Foreign exchange, also known as forex, is growing in popularity as more people try to make extra income. They have been incentivized by the potential profits and the little startup capital that is required. The flashy adverts by forex brokers have also contributed. While there are hundreds of currency pairs in forex, not all of them are worth your time. In this article, we will look at some of the top currency pairs you should avoid in forex.

USD/HKD

Hong Kong is one of the biggest financial cities in the world. It is home to some of the biggest investment banks like Goldman Sachs, JP Morgan, and Bank of New York Mellon. The city has succeeded because of the ‘one country, two systems’ policy that started in 1997. Essentially, the policy meant that Hong Kong, which is a part of China, could operate independently. It has its own legal system, monetary policy, and currency.

Because of independence, most Western investors looked at Hong Kong as the safest place to set their base in their focus on China. Another important factor is the overall stable currency of the city.

To make the currency stable, the Hong Kong Monetary Authority (HKMA) implemented a currency peg. This peg means that the currency can only trade between $7.75 and $7.85.

If the currency moves above or below the band, the central bank usually intervenes by either selling the Hong Kong dollar or buying the US dollar. This is enabled by the bank’s reserves of more than $571 billion. Indeed, in 2020, the HKMA spent more than H$60 billion to defend the currency.

The Hong Kong dollar peg makes the USD/HKD one of the worst currency pairs to day trade. That’s because, at times, the pair rarely moves, as shown below. Without dramatic movements, it makes it almost impossible for a day trader to make money. If you are interested in trading the Hong Kong dollar, we recommend that you focus on the relatively volatile ones — GBP/HKD and EUR/HKD.

USD/HKD price action

GBP/NZD

The British pound and New Zealand dollar are two currency majors owing to the strength of their respective economies. The UK and New Zealand are also allies that collaborate in most issues. Recent data shows that the volume of trade between the two countries is relatively small. In 2019, the UK exported goods worth more than 1.9 billion pounds to New Zealand. New Zealand exported also exported goods worth more than $1 billion to the UK.

Still, the GBP/NZD is one of the least volatile currency pairs in the market. This low volatility happens because of how thinly traded the pair is by traders and the fact that the volume of trade between the two countries is relatively small. Also, New Zealand does not make substantial headlines during the trading week. And the frequency of its news releases tends to be low.

The GBP/NZD pair is offered by many trading platforms. However, because of its low liquidity, the pair tends to have a relatively wide spread, the difference between the bid and ask prices. This means that the pair is often expensive to trade. Instead of the GBP/NZD, we recommend that you focus on the GBP/USD and NZD/USD, which are both classified as majors.

GBP/NZD

USD/ARS

Argentina is one of the best-known emerging market economies. The country has a total GDP of more than $445 billion and a population of more than 44 million people. Argentina is also one of the most fertile economies. Its biggest exports are soybeans and corn. It also exports a lot of food industry waste, meat, and vehicles.

Once the fastest-growing Latin American economy, the country has become a shadow of its former self. This is in part because of the large debt the country owes to external creditors. The official figures put the total public debt to more than $323 billion or 72% of total GDP. In reality, the figure is substantially higher than that, with CEIC putting the figure at more than $334 billion.

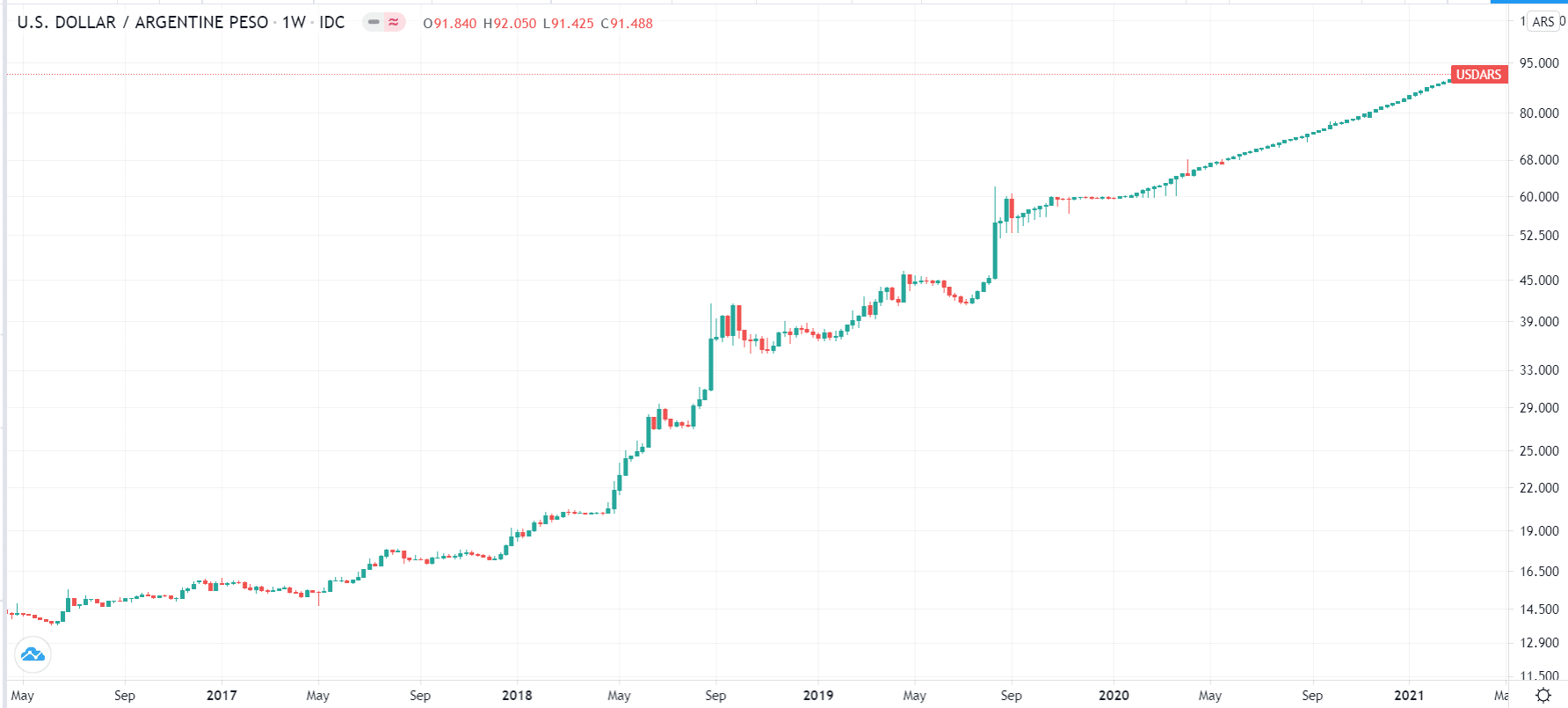

With total debt rising at a time when the economy is slowing, the country has been put into junk status by all credit agencies like Fitch, S&P Global, and Moody’s. This has caused the Argentine peso to crash. In the past five years, the currency’s value has dropped by more than 530% against the US dollar, making it the worst-performing currency in the emerging market.

The price action of the USD/ARS has been rather disappointing, as shown in the chart below. This means that it is highly difficult for traders to make money day trading the currency. Fortunately, many brokers don’t offer the currency pair. Those that do charge a relatively high spread to limit their losses.

USD/ARG price action

CHF/JPY

The Swiss franc and Japanese yen are among the most popular currencies in the developed world. Furthermore, Japan and Switzerland are two of the biggest global economies. Also, the two currencies are often seen as safe havens.

The Swiss franc is considered a haven because of the safety of the country’s financial sector and the neutral stance on most geopolitical issues. The Japanese yen, on the other hand, is considered a haven because of the vast resources that the country owns overseas. For example, it is the biggest holder of the US debt. The two currencies are often viewed as carry trade opportunities because of the low interest rates in the respective countries.

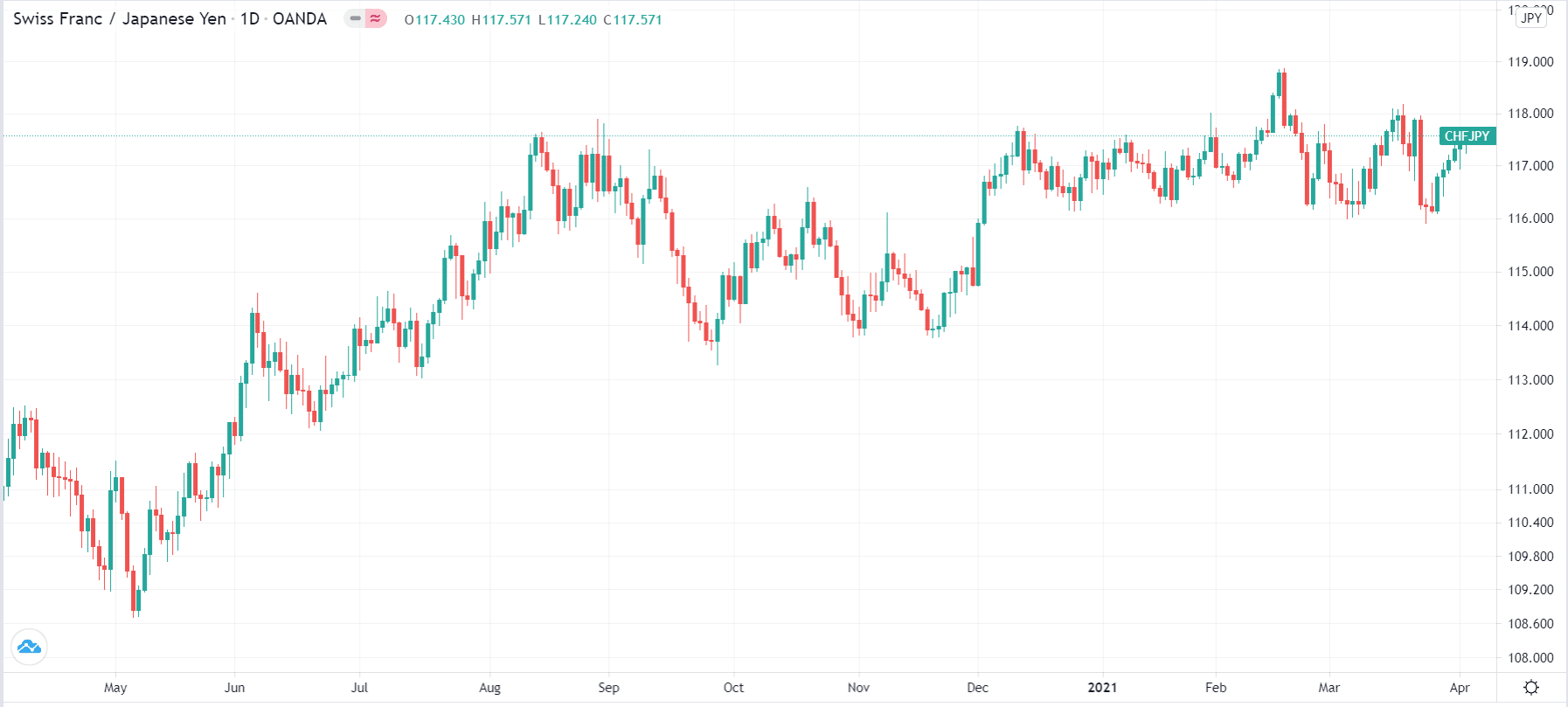

However, the CHF/JPY is a relatively low-volatile currency pair. They barely move, as shown in the chart below. Furthermore, in terms of crisis, investors rush to the two currencies. It is also a relatively expensive currency pair to day trade. The best alternatives for the CHF/JPY are the USD/CHF and USD/JPY.

CHF/JPY

Summary

There are hundreds of currencies in the forex market. However, not all of these currency pairs are worth your time. In this article, we have looked at four of the worst currency pairs to day trade. There are others that we have not mentioned. For most day traders, we recommend that you spend your time focusing on the popular currency majors like EUR/USD, GBP/USD, and USD/CHF.