Unknown to most people is that commodity prices influence currency movements in the forex market a great deal. Since economic growth in most countries is overly dependent on commodity exports, it is natural for the value of underlying currencies to be heavily dependent on commodity prices.

While most currencies often feel the impact of commodity prices, the most affected are the Australian dollar, Canadian dollar, and the New Zealand dollar. Other currencies heavily impacted by commodity prices include the Japanese yen and the Swiss franc.

Understanding which currencies have a correlation with various commodities is essential for traders who trade these currencies in the forex market. This is partly because their exchange rates fluctuate in response to changes in commodity prices.

Oil and the Canadian dollar correlation

The Canadian dollar is highly impacted by fluctuating oil prices as the country is a net exporter. A decline in oil prices often results in the value of the Canadian dollar depreciating against other major currencies.

The decline comes into play because lower oil prices result in the Canadian economy receiving fewer oil business returns. Similarly, an increase in oil prices results in the Canadian dollar’s appreciation, given that the net effect is an increase in revenues from the sale of oil.

Japan, a net oil importer, is also heavily impacted by fluctuation in oil prices. For instance, the Yen tends to appreciate whenever oil prices decline, given the reduced cost of buying one barrel of oil. Likewise, the Yen tends to depreciate when oil prices edge higher, given the increased amount of Yen’s required to buy one barrel of oil.

Oil vs. CAD/JPY correlation

Analyzing the net oil exporter/importer perspective, it is clear that the best currency pair to trade is the Canadian dollar against the Japanese Yen. Whenever oil prices rise, traders tend to buy the CAD/JPY as higher oil prices result in CAD appreciation. Similarly, whenever oil prices are declining, traders go short on the pair as the Yen tends to strengthen given the reduced cost of buying a barrel of oil.

Gold vs. the Australian dollar vs. the Swiss franc

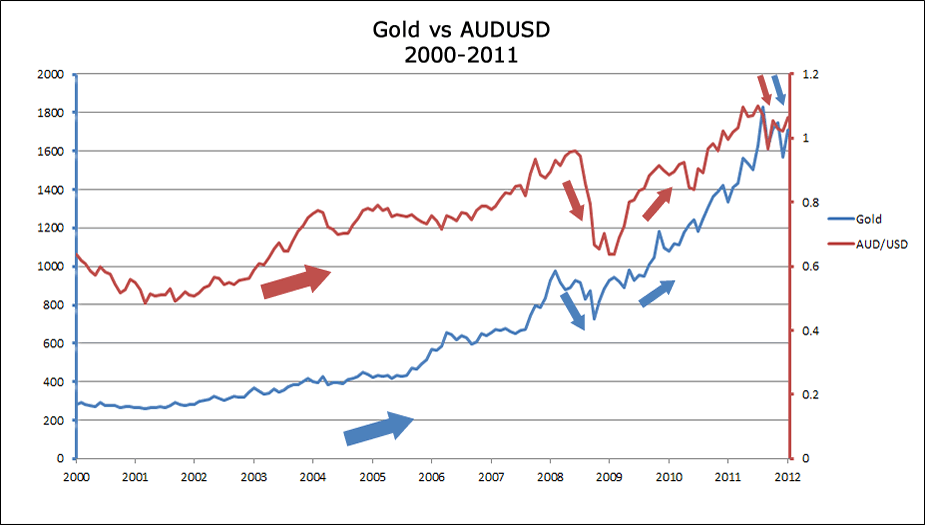

Fluctuation in gold prices many at times influences the Australian dollar rate in the forex market. It is partly because Australia is one of the biggest producers of the precious metal. Likewise, there exists a direct correlation between gold prices and the Australian dollar.

In many ways, traders prefer trading gold in the commodity market to trading the Australian dollar in the forex market. It is partly because whenever gold prices increase, the Australian dollar also tends to behave the same and increase in value.

The Australian dollar’s appreciation with higher gold prices is down to the fact that the economy stands to generate more money from the gold sales, leading to a positive balance sheet. Similarly, the reduction in gold prices often results in AUD weakness, given the gold business proceeds’ expected reduction.

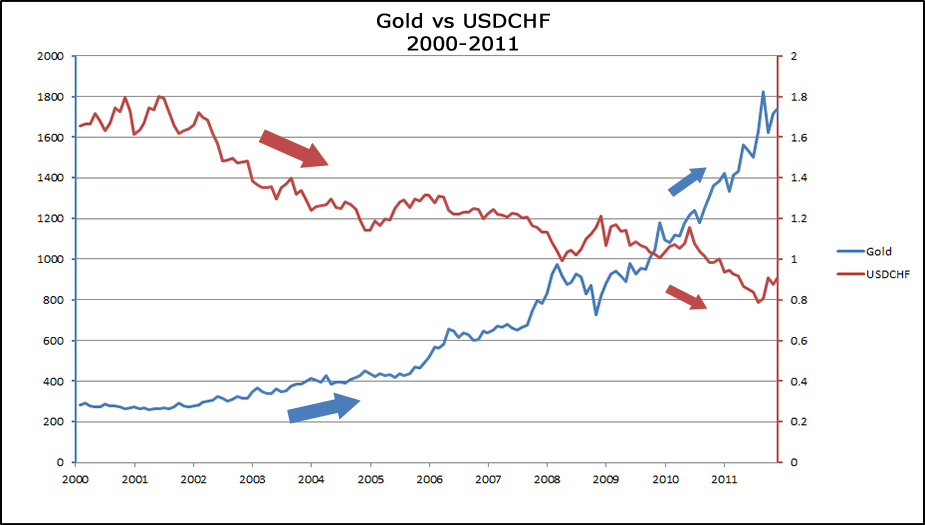

Gold prices also share a direct correlation with the Swiss franc. The yellow metal has always been used as a hedge against risks in the capital markets, thus the safe-haven status. Similarly, the Swiss franc has always been viewed as a safe-haven given the country’s political stability. The fact that the precious metals once backed the currency also affirms the direct correlation.

The Swiss franc tends to appreciate whenever gold prices are rising. Similarly, it tends to fall in value whenever the bullion is under pressure in the commodities market.

Currency vs. gold/oil

By being the global reserve currency, the US dollar influences gold and oil prices a great deal. For instance, whenever the greenback strengthens against other major currencies, the net effect is a decline in gold and oil prices in the commodity marketplace.

The strengthening of the US dollar essentially means holders require only a small amount of the greenback to buy an ounce or a barrel of oil. In this case, oil and gold prices tend to be much lower in response to dollar strength.

Besides, the strengthening of the US dollar is often associated with the US economy’s strength and resiliency. The net result is that traders in the currency market tend to buy the dollar, leading to its strengthening as they also shun oil and gold in the commodity marketplaces.

Similarly, whenever the dollar is weakening against the other major currencies, the net result is an increase in US dollars needed to buy an ounce of gold or a barrel of oil. In this case, oil and gold prices tend to be more expensive relative to the depreciating dollar.

A weakened dollar is associated with weakness in the US economy, which often arouses concerns in the capital markets. Concerns about the health of the US economy often cause traders to invest in gold, given its safe-haven status and a hedge against risks in the market.

Oil prices surged from $60 a barrel in 2006 to record highs of $147 in 2008. The rally in oil price coincided with weakness in the US dollar, which had weakened to its lowest level against the majors. Likewise, the US dollar was under pressure at the time, weakening to its lowest level in decades. The dollar index had weakened to its lowest level of 70 against the majors.

Amid the dollar weakness, gold prices also rose to the highest level at the time to $1600 an ounce as traders shunned the US dollar in favor of the precious metal.

Bottom line

Commodity prices and foreign exchange movements have always correlated. The best way to use commodity prices is to keep an eye on oil and gold prices when trading some currencies in the forex market, such as the US dollar, Canadian dollar, and Japanese Yen.