TradingView is a leading fintech company used by millions of financial professionals from around the world to analyze and execute trades on thousands of assets like cryptocurrencies and stocks. The company has been on a strong growth path over the years, as evidenced by its most recent fundraising. It raised over $200 million at a $3 billion valuation. In this article, we will look at how TradingView works and some of its best indicators for cryptocurrency trading.

What is TradingView?

TradingView is a financial technology company that provides a complete suite of products that are widely used by traders and investors. Its flagship product is charting software that people can use to perform price action and other types of technical analysis.

TradingView has other important features. First, it has a watchlist product that allows traders to watch the price movement of key assets like stocks and digital currencies. Second, it has a strategy tester that lets them conduct a backtest assessment for indicators and robots. Third, TradingView has a news section that gives the latest news across assets.

Fourth, the platform has an economic calendar that provides a schedule of all key events that will come out on a given day. Some of the top events in the calendar that affects cryptocurrency prices are central bank decisions, inflation, and employment numbers.

TradingView also allows people to execute trades without having to go to their broker. It has achieved that by providing an Application Programming Interface (API) that connects brokers to its platform. Some of the companies that have linked their data to TradingView are Binance, Coinbase, FTX, Oanda, and Huobi.

So, let us look at some of the most important TradingView indicators for cryptocurrency analysis.

Moving Average (MA)

Moving Average is one of the most widely used technical tools in analysis. The idea behind this indicator is to find the overall average of an asset’s price on a given day. For example, assume that a cryptocurrency closed at $10, $12, and $9 in a three-day period, then its average price can be said to be $10.3, which is calculated by adding the three numbers and dividing by three.

There are many types of Moving Averages that traders and investors commonly use to conduct analysis. The goal of these averages is to reduce the lag that exists from the most basic calculation. The most popular ones are simple, exponential, weighted, smoothed, least squares, and Arnaud Legoux.

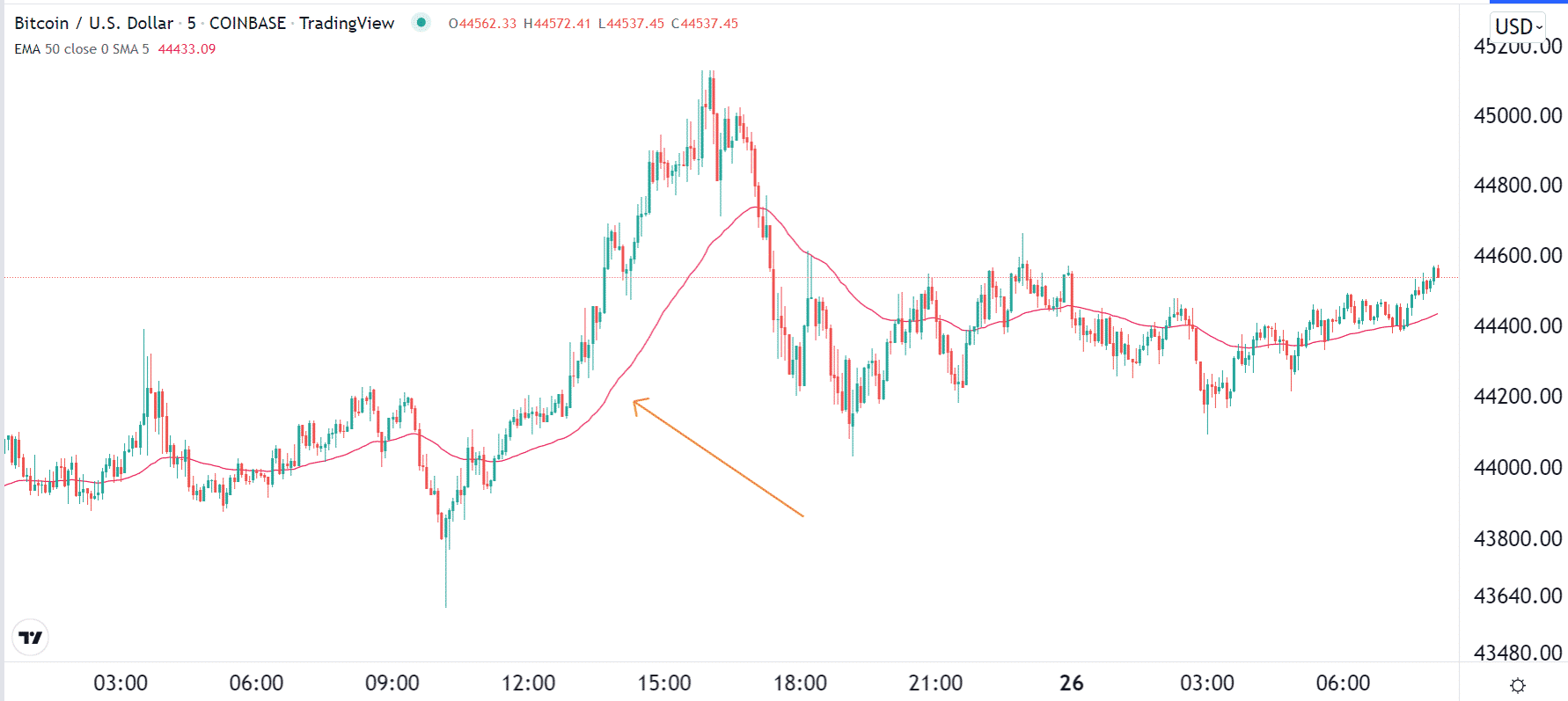

While there are many types of MAs, many traders use them in a similar way. One of them is known as trend-following, where they buy a cryptocurrency when it is above the average, as shown below. They will then exit the trade when it moves below that line.

Volume Weighted Average Price (VWAP)

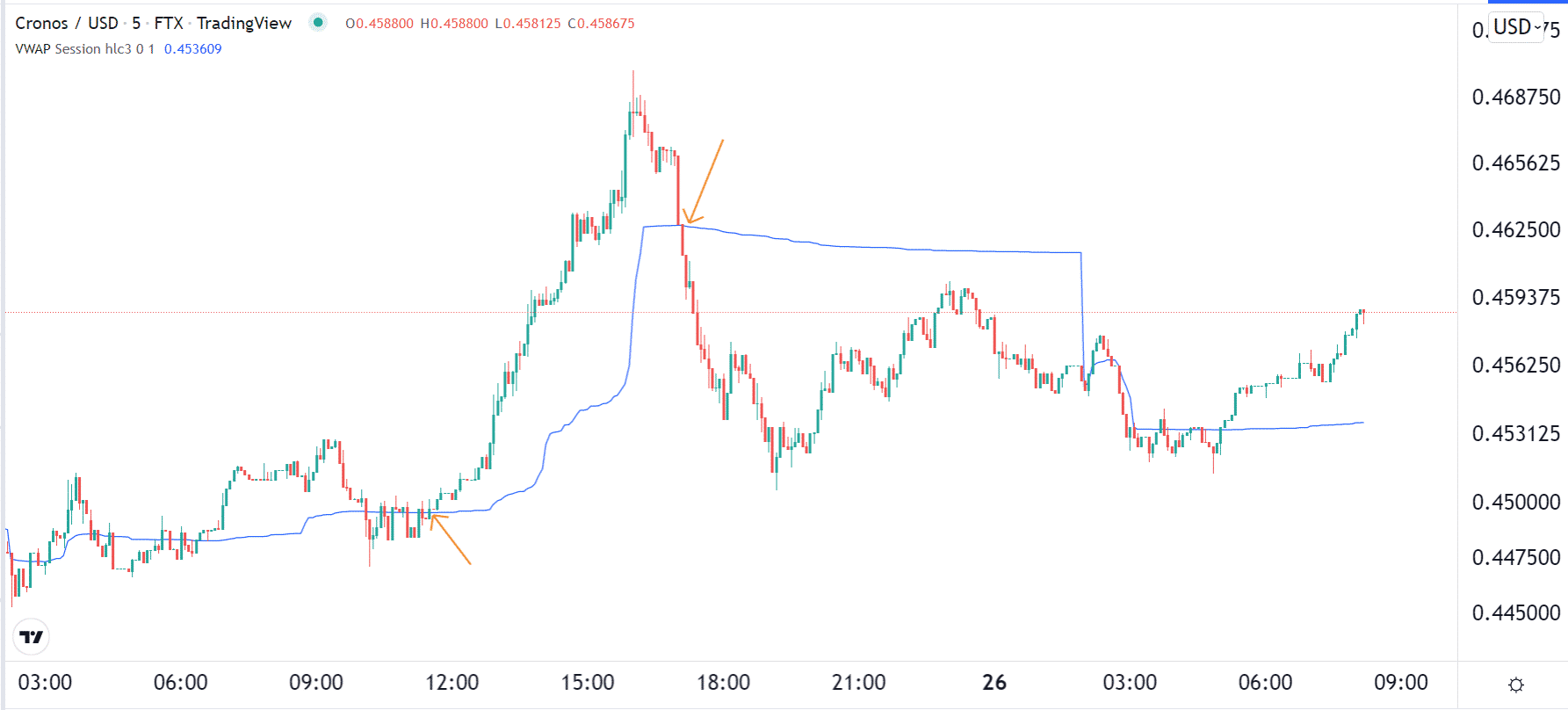

The VWAP indicator is one of the most useful tools for day trading. In fact, unlike other tools that can be used for other strategies, this one is built solely with trading in mind. For one, it only works well with very short-term charts like 5-minute and below.

Its name provides a hint about its role and what it seeks to achieve. It simply aims to find the average price of an asset in a given period, typically less than a day.

Calculating the VWAP is a bit tedious process that first involves getting the typical price and multiplying it with volume. Using it is an easy process. Like the Moving Average, the goal is primarily to buy the coin when it crosses the VWAP and sell when the price falls below the indicator.

Pivot Points

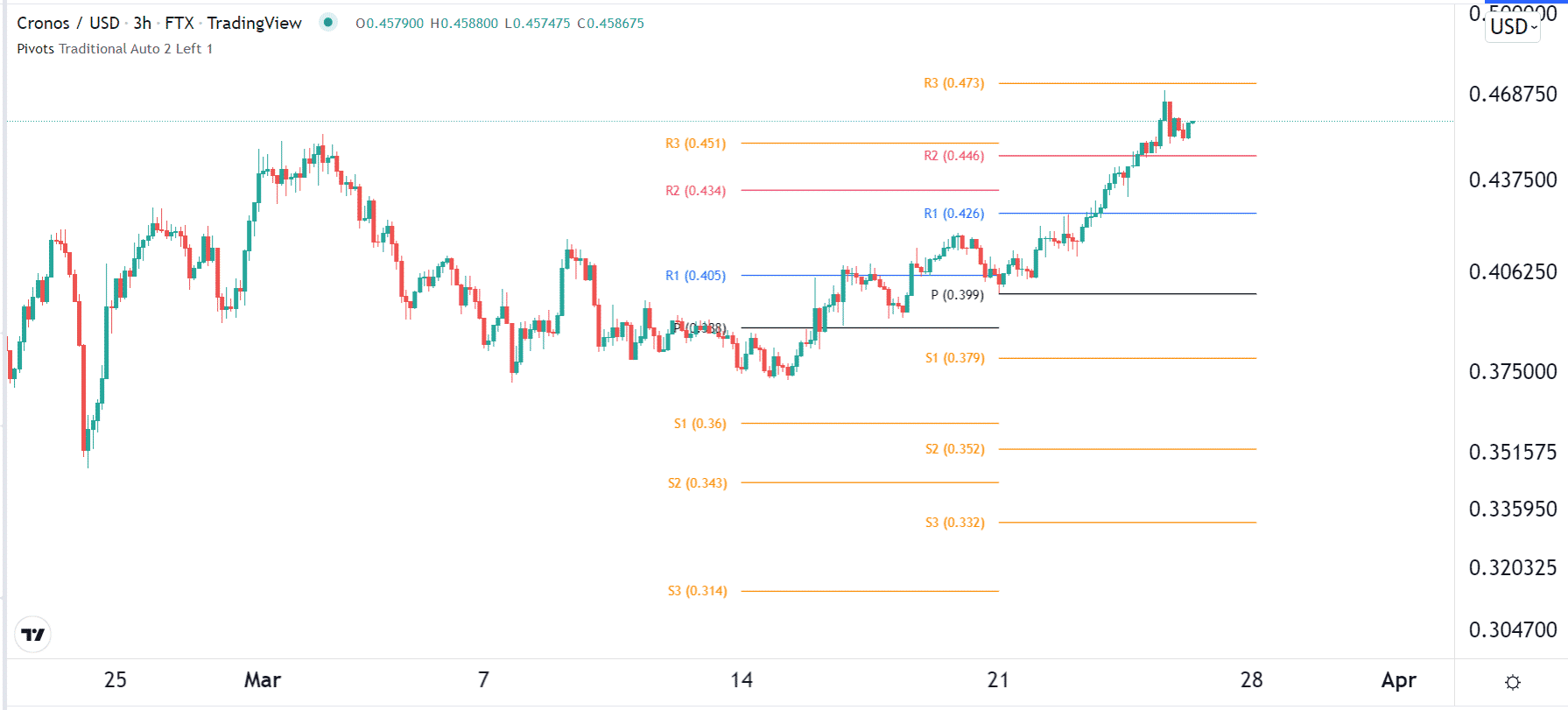

To a large extent, pivot points are not necessarily indicators, although TradingView offers them in that category. Instead, they are price action tools that help traders to identify key support and resistance levels of any asset.

Without TradingView (TV), one would need to do manual calculations and then draw the lines, which can lead to errors. As such, TV solves this challenge by making it easy to add them within a few seconds.

There are several types of pivot points based on how they are calculated. These are standard, Woodie, classic, and Camarilla. To add them to TV, you just need to select the one you want, change the colors, and the number of periods you want to track.

As such, if a coin moves above the first resistance, you can assume that the next level to watch will be R2 and so on, as shown above. In this chart, the coin is above R2, meaning that it will likely move to R3 in the near term. As such, you can have that level as the profit target.

Know Sure Thing (KST)

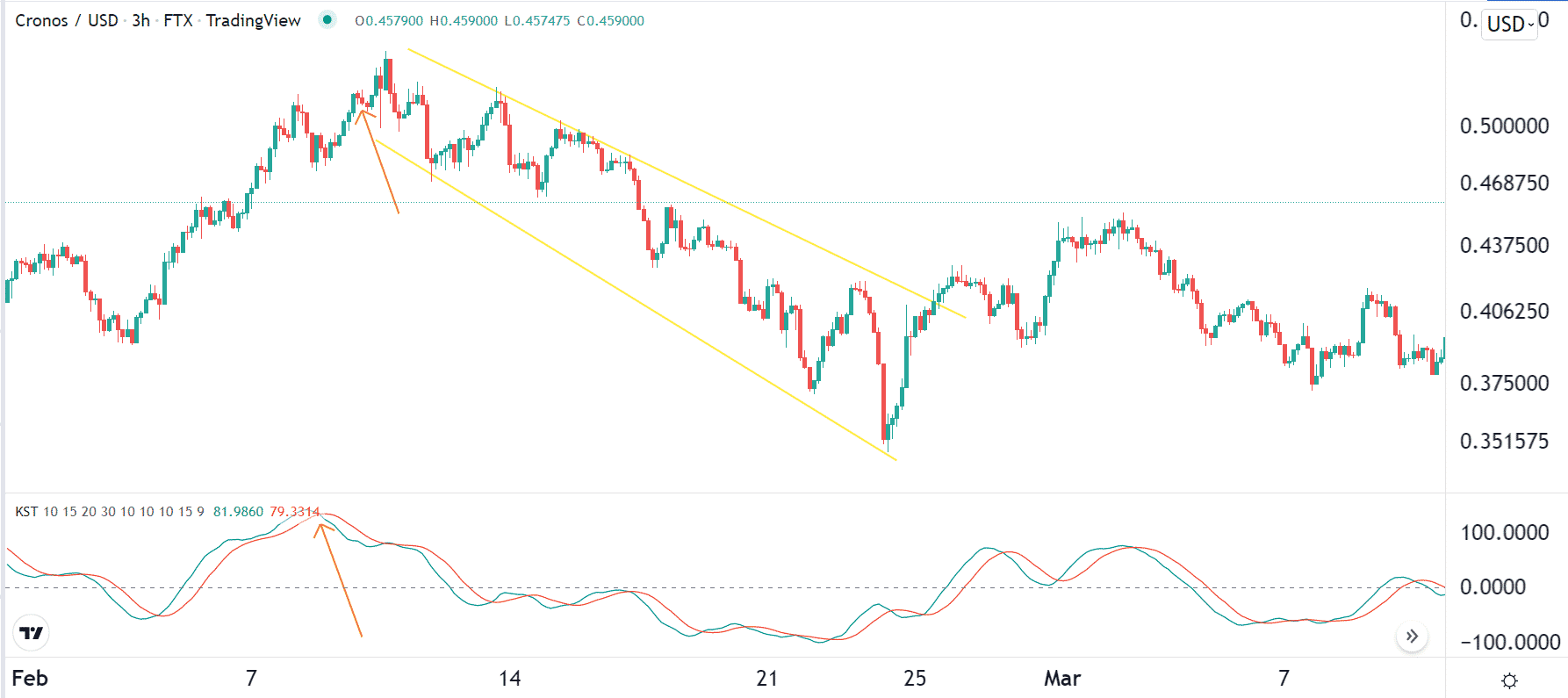

Trading oscillators are tools that provide the overall gauge of an asset. For example, oscillators like the Relative Strength Index (RSI) and the Commodity Channel Index (CCI) are mostly used to find overbought and oversold levels.

Know Sure Thing is a TradingView tool that is used to find bullish and bearish crossovers. It is also used in trend-following trading strategies.

KST has a close resemblance to the MACD, a tool that converts MAs into an oscillator. It has two lines that move up and down a median line. It is used to measure the price momentum for 4 price cycles and then makes it a single indicator.

One of the best ways of using the KST tool is by seeing where the two lines make a crossover below the neutral line. After this happens, you can ride the bullish trend and then exit when it crosses over above the neutral line, as shown above.

Summary

TradingView has hundreds of basic indicators and many others that are developed by individuals. Therefore, we have barely scratched the surface by looking at four of them. Some of the other popular tools worth noting are Elders Force Index, Klinger Channels, and Ease of Movement.