types of scalping techniques, such as:

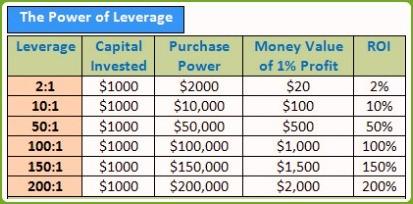

- Leverage in Forex allows traders to scrounge the capital from a broker to have more coverage of the forex market. This technique only uses a minute percentage of the entire asset worth as a deposit and increases the profits and losses, contingent on the market.

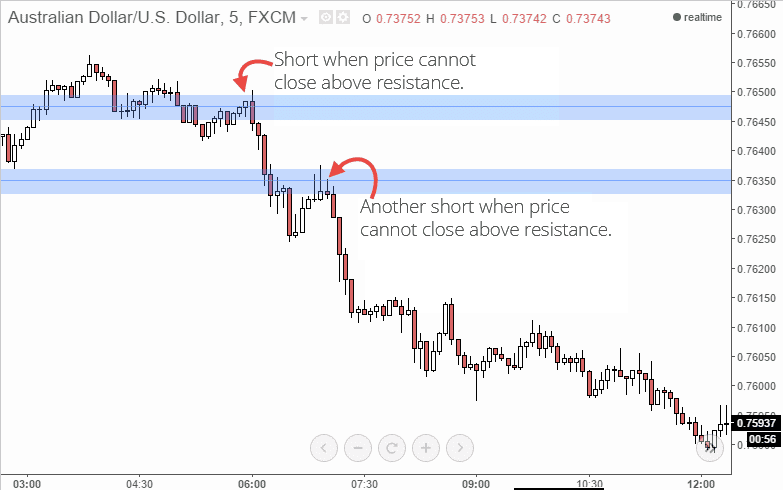

- Price Action Scalping does not work with an indicator, rather it works with candlestick graphs to extract the information. Traders using this technique will scalp only if there is a suitable risk-reward ratio.

Figure 2: Price Action Scalping

Pros and Cons of Scalping:

You can try scalping since –

- There are not many market risks as it limits the risk of loss from businesses by making leverages and stop-losses. It does not even require huge holding capital – it is inexpensive, and the percentage of successful trading is higher.

- Scalping does not require a certain market situation; one can earn profits from both top and bottom markets. You need to know how to manage time and opportunity to wait for the trade to close as it takes only a few seconds. This also ensures that one does not get caught in reversals.

- Strategies used for scalping are easy to understand as they are based on calculative criteria. It does not require any specific qualifications or experience – traders can start with basic knowledge of the stock exchange. However firm psychological mindset and fast decision making ability is a must.

You may want to steer away from scalping as –

- A lot of effort is needed to put the money on the right entry price. The forex market fluctuates often and requires keen attention to make decisions. One has to make dozens of trades regularly to achieve their financial goal.

- Most traders follow the 1:1 risks-to-rewards ratio, sometimes one loss can eat up multiple successful trades. It also tends to exhaust the trader.

- Scalping results in numerous transactions and thus has a higher transactional cost – continuous trade can lead to added commissions.

- Sometimes, traders have to look for different brokers as not all of them allow scalping on their platform.

Is Scalping Suitable for You?

Scalping is suitable for on-the-go traders who are comfortable with making on-the-spot decisions. Scalping requires traders to manage stress and remain unwavering in distress. If the thought of waiting for numerous days for a subsequent trade annoys you, and you prefer trades that take place in a span of a few seconds, clued-up primarily by price patterns, scalping could be suitable for you.

Scalping is suitable for:

- Amateurs with minimal knowledge about the forex market.

- Fast-fingers traders, capable of quick trading, who are highly disciplined and determined towards making immediate profits.

- Someone who is properly acquainted with the system and can automate his strategies timely.

- Someone who doesn’t believe in following market patterns and looks for liquidity, access to data.

To be successful, a scalper needs to be disciplined, have an eagle’s eye, the confidence and instinct to pull the trigger at the right time and price without any hesitation. There is little room for error and you will need to conduct technical analysis with historical price-action to make informed decisions. As there is cut-throat competition in the market, a scalper needs to be flexible to be able to adapt to the changing forces in the market. An attitude to handle risks without getting overwhelmed is vital to a successful career in scalping.

Final Thoughts

Scalping is a trading strategy wherein traders close deals in a very short period of time. Prone to uncertainty and fluctuations, the forex market makes it difficult to keep tabs on the dynamic market circumstances. To be successful at scalping, you need to be quick with informed decision-making, have strong time management skills and keep close watch on price-mechanism to earn profits. Scalping works on the idea that the majority of the stock will complete the primary stage but from there, it is uncertain where it goes. Some stocks may go further while others cease. It also involves constant check and can be stressful – as you scalp with just one pattern, you will have to specialize in a few markets by understanding its behaviour and pay attention to the costs and be aware of new releases. Suitable for amateurs and professionals alike, scalping is cost-effective and allows you to reap large profits in the long run. Even though it demands more screen time, scalping remains an attractive tool for trades worldwide. The bottom line is that in a vast and liquid market, scalping is a platform where rapid decision-making and thorough concentration are demanded.