One of the biggest, most liquid, and most volatile market in the world is the forex market. As the premier financial market of the world, it never closes during the workweek and sees people participating every day from all over the world. In this guide, we take a look at the top five forex pairs to trade.

What are forex pairs?

When a trader is buying or selling a currency, s/he is automatically selling or buying the other. This is why currencies are always traded in pairs. There is a base currency and a quote currency in every such currency pair. The former, that is the base currency, appears first on the left, while the latter, that is the quote currency, comes later to its right.

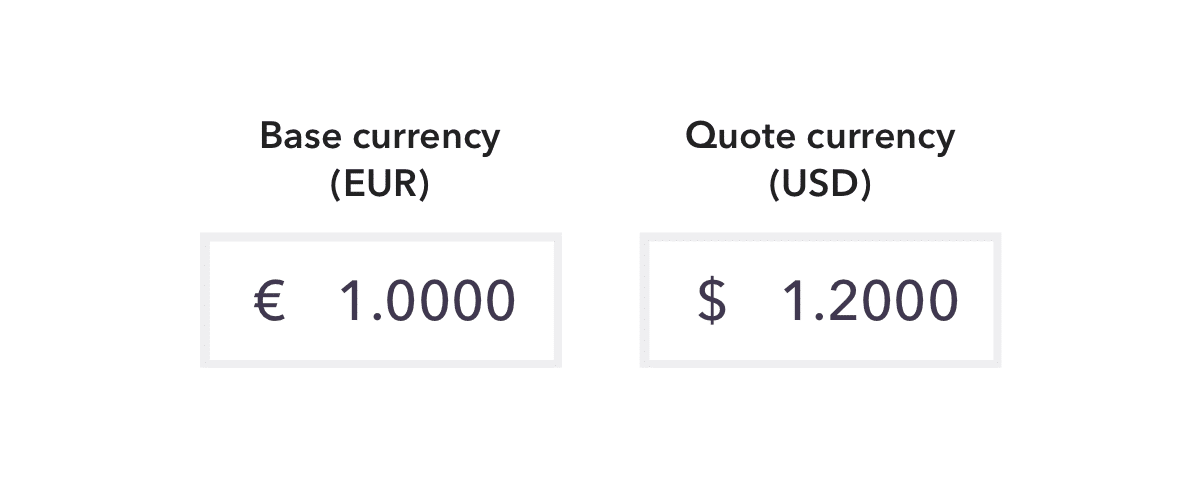

The price shown for a particular currency pair highlights the amount of the quote currency that one needs to spend to be able to purchase a unit of the base currency. One such example is given in the image below.

In the image above, we have the currency pair EUR/USD. It highlights that in order to buy one unit of EUR (base currency), you need to spend $1.20 (the quote currency).

3 types of forex pairs

All the forex pairs in the world can broadly be categorized under three different groups. These include forex majors, forex minors, and a few exotic currency pairs.

Majors

Major currency pairs or forex major pairs are the ones traded the most on forex. They usually have USD on one side (either as a quote or base currency) and on the other side, a global currency of high value.

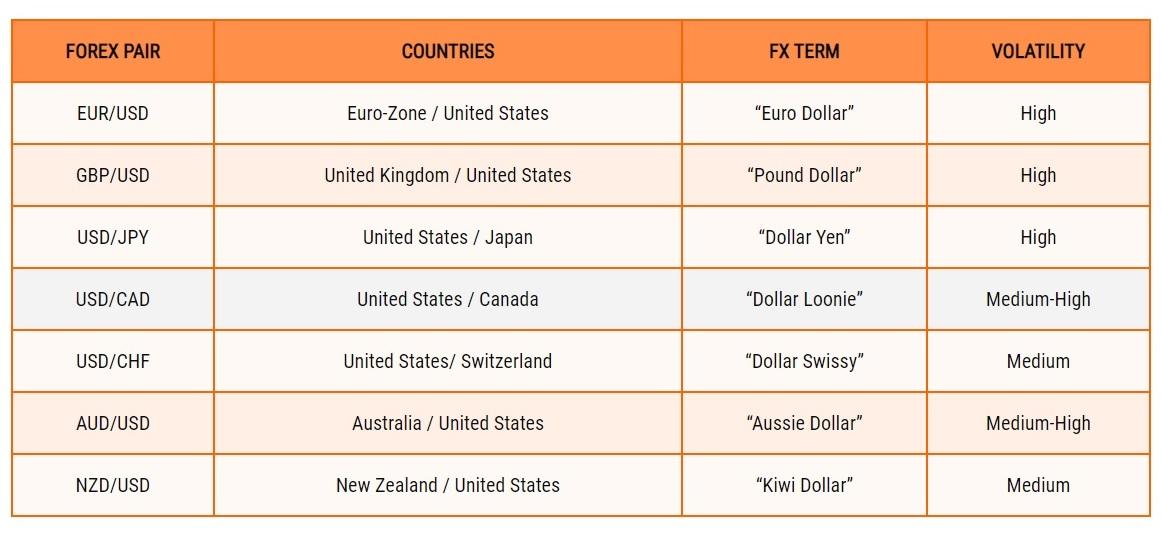

There are different opinions as to the number of major currency pairs there are but some of the top major currency pairs are shown in the table below.

These seven pairs account for as much as 82% of the overall global forex trade. These are also highly liquid at most times of the day.

Minors

Minor currency pairs or cross currency pairs are those which do not contain USD but other major currencies both as a base and quote currency. These are not traded as frequently or in as high a volume as the major pairs.

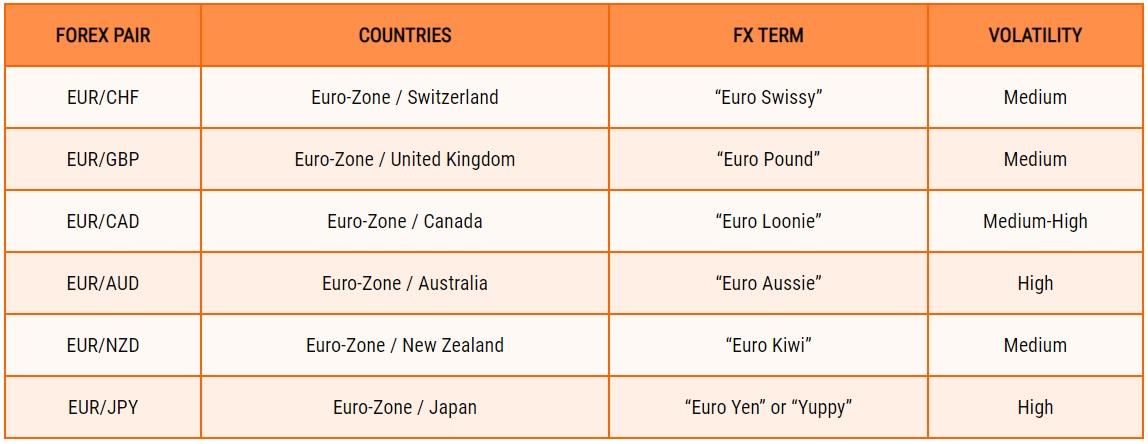

There are multiple such minor ‘crosses,’ which are as popular as the forex majors. Some of them include:

- Euro Crosses

- Pound Crosses

- Yen Crosses

- Aussie Crosses

- Kiwi Crosses

In all these crosses, one of the base or quote currencies is the currency, which it is named after. An example of Euro Crosses is given in the table below.

Exotic

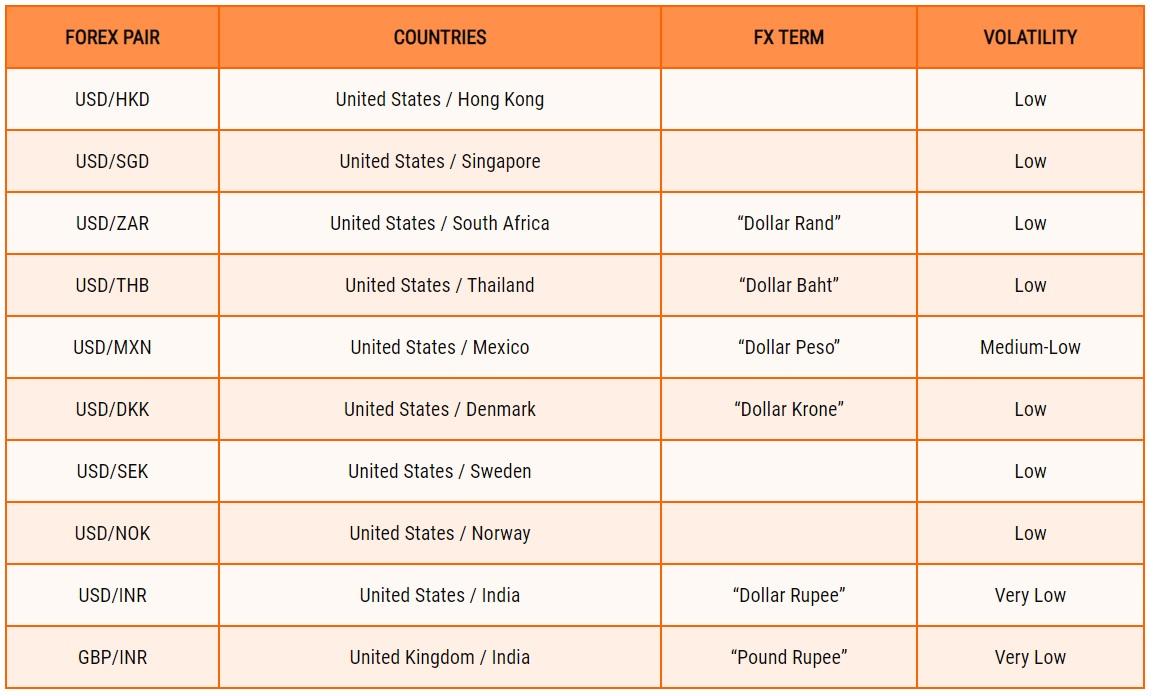

Exotic currency pairs have one major currency coupled with currency from an emerging or developing economy. Since such pairs aren’t as popular as other pairs, they aren’t the most liquid. Many of these are amongst the most volatile pairs since they aren’t as heavily traded as the forex majors and minors.

It is important to note that the spread and the transactional cost as well as the swap fee of these pairs are likely to be 2-3 times higher than the major and minor pairs.

5 Best Currency Pairs to Trade

Now, let us take a look at the top five currency pairs to trade in the forex market.

1. EUR/USD

EUR/USD transactions made up a quarter of the daily forex trades in 2019, making it the most traded currency pair. This is because they are representative of the two biggest economies of the world: the US and the European Union.

The EUR/USD pair has a lot of liquidity, thanks to its high daily transactional volumes. This results in tighter spreads which, in conjunction with liquidity, make up an enticing prospect for traders as it means that large trades can be executed with very little impact on the market.

The EUR/USD exchange rate is influenced by multiple factors, including the interest rates set by the US Federal Reserve (Fed) and the European Central Bank (ECB). This is done so because the currency, which has a higher interest rate, will have a higher demand since it will generate better returns on investments.

2. USD/JPY

The USD/JPY currency, also called ‘the gopher,’ is the second most traded currency pair in the world, as highlighted by Bank of International Settlements Report of 2019. It is also known for high liquidity, similar to EUR/USD. This is because USD is the most traded currency in the world and Yen is the most traded currency in Asia. The Bank of Japan (BoJ) is responsible for setting the interest rates for the Japanese economy, which affects the Yen value in relation to the USD.

3. GBP/USD

Pound Sterling and the US Dollar make up the currencies in this pair, also sometimes called ‘cable.’ It is named on the basis of the deep-sea cables that carried bid and asked quotes between New York and London. The currency pair transaction amounted to 9.6% of all daily forex transactions in 2019.

The strength of the currency pair of GBP/USD is derived from the strength of the British and American economies respectively, as is the case with most other currency pairs as well. Of the two, the currency of whichever economy is doing better will strengthen against its counterpart. The quote price of the two currencies is determined by the interest rates set by the Bank of England and the Fed.

4. USD/CAD

The US Dollar and the Canadian Dollar make up the currencies in this pair. It is also referred to as the ‘loonie’ because of the loon bird that is on the Canadian dollar coins. It is made up 4.4% of all daily forex trades in 2019. Since oil is Canada’s chief export, the strength of the Canadian dollar is linked very closely to oil prices.

Canada earns a large supply of USD through its oil exports since oil is priced in USD in world markets. Therefore, whenever oil prices rise, the value of CAD strengthens compared to USD. It is almost a rule that USD weakens as oil prices increase since, in order to purchase the same amount of oil as before, more USD has to be converted to other currencies.

When trading USD/CAD, traders should keep an eye on the price of US crude and Brent Crude. This is because any fluctuations or changes in oil prices will have an impact on the exchange rate of this pair.

5. AUD/USD

Also sometimes called the ‘Aussie,’ this pair represents the Australian Dollar against the US dollar. In 2019, it amounted to 5.4% of all daily forex transactions. The AUD value is tied to the value of Australia’s exports, such as metal and mineral exports (coal and iron ore) account for a large portion of the country’s GDP.

If there is a fall in the value of these commodities, it will also lead to a fall in the value of AUD. The AUD/USD exchange rate is also determined by the differences in interest rates set by the Reserve Bank of Australia and the Fed.

Conclusion

Although EUR/USD is the number one currency pair in terms of the daily trade volume, there are many other currency pairs that have high liquidity and low spread, which traders can look to benefit from.

There are various factors that traders should consider before deciding on a currency pair to trade, such as the health of the economies, the interest rate differentials, and the price of commodities. Such technical and fundamental analysis will allow traders to know whether a particular currency pair is a viable trading option.