Participants in international trade, be it importers, exporters, investors, or even governments cherish the opportunity of transacting in one currency and having proceeds repatriated in their preferred currencies. However, that is not always the case; Cross-currency triangulation is one such method that makes it possible to convert one currency to another when dealing with currencies that don’t have freely floating exchange rates.

With Cross currency triangulation, amounts in one currency are converted to another currency through another currency. The method came into being in response to the fact that many spot currencies are not traded against each other in the interbank market.

The method first came into being when countries within the European Union were transitioning to the euro from their national currencies. During this period, there was no conversion between national currencies. Likewise, all conversion had to involve the euro in what came to be known as triangulation.

While the method was first used to enable conversion of European currencies on the introduction of the euro, it has since found great use in converting other currencies with or without euro involvement. The method finds great to use where there are no published rates between two currencies. In this case, a third currency is used whose rates are known and applicable to the two currencies.

Understanding cross rates

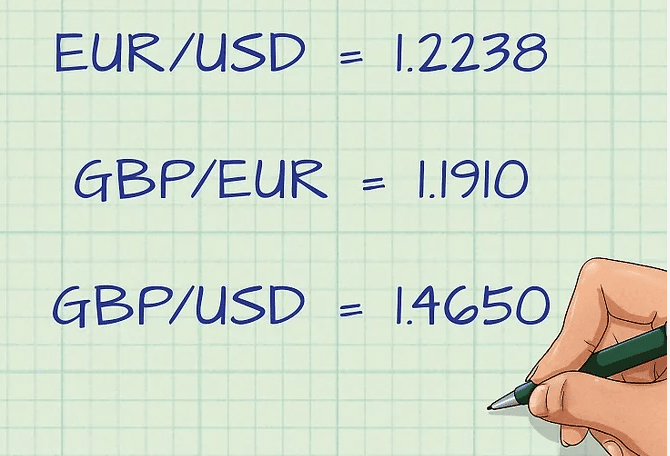

The US dollar is one of the currencies in major currency pairs and is usually considered the major one. For instance, EUR/USD USD/CAD or GBP/USD. In contrast, cross rates are currency pairs that don’t include the US dollar. They include the EUR/GBP, AUD/EUR, or EUR/GBP, among others.

Cross rates can be obtained in two main ways, direct from the source or through triangulation.

With the ‘direct from the source option,’ one only has to use the source’s available exchange rate, e.g., EUR/CAD. However, if the source does not provide the exchange rate, it is still possible to carry out the conversion. Triangulation has made it possible to convert currencies whose exchange rates are not readily available by using another pair.

For instance, we can get the exchange rate of EUR/CAD by using the available exchange rates of EUR/USD and USD/CAD.

How it works

In the past, it wasn’t easy to transact in one currency and receive returns directly without carrying a US dollar transaction. Consider a UK exporter doing business in Japan. The traders would often receive the Japanese yen for goods sold. The traders would then have to sell the yens for the US dollars and then sell the US dollars to obtain the preferred British pounds.

The long transaction was the norm before the cross currencies triangulation method came into being. Fast forward, cross-currency triangulation has made it possible to convert one currency to another using a different pair.

The method came into being with the inception of the euro, making it possible to transact businesses in euros and have funds channeled back to national currencies. Likewise, the conversion is often rounded to the euro.

In the triangulation method, a source currency is first converted to an intermediate or base value expressed in a reserve currency such as the euro or US dollar. Finally, the intermediate or base currency is inversely converted to the destination currency. For the method to work, the exchange rate of the intermediate currency must be set at a fixed rate that can never change.

Likewise, the method also works in the scenarios where there is an established relationship between all the currencies subject to triangulation. The three must be defined from the source to the target with no exchange rate.

The triangulation method has since made it possible to take advantage of the disparity in bid-ask spreads. Similarly, traders are always on the lookout for discrepancies between the bids and ask prices in the conversion.

The discrepancy that exists between the bid and ask spreads on currency pairs gives rise to arbitrage opportunities that most people take advantage of. However, given that the opportunities last for as little as 10 seconds, it requires high-speed trading to profit from them.

Conversely, computers linked to the interbank are fond of identifying these discrepancies and opening positions before the prices are adjusted.

Example 1

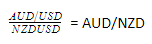

Suppose we know the exchange rate of AUD/USD and NZD/USD, and we want to profit from AUD/NZD. To get the AUD/NZD rate, divide the AUD/USD exchange rate with NZD/USD rate.

Likewise, the AUD/USD offer, divided by the NZD/USD pair, would give rise to the AUD/NZD rate.

Example 2

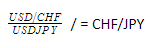

Suppose we wish to triangulate CHF/JPY from the US dollar. In this case, we could leverage the USD/CHF pair and the USD/JPY. The bid, in this case, will be the division of the two currency pairs, which gives rise to the CHF/JPY:

Now assume the USD/CHF rate = 1.4000-10 and USD/JPY = 99.000-10

JPY/CHF = 99.00/1.400=70.7

The importance of currency pair triangulation

Triangulation has given rise to one of the most effective trading strategies that allow people to profit from disparities in exchange rates. In most cases, people enter two long positions in the same pair, and one sells in the same bid to profit from price discrepancies. Similarly, one can open two sell positions on the pair and one buy.

Brokers worldwide are including cross currency pairs, providing an opportunity for people to detect price discrepancies and profit from them.

The triangulation method makes it possible to transact opportunities that crop up involving two to three currency pairs crossed by many nations. However, it is essential to note that the strategy would mostly work for small traders with limited funds. The same might not work for capitalized traders as the spot market does not always reflect the exchange rates.

Conclusion

Cross currency triangulation is an ideal conversion option for the currency pairs whose exchange rates are not readily available or known. The method makes it possible to convert one currency to another using the third one.

The conversion that must occur gives rise to ideal trading opportunities that crop up from time to time due to bid-ask price discrepancies. Therefore leveraging arbitrage strategies, it becomes pretty easy to profit from these discrepancies.