Both the Adam and Adam and Adam and Eve Double bottoms are double bottom reversal patterns. While the Adam and Eve formation has a sharp and deep bottom first on high volume followed by a flatter, more rounded trough-shaped bottom, Adam and Adam has twin bottoms at the same price (approximately). We shall discuss the two patterns in detail below.

Adam and Adam

When we look at bottoms, the pattern is formed at the end of a price plunge downward. It can also form in the corrective phase of a measured move up. Take note of the bottoms that appear in this pattern so frequently. The twin spikes drop below the surrounding price lows but still, stop around the same price level. The rounded turn that connects the two bottoms does not need to be rounded at all. It appears irregular at many times. In this example, volume is higher on the left bottom compared to the right.

Identification

The shape and appearance of both bottoms should be similar. It means that each should look narrow, not one narrow and one wide, possibly with a long and downward price spike or tail. Take a look at the lowest part of the bottom to measure the width. It may sound confusing, but the top of the spike would be wider than the base.

There are several key factors indicating the pattern, which you should consider in combination:

- Trends: Downward price trends should lead to the double bottom. They should trend without drifting below the left bottom.

- Bottom shape: Narrow and v-shaped. It can be composed of long and one-day spikes sometimes.

- Rise between: Minimum 10% from the lowest valley to the highest peak between the two bottoms. Taller patterns perform greater.

- Bottom low: Bottom to bottom price variation is little. Best performance is observed when prices are from 2% to 5% variation. It is a must for bottom lows to be at least a few weeks apart. In this case, best performance is ensued with the separation of 3 to 6 weeks. Performance deteriorates when it is wider than 8 weeks.

- Bottom volume: The bottom volume is usually lower in the right bottom compared to the left bottom. The pattern is confirmed as a valid double bottom when a close above the price confirmation point is the breakout.

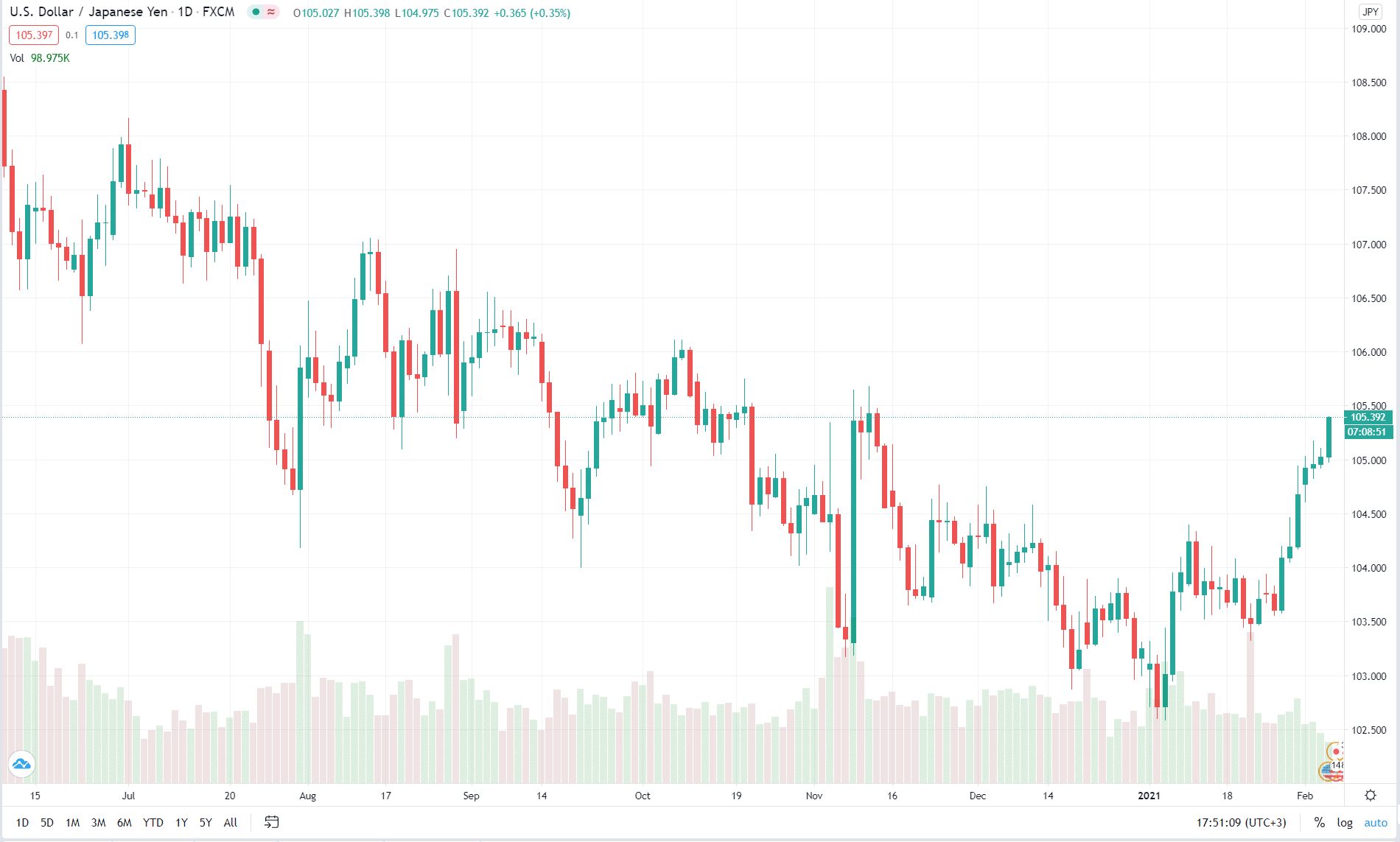

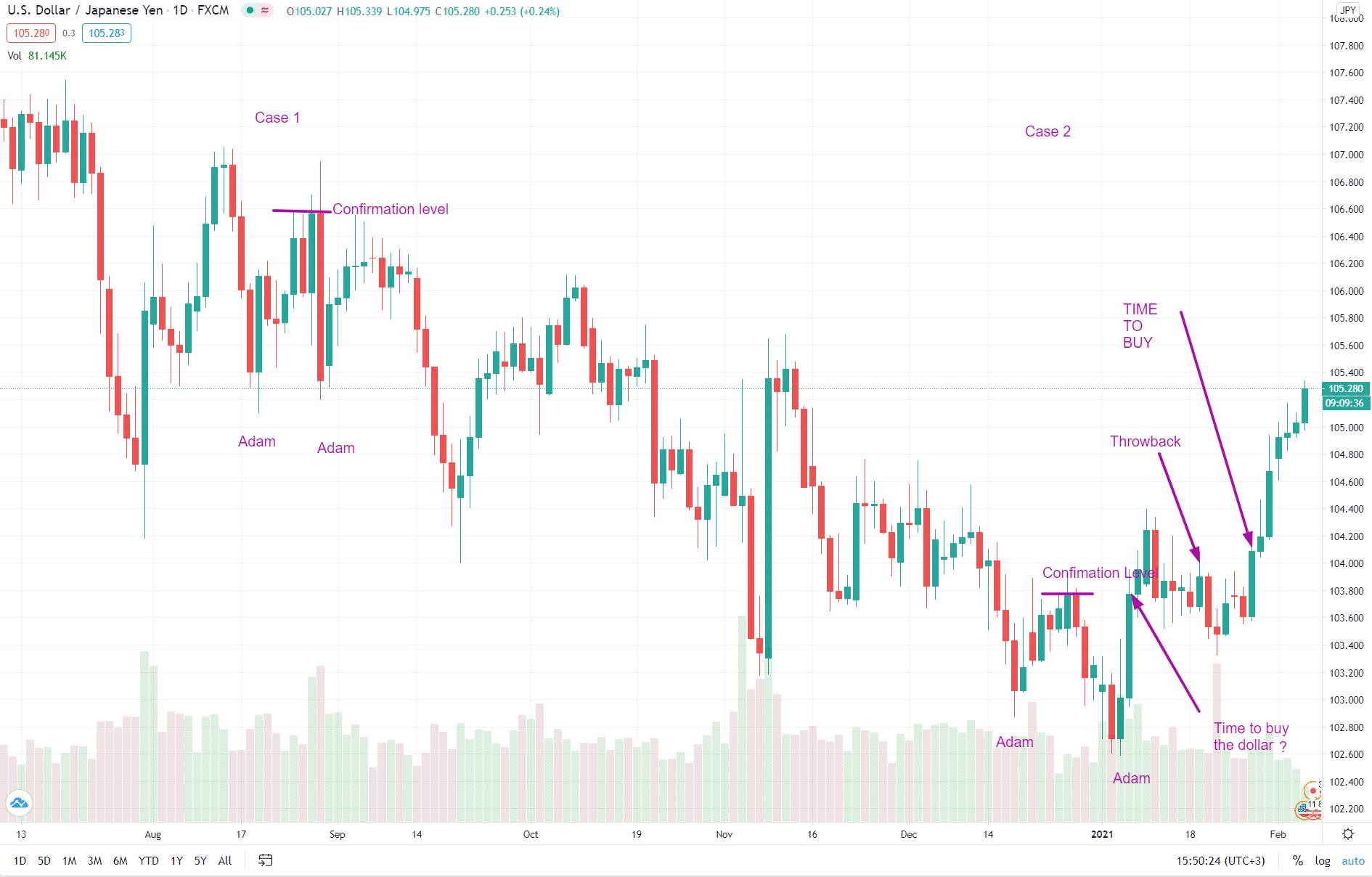

In the chart below, you can observe the situation suggesting that the AADB pattern has formed for the USD/JPY pair after the first price reversal in mid-December 2020. The second bottom was followed by a characteristic throwback and an uptrend.

Peculiarities

As a rule with this type of pattern, the price tumbles about 33% after it tops out at the ultimate high. In a bear market, all the gains are given up by the decline. An aggressive trader must wait for prices to peak in such a case to short the stock and ride it down on the throwback. The trick here is to buy exactly after price peaks.

How will you know when the stock peaks? You have to look for topping patterns breaking out downward in other stocks, especially the ones that are in the same industry. A strong downward market or trading a busted pattern is also helpful.

So, if the question is how long it should take to reach the ultimate high, the answer to this would be about 3.5 months in a bear market and about 4 months in a bull market. The longer it takes the pattern to form, the more reliable it is.

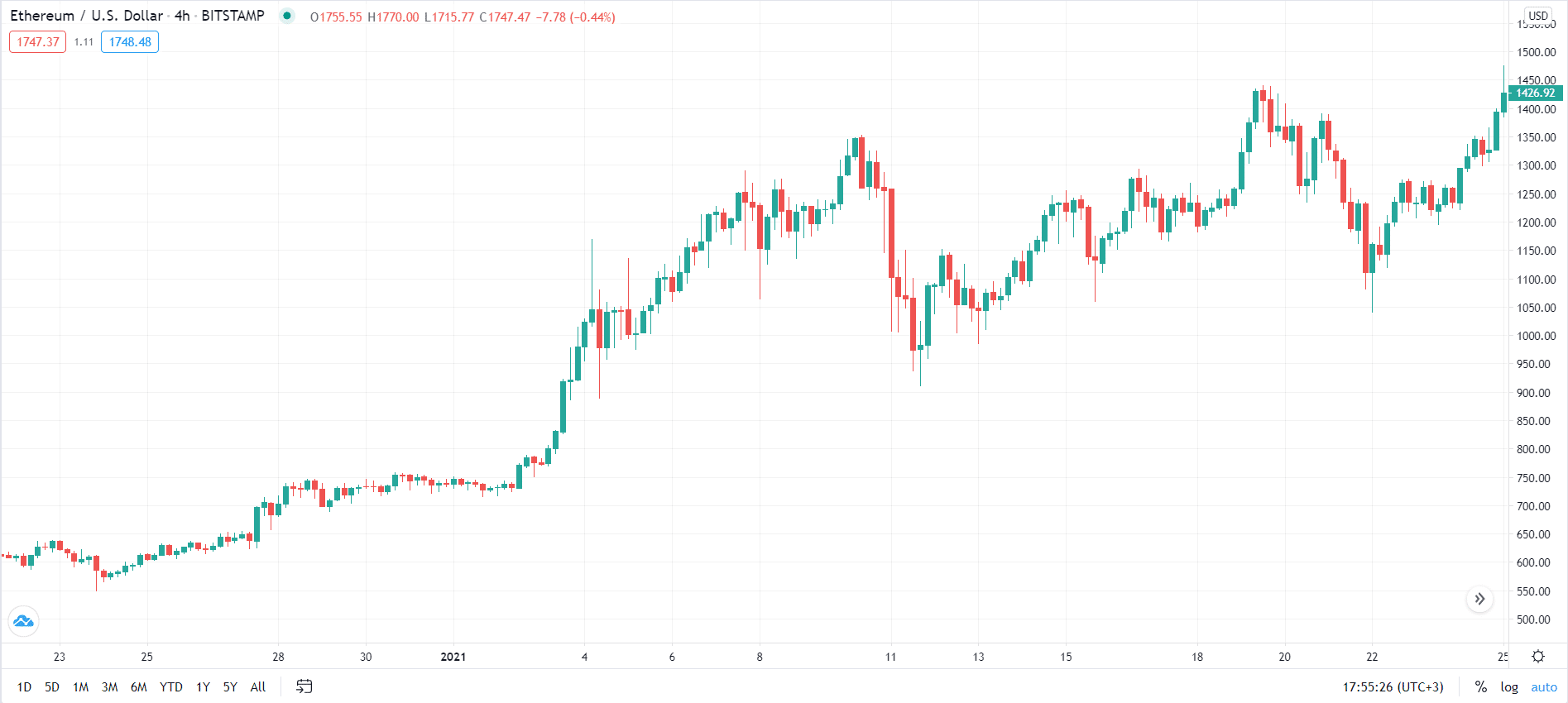

The average double bottom length is estimated slightly less than 2 months, meaning the time between the lowest lows of each bottom was used. Yet it is shorter in the example above, and can be way shorter still: the pattern can be observed in the 4-hour charts and even shorter time spans

Both tall and wide AADBs perform better in a bull market. Short and narrow AADBs perform well in a bear market, but the sample size is small. It is the best to avoid wide and short patterns since they have shown the worst performance.

Trading recommendations

You have to measure the distance from the highest point between the two bottoms to the lowest of the two bottoms. After that, you have to add the difference to the highest high. The result would be the target price.

The peak between the bottoms serves as the confirmation level (see below), so you will fare better if you wait until the price rises to the same level after the throwback and then long USD.

Another thing you can do is wait for a breakout. Always, wait for confirmation of a close above the highest high.

Make sure to trend with market trends. Trading the bullish pattern in a bull market will improve your odds.

Adam and Eve

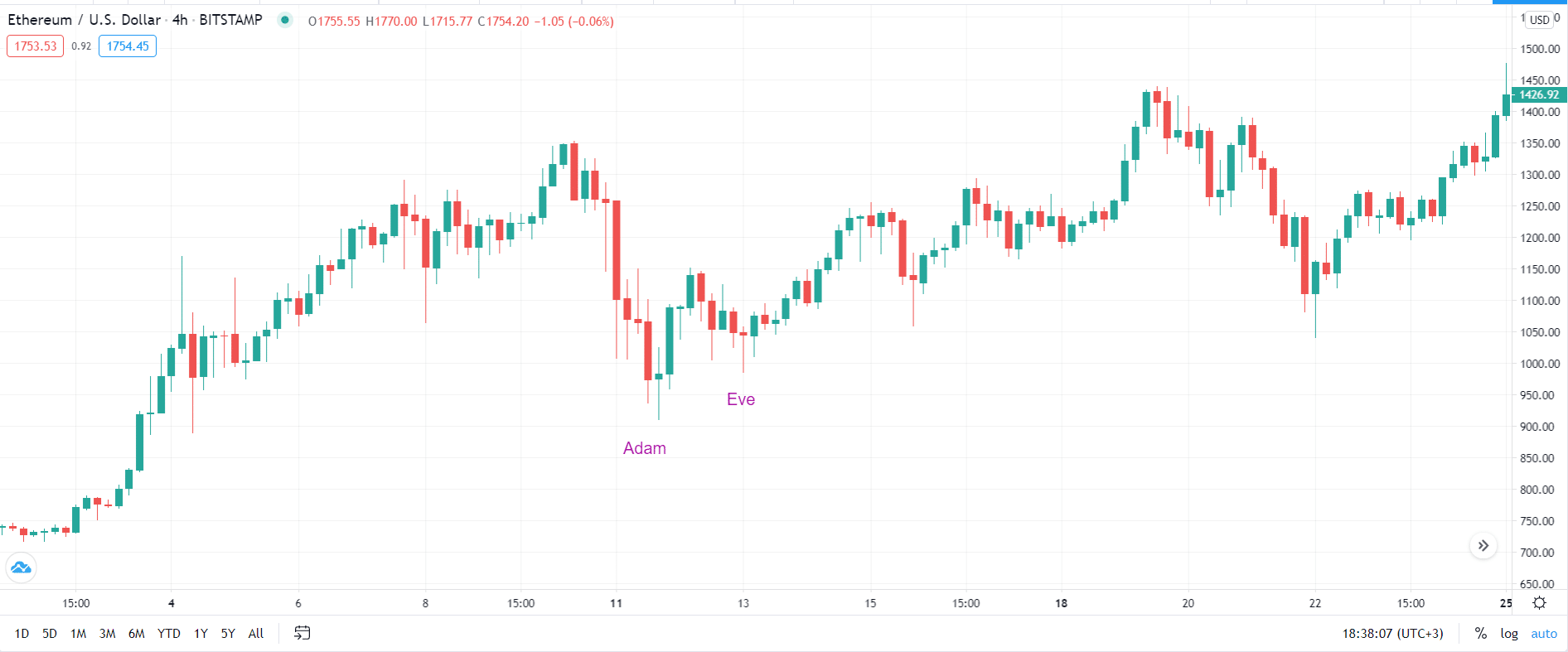

The Adam bottom is V-shaped, and it looks narrow, with a major downward price spike, while the Eve bottom is rounded, wide, and sometimes it has many short spikes.

The average rise in a bear market is as good as the 37% rise in the bull market. About half the time, throwbacks take place that cause performance to suffer. When AEDBs perform well, it results in several characteristics such as tall patterns, volume heavier on the left bottom, and patterns with a receding volume trend.

Identification

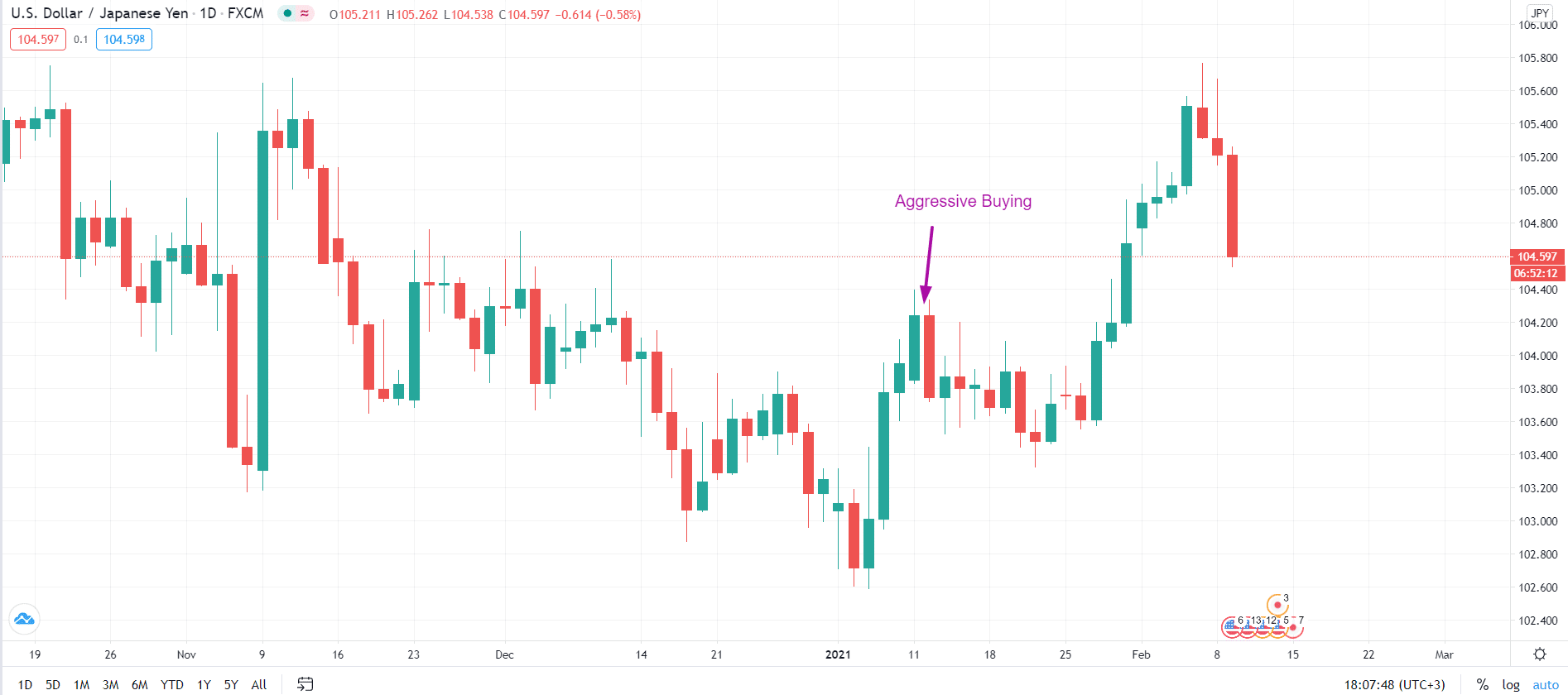

The two bottoms must not appear similar. As mentioned earlier, the left bottom or Adam must be pointed, narrow, and v-shaped while the right bottom Eve must be wider and rounder as you ca observe in the chart below between January 11th and 15th, 2021. For Adam and Eve double bottoms, the Adam bottom should come first and close in price to Eve.

Peculiarities

The average rise is higher in the bull market than the bear market, which is expected, but the numbers are close. Both of them are above average for any type of chart pattern. It takes about 160 days for the price to reach the maximum rise in a bull market, and about 99 days in a bear market if you choose the long time frames as a position trader. However, the set up below would better suit a swing trader.

Therefore, you need to be patient but keep an eye on it because not all AEDBs take that long before they start a huge decline.

Trading recommendations

You can calculate the height from the highest high to the lowest low between the two bottoms. Then, you may add the difference to the highest high. The target price is the result. It works 56% of the time in a bear market and 66% of the time in a bull market.

Checking other stocks in the industry before you trade is very useful. If they rebound or show some reversals, you can be confident that the trade will work as expected. If they are going down, that indicates risks of a failed trade.

Throwback is another option you have. It takes place about half the time. They give you the opportunity of initiating a position or adding to an existing one. Wait until prices begin rebounding and then you can buy.

Conclusion

Double Bottom Reversal patterns highlight work in a different manner in the bull and bear market. They can be formed within the different time spans to be used in different types of forex trading strategies.

You can buy aggressively and sell on the throwback immediately after the second, Adam or Eve, bottom has been formed or wait for the price to reach the confirmation level after the throwback to buy and wait for the price to trend up.