Brokers play an important role in executing trades in the forex market. They act as intermediaries connecting traders with liquidity providers. While serving as middlemen, they tend to increase the cost of trading, reduce transparency, and minimize trade execution speeds. Amid the deficiencies, it is possible to bypass the brokers and have direct access to the liquidity providers in some cases.

Understanding Direct Market Access

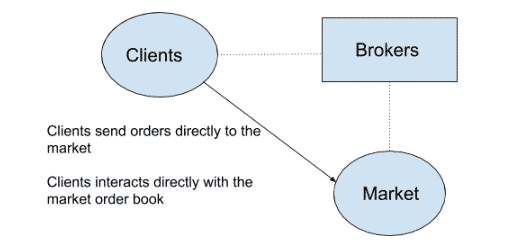

DMA refers to the ability to have direct access to electronic facilities and order books. In this case, one does not rely on forex brokers to have orders executed. Instead, one can directly access well-known exchanges such as the New York Stock Exchange or NASDAQ. Conversely, one can place market orders directly with liquidity providers.

By having direct access to exchanges and order books, a trader can enjoy high levels of flexibility and transparency while trading. However, given the complexity often involved, such models are recommended for advanced traders only.

Direct market access differs from over-the-counter dealing as prices are not quoted through a network of intermediaries or market makers. The fact that prices are not aggregated over the counter allows traders to choose prices they want, given their direct interaction with exchanges.

Given the complexities involved and advanced technology required, individual or retail investors don’t have direct access to exchanges. Even though most of their orders are usually immediately enacted, the same is done through intermediary brokerage firms.

How DMA works

Traditionally one needed to first interact with a broker to place a trade or an order. The same was done via the phone, email, or online. In return, the broker would look for the best price to execute the trade on behalf of a client.

Direct Market Access bypasses all these intermediaries by allowing traders to access the exchanges where the trades are executed directly. Consequently, traders can choose the price they would like their orders to be executed at instead of relying on brokers to choose for them.

In most cases, a market player places an order via an online trading platform; it could be a financial instrument’s buy or sell order. Instead of a broker taking the order, it is recorded in an electronic trading book and communicated directly to exchange servers.

The exchange where such orders are executed receives the order. The order is then fulfilled once the exchange finds the purchase price matches the sellers’ price.

While DMA is best known for facilitating direct access to stock market exchanges, it can also be leveraged while trading fixed income securities, financial derivatives, and other financial instruments.

Who can use DMA?

DMA is highly recommended for advanced traders. Such traders have access to trading strategies such as algorithmic trading that allows them to interact efficiently with exchanges.

In addition, it is also suitable for high net worth investors looking to trade in large volumes. While looking to execute large volumes likely to drive the market in a given direction, such players can interact directly with exchanges and order books to get the best price.

Institutional investors such as hedge funds, mutual funds, and pension funds may use advanced technology infrastructure provided by sell-side firms such as investment banks to gain direct access to the market.

Comparing DMA brokers

The best DMA brokers in the business are well-established players boasting of a high professional and institutional clientele base. In addition, they’re known to offer a contract for differences for various securities.

Big retail and institutional traders looking to leverage the services of a DMA provider should look to negotiate commission rates. While normal brokers publish their commission rates, DMA trading is quite different.

However, traders can still get discounts on commission rates or rebates on putting enough business through. The fact that many providers are offering DMA services will always see providers being willing to bend a little bit not to lose a big client.

In addition, it is important to note that DMA brokers don’t provide all the financial instruments. Consequently, it is important to double-check and see beforehand the securities they offer support to for trading.

Some of the best DMA brokers in the market include Saxo Markets, Interactive Brokers, and IG.

Benefits of DMA brokers

Bypassing brokers in the trading process allows investors to access the market faster with DMA. Consequently, the speed of order execution is increased, allowing players to enjoy the best prices available.

Bypassing brokers also reduces trading costs significantly. Brokers often charge commission for enabling the buying and selling on their platforms. The fact that clients deal directly with exchanges averts the risk of incurring additional costs in the form of commission.

DMA also accords traders and investors full control of the trading process. This is because transactions are managed directly with the investor rather than a broker that acts as an intermediary in some cases.

Additionally, DMA allows investors to take part in pre-market and post-market auctions given direct access to order books. Investors also get to optimize high-frequency trading by leveraging advanced trading tools for a high turnover rate.

DMA brokers cons

DMA is only suitable for traders leveraging advanced trading strategies. Consequently, it is not recommended for traders that deal in small volumes.

In addition, DMA is highly regulated. Consequently, it makes trading less flexible compared to OTC trading. In most cases, one cannot engage in repeat trading, and an order can be rejected at any given time. With the model, one cannot reverse or change an order.

Final thoughts

Direct Market Access is a service that allows sophisticated and high-net-worth investors to place buy and sell orders directly with electronic facilities. Instead of dealing with intermediaries such as brokers, DMA allows people to place trades directly with the central market.

DMA is commonly used by investment firms and high net worth investors to implement strategies based on algorithmic trading. It is efficient as it enhances the overall speed of execution and lowers trading costs.