There is no debate over the fact that the US dollar was, is, and continues to remain the dominant currency for global trade. As USD achieved the de facto reserve currency status years ago, any asset denominated in the US dollar is perceived safe. Hence the bonds issued by the US government are considered to be the world’s safest assets.

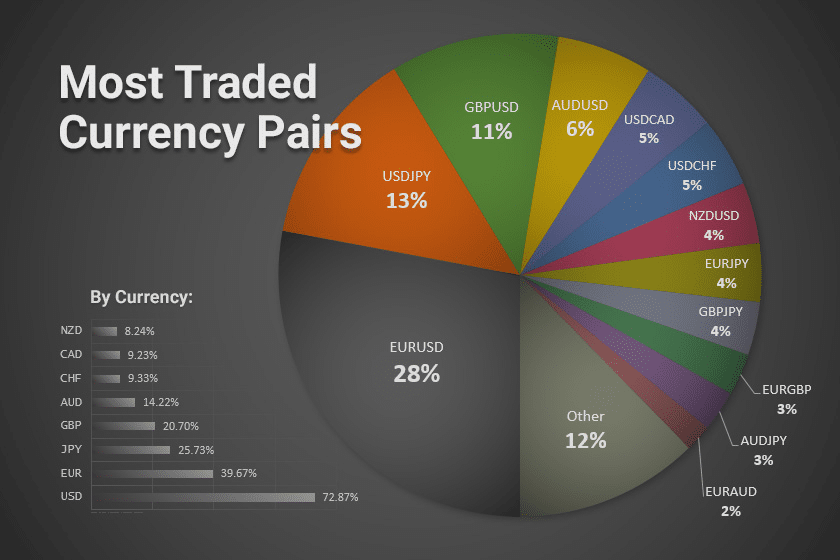

Hence it is no surprise that the US dollar also dominates when it comes to FX transactions across the globe. For example, the world’s seven most traded Forex pairs all involve USD. In terms of standalone transactions, the USD accounts for a whopping 73% of all global transactions, which is more than twice all the other currencies put together.

So, it wouldn’t be an exaggeration to say that one can’t be a successful FX trader without understanding the intricacies of the USD. When it comes to individual currency strength, as always, there are a plethora of factors that affect the currency’s strength. But one of the most influential factors for any currency is the policy actions undertaken by its central bank, which, in the case of the US dollar, is the Federal Reserve.

Federal Reserve’s policy actions – interest rate

The Federal Reserve, also commonly known as the Fed, is responsible for managing the monetary policy of the United States. This means that it has complete control over short-term interest rates and money circulation.

The benchmark rate for the US is called the Fed Funds rate. It is the rate at which banks are able to borrow money from the Fed. The lower the rate, the lower the cost of borrowing for the banks, which in turn also lowers the cost of money for the economy.

Changing the Fed Funds rate has a two-pronged impact; first, as discussed above, it lowers the cost of capital, thus encouraging institutions and individuals to borrow more. If they borrow more, they will spend more, and hence this cycle will end up stimulating the economy.

But this also has a flipside. If the demand for goods and services rises rapidly with this, we might be in for high inflation. Inflation would reduce the value of money in our pockets. This will incentivize people to spend even more rather than saving. Thus what was a virtuous cycle could rapidly turn into a vicious cycle, thereby defeating the original purpose. So, it is important to remember that lowering rates is not a straightforward measure and requires careful calibration.

The second impact is that along with the cost of borrowing, the return on saving also falls. One would receive less interest for keeping their money in the bank. This again has the same effects as discussed above.

How does understanding this help me as a Forex trader? There are two key takeaways from here. A lower interest rate means lower return making the foreign capital less incentivized to flow into USD. So, any rate cut or even expectations of rate cut typically lead to the weakening of the currency. Thus USD may fall relative to other currencies given all else remains the same.

The second key takeaway is that inflation is always bad for any currency. It eats away the purchasing power making it weaker. Thus if rate cuts are pushing the economy towards inflation, that again points towards currency weakening. So as a Forex trader, any rate cut expectations should help you put short USD trades on your radar.

Federal Reserve’s policy actions – liquidity

In times of economic crises, the Fed might cut interest rates, but the banks could still be unwilling to lend simply because they find the business environment risky. In order to tackle this issue, the Fed uses another weapon called Quantitative Easing (QE).

This process involves the Fed buying massive amounts of bonds from the banks and, in return, giving them cash. The banks simply can’t sit on a pile of cash and hence are incentivized to lend, thus increasing the liquidity in the economy.

The Fed used this tool for the first time on a large scale after the 2008 crisis. It implemented the same on an even larger scale after the recent Covid-19 crisis. By pumping liquidity into the system, the Fed effectively increases the money supply in the system. So, let’s say that before QE, there were X amount of dollars circulating in the economy, then after QE, that number can be 2X.

What this effectively means is that the supply of USD is ramped up. By the simple law of supply-demand, one can deduce that excess supply leads to a drop in the price of a currency which is what happens to the USD strength. The exact opposite will happen if the Fed decides to end or taper its QE by reducing the purchases of the above-discussed bonds.

So as a Forex trader, you should also be on the lookout for news of taper. Should the taper be implemented at a pace faster than expected, it could result in massive USD strength, and one should be on the lookout for long USD trades.

The Fed calendar

The Fed’s committee that makes the policy decisions is called the Federal Open Market Committee (FOMC). The FOMC has eight meetings every year with a frequency of roughly six weeks. It announces major policy decisions at the end of these meetings, and hence one should always keep track of the calendar of meetings.

Another key aspect is the minutes of the meeting released roughly two weeks after the meeting. These minutes give clues on what could happen in the subsequent meetings. Finally, various members of the FOMC give speeches throughout the year, which are also useful indicators.