Conventionally, currency pairs in the $6 trillion forex market are paired in a given way. The representation makes it easy for traders worldwide to understand price action at any given time. While the naming standard mostly covers the majors, minors, and exotic fiats, other naming systems do exist.

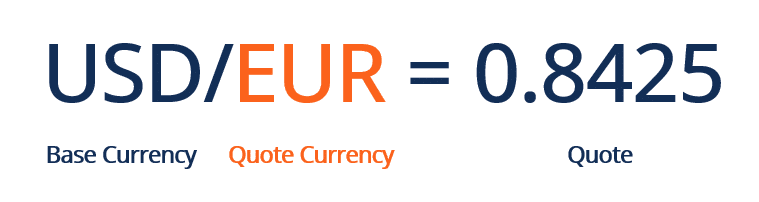

When combining currencies to form pairs, one legal tender assumes the base position on the left-hand side while the second takes the quote position on the right-hand side. The exchange rate, in this case, shows the amount of money needed to buy the legal tender on the left-hand side of a fiat pairing.

For instance, if EUR/USD is 1.2200, it simply means that one needs 1.2200 dollars to purchase one euro on the left-hand side.

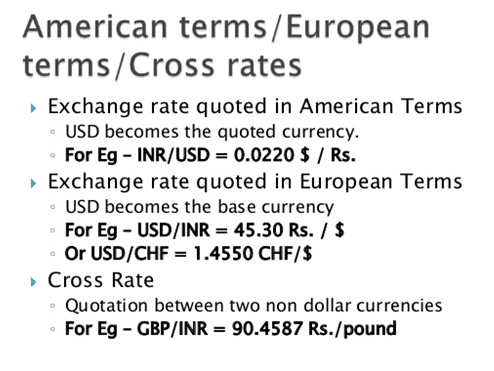

Given that the U.S. and the E.U. account for the biggest trading volume in the $6 trillion markets, two naming structures exist; the European terms and the American system.

European terms

It is a naming structure in which the euro, the official legal tender for the E.U., assumes the quote position when combined with other foreign legal tenders. The resulting instrument is considered a direct combination for people within the E.U. It shows the euros needed to purchase another fiat.

It is said to be a direct pairing because it shows the amount of domestic money (euros) needed to purchase a unit of foreign cash, which is always on the left-hand side of a fiat pairing.

Conventionally, EUR/USD is the commonly used instrument. Given that the euro is the base and the buck the quote, the combination is considered an indirect blend for traders within the E.U. For traders in the U.S., the duo is direct as it shows the greenbacks needed to purchase the common E.U. money.

The structure can also be reversed such that EUR becomes the quote and the buck the base. In this case, the pair becomes USD/EUR. The instrument, in this case, is considered a direct instrument for traders within the E.U. as it indicates euros needed to purchase one greenback.

Likewise, if the EUR/USD exchange rate were 1.2200, the USD/EUR would reverse and become (1/1.2200= 0.8197)

For instance, EUR/USD indicates the amount of foreign money needed to purchase the domestic money, which is the euro.

Trading: Long vs. short

In European terms, the acceptable structure is USD/EUR to show the exact amount of euros needed to purchase the base, in this case, the dollar. Other instruments that can come into being taking into consideration the structure include GBP/EUR showing the number of euros needed to purchase the British pound or CAD/EUR is indicating euros required to buy one Canadian dollar.

Whenever anyone purchases a currency pair, they are simply buying the base fiat while selling the offer. For instance, going long on USD/EUR translates to buying the greenback while selling the euro.

In contrast, when one goes short or sells a currency pair, they are simply selling the base while buying the quote at the same time. For instance, going short on USD/EUR would amount to selling the greenback and buying the euro.

American vs. the European terms systems

While the euro becomes the quote with the European terms naming system, the reverse is true with the American system. In the American system, the greenback always assumes the quote position. Consequently, it indicates the dollars needed to buy the base, the foreign legal tender.

Consider EUR/USD. The exchange rate will show the number of dollars needed to purchase one euro, which is the base and the foreign fiat in this instrument.

The use of the American and European terms in forex depends significantly on the trader’s location. The direct and indirect structures also come down to the location of the traders. While business publications and media outlets use direct structure to assist their customers in understanding the exchange rates, the reverse is true in the forex market.

The forex market is a global phenomenon that relies on a conventional system when structuring various currency combinations. The standard holds for majors and minor fiat as they are the ones that elicit the most trading volume in the market.

The conventional standard is deployed to name fiat instruments in the forex market. The structure does not change regardless of which broker one is using or the traders’ location.

The U.S. dollar is the most dominant and is usually represented as the base to signify the amount of foreign fiat needed to buy it. Some notable instruments with the buck on the left-hand side include USD/RUB, USD/MXN, USD/CAD, and USD/SEK.

Bottom line

The European terms refer to how exchange rates are represented within the E.U. In this case, the euro always assumes the quote position showing euros needed to purchase a foreign fiat which could be pound, dollar, or any other option on the right-hand side of an exchange rate.

The European naming structure gives rise to direct currency quotes for traders within the E.U. on the euro acting as the quote. In contrast, the American system sees the greenback become the offer in a forex instrument to signify the greenbacks needed to purchase the foreign legal tender, which could be the euro on the left-hand side of an exchange.

While the European and American forex naming systems are important, they are not the conventional way pairs are named in the forex market. The two are mostly used by media and business outlets in a given jurisdiction to make it easy for clients to understand what they are purchasing or selling.