Currency risks are a common phenomenon to any business or company that engages in the conversion of foreign currencies. The risk is exacerbated whenever a payment is delayed as exchange tariffs change in response to various monetary policies and economic factors.

A money market hedge is a commonly used strategy to avert downfalls triggered by exchange rates fluctuations. It entails borrowing or depositing cash in interest earnings accounts which can then be used to cater to future monetary requirements.

By borrowing now, a business or company would be able to avert a peril triggered by interchange rate uncertainty in the future. The borrowing can occur until the actual transaction occurs. The borrowing can take place using various financial instruments not limited to treasury bills.

In most cases, the currency risk aversion play does not offer the ideal way of dodging against the perils triggered by conversion tariffs fluctuations. This is especially the case given the availability of futures and options known to be cost-effective in offsetting such threats. However, it is still an ideal play for retail investors and traders not looking to leverage other coinage loss mitigation strategies.

How it works

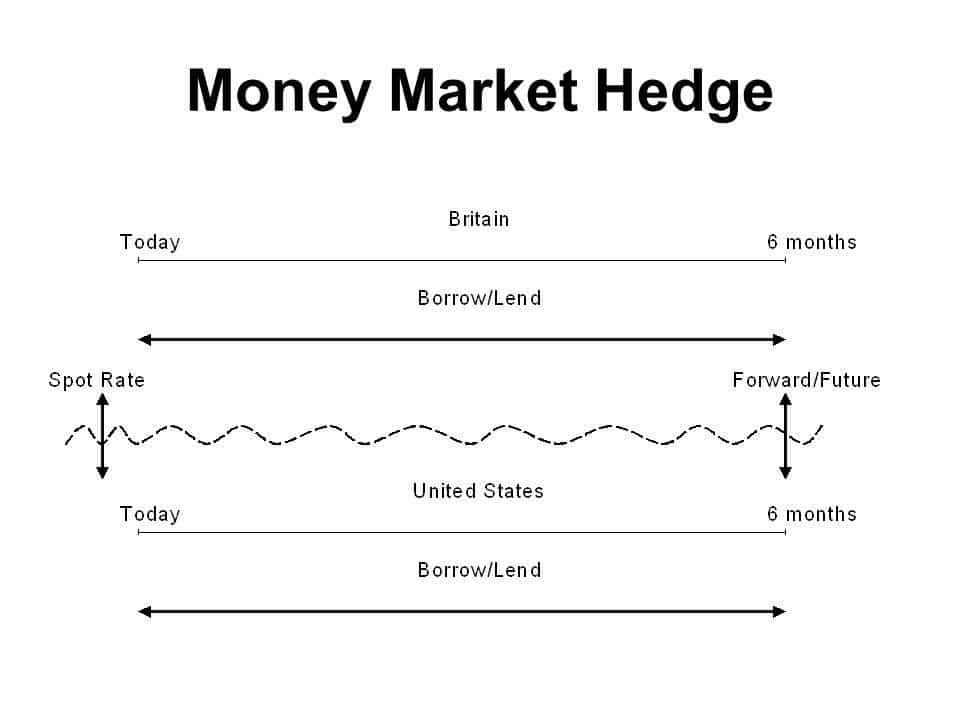

The technique works by a company locking the value of a given transaction in advance. This is achieved by borrowing a foreign legal tender in a sum equivalent to the present value. The sum is then converted into local legal tender at the prevailing spot level and deposited in an interest-earning account.

The cash deposited can accrue interest during the period, therefore deterring uncertainty about the cost of future transactions. When the transaction date nears, the sum accrued over the period is used to pay for the underlying transactions.

Example

Suppose you plan to take a vacation to Germany, which could end up costing about 5,000 euros. If you are worried that the current spot ratio of 1.20 could increase in the next six months before going on the trip, deploying a money market hedge would be the best play to avoid the costs rising by as much as 500 euros

In this case, you could borrow in your domestic legal tender, which in this case is the greenback, for six months at an annual rate of say 1.5%. Convert the loan to a euro account and earn interest at 1.25%. After the six months have elapsed, you can use the sum deposited plus the interest earned to pay for the vacation.

Additionally, the technique also entails locking in a tariff ahead of a transaction. For instance, a company could reach an agreement to lock in the prevailing charge in the hope of using it after, say, six months to convert a given sum.

By locking the exchange rate, the firm would be protecting itself against the conversion ratio going against it, resulting in losses upon conversion. Additionally, the locking could result in the firm losing on the conversion ratio moving in favor.

Forward exchange tariffs

With the money market hedge, forward exchange tariffs are a key component that factor interest differentials between fiat pairs. In this case, it is the spot level that is adjusted while factoring in changes in the benchmark.

Consider banks in the UK are offering interest rates on the sterling pound at an interest of 1%. In contrast, banks in Germany are offering 2% on deposits. In this case, businesses and investors may be tempted to convert holdings into euros to take advantage of the high deposit rates on offer. However, the conversion would expose them to coinage perils which can be mitigated by hedging

Applications

The currency risk mitigation strategy is one of the best for alleviating conversion price changes in instances where forward contracts won’t be cost-effective. The technique is especially useful when dealing with exotic currencies or other fiats not widely used in the global financial system.

Additionally, it works well for small businesses with no access to other instruments for shielding against such risks. It also works well for smaller totals where one is not ready to incur the cost that comes with hedging using futures or options.

Pros

Money market hedge is an ideal method for averting risks that come about due to exchange rate changes. By locking the prevailing interchange level, one can avoid losses that come about on fiat values changing significantly in the future.

It also stands out as units can be customized in precise amounts as well as dates. While the synergy is also available with other methods, it is usually not available to everyone, especially in the forward market.

Cons

Logistical constraint in implementing the risk mitigation strategy is one of the biggest headwinds. The technique entails many procedures, right from applying for a loan and placing the borrowed cash into an interest-earning account. Therefore, the entire process could take some time; therefore, not useful for someone looking for a quick fix to avert perils.

Compared to other hedging techniques, the money market is complex as it entails lots of steps. Therefore, it might not be suitable where one needs to avert perils one-off. The distinct steps could also be cumbersome when more than one transaction is involved.

Bottom line

A money market hedge stands out as it allows businesses and companies to shield themselves from the negative effects of wild exchange ratio fluctuations. Such changes could dramatically alter the conversion ratio, resulting in significant losses when converting one legal tender to another. The risk mitigation strategy works best when dealing with occasional or one-off transactions.