There are so many trading strategies anyone can copy from the internet, but if so many traders still fail, what could be the reason? One of the reasons is what we define as an edge. The edge is what separates a trader from the rest of the pack.

Every market participant uses very similar trading approaches, strategies, and tools, yet some are more successful since they understand where to find the weak spots and how to exploit them; this is an edge.

What is an edge in forex?

An edge is merely an exploitable advantage or skill a trader can repeatedly use to tilt the odds in their favor. It is simply something a trader knows that others either don’t or don’t know how to utilize efficiently.

Interestingly, all retail traders more or less have access to the same information as everybody else. While there are traders who may have studied finance, economics, and mathematics, it doesn’t necessarily mean they have better knowledge (unless they trade institutionally).

Thus, if the information is consistent and freely available to the public, a trader can find any gaps that haven’t been explored yet? Fortunately, the answer here is yes, as an edge comes in various forms. One of the core aspects of developing this is understanding how forex is essentially a zero-sum game.

Any trading strategy or system aims to exploit consistent weaknesses of other market participants, whether through an entry trick, a repeatable technical structure, a unique way of using an indicator, an advanced method of analyzing price action, or anything else.

Why understanding forex is a zero-sum game is crucial to developing an edge

The forex market operates similarly to poker. In the game theory, the zero-sum refers to the mathematical principle that the losses and wins of a group of participants are balanced with those of others.

Although some traders may not like to believe that forex is a type of game, ultimately, a trader profits off others’ shortcomings. Whenever a trader loses money, this gets transferred to other traders that better predict the market direction (and vice versa); that is why no money technically gets created in forex.

For every winner, there is always going to be a loser in the equation. Any trader’s job is to find scenarios where a large enough group of traders will likely lose based on repeatable trade set-ups.

Although trading isn’t necessarily a competition against others, consistent narratives play out in all markets over time, which we hope to take advantage of. These occurrences often happen because of ‘losing traders.’, which is where we find an edge.

Examples in forex for developing an edge

Understanding technical analysis in forex forms any trader’s framework; it is the first requirement before anything else. But without an edge, it isn’t enough. For example, there are many trend-trading strategies, but very few remain consistently profitable with this approach in the long run.

Millions of traders have an impressive comprehension of trends, but some still know a little bit more in the same field than others. Let’s look at a few simple concepts of how traders can develop an edge by capitalizing on a few technical discrepancies:

Exploiting support & resistance (S&R)

S&R is one of the first concepts that any trader introduces themselves to. Although the idea sounds simple (support represents a ‘floor,’ while resistance represents a ‘ceiling’), not every trader uses it properly.

One of the common misconceptions is the more a market tests a support or resistance level, the stronger it becomes (the strength of which is believed to be enough at causing a reversal or trend change).

We then have a scenario of many traders blindly placing orders at these areas without strong confirmation of whether these places warrant any strength. A breakout trader can use their knowledge of momentum at S&R and how it plays a huge influence to the extent of a breakout.

Let’s take a look at real-life examples and the ways traders develop an edge.

On this GBP/ZAR chart, we see with the orange arrows how many times the price reached this resistance area. To the uninformed trader, if the market did come back again to this area, they may have assumed a short position aligning with the downtrend.

What they wouldn’t have known is momentum in this area was very strong to the upside, which is one of the reasons for the powerful breakout. Therefore, the assumption of multiple tests of support or resistance making it tougher is not always valid.

The edge here is capitalizing on this weakness by better understanding momentum in these areas rather than just accepting things at face value.

Deep pullback entry trick

The Deep pullback entry trick using the image above, if we observe any reversal, we will sometimes note the price will retrace strongly in line with the previous trend, tricking traders into believing it will continue further.

The market tends to make a deep pullback, usually between the 38.2 and 23.6% Fibonacci retracement. There will always need to be more confirmations, but this occurrence alone is exploitable and has happened multiple times before.

Observing a sentiment indicator

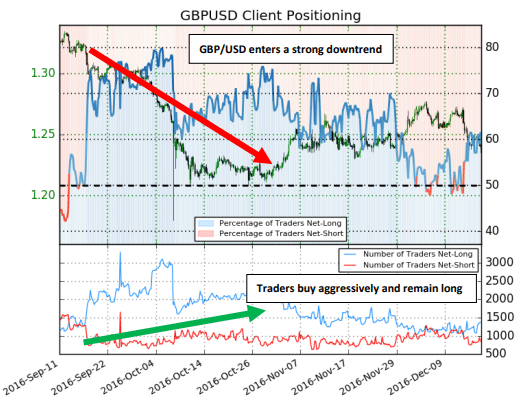

A tool like the IG Client Sentiment Indicator is one of the best at using sentiment to confirm existing trends and potential trend changes. Very few use this feature as many primarily utilize technical and fundamental analysis.

It provides a real edge in seeing how institutional traders often take the opposite positions of retail traders who constantly pick tops and bottoms.

These examples above are either based on technical or sentiment analysis. Traders can still find an edge using specific fundamental data by anticipating big moves before everyone else; there are different ways one can explore to find an advantage.

Conclusion

An edge is all about doing something to capitalize on a flaw in the markets, utilizing some form of tool or ‘tweak’ other traders have little or no knowledge of. Skilled traders will believe that as long as they’ve seen their edge repeat enough times, they stand to profit in the long run.

In the same instance, we should also appreciate that we will not always get it right; traders will need to weather the storm at some point. An excellent trading strategy should have one underlying quality or ‘trick’ that ensures it performs better than the average over time.