Do you wish to be notified of the market performance round the clock? Do you want to convert every single hint to a prospective trading opportunity? Then, take advantage of the automated trading system and channelize its advanced knowledge for your trading benefit.

The Forex Expert Advisor is an automated system that guides the trader to leverage on the current trading opportunities with the help of signals. Are the Forex EAs experts in analyzing the market and rendering accurate forecasts? The answer is a big no. But, the market for foreign exchange is open 24/5 and no human can stay active round the clock.

And, here comes the importance of automated systems as they are programmed to generate automated trading signals and notify traders of prospective trading opportunities. Here are a few proven tips to incorporate human intelligence with the EA software to rule the Forex exchange and trade the market successfully.

Evaluate market conditions

Understand that the Forex EA is a software tool with no human heart. No machine can analyze and interpret the market conditions like a human brain. Of course, it helps interpret the trending market, but it is also important to perform a thorough ground-level analysis of the market for success. Trading according to the fluctuating market conditions is the only tool to generate success from the Forex EA.

Have a plan B

Smart traders will always have an exit plan to escape the short squeeze that the expert advisor at times creates. The market will always be ready to throw unexpected situations at the trader, and from outside, we should have a clear pre-plan in mind to escape the outbreak.

Allocate your funds wisely

How well and easy we attain our trading goals will depend on how best we allocate the funds to Forex Expert advisors. Smart traders will allocate more funds to the well functioning EA and fewer or no funds to those tools that are not functioning up to the standard. Never allocate equal funds on all systems as it can have a devastating effect on the returns.

Lower costs by avoiding high spreads

High spreads are always dangerous in Forex trading as they have the potential to decrease the profits. Also, by indulging in wider spreads, there are higher chances of losing the trades. Successful traders feel that a low spread with the commission is ideal for trading with EA.

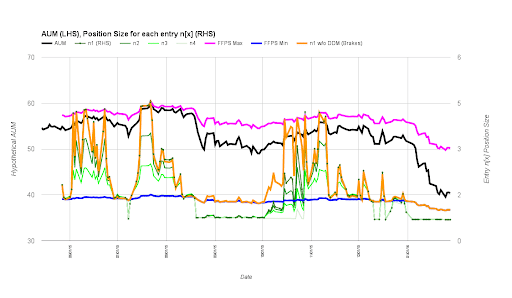

Reduce the size of your trades during a drawdown

When the Expert advisor algorithm is facing a drawdown, the best way to improve the system and escape from loss is to decrease the size of the trade to a minimum. Exaggerating the trade while the EA is facing a loss is suicidal.

One important prerequisite to trade with the EA algorithm is to understand it thoroughly and ascertain when it is going through a losing phase. Lucky investors can gain profits if it recovers faster than expected, but the wise move during the drawdown is to cut short the size of the trades.

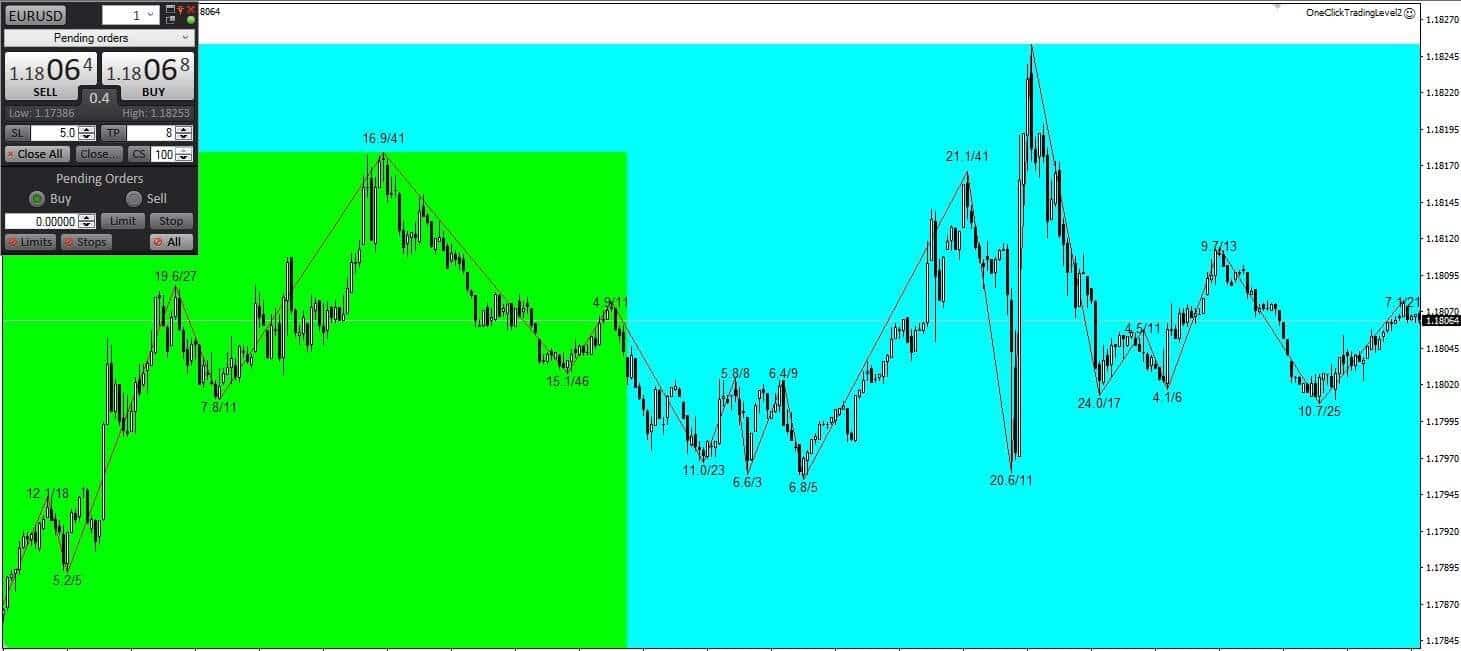

Keep your MT4 workspace to a minimum

We all know that when it comes to trading during fast market movements, every single millisecond matters. This can affect the returns tremendously, and to make every second count, it is important to have the fastest EA and make it route orders precisely.

To increase the speed on the terminal and boost the performance of EA, traders have to close all other windows and market prediction charts and keep the MT4 workspace to a minimum. In other words, channelize all the data to your EA rather than the MT4 station during volatile market conditions.

Backtest your strategy

It is not unnatural for the expert advisor algorithm to fail at the time of trade and throw the trader literally into the pitfall. Several trading systems that sound too good on paper and demo accounts fail to perform when in the live mode. The reason could be their poor system design or that their strategy was tested long back. Be sure to backtest your strategy on the day of trade to avoid such unwanted conditions.

Use position sizing algorithm

Position sizing is more of a style of trading, just like the stop loss system that reflects on one’s trading strategy. To realize profits in the Forex trade, it is advisable to concentrate more on position sizing rather than concentrating on entry rules. We can also include certain position sizing scales as rules to the EA for a positive impact on the trade.

Optimize the working hours

Run a demo test on your EA to ascertain which part of the day it functions at its best and what are its favorite trading sessions. Optimize the working hours based on your inference. Understand that EAs are robots that behave the same way irrespective of the market conditions. Analyzing their working pattern and optimizing the trading technique can lead us towards success.

Review your currency pairs

Similarly, expert advisors cannot adapt to different currency pairs. If you are trading on several instruments in the Forex market, do a little research and record the results of each currency pair. Be smart to get rid of currency pairs that offer the lowest results and invest in those that always steal the show.

Final thoughts

Now, the ball is in your court. The Forex market is not pure art or craft or based on science. It is based on insights and smart decisions one makes based on the insights. Take all help from software and technological advancements, but ultimately use them through your insights to rule the exchange. By practicing the techniques that we have listed here, you can be sure to have a significant increase in your profits.