Quantitative easing (QE) has become a popular monetary response tool following the 2008/9 Global Financial Crisis (GFC) when the Fed used it to calm the markets. In 2020, many central banks like the Bank of Canada (BOC), Reserve Bank of Australia (RBA), and Bank of Japan (BoJ) used the tool. In this article, we will explain what quantitative easing is and what forex traders need to know about it.

What is quantitative easing?

A Central Bank is given the mandate of setting a country’s monetary policy. It achieves this through several tools, including interest rates, yield curve control, and quantitative easing. QE is a relatively new tool that was first used widely after the housing crisis of 2008/9.

QE refers to the process of creating money and using it to buy a wide variety of assets like mortgage-backed securities (MBS) and government and corporate bonds. Its goal is to lower the cost of borrowing for the government and other entities. It is also used to create liquidity in the market by making capital accessible to those who need it. Furthermore, capital flight is common during times of crisis.

QE during the coronavirus pandemic

During the coronavirus pandemic, many central banks announced large-scale purchases. In the US, the Fed launched an ambitious program, spending about $120 billion per month on asset purchases. In the one year since the pandemic started, the Fed’s balance sheet had ballooned by more than $3 trillion.

In Japan, the BOJ also launched unlimited QE purchases, which have pushed its balance sheet to more than $7 trillion. Japan has a GDP of more than $4 trillion.

In the European Union, the European Central Bank (ECB) has launched a EUR 1.85 trillion quantitative easing program, while in the UK, the Bank of England launched a GBP 700 billion package. Countries like Canada and Australia have also embraced QE.

Unfortunately, QE is a process that is only possible for developed countries whose currencies have demand overseas. For developing and emerging markets, QE can be detrimental because it would lead to high inflation and a significant devaluation of the local currencies.

How quantitative easing works

While the concept of quantitative easing sounds difficult, in reality, it is relatively easy. It starts when a central bank starts seeing difficulties in an economy. To deal with these challenges, the central bank has several tools.

The most obvious one is interest rates. If there are challenges, the bank will first slash rates in a bid to lower the cost of doing business. They also incentivize the residents to borrow money and spend on items like cars and houses. This, in turn, will lead to higher inflation and a low unemployment rate.

In times of severe strains to the economy, the bank will activate other measures like yield curve control and QE.

On QE, the bank will come up with a target of the purchase and announce it to the market. As mentioned, these assets could be government and corporate bonds and mortgage-backed securities. It will then go to the market and buy these assets. It uses some financial intermediaries like Blackrock to acquire these assets. By so doing, the central bank is able to supply liquidity to the market and make it function well.

Quantitative easing for forex traders

Forex traders watch the actions of central banks closely. Indeed, central bank decision days are usually some of the most closely-watched events in the market.

The most closely-watched central bank decision is by the Federal Reserve. Ideally, when the Fed launches QE, it tends to lead to a weaker US dollar. There are two reasons behind this. First, QE is usually accompanied by low-interest rates. When rates in the US are low, they make the US dollar less attractive to investors, leading to low demand.

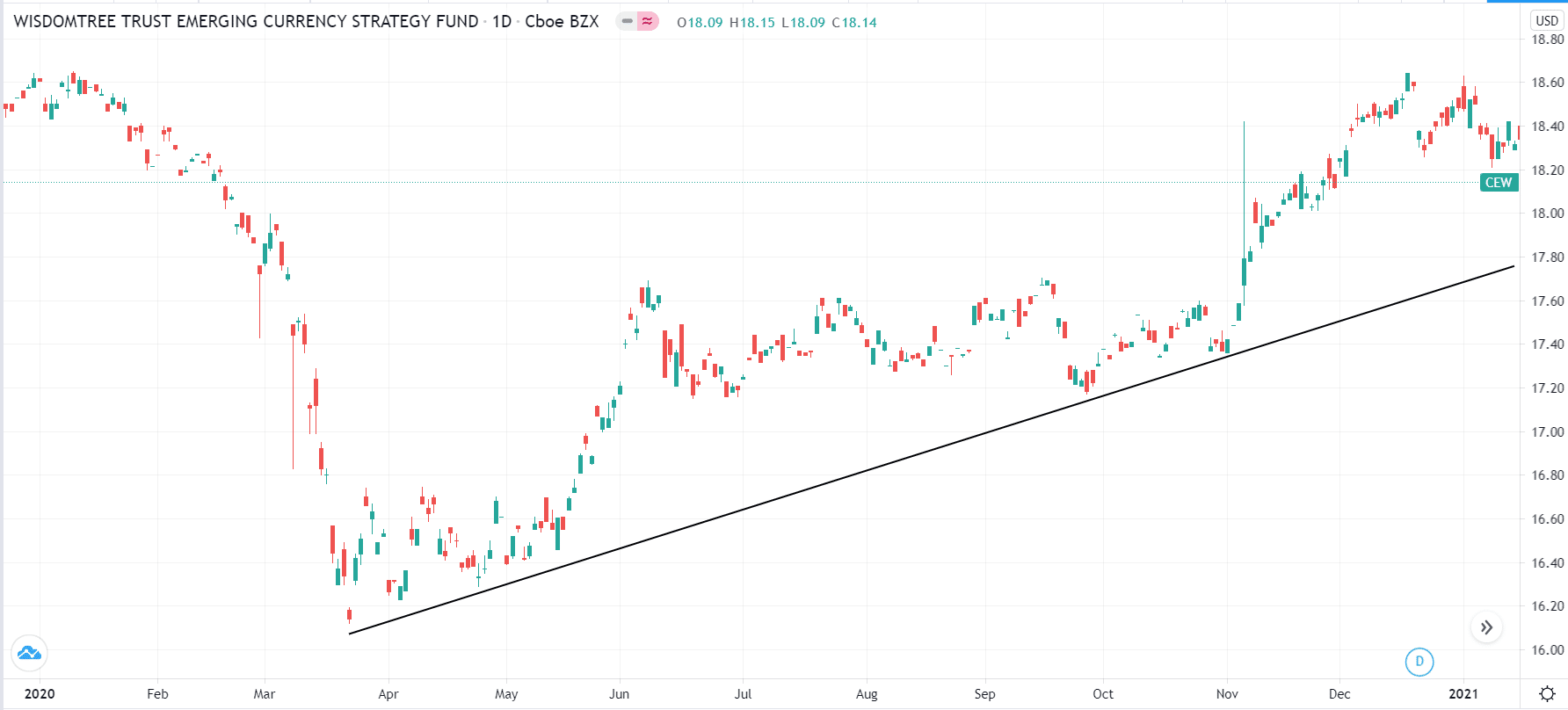

Second, QE is an indirect method of printing money. When you have a lot of money, its value tends to depreciate because of a higher supply. The chart below shows how the US dollar weakened when the Federal Reserve launched its open-ended QE program.

US dollar index performance

Most importantly, a large QE program in the United States leads to a risk-on sentiment in the market. This is where investors prefer using their dollars to invest in other less attractive countries like South Africa, Mexico, and Brazil. Furthermore, they can borrow cheaply in the United States and invest in those countries.

Emerging markets performance

Winding down or tapering the Quantitative Easing program

Like all central bank decisions, QE is not meant to be permanent. Instead, it is a temporary measure aimed at supporting the economy for some time. Therefore, the forex market tends to change when there are signs that the Fed will begin ending the QE program.

Traders use several tools to predict that the bank will start raising rates. First, they look at the overall data and whether it is showing signs of improvement. Some of the key numbers watched closely are inflation, employment, retail sales, and industrial and manufacturing production. If these numbers start bouncing back, it usually sends signals that the bank will start scaling down the program.

Most importantly, traders focus on the bond market, which is usually the best predictor of the future in the market. When government bonds start rising, it sends signals that the bank will start winding down the purchases.

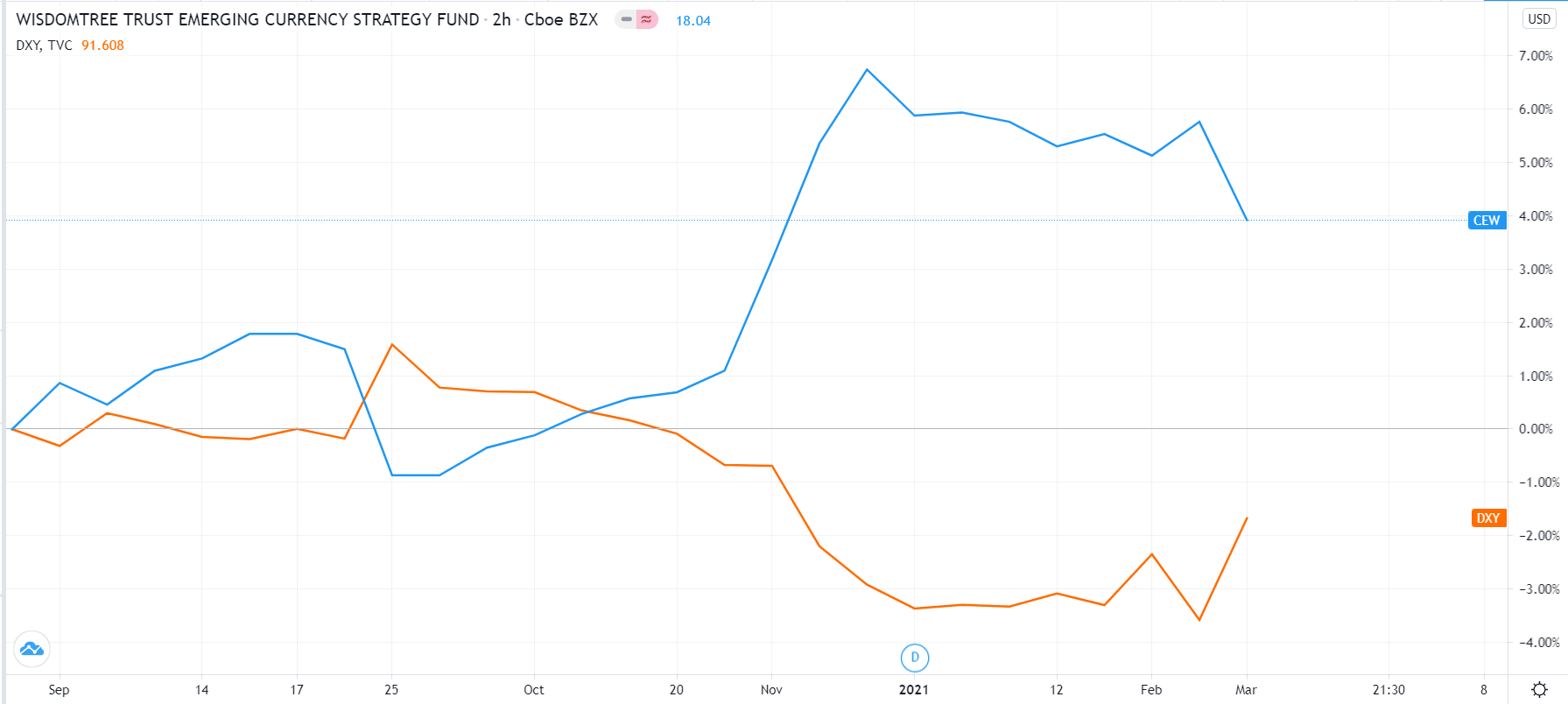

In the chart below, we see that the US dollar started rising while EM currencies started declining when signs started emerging that the Fed will start tapering.

EM currencies vs. DXY

This happens because most central banks usually start ending quantitative easing before they start raising rates. In other countries, signs of Fed tapering are usually followed by relatively stronger currencies.

Final thoughts

Quantitative easing has been a controversial monetary policy tool. In fact, in 2020, a German court raised concerns about its legality in the European Union. It has also played a role in the ongoing growth of cryptocurrencies like Bitcoin that have a finite supply. Proponents of these currencies typically argue that they are better because they cannot be manipulated. In this article, we have looked at how QE works and how you can use it to trade the currencies market.