In the financial markets, more often than not, it will pay off greatly to trade in the direction of a strong market move. This then raises the question; how do you identify a strong market move? Many investors the world over have grappled with this question for years, which has led to the development of various tools to aid in this very venture. The Average Directional Movement Index (ADX) is one of the most efficient tools in that regard.

ADX explained

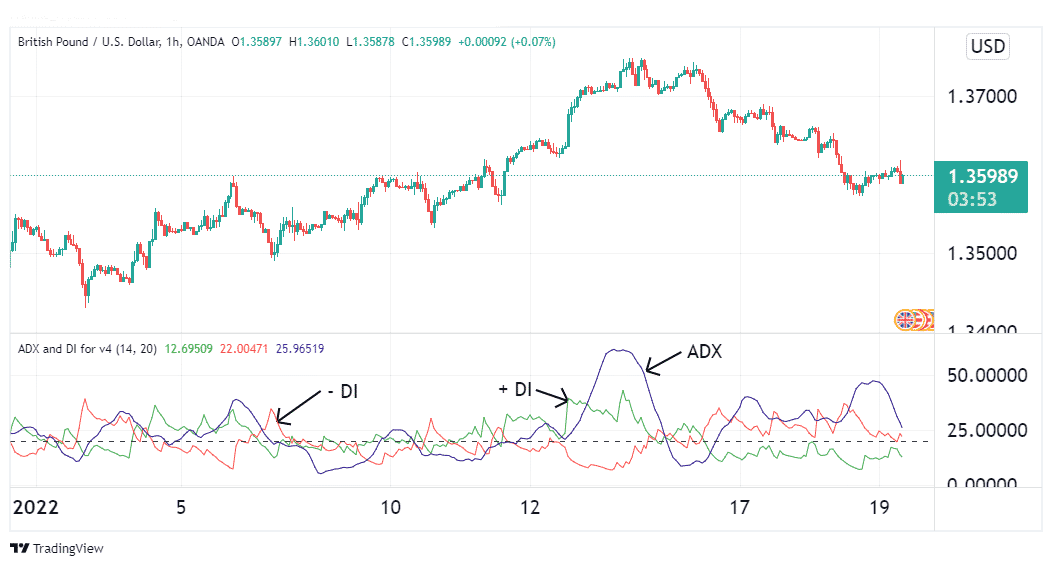

The ADX is a multifunctional tool, as it is capable of gauging the strength behind a trend as well as its direction. It does this by utilizing three lines, one of which is the ADX itself. The other two lines are directional indexes, of which one is positive and the other a negative (+DI and -DI, respectively). However, not all charting platforms will display these directional indices.

The ADX line provides a measure of the strength behind a trend. The directional indices, as their nomenclature suggests, point out the direction of said market trend. Above is how this indicator looks on a chart.

How to read the ADX

We have established that the ADX line measures the strength behind price moves. Therefore, a rising index points to a strong market trend, while a declining index will signify that the current trend is losing momentum. The ADX is displayed on a chart with a scale from 0-100, and a threshold is placed at the 20 or 25 mark.

When the ADX is reading between 0 and this threshold, it points to a market in consolidation, as any present trends are extremely weak. When it rises to between 25 and 50, the market is in a strong trend. A reading between 50 and 75 implies that the prevalent trend is a very strong one, and is likely to persist. Any reading above that points to a remarkably strong trend, which happens once in a blue moon and is seldom sustainable.

To obtain the direction of the trend, we use the directional indices. When the +DI is above the -DI, the current trend is bullish. Whenever the -DI trends above its positive counterpart, then the bears have the upper hand.

ADX signal types

1. Crossovers

As aforementioned, whenever the +Di is above the -DI line, it points to a rallying market, while when -DI is above +DI, the market is in a downtrend. It follows then that whenever these two lines cross, it points to a possible trend reversal. Luckily, we can confirm the validity of this reversal signal by using the ADX line. If the ADX reads above 25 at the point of the crossover, then the reversal can be construed as valid.

In such a situation, if the +DI was crossing over the -DI, then that would call for the opening of a long trade. If the -DI was crossing over the +DI instead, that would call for the opening of a short trade. These crossovers could also be used as exit signals if they predict a reversal in the opposite direction of your open trade.

2. Consolidation ranges

If the ADX reading falls below 25 and stays down there for a prolonged period, then the market is in consolidation. Such range-bound markets tend to adhere strictly to resistance and support levels, which make them easy setups for trading.

Long trades could be entered when prices bounce off of support levels, while short trades should be entered as prices bounce off of resistance levels.

3. Breakouts

Whenever prices get out of a consolidation range, they tend to stage dramatic breakouts. These breakouts could be in either direction. However, there have been several instances of false breakouts, which could lead to losses if wrongly traded.

Fortunately, we can use the ADX to gauge the validity of these breakouts. Whenever a breakout happens, check the ADX reading. If it is above the 25 threshold, such a breakout has higher chances of holding out. A reading below 25 points to a false breakout.

Limitations of the ADX

First off, the ADX is a lagging indicator. This means that it lacks the ability to produce accurate price predictions since its signals emanate from past price movements. Additionally, it does not clearly stipulate the directions to use when searching for exit signals. This leaves such signals open to interpretation by the trader, which cannot guarantee their success. Thus, for best results, this indicator should be combined with other complementary tools, so as to offset its limitations.

ADX combinations

1. ADX + RSI

This combination is especially useful when trading ranging markets. Recall that we established the ADX reading in such market conditions should ideally be below 25. Therefore, when prices are declining, and the ADX reads below 25, one can look for an oversold RSI reading, which would prompt the entry of a long trade. Similarly, when prices are rising while the ADX still reads below the threshold, an overbought RSI reading in such an instance would prompt the entry of a short trade.

2. ADX + MACD

This combination is best suited for trending markets, and in particular, when spotting reversals. Typically, MACD signals will come first, which leaves the ADX to provide signal confirmation. When the MACD goes above zero, while the ADX reads above 25, all the while having the +DI cross over the -DI, that is confirmation enough of a bullish reversal. This would call for the opening of a buy trade.

Similarly, if after a sustained rally the MACD goes negative, the ADX above its threshold, and the -DI crosses below the +DI, a bearish reversal is imminent. This would prompt us to take profits on all open long positions and/or short the currency pair.

Conclusion

The ADX is a tool used to gauge trend direction and the momentum behind price moves. It is drawn on a scale of 0-100, with a threshold at the 20 or 25 level. The ADX line gives a measure of momentum, while the DI lines are used to indicate the trend direction. Since it is a lagging indicator, it would be best to combine it with complementary indicators for improved signal accuracy.