A reversal is a change in the established direction of a trend. Reversals can occur during uptrends as well as during downtrends. When a reversal occurs during an uptrend, a downtrend is being established and vice versa.

Reversals are relatively longer-lasting. Retracements are short-lived changes in the trend’s direction. Retracements can lead to a short-interval consolidation followed by a continuation of the previous trend or the establishment of a new trend.

Implications of retracements and reversals in trading

There are three ways a trade can play out as a result of a reversal or retracement:

- You can exit your position and wait for the market to stabilize and establish a well-defined trend before re-entering. Note, however, that you will incur additional costs as a result of paying for spreads again.

- You can stick to the position you held and hope that the market trend favors you. However, if a retracement develops into a reversal, then you risk losing your money. At this point, you may need to sell at a loss to prevent the market from wiping out your funds.

- You could opt to close your position if you are jittery about the established trend. By doing this, you may make a decent profit if the reversal or retracement favored your position or take a loss if the newly-established trend does not favor you.

Differences between retracements and reversals

- Retracements last for a shorter time, usually up to a few days. However, reversals stay for a longer time, usually up to several weeks.

- There is usually a notable decline in buy orders (in an uptrend) during reversals compared to retracements.

- Reversals are typically triggered by significant changes in the market fundamentals. Retracements do not necessarily require changes in fundamentals.

- The candlestick sizes in retracements have characteristically long wicks at the top and the bottom.

- Retracements usually follow a recent price upsurge, while reversals can happen at any time as a result of the push and pull between bulls and bears.

- Retracements hardly have significant patterns. Reversals tend to form multiple reversal patterns.

How to spot retracements

1. Fibonacci Retracement

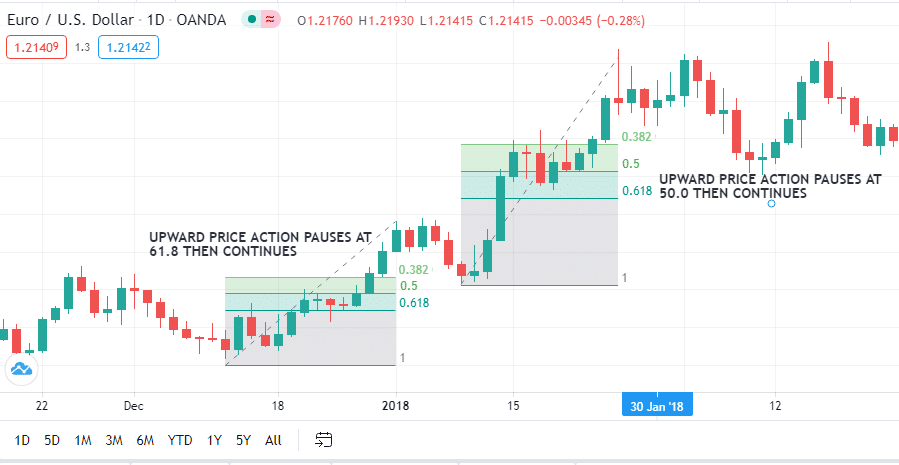

Fibonacci levels 38.2%, 50.0%, and 61.8% are the key points of reference when looking at retracements. The price will often stick to these levels during retracements. However, when the price movement goes outside these levels, it is a signal of an upcoming reversal.

It is important to incorporate other considerations, especially fundamentals, to build a strong case.

As shown in the chart above, the price settled at 61.8% Fib, which was followed by a surge. It then fell back to 50% Fib, which transitioned into further price gains.

2. Using Pivot Points

Support and resistance levels help us to weigh whether an uptrend or a downtrend is likely to hold. The three support levels S1, S2, and S3, are the reference points during uptrends.

When the price is headed down, traders will pay attention to resistance levels R1, R2, and R3. As long as the price action is constrained within these points, a retracement is more likely than a reversal. However, if the action goes beyond the levels, then a reversal is possible.

How can you tell when a reversal is imminent?

As time goes by, buyers and sellers keep pushing prices to a point where a previously established trend becomes weaker, and an equilibrium is achieved between buyers and sellers. This results in a range. The established range acts as a support level, and if it is broken, then the market is likely to become bearish.

For example, in the chart below, a well-defined support level is established during the range. However, as the support is tested repeatedly, it becomes more likely for the trend to be reversed. Note that a longer time frame gives more reliable support levels than a shorter one.

For example, the support and resistance levels of the one-week timeframe are likely to hold for longer than the 4-hour timeframe.

The case of false signals

In any market, there are no assurances. Trading is dynamic, and even the most compliant setup can go against your expectations. This means that your setup may indicate an almost-assured reversal, but market forces can suddenly change to prove the signal wrong, with the “reversal” turning out to be a retracement. The only way to limit your downsides is by using stop losses.

The best way to locate your stop loss levels is to use the support levels of longer time frames because of their stability and reliability. Your stop losses should be just below the established support levels.

Bottom line

Retracements can be just as useful to traders as reversals. However, the two are closely related, and one can easily misread their signals. The methods highlighted above can help you identify them, but they are not foolproof. You can, however, increase your efficiency through practice and experience.