Quick profits within seconds; is that even possible in forex? If you’re a scalper, then this is the mindset you adopt. Believe it or not, the concept of scalping did not originate within the financial markets.

Several centuries ago, people traveling using railways were selling unutilized tickets quickly at an inflated price. This type of behavior still occurs today, even at events like concerts and sports matches.

It wasn’t long before that traders realized they could do the same with financial instruments. Rather than buy and hold a trade for several hours or days, you can essentially ‘hit-and-run’ by opening and closing positions for a quick profit.

If you repeat this process multiple times throughout the day or during one trading session, the profits can accumulate to significant sums. Despite some of the negative perceptions placed on scalping, this approach presents some unique advantages.

Aside from the profit potential, scalpers have the luxury of carefully selecting only a handful of markets, typically less than five. It’s not unheard of for many of these traders to only speculate in one pair continuously.

So, this article will provide the best four currencies for scalping and the key things to note about such markets.

How to pick the best currencies for scalping

One of the most crucial aspects any scalper must always show cognizance for is spreads.

- Spreads: Although spreads have become consistent over the years, regardless of the broker you choose, it’s still something to consider. Since the execution frequency is relatively high for scalping and the profits are small, it becomes necessary to minimize trading costs.

So, one of the critical elements in trading the best currencies for scalping is low spreads. Generally, the major pairs are the perfect markets offering this quality, e.g., EURUSD, USDJPY, GBPUSD, and so on.

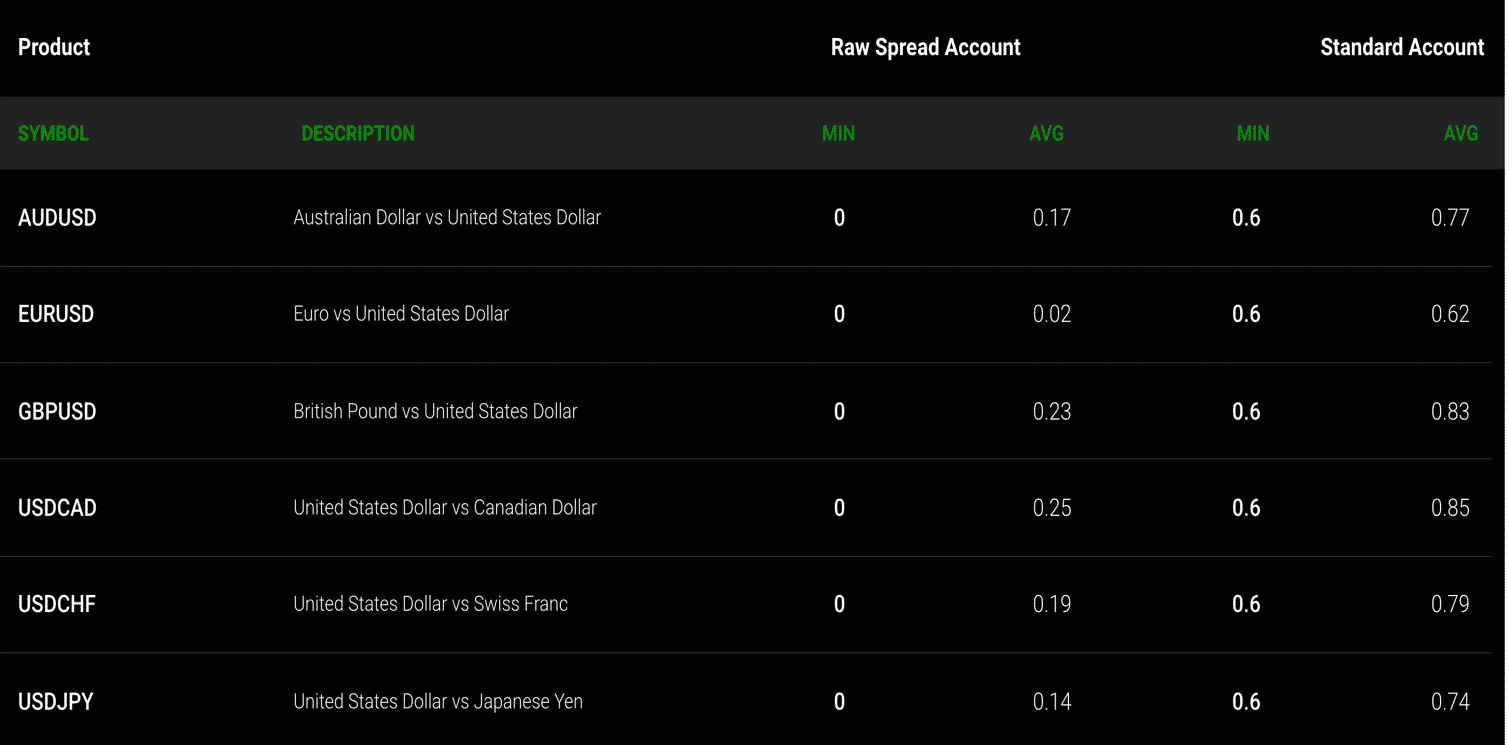

In most cases, traders shouldn’t pay above one pip for such markets. Below is a spread comparison from IC Markets for the major pairs.

- Volatility: The second essential element in the currencies traded with scalping is volatility. Scalpers thrive off fast-paced markets, moving great distances quickly.

The crosses or minor pairs exhibit these qualities better than the majors. Yet, it’s still better for scalpers to focus most of their time on the latter since the spreads are slightly higher on the former.

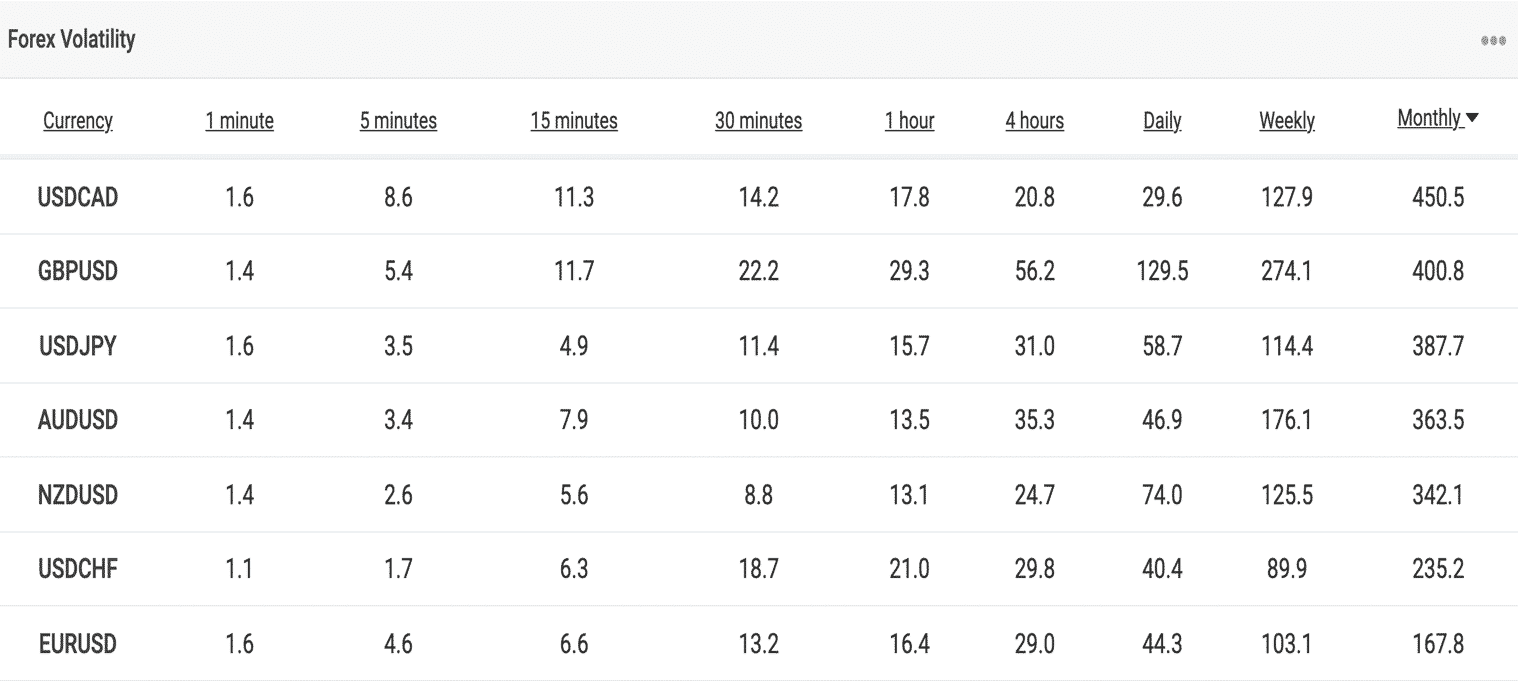

For major pairs, you can observe the markets with the highest volatility (measured in pips) across all nine timeframes in the table below.

Overall, scalpers look for a combination of low spreads and relatively high, stable volatility.

Best 4 currencies for scalping

It’s beneficial to understand the thought process behind selecting these instruments as scalpers aren’t limited to only a few markets. Nonetheless, let’s cover what we believe are the best four currencies to scalp.

1. EURUSD

Despite surprisingly being less volatile than the others, the euro-dollar has been the most heavily-traded pair, accounting for much of the trading volume in the markets. It comes as no surprise since this pair represents the two most used currencies globally.

This market also represents the economic power of the United States and the European Union. One of the reasons traders love ‘fiber’ is it possesses the cheapest spreads across all markets due to the pair’s enormous demand.

The euro’s movements are relatively fluid, and it’s rare to experience any erraticness. As a scalper, it’s a pair one can get in and out of with ease. You can employ all types of technical strategies and fundamental analysis as you’d do with other markets.

If the present exchange rate for the euro is 1.159, it’s clear to see how competitive both economies are, presenting scalpers with a constant flow of profiting opportunities.

2. GBPUSD

The British pound or ‘cable’ also boasts substantial trading volume, among the top 5 speculated in the markets. As a major pair, this pair shares positive and negative correlations with other USD-denominated pairs (EURUSD, USDJPY, etc.) depending on whether USD is the base or the quote currency.

It’s crucial not to unnecessarily increase your risks by, for instance, taking a buy order on both the euro and pound simultaneously. What’s unique about ‘cable’ is the tremendous volatility that remains one of the highest across the foreign exchange.

Plus, the spreads are pretty reasonable and not far off from the euro-dollar. Instead of trading the former, some may purely stick to the pound as it moves faster and provides them exposure to the competitiveness of the US and British economies.

3. GBPJPY

This pair is even more volatile than GBPUSD, earning several nicknames like ‘The Dragon,’ ‘The Beast,’ and ‘The Widow-Maker.’ In many cases, GBPJPY shares a positive correlation to GBPUSD since the pound is the base currency.

However, since JPY is the quote and not USD, scalpers may find unique opportunities not driven by any USD-related technical/fundamental analysis or news. The spreads will be slightly higher as a cross pair but shouldn’t go above 2-3 pips.

Scalpers should consider a fixed spread account to trade this market. Overall, GBPJPY is an exciting and often fast-moving currency pair for scalpers.

4. EURCAD

EURCAD is an intriguing market for scalping. As a pair uncorrelated to the US economy, it’s quite volatile. It’s a worthy addition to this list as traders have reduced exposure to any dollar fluctuations.

Like GBPJPY, traders should consider a fixed spread account with this pair as the spreads are slightly higher. Moreover, cross pairs like this one may have lower liquidity during certain occasions, which increases the spreads.

Final word

One of the benefits of scalping is traders focus only on a handful of currencies. In this manner, one has more time to study each market and thoroughly understand its behavior.

Of course, your selection of currencies doesn’t automatically guarantee success. Scalping is incredibly difficult to perform consistently. Hence, the correct application of this methodology is the difference-maker, aside from the currencies one chooses to analyze.