Cryptocurrencies have grown in popularity in part because they are decentralized. This means the blockchain inventions are not controlled by any centralized institution such as a government or bank. Instead, they exist in computers as networks and nodes, therefore attaining the highest levels of privacy and security. To automate all decisions involving cryptocurrencies, a group of developers came up with the Decentralized Autonomous Organization (DAO).

What is a DAO?

It is an organization without any centralized leadership. It is also not affiliated with any institution or nation but works to make key decisions on cryptocurrency projects. It is governed by rules enforced on the blockchain, operating as a board of directors.

At inception, Decentralized Autonomous Organization was envisioned as a venture capital fund that eliminated any human error or manipulation of investors’ funds in the crypto world. In this case, all organization’s decisions were conducted in an automated system without the control of any centralized authority.

Over the years, the DAO has allowed investors from all walks of life to send money and invest in specific blockchain projects. The investors are, in return, allocated tokens of the underlying projects. The tokens also accord the holders voting rights allowing them to participate in the decision-making of key projects.

How the DAO works?

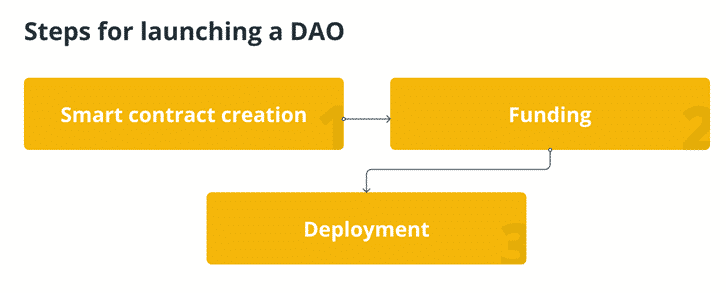

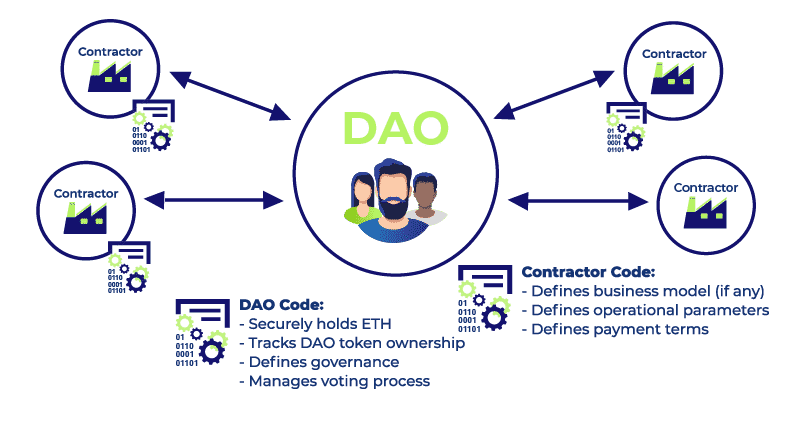

A DAO comes into being whenever developers of a given blockchain project create smart contracts. In return, smart contracts are used to control the organization’s workings and the underlying project.

Once the terms of service of the project are set, they can only be altered through a governance system that depends on the majority voting for the same. The DAO must also develop a framework for raising funds to support the organization at inception. In addition, a framework for enhancing governance is also established.

A DAO is deployed when everything is set, from the setting up of governance rules to members determining how funding will be arrived at. Once everything is set up, the developers or creators who wrote the smart contracts that control the DAO no longer influence the project.

In any DAO, decisions are made from the bottom to the top in a network of computers. Most DAOs operate through smart contracts, which are computer programs that automatically execute once certain conditions are met. The smart contracts also establish the rules that all computers connected to the network must adhere to.

Consequently, any person who owns tokens of a given project becomes a member of the underlying DAO. Depending on the token holdings, the holders have the right to vote on proposals for various projects.

Staking of tokens to participate in voting on projects prevents DAOs from being spammed. A proposal is only adopted once most token holders approve the same. The majority varies from one DAO to another and is articulated on the smart contracts that control the workings of the DAO.

Examples of DAO

Bitcoin was the earliest form of DAO as it operates via community agreement without any centralized authority. The lack of any centralized governance mechanism but a network of miners and nodes affirmed its status.

However, the level of distribution on the Bitcoin ledger has been called to question in the recent past. DASH appears to have toppled it on the distribution as its governance structure ensures stakeholders always vote on its treasury. New DAOs built on top of the Ethereum blockchain have also cropped up, leading to the development of new altcoins and stablecoins pegged on fiat currencies.

Why do blockchain projects need DAO?

Trust is always a big issue in any project that pools together many people with different ideas. In a centralized organization, trust is essential. However, in DAOs, trust is not needed. All project operations are controlled by a code implanted in smart contracts.

Consequently, all operations are carried following a set of predetermined rules. Token holders, in this case, are provided an opportunity to participate in decision-making instead of relegating the duty to a centralized authority.

While the DAO does not have any hierarchical structure, it is set to accomplish everything it was set out to, thanks to the participation of token holders in decision-making. Every token holder is given the opportunity to make a proposal on the project for consideration by all members. In addition, all disputes are settled through a voting system, with the majority carrying the day.

Additionally, they allow investors to pool funds together, which are used to enhance the development of the underlying project. The investments also allow investors to participate in the project’s growth and conversely generate significant returns in the long run.

Downsides of DAO

Just like any innovation, DAOs are not entirely perfect and not immune to challenges similar to those experienced in centralized organizations. The new technology behind such an organization continues to elicit security concerns. There have also been concerns about their legality and structure.

Contrary to perception, it is not always good to trust the masses with important decisions. The fact that the masses have to be consulted before a decision is arrived at can derail the development of a project. Conversely, disagreements are always common, some of which often result in massive splits between the community members.

Security concerns have also been a big challenge for the distributed organization. In 2016 hackers gained access to a DAO and stole 3.6 million ETH. Flaws in smart contracts prepared by developers at the start have left many projects susceptible to hack attacks.

Bottom line

Decentralized Autonomous Organizations are growing in popularity thanks to the increasing need to achieve the highest distribution levels when dealing with blockchain technology. Its adoption is expected to transform the way corporate governance is achieved in various blockchain projects and the mainstream sector.