You may hear the famous saying that knowledge is power or the pen is mightier than the sword. These hold their value in trading to some extent; however, the question at our disposal is whether gaining more understanding of financial markets is harmful to you or not.

Humans are complex organisms, and our brains are wired to handle any information and process it accordingly. It can be taxing for the mind to go through so much learning while storing it inside the hippocampus. Our article will discuss the probable outcomes of having too much trading knowledge by reading books.

Where can more knowledge be destructive?

Reading books is one way to consider filling up your knowledge tank. We can indeed access information from all corners of the Internet with ease. Let us look at the possible ways where more trading knowledge can be destructive.

Analysis paralysis

As the name indicates, analysis paralysis is where a trader cannot manage their thoughts as different emotions freeze them. You may link this to psychology, but a considerable amount of trading knowledge can also contribute to the underlying cause.

A trader who has a high awareness will think of various scenarios when there is only one in reality. His strategy will be screaming buy, while, on the other, the trade will seem like a short.

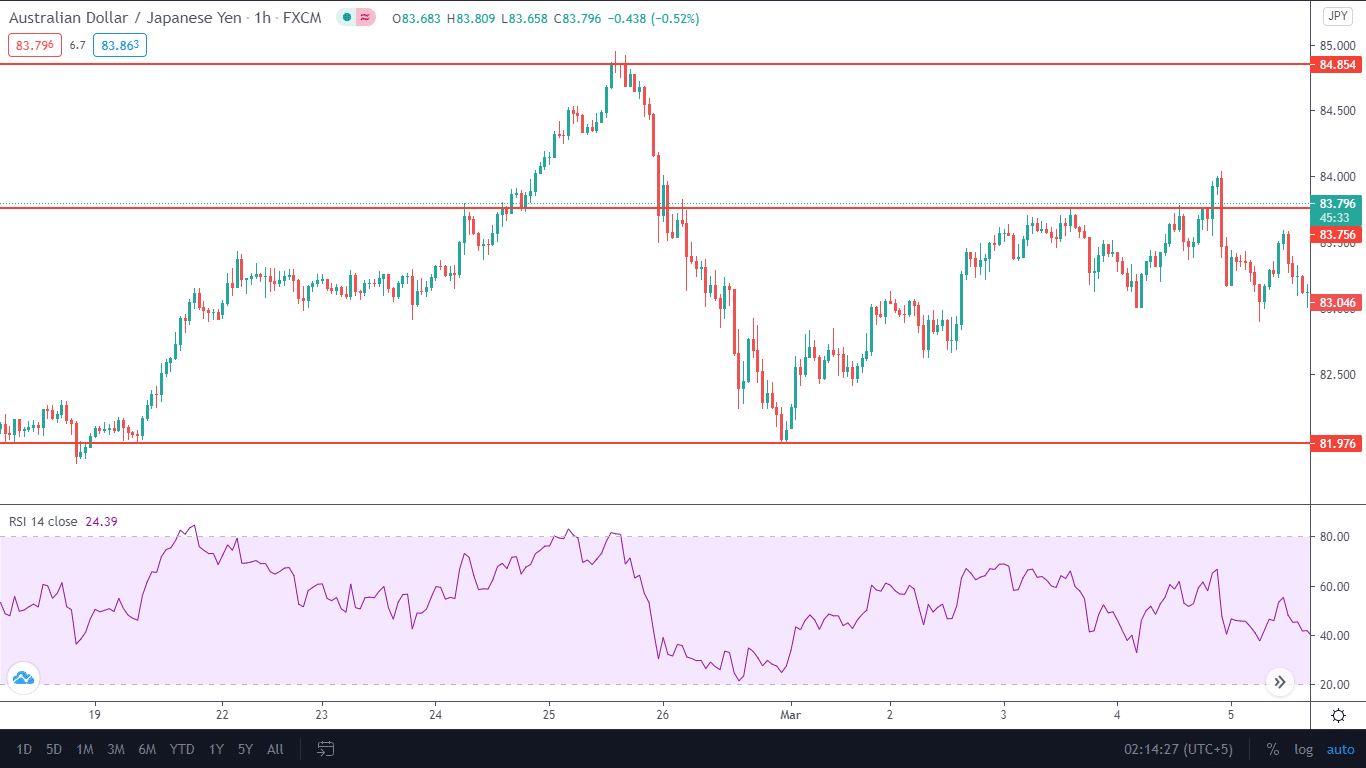

Image 1. A trader who likes to enter a long trade based on price actions plus bullish engulfing patterns is met by resistance with his other idea. The RSI indicator still hasn’t crossed below 20, which would confirm that the market is oversold. The market leaves without the trader who has missed on the opportunity to extensive complications or knowledge.

Switching plans

Investors overloaded with trading knowledge constantly shift themselves from one plan to another as they cannot guess which one is perfect. They go over all the different strategies and buy courses from all sorts of investors, whereas in trading, sticking to your original theme is the only quick way to succeed. Financial institutions suggest spending at least 10,000 hours on mastering your craft.

No profitability

You can not witness a trader who admits remembering or reading hundreds of books and showing verified results. Participants who reach out to prop firms for understanding the phenomenon of trading are constantly advised to master a single craft and stick to it for a lifetime. You can only achieve profitability by keeping little yet precise information on trading.

An act of losers

It is an act of losers scrambling everywhere to find details about trading. However, the information is never enough as they search books, websites, etc.

When should you know that you have enough knowledge for trading?

As a trader working at a beginner level sticking to the original methodology from a single reputable website will be enough to fill your brain with everything that trading demands. A good mentor can also help in this regard as he will stop you from poking here and there. To save you from margin calls, let us say sticking to demo trading is the best option.

It is easier for amateurs and professionals to control their thirst for knowledge as they have already experienced trading success. They also realize that they can beat the market with virtually any possible strategy by managing their risks and mindset.

A few books that you should read

The following trading books can help you keep your knowledge at bay. With them, you can ensure that you do not exceed in the learning portion.

- Trading in the Zone. One of the most famous books of all time to manage your psychology by Mark Douglas. It will maximize your state of mind and help you become consistent as a good mindset constitutes 80% of trading.

- Market Wizards. The book features interviews with top traders in the industry, including Bruce Kovner, Richard Dennis, Paul Tudor Jones, Michel Steinhardt, Ed Seykota, Marty Schwartz, Tom Baldwin, etc. You will become a much better trader by reading how current millionaires and billionaires made their way towards trading success.

- Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications. Any trader who wants to develop a sound understanding of technical analysis and read charts better takes a good read at the best option from John J. Murphy.

- Reminiscences of a Stock Operator. If you’d like a good read on how the market makers made money back in the 1900s, the book is for you. The Seattle Times states the book as “The most entertaining book written on investing is Reminiscences of a Stock Operator, by Edwin Lefèvre, first published in 1923.”

- Trade Your Way to Financial Freedom. Finally, the book by Van K. Tharp comes with a good amount of advice on trading that helps investors develop their methodologies. You will also get insight into risk management.

While these are our recommendations, you can also find more reads on the Internet that will answer your questions.

End of the line

Reading hundreds of books to develop trading knowledge is a mistake of novice traders. Profiting in the financial markets is possible with a handful of rules to manage your risk and mind. A good trader can capitalize on opportunities by limiting the number of tools at his disposal.