Introduction

Buy-and-hold forex trading, as the name suggests, indicates that a trader or an investor buys a currency pair and holds it aiming to maximize profits. Profit-taking is central to this strategy as opposed to the time needed. Unlike short-term traders such as the day or swing traders, buy-and-hold investors act similarly to position traders. They work as passive investors, leaving money in the market for as long as possible.

The buy-and-hold strategy is less dependent on technical analysis than it is on fundamental analysis. Investors need to know a country’s long-term economic inclination against another country to decipher the time frame needed to hold a forex pair. If the economic trends support the future growth of a currency pair, the trader will buy and hold it with a profit in mind.

Trading guidelines

- Value targeting

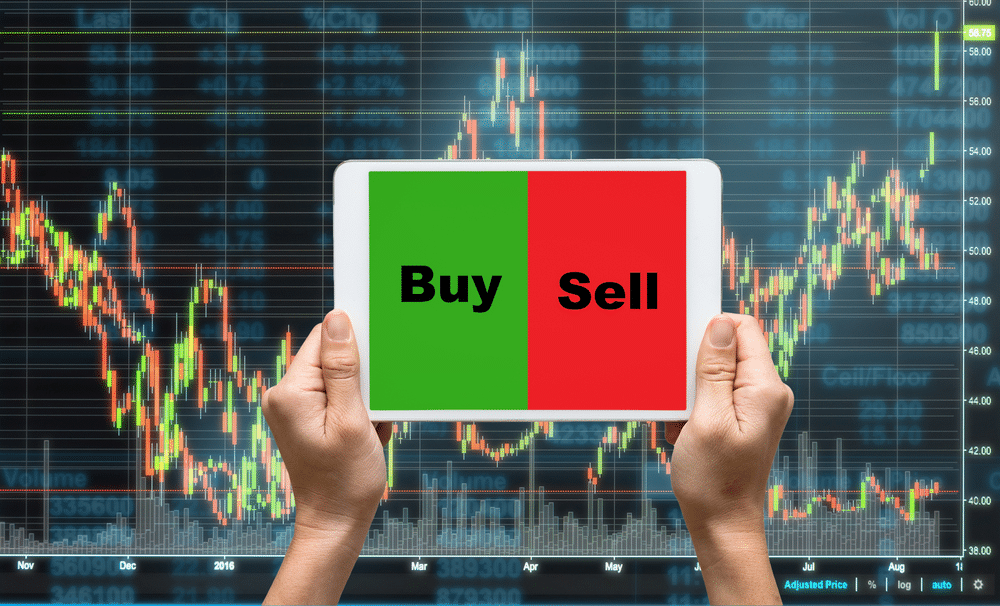

Figure 1: Long-position indicator in the EUR/JPY trading pair

In figure 1, the investor entered the trade at 122.097 with the risk/reward ratio at 1.65. The stop-loss order was placed 4.17% below 117.006. This trade is an upward breakout with short throw-backs indicating an impending long-term gain. The trade was entered on July 27, 2020, and proceeded until April 2021.

The trader bought the EUR/JPY pair at 122.097 and hoped to exit at 130.473. The profit margin, in this case, is 837.6 pips. The amount can be increased depending on the investor’s capital.

Value targeting means that an investor traces a buy position in the trading panel and identifies a price target using the long-position indicator. The target shows the profit level the trader wants to take, irrespective of the time spent in the trade. The investor enters the trade once this position is identified and exits after realizing the profits.

Two factors are central to this strategy, the time and the amount of profit realized. It means taking into consideration day, swing, and position trading. An investor can buy and hold a forex pair for a day to several years, depending on the amount of profit realized.

This strategy is different when you want to test a short position. A short-position test is necessary to ensure the trade value is covered in case there is a downward breakout.

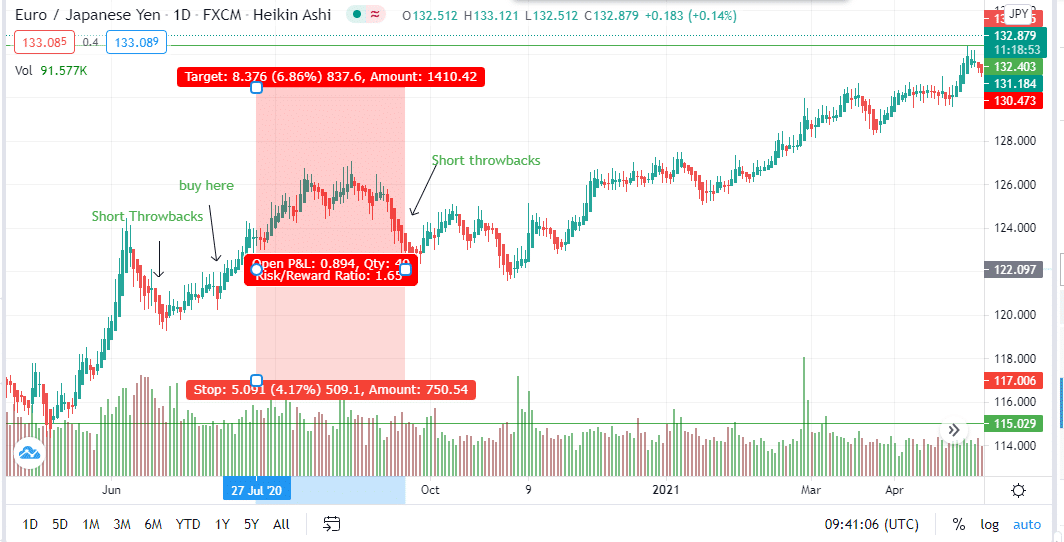

Figure 2: Short-position test of the EUR/JPY trading pair

In figure 2, the trader targeted the EUR/JPY to fall by 3.594 from 125.555 to 121.961. The stop-loss order was placed at 129.149. The chart shows various pullbacks indicating there may be a continual rise of the pair.

Shorting this currency pair would mean that the trader will get to buy it again at a lower value with the hope that it will rise. With the risk/reward ratio in the short position at 1, the trader will be focused on limiting the short and maximizing the buy-and-hold strategy. Therefore, in value targeting, the trader can choose to either buy immediately or short then buy depending on the trading analysis prompting the decisions. Investing in this strategy requires research analysis since it is mostly a long-term trade.

Prior profit margin assessment

Before buying or going long in a forex position, it is important to first assess the profit/loss margins in the trading pair within a selected period.

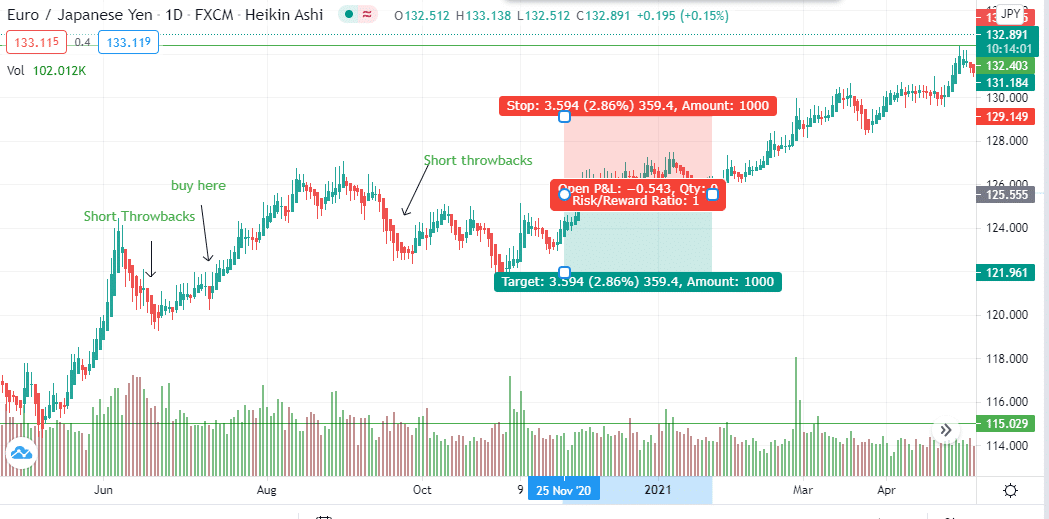

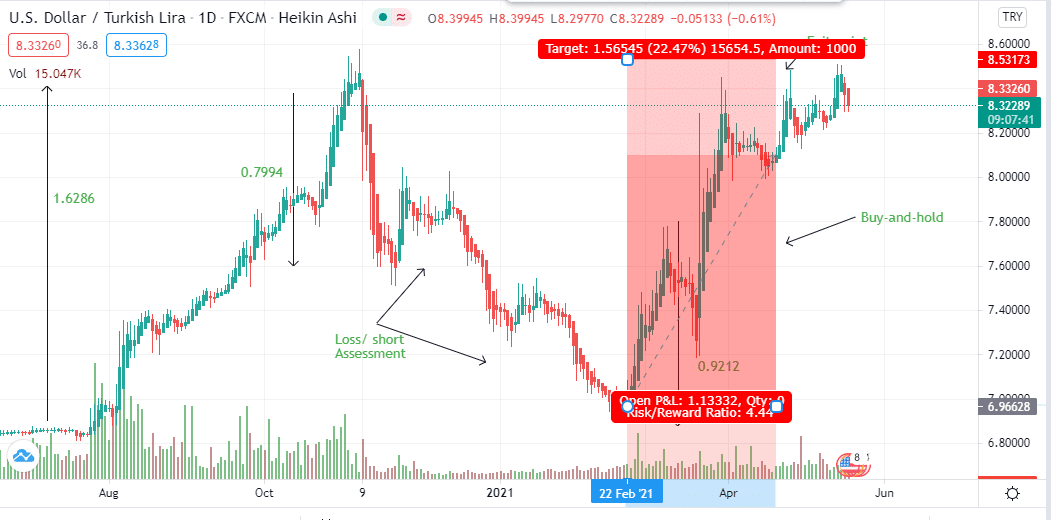

Figure 3: Profit/ loss assessment of the USD/TRY trading pair

In figure 3, the USD/TRY pair has three main trading levels that cover a long period. The pair rose by up to 16,286 pips from August 2020 to November 2020. Profit assessment in this category shows that the pair was bought at 6.9121 and rose above 8.5317.

In the second category, the pair declined before the first pullback by 0.7994 and then by 0.9212 after the second pullback. Shorting the pair would have seen the trader gain a total of 17,206 pips by February 2020. Since the trader intends to buy and hold the forex pair in March 2021, he will estimate the profit against the loss to determine how to extrapolate the long-term position.

The pair may jump towards or close to the previous high position. This understanding means that the buy and hold strategy will aim at a profit nearing 15,000 pips after entering the trade.

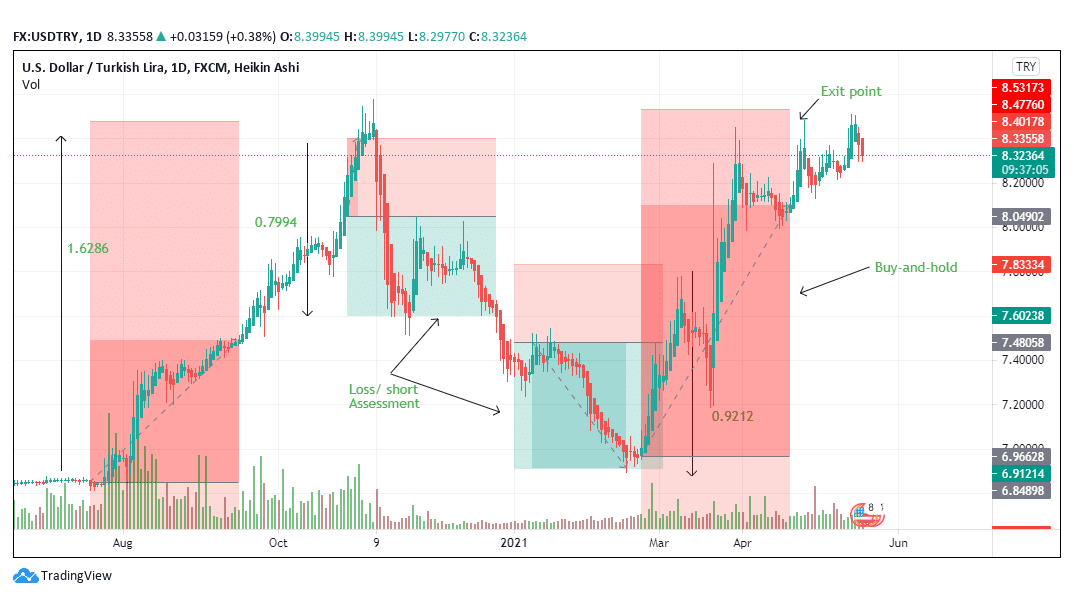

Figure 4: Buy-and-hold USD/TRY pair after profit/ loss assessment

In figure 4, the buy-and-hold strategy was executed on February 22, 2021, when the USD/TRY pair stood at 6.9663. This chart targeted an additional 1.5654 points to the buy point, meaning a profit of 15,654 pips. This conclusion was based on the prior price pattern of the pair, indicating that it had neared its yearly low point as of February 22, 2021. The chart shows that the pair continueы to rise as predicted by close to 16,000 pips in April 2021.

The chart shows that the buy-and-hold strategy does not have to take years or many months for the profit to be realized. In essence, strong fundamental analysis supported the strengthening dollar against the Turkish lira.

Fundamental analysis

Currency values are affected by socio-political and economic events that inform the traders’ perspectives. In this article, we have considered four main currencies: the euro, Japanese yen, the US dollar, and the Turkish lira.

For example, in Turkey, the economic confidence level index (based on official consumption data) showed a decline of 3.5% in November 2020 at 89.5 from 92.8 in October 2020. With the optimistic level at 100, investors would know that the Turkish lira would suffer a setback against the key currencies such as the dollar, although it was doing well. Additionally, the Turkish President replaced the leadership of the Central bank with a dovish administration in the first quarter of 2021, a move that saw a further decline of the lira against the dollar.

Conclusion

Buy-and-hold strategy in forex depends on the trader’s profit target as well as prior trade level assessments. Additionally, fundamental analysis informs the trader’s choice due to the price movement of the currency pair. Rather than looking at the time frame, the trader is considered the market position and the profit margins.