When it comes to classification, gold is termed a commodity, given it is something that needs to be physically stored. In economics, a commodity is defined as a resource or an economic good that is fungible, i.e., interchangeable. While gold meets this definition, it is starkly different from most other commodities traded in the market.

First of all, gold is immune to the typical demand cycle. During a demand upswing, prices of notable commodities such as metals and crude move up. This is because these commodities are used in economic activities such as industrial production and transportation.

Gold, on the other hand, doesn’t have major industrial use. It is typically used as a store of value specifically because it is rare. Governments and central banks stockpile gold as ‘reserves.’ So, gold does not have any connection to business cycles.

On the other hand, because gold has a limited supply, it’s immune to inflation. That means that when prices of products and services are rising too fast, investors tend to flock to gold. The limited supply of gold implies its supply can’t be increased even in case of high demand. This leads to the price of gold increasing in case of high inflation. Gold is also considered a safe-haven asset, so investors also rush to gold in times of recession.

Relationship between USD and Gold

Having understood the price dynamic of gold, let’s come to its relation with FX. Gold prices are dollar-denominated. This means that global prices of gold are always quoted in US dollar and is popularly known as XAUUSD, where XAU is the symbol for gold.

So, as a result, when the dollar strengthens, the price of gold falls. Since this relationship is so well established, global gold prices are also considered as contraindications for dollar strength. A rise in gold prices almost always implies a weakening of the USD.

The most widely traded Forex pairs include USD, and predicting the strength of the greenback can be a useful tool in understanding the price movements of most FX pairs.

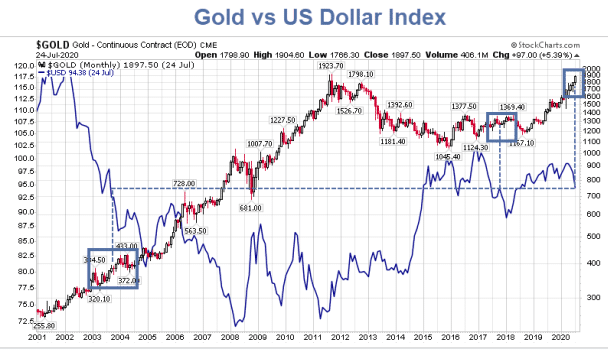

Let’s see this relationship with the help of the chart below. As you know, after the 2000 tech bubble burst, the economy slowly recovered. Then, led by a housing boom, the US economy and by that virtue, the global economy grew at a breakneck pace.

The period from 2005 to 2008 saw gold prices fall. In the same period, USD strength increased. But when the housing crisis unraveled in 2008, gold and USD reversed their directions, with USD falling and rising gold prices.

Recently, one can see multiple instances of the inverse relationship between gold and USD.

So one can surmise that when the Forex pair is driven predominantly by USD dynamics, gold price becomes an important indicator. While above we saw the relation between gold and USD alone, let’s study the relationship between gold and currency pairs.

Correlation between Gold and EURUSD

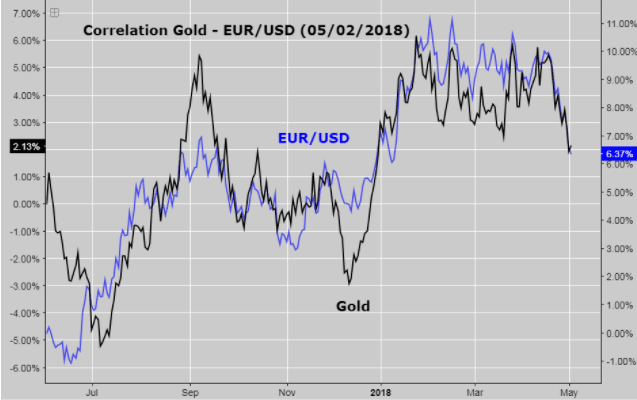

The period under observation is late 2017 and early 2018. As you might recall, 2016 was a tumultuous year. In June, Britain voted to exit from the European Union, triggering Brexit. At the end of 2016, Trump won the presidential election when he was widely expected to lose.

Both events brought significant volatility to the markets. However, while Brexit turned into a long, stretched-out process, Trump’s presidency brought almost daily volatility.

It was in mid-2017 that Trump brought his trade war with China to the fore. As a result, the news flow was primarily driven from the US, and the USD was the “in-play” currency. FX pairs, such as EURUSD, were mainly driven by events impacting USD rather than EUR.

As seen below, when the two graphs are normalized, the FX and gold price move is almost perfectly correlated. In fact, you can see that the gold price is leading marginally, and EURUSD is following.

Any trader who managed to grasp this correlation getting built up could have easily leveraged the gold price as a leading indicator.

Correlation between Gold and AUDUSD

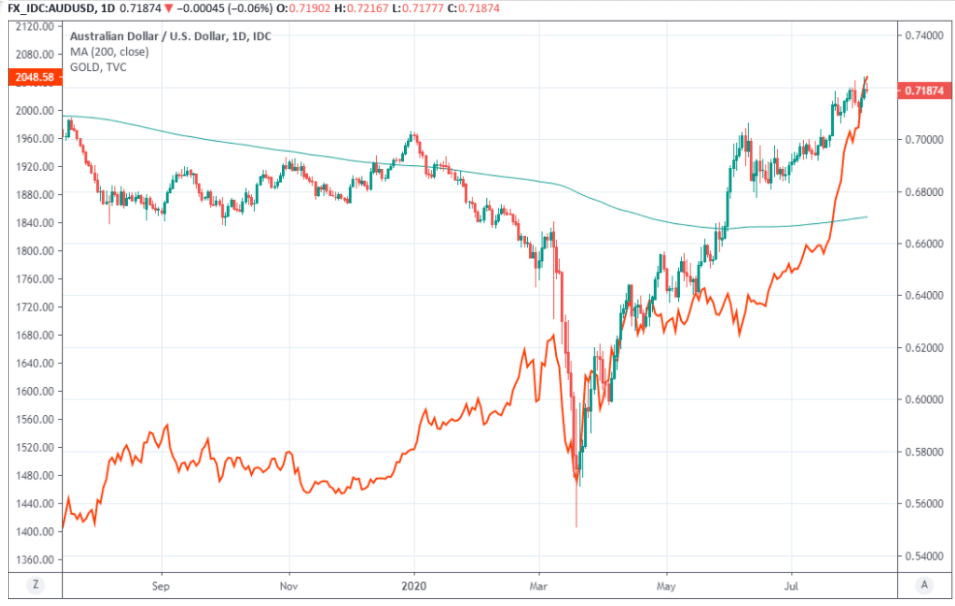

Let us take another example of AUDUSD. Australia is one of the largest gold miners in the world. The country mines $5 billion of gold every year. This naturally leads to a strong correlation between the gold price and the Australian economy.

As you can see, the correlation broke down marginally in early 2020 due to the Covid-19. However, the correlation reverted, subsequently making gold price and AUDUSD move almost in tandem.

The gold prices reflect the existing supply-demand of gold and the extent of mining being done in Australia. Since Australia’s economy is significantly involved in the process, investors were tracking AUDUSD watch gold prices very closely as well. The correlation is amplified as market participants would react sharply to AUDUSD in response to any change in the gold price.

Summing up

Overall, gold had a distinct relationship with most FX pairs. Its fundamental relationship with USD is often the major driver for most of the price action. However, there are cases when other currencies also have a specific connection to gold prices, as seen in AUD.

Gold is tracked not just by commodity traders but global asset managers as well, as it’s considered the contrarian indicator. This often results in the price action in gold becoming the leading indicator for other markets such as Forex.

It’s an important exercise for any Forex trader to continue tracking gold prices and calculate the correlation with each pair in the portfolio.