Buying the dip is a common maxim in the financial market. It simply refers to a situation where a financial asset like a stock, commodity, currency pair, or exchange-traded fund suddenly declines. In most cases, the situation happens after the asset makes a strong bullish trend. In this article, we will look at some of the popular dips in the forex market and how to trade such situations.

What is a dip in forex?

A dip in forex is defined as a period where a currency pair suddenly makes a major drop for one reason or the other. When this happens, a trader has three main options. One, they can buy the dip and hope that the currency pair will resume the bullish trend.

Second, the trader can ignore the event and look for opportunities elsewhere. Finally, when a dip happens, a trader can decide to follow the dip and do what is known as selling the rip. In this, the trader sells or shorts the currency pair hoping that the price will maintain the bearish trend. This situation is popularly known as selling the rip.

Causes of dips in forex

To understand how to trade dips in forex, it is important that you understand what causes these dips. Some of the causes are listed below.

Central Bank decisions

Central banks are the most important entities in the financial market. Besides, only a central bank is given the mandate to print money, set interest rates, and implement quantitative easing policies. Therefore, in most periods, a dip can happen because of a major decision by a central bank.

In all fairness, in recent years, central bank decisions typically don’t lead to significant volatility because of the idea of the forward guidance. This is a situation where a central bank tells the market what it will do in the future. For example, as the economy rebounded following the Covid-19 pandemic, the Federal Reserve told the market in advance that it would not hike interest rates until at least 2023.

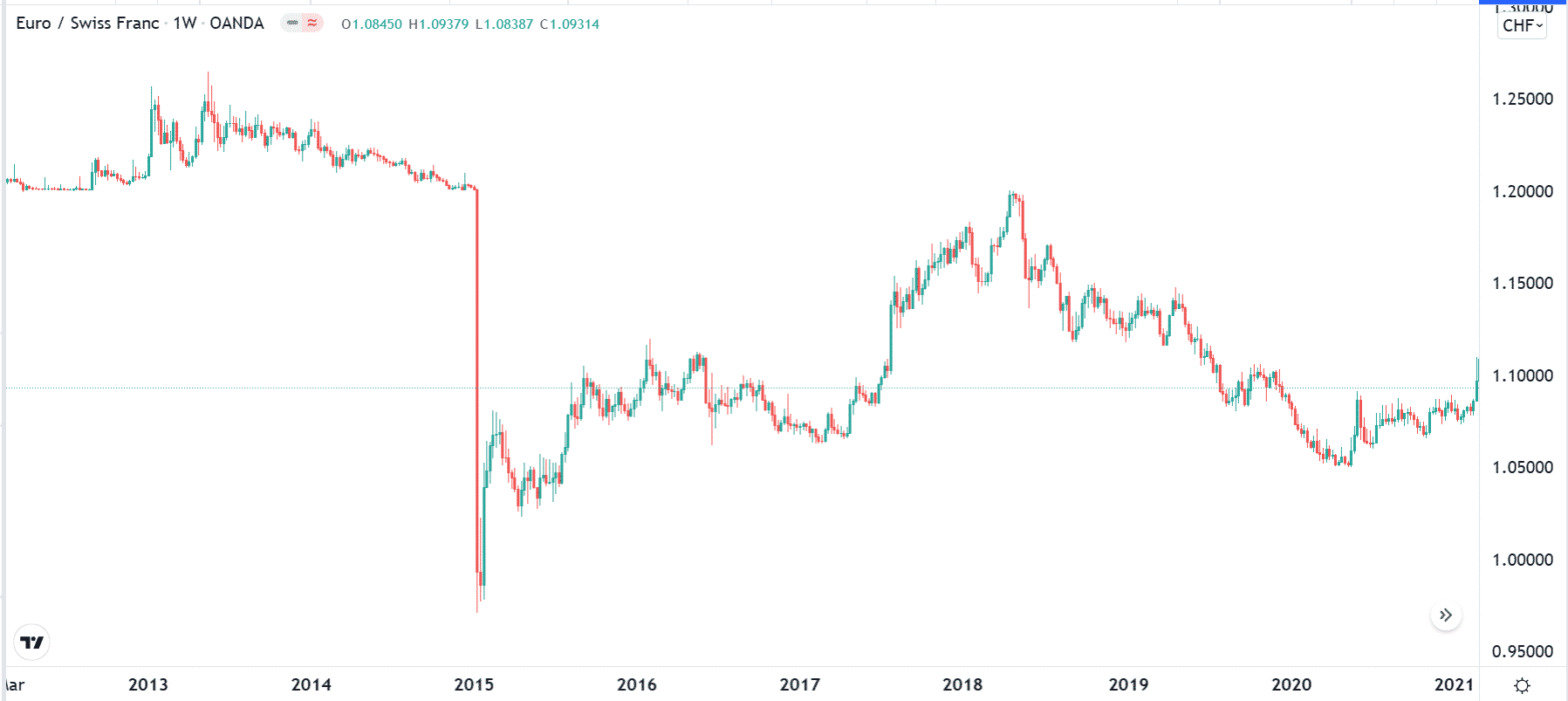

EURCHF when the SNB removed the peg

One of the biggest dips in forex was caused by the Swiss National Bank (SNB) in 2015 when the bank decided to remove the franc peg on the euro. On that day, the EURCHF and USDCHF pairs declined by more than 15%, as shown above.

Political events

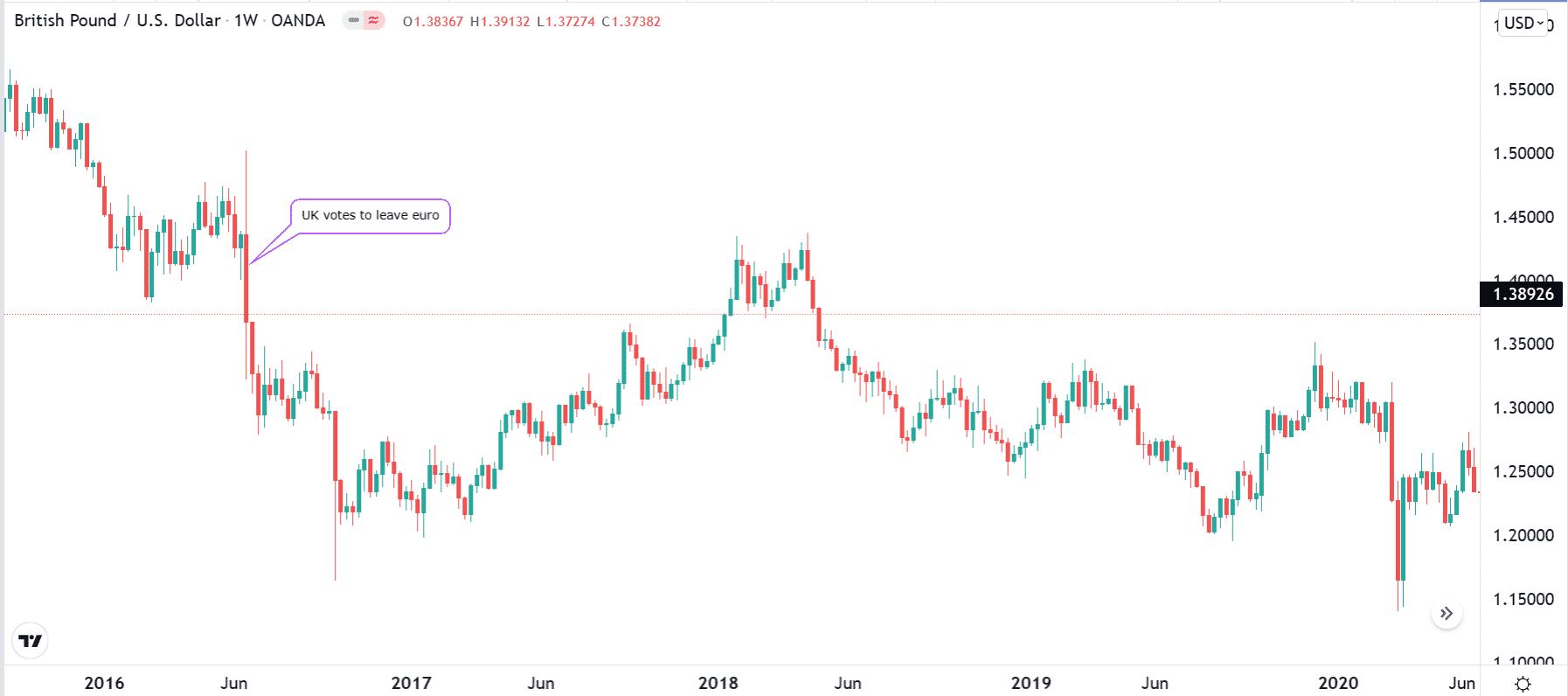

At times, a political event could cause a major dip in the forex market. These events lead to volatility, especially when the outcome of an election or referendum is against expectations. A good example of this is what happened in June 2016 after the UK went to a referendum.

GBPUSD performance after Brexit vote

Before the referendum, most polls were pointing to a large victory by the remain side. When the leave-side won, the GBPUSD pair sharply declined, as shown above.

Economic data

Economic data, which are released on a daily basis tend to have major implications on currency pairs. These numbers are important because they provide more information about the state of the economy. They also provide a signal about what the central bank will do. Some of the most popular economic numbers that lead to significant volatility in forex are employment, inflation, PMIs, GDP, and industrial production.

Other key causes of dips in the forex market are commodity prices, geopolitical issues, political speech, and technical reasons.

Strategies of buying the dips

There are several trading approaches to use when a dip situation happens. When you use these strategies well, there is a likelihood that you will limit your losses and even make more money.

Multi-timeframe analysis

A common approach to use when buying the dip is known as a multi-time frame analysis. It refers to a situation where you identify patterns and key levels by looking at multiple timeframes. For example, if you notice a dip that happens on the 30-minute chart, you could look at other time frames to identify key support levels.

In this, you could draw a horizontal line at the session’s low and look at other time frames like hourly, four-hour, daily, and even weekly. In most cases, doing such an analysis will help you identify potential levels that the currency pair will drop to.

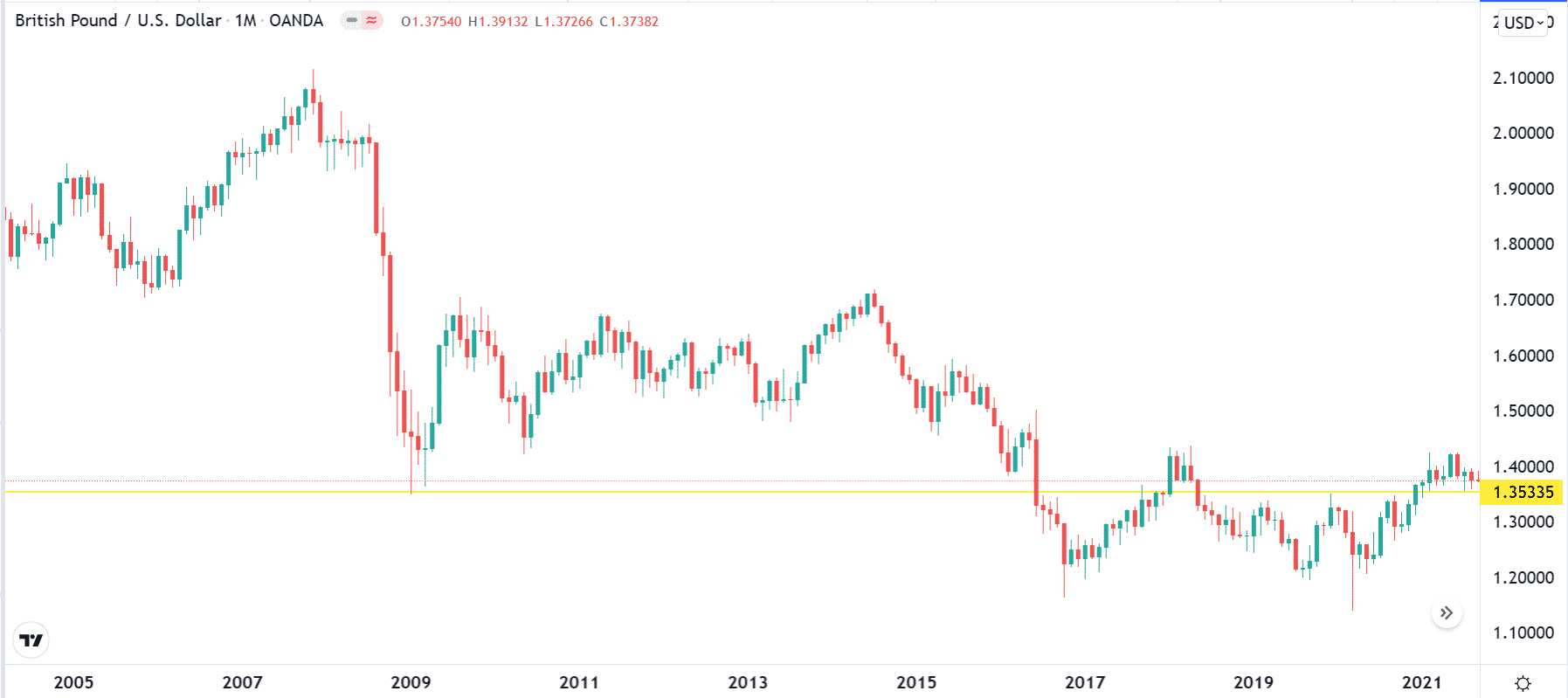

GBPUSD after Brexit

For example, in the chart above, we see that the GBPUSD dropped below the key support at 1.3533 after the Brexit vote. This was a notable level since it was the lowest level since the Global Financial Crisis of 2008/9. Therefore, by falling below this level, it increased the possibility that the pair would continue falling.

Chart patterns

The next approach to use when buying the dip is to look at chart patterns that emerge when there is a big dip. Some of these patterns can give you a signal about whether the dip will continue or whether there will be a rebound. For example, a bearish flag or pennant usually signals that the bearish trend will continue. Therefore, in this case, you could sell the rip and benefit as the price drops.

Some chart patterns, on the other hand, can give you a signal to buy the dip. For example, if the price forms a double or triple bottom pattern, it is a signal that a rebound is possible.

Candlestick patterns can also tell you whether to buy the dip or sell the rip. Some of the popular candlestick patterns that tell you to buy the dip are the hammer, doji, morning star, and bullish engulfing patterns.

Summary

Buying the dip is a popular way to make money in the forex market. When done well, it can lead to significant profits. However, when you don’t employ proper risk management, it is possible to lose substantial amounts because you will be attempting to time the market. In this article, we have looked at some of the top reasons for buying the dip and some popular ways to use it when entering the market.