GBPUSD, commonly referred to as the Cable, is the third most traded pair globally. This name was derived from the first transatlantic communication cable that was laid from the UK to the US in the 1800s. According to the BIS, the cable trades account for 9.6% of the global forex market turnover. Its popularity is due to the fact that the pair enjoys relatively high liquidity and volatility. Besides, getting economic information on the two economies is relatively easy, which helps investors with price speculation.

Background of the two economies

The UK and the US are among the world’s biggest economies. Due to their economic stability, both countries’ currencies are used by many as safe havens in times of crisis. The dollar, for one, is on one side of 88% of all currency exchange trades executed globally. A Morgan Stanley strategist once floated the theory that the dollar tends to strengthen whenever the US economy is very strong or very weak.

When the US economy outperforms most of the world’s economies, the dollar’s value grows. During a global recession, even though the US may itself fall victim, many people the world over turn to the USD as their safe-haven currency. This also drives up its value.

Further, the trade relationship between the two countries is pretty close. The US purchases most of the UK’s exports. These include vehicles, medicines, turbines, etc.

Best time to trade the pair

The GBPUSD pair is well suited for day trading and swing trading. This is because its average daily range (ADR) is high enough to allow these short-term traders to take advantage of price movements for profit. Additionally, the pair’s prices are moderately stable, except for when big news events such as monetary policy statements by either of the two central banks cause spikes.

Therefore, the pair works well for both fundamental and technical trading. Fundamental traders can predict price moves emanating from the several economic reports released from both of these countries. Technical traders can also utilize chart patterns and other indicators to forecast price movements.

The best opportunities for profit occur when the pair is being traded in large volumes, which increases its volatility. For this reason, it is important to know which sessions carry the most market participants for the pair. During such periods, the liquidity of the pair is highest, which means spreads and other transaction costs are lower.

GBPUSD sees increased trading activity during the UK session and the New York session. When these sessions overlap between noon and 4:00 pm GMT, this is when the pair records most volumes. During this period, you can enjoy the tightest spreads as well as reduced slippage. Alternatively, you could trade it during the beginning of the London session at 7:00 am GMT, as the pair enjoys decent trade volumes then.

Trading GBPUSD with fundamental analysis

As aforementioned, there are several economic reports from the UK and US that affect the pair’s prices. The GDP report is one such data point. It is released every quarter, and it measures the total output of a country. Preliminary GDP reports have the most effect on a currency’s value, as they provide insight into the health of the country’s economy. A strong UK GDP is bullish for the GBP, while a strong US GDP tends to send the dollar on a rally.

Monetary policy decisions by the BoE and the Fed also tend to move GBPUSD prices significantly. When either of the two central banks hints at increasing interest rates and tapering on quantitative easing programs, they are said to be hawkish. When these banks hint at a more accommodative monetary policy, they are said to be dovish. A hawkish Fed is positive for the dollar, as is a hawkish BoE for the pound. When any of these banks go bullish, it tends to devalue their currency.

Trade balance figures also shed light on the state of the economy. When exports exceed imports, there is a trade surplus which is bullish for that country’s currency. On the flip side, a trade deficit sends the country’s currency on a downtrend.

Unemployment numbers are another statistic that moves the GBPUSD pair. This includes jobless claims and Non-Farm Payroll data. A high unemployment rate is bearish for a country’s currency, while low rates of joblessness drive its currency’s value up.

Trading GBPUSD with technical analysis

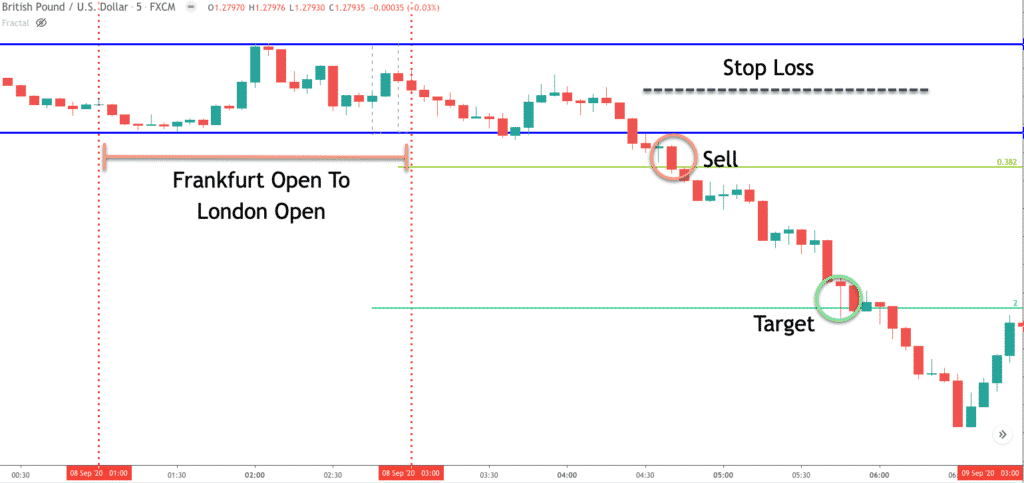

There is one universally acclaimed strategy for trading this pair called the Big Bend strategy. Usually, between the time when trading opens at Frankfurt to when markets in London are open, the GBPUSD pair showcases low volatility. However, during the London session, this period of consolidation often stages a breakout in either direction, which sets the pace for the day. This strategy involves trading these breakouts.

From the example above, we see that prices staged a downward breakout after being in consolidation during the Frankfurt session. This means that we’d be looking for short trades. The entry point is placed below the consolidation range’s support level to protect us from trading a false breakout. Once the breakout has been confirmed, we can place the stop-loss at the center of the consolidation range. A suitable take profit would be at a distance twice the height of the consolidation range from our entry.

As is evident in the chart, the breakout went to hit our take-profit level and even surpassed it as the pair’s price plunged further downward.

Conclusion

GBPUSD is the third most traded pair in the forex market. It enjoys high liquidity, volatility, and some of the tightest spreads. There is also no shortage of economic data that moves the pair, which further contributes to its popularity. Due to this, the pair is well suited for fundamental traders and technical traders alike.