Swing trading is the happy medium or sweet spot between day trading and position trading. This methodology is not focused too much on the long term, nor the short term either.

With swing trading, forex speculators hold their positions over several days or weeks to profit from price ‘swings’ or changes. Swing traders can trade all market conditions, from trending, reversals, and range.

Your average swing trader looks at time frames from the 4HR up to the weekly or monthly charts where they can find the best opportunities to hold their positions for a few days or weeks.

Swing traders will observe the market daily but may only execute a few orders weekly or monthly. Hence, the trading frequency is minimal, making this approach far less time-consuming than day trading and scalping.

You need to be extremely patient with swing trading and take a ‘quality over quantity’ mindset. Another advantage of swing trading is traders can employ strategies based on this methodology across most pairs with relatively the same profit potential.

However, this article will explore the best four currencies and why they provide the best chances of success.

Picking the best currencies for swing trading

It’s unnecessary to have tunnel vision on the pairs to observe when swing trading. As briefly mentioned, swing trading is versatile and works with similarly equal levels of success across the board when practiced strategically.

However, for those considering a narrower selection, we’ll outline the criteria in deciding the best four. Regardless of your trading style, most traders would agree that focusing on highly volatile and stable markets is vital.

In a nutshell, you want currencies with fairly sizable volatility as they can move the most amount of pips in the shortest period possible. Additionally, these markets must exhibit relatively stable price movements without any ‘choppiness.’

The best markets with most of these qualities are major and minor pairs. Some exotics may be worthwhile considerations, although many tend to be erratic and have higher spreads.

The latter decrease your position size, meaning the value of your trades becomes smaller. Yet, one may find some rare gems with these instruments if the swap rates are favorable in your trade direction.

Swaps with the major and minor are pretty low. Conversely, you’ll have to observe the swaps when trading exotics to ensure they don’t eat too much of your profits, considering swing traders hold their trades for days or weeks.

Therefore, the two key factors here are volatility (for maximizing gains in the shortest possible time) and swaps (to reduce your trading costs for overnight positions).

Best 4 currencies for swing trading

Now we’ll explore the actual best four currencies in swing trading and the benefits they provide.

1. GBPUSD

‘Cable’ or the British pound’s inclusion here shouldn’t come as a surprise as it’s one of the most frequently traded pairs globally. What’s unique about this market and most GBP currencies is their inherently high volatility.

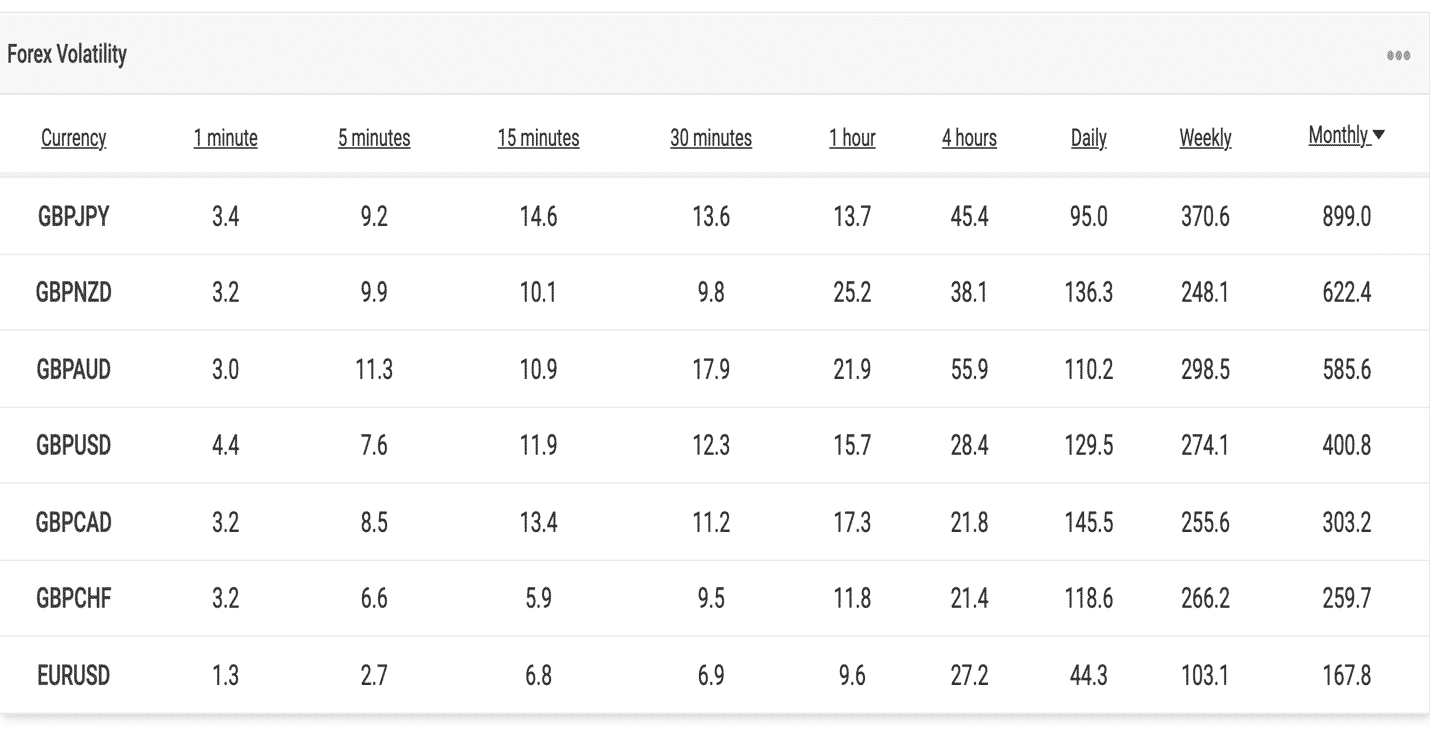

Below you can observe the notable pip differences in volatility between several GBP-based instruments against the euro, which is technically the most traded forex pair.

Of course, ‘Cable’ is heavily correlated against USD pairs, and traders typically want exposure to the US economy. Price movements on the pound are pretty stable, and many of the technical and fundamental indicators driving the price are applicable with other markets.

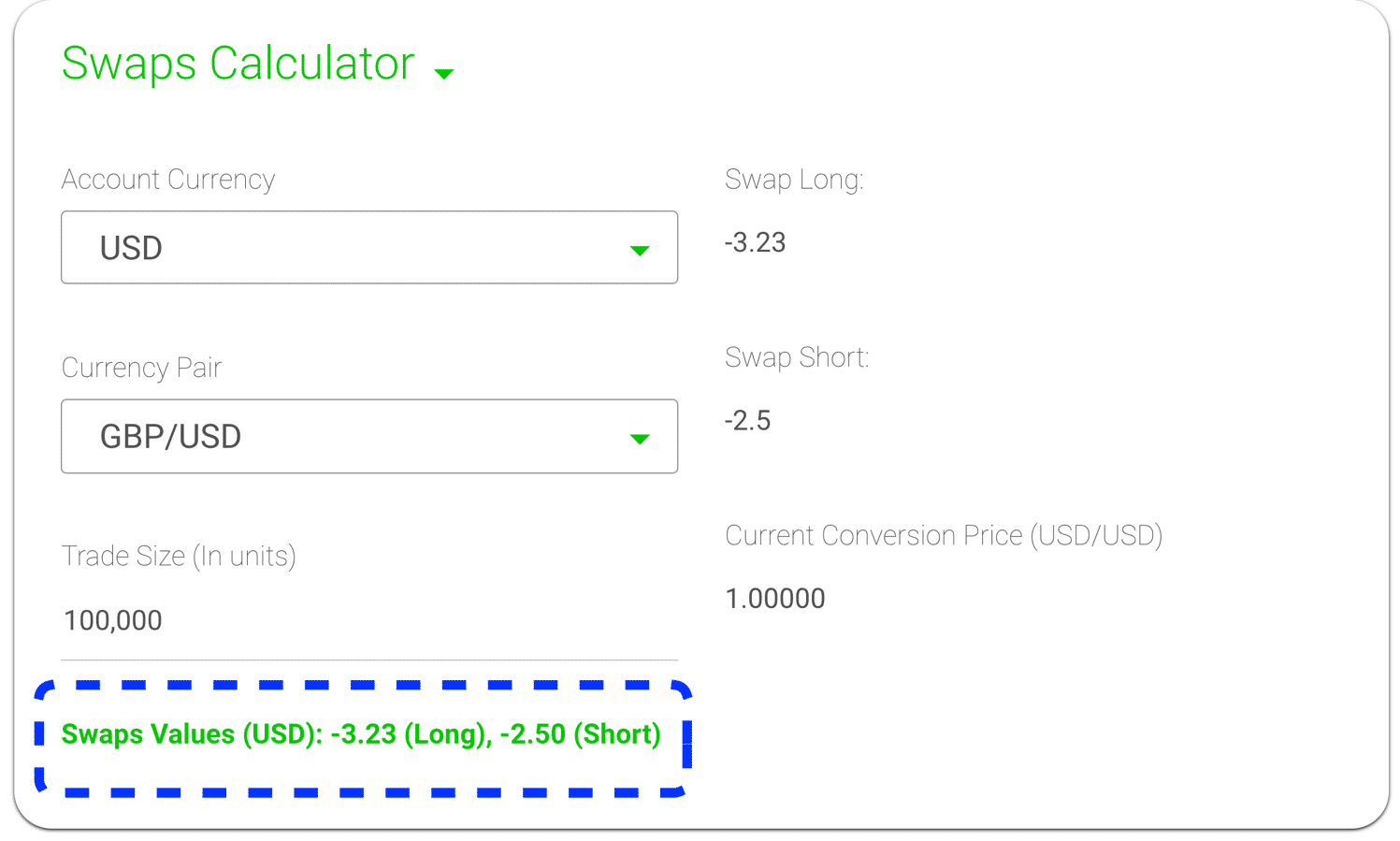

The other benefit of GBPUSD is the pair has reasonable swap fees for both buying and selling presently.

Using IC Markets’ swap calculations, it costs $3.23 (for going long) and $2.50 (for going short) daily with one standard lot (100 000 units).

2. XAUUSD (gold)

With gold, you have exposure to the US dollar and the commodities market. Although XAUUSD and GBPUSD both share the greenback as their quote currencies, you may find several instances of the former moving on its own based on unrelated commodity indicators and events.

Hence, the correlation isn’t as positive, but it’s crucial to observe the relationship according to market conditions regularly. XAUUSD is even more volatile than other forex markets, making it particularly attractive for speculators.

Yet, despite this benefit, gold is inherently expensive to trade from a value perspective (not spreads). One standard lot on this pair is worth significantly more than on GBPUSD.

This market is a worthy addition to the portfolio of any swing trader, provided they are appropriately capitalized and ensure they aren’t increasing the correlation risks when trading other USD pairs.

3. EURNZD

EURNZD is also a highly volatile and popular cross pair, providing exposure away from the US or GBP markets. Like most markets, traders use the same technical and fundamental data to make decisions on buying and selling.

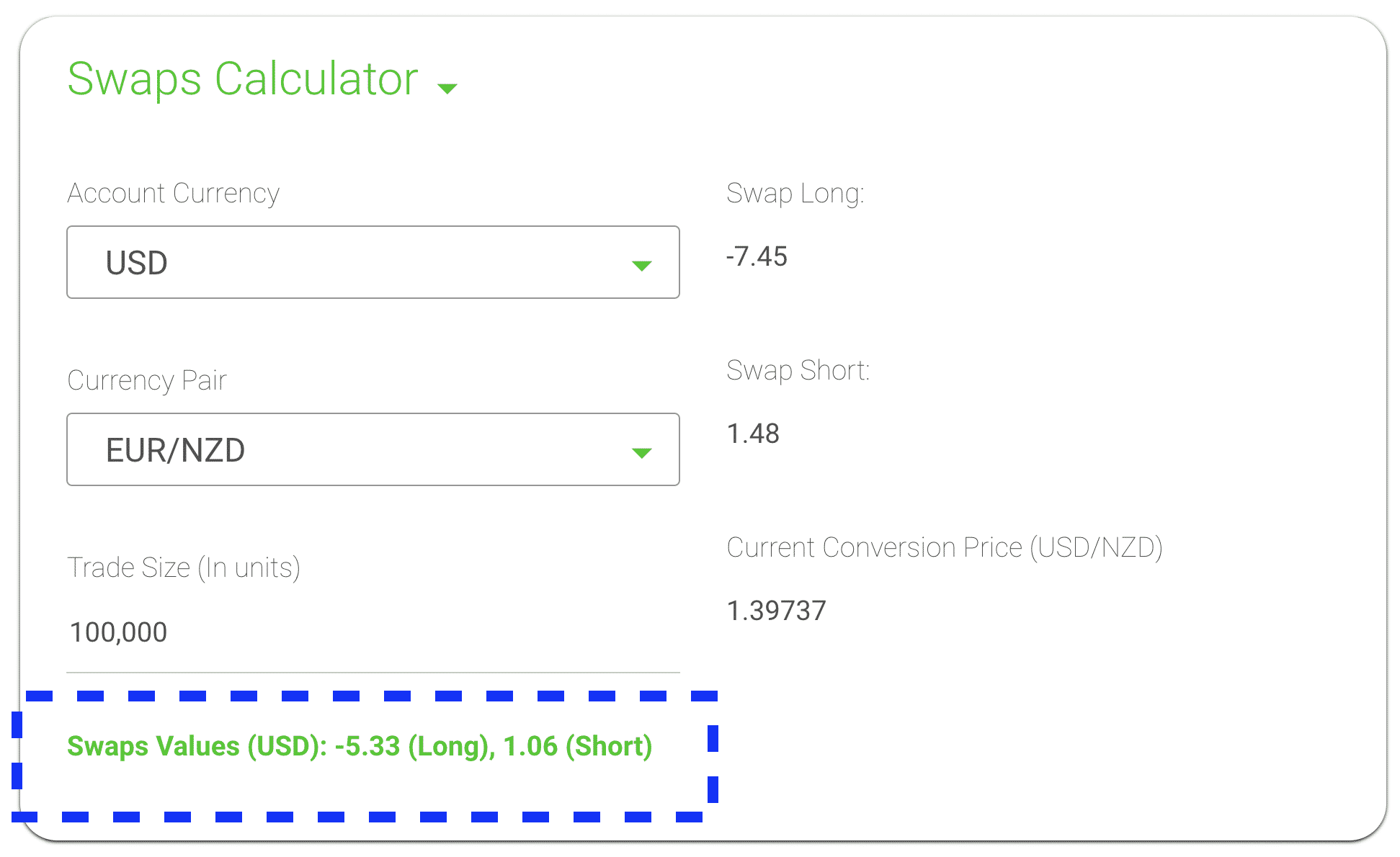

The other benefit worth mentioning about this instrument is the current swap rates. For example, with IC Markets presently, you earn $1.06 for going short and are debited $5.33 daily using one standard lot.

Not every broker may provide a positive swap for selling EURNZD. However, the rates would be reasonable if you held your orders for a long time.

4. EURZAR

EURZAR is one of the most popular exotic markets. This pair is unique compared to others as a thinly-traded instrument. For starters, swing traders would certainly need to be cautious of the high spreads and weigh up those across numerous providers.

EURZAR is tremendously volatile, characteristic of exotic markets generally. This pair allows traders to take advantage of a developing country’s (South Africa) economic situation, providing some variety away from the typical pairs.

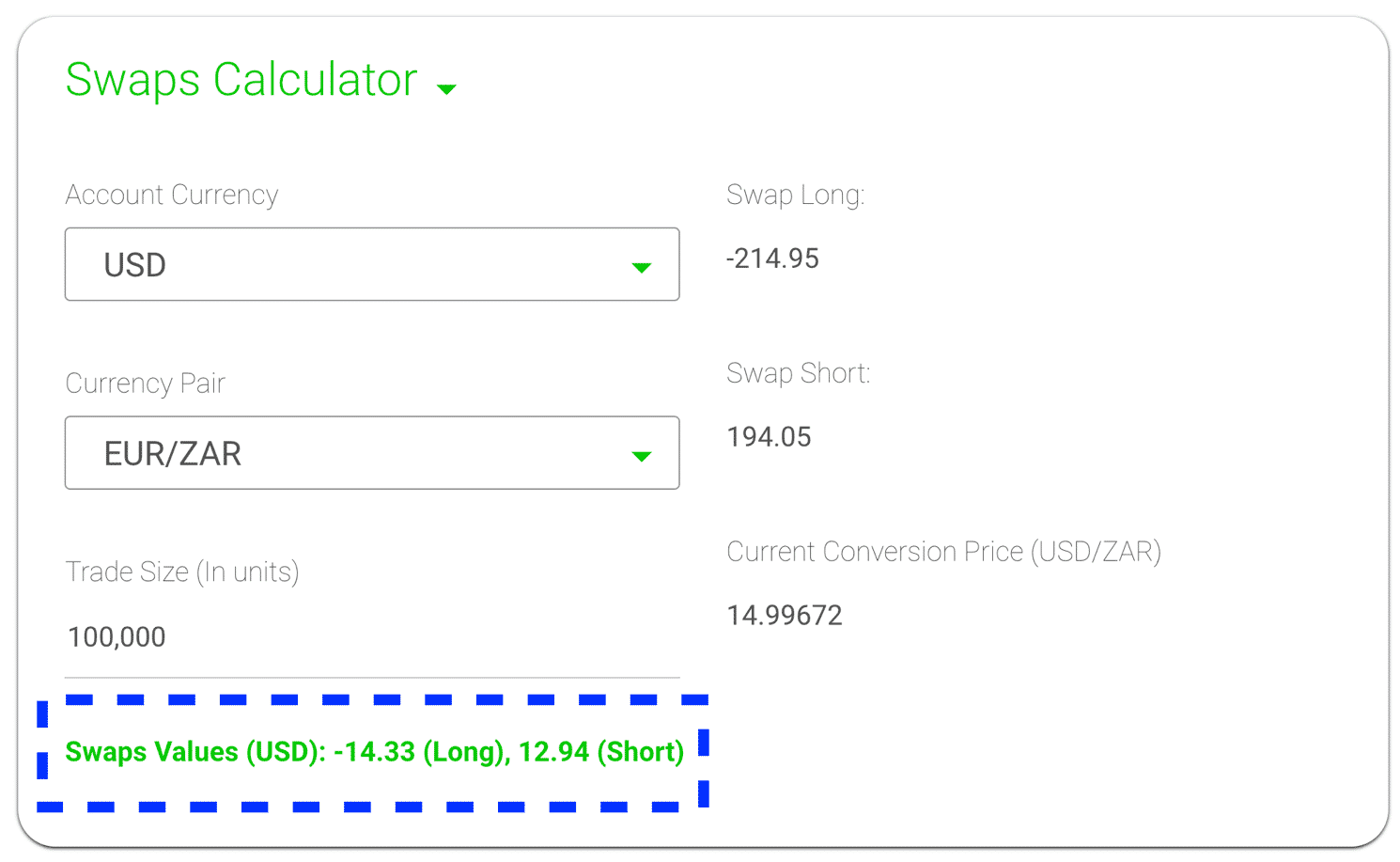

Lastly, the swap rates for selling this pair offer trader a positive swap. If we look at the calculations from IC Markets, one is credited $12.94 and debited $14.33 on a standard lot trade.

Of course, the rates will vary, but all brokers should credit you for selling EURZAR. This pair isn’t one swing traders should focus on as much as the others due to the spreads, swaps, and the tendency for exotics to behave erratically.

Yet, there could be favorable instances of trading this market.

Final word

As a swing trader, it’s not only the currencies one chooses which determine their success, but also the application of this trading style. While we’ve provided a finite number of pairs exhibiting the most favorable qualities, several others do offer similar characteristics.

Ultimately, swing trading is not for the faint-hearted psychologically. Although it requires less active time and is suitable for those with jobs, traders need incredible patience considering the seldomness of their execution in the markets.