The US dollar index, popularly known as DXY, is a financial asset that tracks the strength or weakness of the greenback. It is the most popular currency index in the world. In this article, we will look at what it is and how you can day trade it successfully.

What is the US dollar index?

The US dollar is the most popular currency in the world because of the strength of the American economy. It is the best-known medium of exchange globally and the reserve currency of the world. Indeed, most countries, including American foes, store their foreign reserves in US dollars.

However, there is a common challenge on how to measure the strength of the currency. This is because it might be weak against the British pound and stronger than the euro. Therefore, the dollar index is a financial asset that helps solve this challenge. It does this by comparing the performance of the US dollar with that of other currencies.

US dollar index constituents

The US dollar index is calculated by weighing the performance of the greenback against other currencies at different weights.

The biggest constituent of the index is the euro, which has a 57.6% weight. This is simply because the euro is the second most popular currency in the world. It is also a popular reserve currency that is held by many countries. Therefore, because of the euro’s weight, its price action tends to have a stronger impact on the dollar index movement.

It is followed by the Japanese yen, which has a weight of 13.6%. Similar to the euro, the Japanese yen is an important global currency because of the volume of goods that the country exports globally and the fact that Japan is the third-biggest economy.

The other constituents of the dollar index are the British pound, Canadian dollar, Swedish krona, and Swiss franc. These currencies have a weighting of 11.9%, 9.1%, 4.2%, and 3.6%, respectively. The US dollar index is therefore calculated using the formula below.

USDX = 50.14348112 × EURUSD -0.576 × USDJPY 0.136 × GBPUSD -0.119 × USDCAD 0.091 × USDSEK 0.042 × USDCHF 0.036

While the DXY is a popular index, a common criticism is that it has not changed at the same pace as the world has. For example, its constituent currencies are only from developed countries like the European Union and Canada. It excludes the popular emerging market currencies like the Chinese yuan and the Brazilian real.

How to day trade the US dollar index

Broadly, there are two primary ways of trading the US dollar index. You can trade the index itself if it is offered by your broker or you can trade an exchange-traded fund (ETF) that tracks the index.

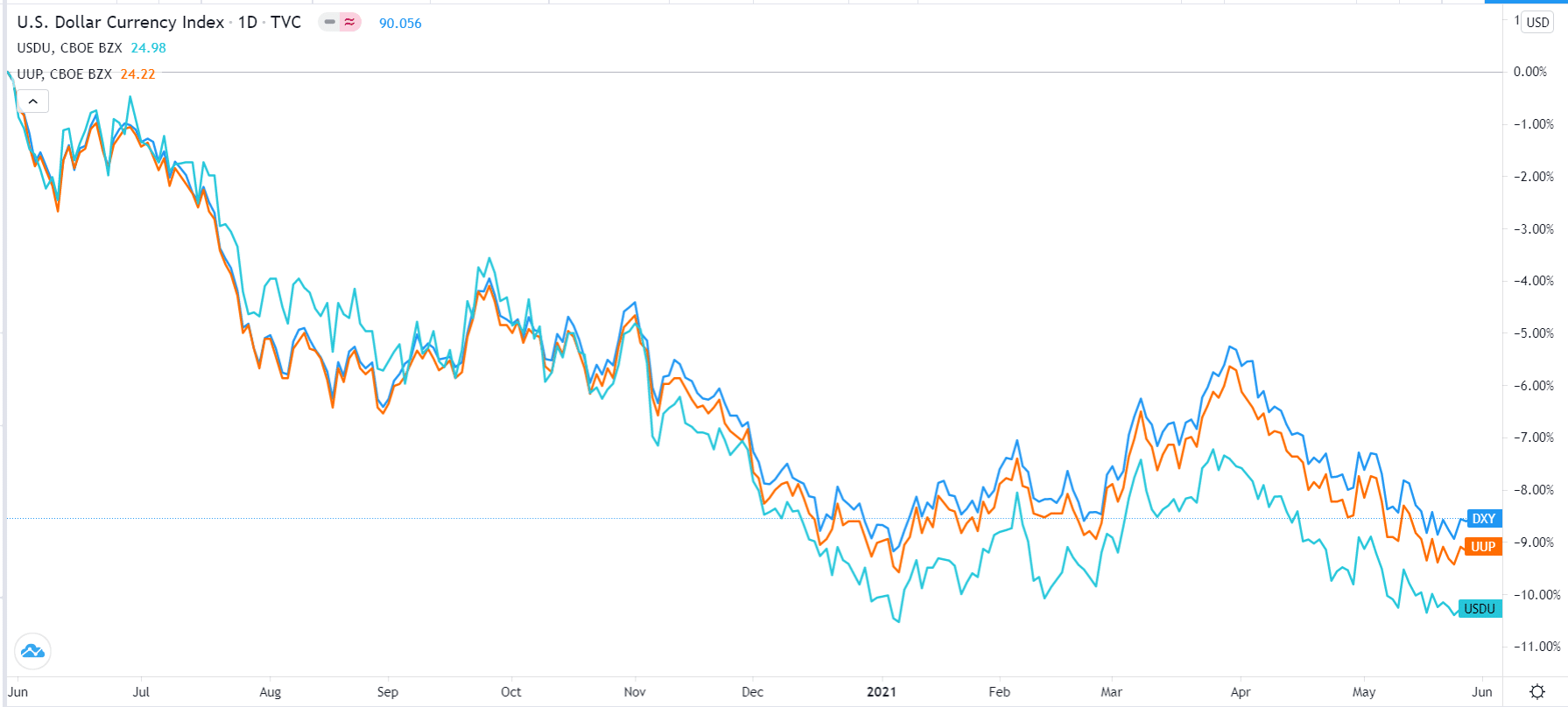

Some of the most popular dollar index ETFs is the Invesco DB US dollar index (UUP) and WisdomTree Bloomberg US dollar index fund (USDU).

US dollar index vs UDU and UUP.

As shown above, the funds move in the same direction as the DXY.

US dollar index fundamental analysis

The first step of trading the US dollar index well is to conduct fundamental analysis. This is a simple process where you look at the broader issues that affect the US dollar. Some of the key information to look at are:

- US employment data – In this, you look at the US nonfarm payroll numbers that are published every first Friday of the month. You can also look at the weekly initial jobless claims numbers.

- Inflation – This is where you look at the current and overall trend of inflation in the United States. Inflation and employment are important since they form part of the Fed’s dual role.

- Retail sales – The US publishes its retail sales numbers every month. These numbers are important gauges of the overall performance of the US economy.

- PMIs – The US publishes the services, manufacturing, and composite PMIs every month. Like retail sales, these numbers are important gauges of the economy.

- Federal Reserve – You should pay close attention to the statements made by the Federal Reserve.

Still, conducting fundamental analysis of the US alone is not enough since the dollar index is made up of other currencies. Therefore, you should look at the numbers and events from the constituent countries, especially the European Union.

Technical analysis

The next stage in day trading the dollar index is to conduct technical analysis. This is where you use several technical indicators and analysis tools to predict the future direction of the index.

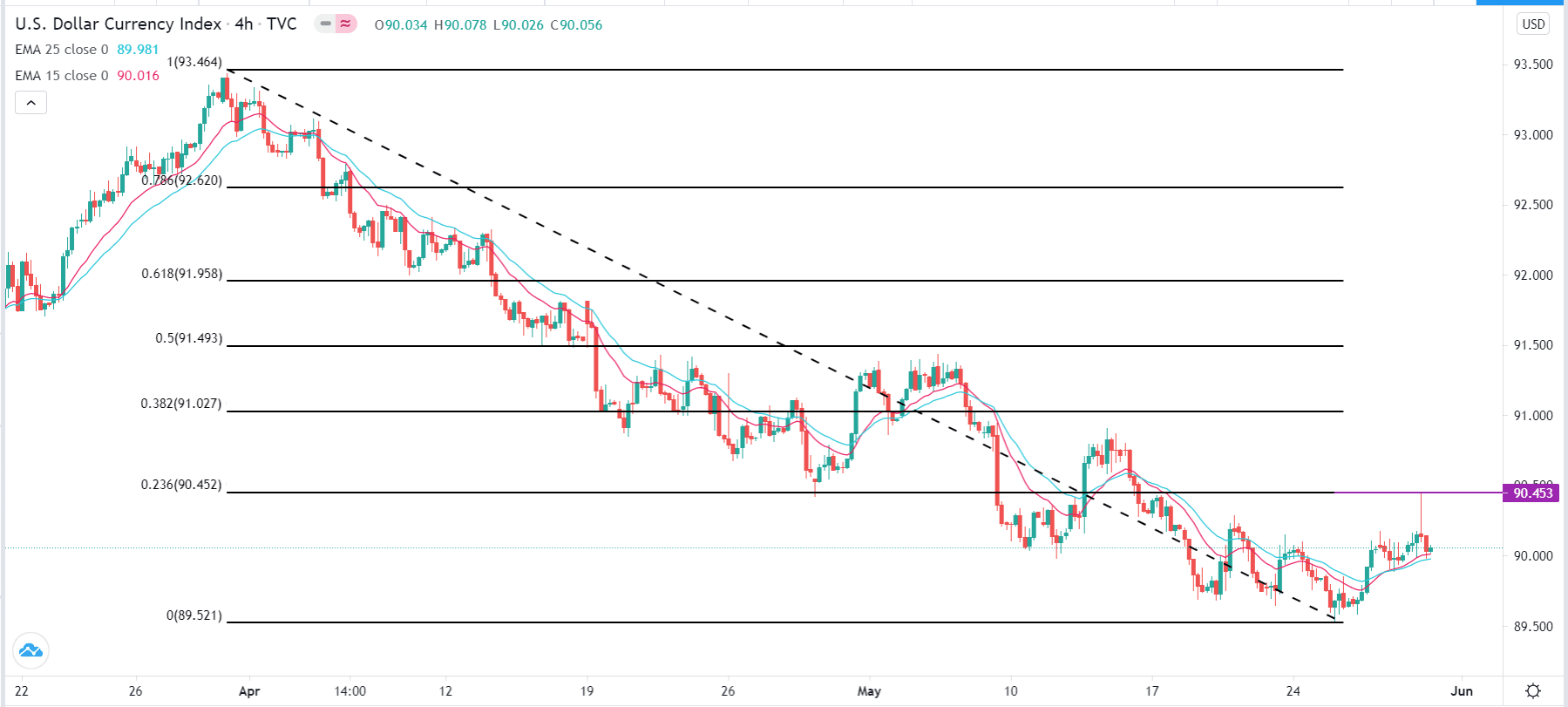

For example, you can use trend-following indicators like the Moving Average and Bollinger Bands and oscillators like the Relative Strength Index (RSI) and the Relative Volatility Index (RVI) to predict the future of the index.

Technical analysis example

Other tools that you can use to conduct technical analysis are the Fibonacci retracement and the Andrews Pitchfork.

Price action analysis

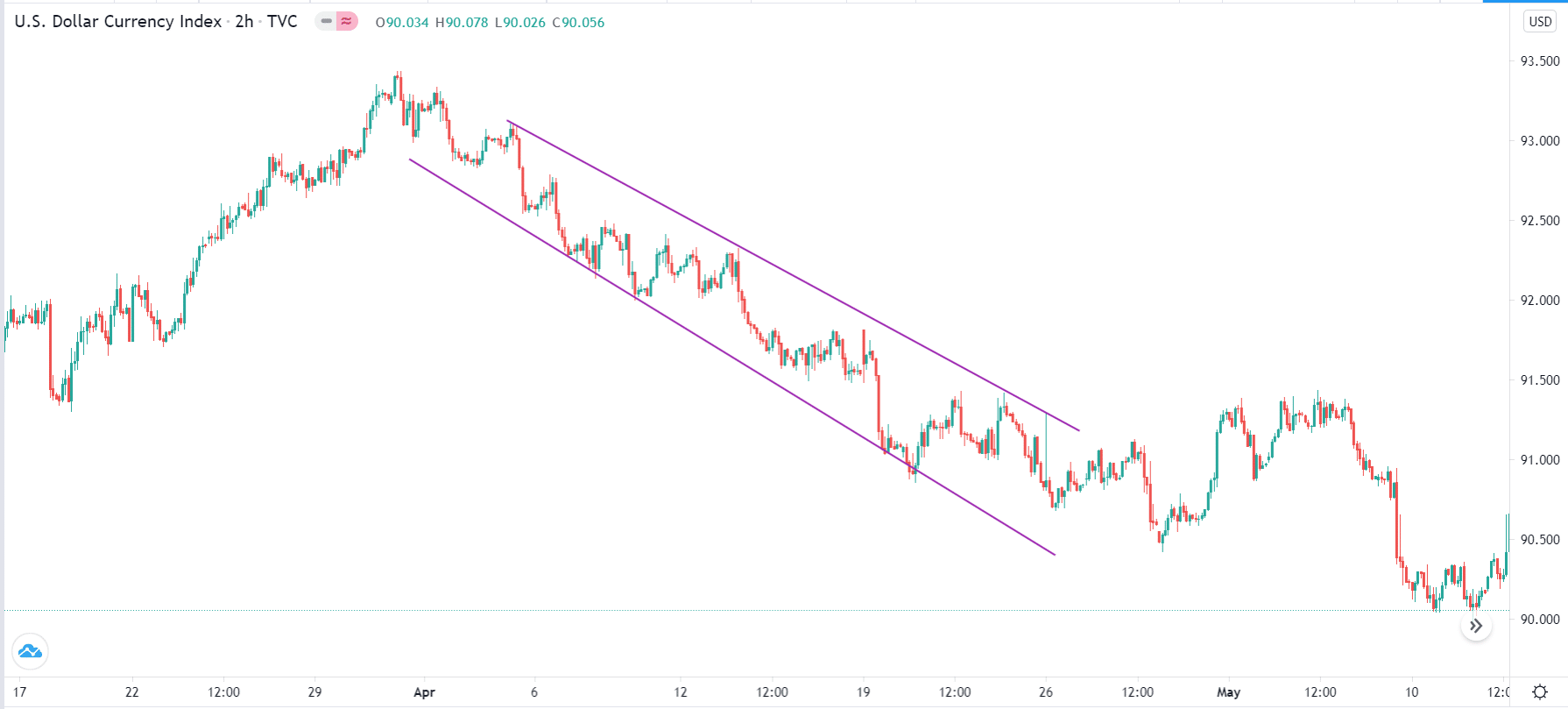

The final stage of analyzing the US dollar index is to use price action. This is the method where you identify patterns to determine the future of price movement.

Some of the most popular patterns are the bullish and bearish flags, bullish and bearish pennants, rectangles, triangles, and the head and shoulders pattern.

US dollar index channel

These patterns can help you predict whether the US dollar index will keep moving in a similar trend or whether it will have a reversal. For example, the chart below shows the US dollar index that has formed a descending channel pattern.

Final thoughts

The DXY is a popular index that is used to evaluate the strength or weakness of the US dollar. In this article, we have looked at its constituent currencies, how it is calculated and some of the top strategies to use when trading it.

These strategies are technical, fundamental, and price action-based. We have also looked at some of the most popular dollar index ETFs that you can trade.