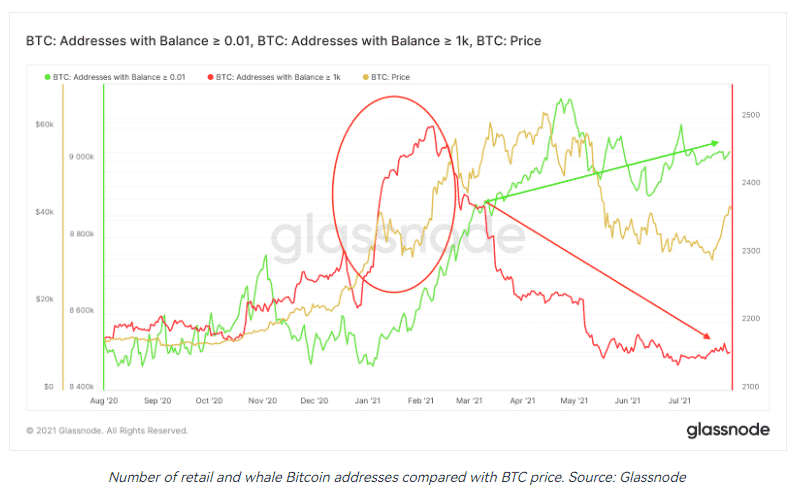

In the cryptocurrency market, whales are simply investors or institutions that hold a significant amount of the underlying tokens. Their giant holdings greatly determine how the crypto asset price fluctuates depending on their actions.

Whenever a whale adds to its holdings by buying more Bitcoin coins, the prospect of Bitcoin price increasing is usually high. Similarly, whenever a whale offloads some of its holdings, the actions are known to trigger fear in the market resulting in widespread sell-off. The net effect is usually a significant drop in BTC price.

In 2020, Bitcoin price rallied by more than 1200%, from lows of $4,600 to record highs of $63,000. The rally came at the backdrop of the increased institutional investment that fuelled one of the biggest crypto booms.

Some Whale investors that helped propel Bitcoin price to record highs include Grayscale Bitcoin Trust, which holds more than 600,000 BTC coins. MicroStrategy has also emerged as one of the largest investors, with about 48,400 BTC holdings.

Understanding cryptocurrency whales

Crypto whales are classified as investors that hold over 1% of the total crypto assets circulating supply. Their holdings carry more weight in crypto-assets with high market capitalization. For instance, a Whale in Bitcoin holding over 1% would own a higher dollar amount than a 1% holding in DASH crypto.

In addition, Whales are classified as either high or low activity. Holders that carry out over 300,000 transactions are considered high activity has given that their actions sway market sentiments given the size of their holdings. In contrast, those that carry out less than 300,000 transactions are classified as low activity.

How to profit from Whale Activity in crypto trading

The whale’s indicator is commonly used to analyze the concentration of holdings in given assets. Two outcomes are possible whenever supply is concentrated in a small clique of investors.

High supply concentration leaves the overall market at a disadvantage. This is because their actions will always influence how the price fluctuates, which can lead to episodes of market manipulation. A large holder can move the price of a cryptocurrency in the direction they wish, leaving small investors susceptible to wild price swings.

For instance, a whale can offload a small number of his holdings enough to sway other players, the market has turned bearish. Once sufficient sellers enter the market in a bid to push the price lower, the whale would then enter a large long position to reverse the trend and undercut the small retail investors.

Similarly, a whale could try to prop the market by entering small long positions only to sell afterward when sufficient buyers have entered to try to profit from price tanking significantly. A market with a small number of whales implies a form of monopoly whereby they dictate the direction the overall market moves. Therefore, a crypto asset would not be trade-based market forces but based on manipulation propagated by a few cliques.

The impact of whale activity has become clear in recent years. Tesla is one of the biggest investors that have swayed Bitcoin prices. Last year Bitcoin price rallied to record highs of $63,000 on the confirmation that the electric vehicle giant would accept Bitcoin payments for some of its products.

The confirmation acted as a buy signal affirming mainstream adoption. However, Bitcoin came down tumbling, shedding more than 50% in market value as Tesla said it was suspending Bitcoin payments due to concern of the negative impact on the environment of Bitcoin mining activity.

Dogecoin is another cryptocurrency that has benefited and suffered in equal measure amid the actions of whale investors. The hype that goes around social media by celebrities and high-profile investors such as Elon Musk has often triggered wild swings resulting in double-digit gains and losses.

Whale traders in forex

While forex is one of the largest markets, drawing millions of market participants, it is not immune to manipulation from whales. Institutional investors or big banks with significant financial firepower are known to influence the price action of various currency pairs, as is the case in the crypto markets.

Therefore, the playing field is never leveled as many people would like to think. The big banks and other institutional traders have an array of tools at their disposal that they can use to manipulate the forex market to their advantage.

How whales manipulate forex market

Big banks and institutional traders affect currency prices by accumulating and distributing their positions using tailored market orders. Whenever small traders want to trade, they put a full order, which gets executed in real-time without impacting the market. In contrast, when an institutional trader wants to trade, the size of their position can be so huge that it will overflood the market with demand and supply.

Therefore, big banks engaged in forex trading often break down their positions into small chunks and execute bids. For instance, whenever they’re exiting the market, they would sell a portion of their portion, resulting in the exchange rate dropping as the large sell order acts as a sell signal among retail investors.

Once the sell order is filled, the price would often bounce back as small traders assume the price has fully corrected and has bounced back. The bounce back in price allows the institutional traders to get their preferred price to sell another small chunk of the big position.

Small investors often see it as an opportunity to buy whenever large investors sell, taking advantage of the highly discounted price. Given that large investors have enough money, they would often shrug off any buying pressure by placing a much larger sell position.

How to detect whale activity

Watch out for large order cancellation

Whenever a big order buys or sells disappears, it implies a whale is about to act. Were a buy order to vanish from the order book, this would be the best time to eye sell positions as it implies whales are about to go short.

Look out for sudden price swings and volume change

A sudden price swing in either direction that disappears immediately implies whale activity in the market. Were the volume to increase significantly, this would be the perfect time to be on the lookout for a potential price swing to the upside.

Final thoughts

Whales are the force that drives prices in the crypto and forex market. Their actions determine whether a cryptocurrency or currency pair will trend up or down. If you’re a small fish and wish to make a fortune in the two markets, ensuring your trades align with Whale trades can guarantee good profits