A trading journal or a notebook is one of the unique ways to leverage your monthly gains. You can record your every execution in the market and analyze them later on in a piece of hard or a soft copy. One may include their trade entry/exit, position time, confirmations, risk-reward, results, notes on psychology, etc. In short, anything that can prove to be beneficial in determining your trading statistic must have some space in the journal.

In each profession where professionals excel, there is constant hard work and record keeping. Sprinters keep a note of their diet and training, boxers analyze their matches, and formula one race drivers know exactly where to turn as they have scrutinized the whole scenario by calculations from engineers. So when it comes to financial markets, the approach is similar. Success will come through journaling each aspect of your trade.

What if I keep trading?

The 10,000-hour rule does not hold in this regard. Spending hours and hours in front of charts live or demo trading won’t get you anywhere without a trading journal. It is especially troubling for beginners as their mind tricks them into believing the get rich quick scheme where they ignore trading necessities.

Some traders have a strange habit of recording only the winners, which is the opposite of what they should be doing.

Kind of trading journals

Recording your trades can be done in two different ways:

- Automatic in which the executions are recorded automatically and the results show detailed information including drawdown, profit factor, average win, and intermediate trade lengths, to name a few. Myfxbook, MetaTrader report, etc., are the available options.

- Manually noting all the trades may be a hassle for some. It does take some time to do everything by hand, but it carries the most benefits. Doing everything by hand is the choice of all professional traders. To get the best, they keep the archive in both manual and automatic forms.

You may also choose to keep your journal private or open to the public. The latter has more benefits as it can allow other traders to critique your trading.

Example of automatic and manual journaling

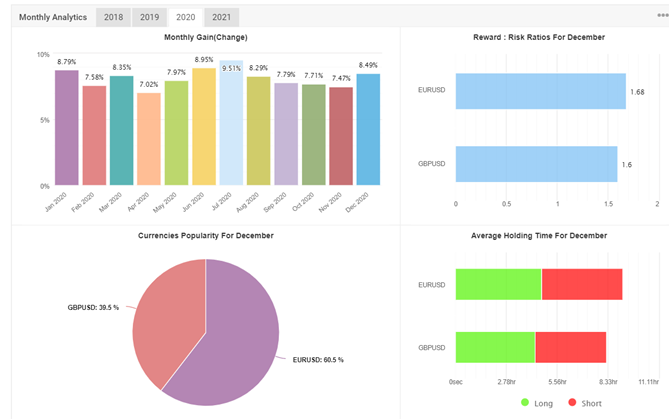

A trading journal with automatic documentation is readily available through many sources. In most cases, you only have to connect the industry standard MetaTrader 4 or 5 to your online tracking website. See the example below:

As one puts his/her eye, the differences are visible between the two forms of journaling. Let’s take a peek at a trader who uses manual trading.

Symbol

EUR/USD

Confirmations:

- Daily key level

- Daily candle with a little wick around 33 percent

- 4 hr bearish

Trade Type: Anti Trend

R/R 1:2

Result: Loss

Daily

I see an opportunity to go short on EUR/USD. I had confirmation on the daily wick candle. Resistance was also present at the daily and weekly key levels.

H4

The 4-hour time frame’s overall trend was bearish, adding the overall plus points to the position. A bearish engulfing pattern was present.

H1

Topping tails on the hourly chart and a bearish engulfing pattern to support my idea.

Lessons:

- News took me out of the trade. The Brexit deal impacted European currency, which went up as the Euro became stronger. I should keep an eye out for fundamentals and do not ignore them.

- I should have gone breakeven after I had the trade in profit. I let my emotions take the best of me as I gave into greed and forgot to move my stop loss to the entry point.

From the above example, we can see that this price action trader has amateur journaling skills. He does not have an excel sheet to record the percentage gain, nor does he have the P&L ratio. But still, at the end of the day, his learning curve will be much better.

Benefits of journaling

The key benefits of journaling can be summarized as follows:

- Having a detailed overview of your executions can help you determine your strengths and weaknesses.

- It can improve your trading psychology by leaps and bounds.

- You will not work yourself up on a few losers as you know that your journal’s statistics confirm a positive outcome on the strategy.

- Consistency and discipline are achieved. One can manage their trades much, much better.

- You can remember your winners, and as soon as you see a similar setup, you will not hesitate to push the button to get that easy gain.

- An important insight is available to a person to judge who they are as a trader.

- The ability to write and work on trading goals is easy.

When should I journal my trades?

Some traders journal their trades at the end of each trading week. However, this is not a good practice as you may forget the reasons behind a setup. It is recommended for day traders and scalpers to put everything on their book as soon as they place a trade. Any modifications in the position, including exit, should also be put down in the sheet immediately.

Conclusion

In trading, no matter how good a person is, they will always need some improvement. Institutional and professional retail traders keep a journal with them at all costs. Amateurs and beginners are stuck to their level and never reach the top even after managing their risk, psychology, and strategy. The reason behind this is simple; i.e., they never keep a background record of their positions.