Nations worldwide depend on each other for growth and survival. At the heart of the interdependence is the sale of goods allowing nations to profit from surplus. Governments strive to ensure a balance between exports, from which they accrue inflows, and imports giving rise to the balance of payment (BOP).

Similarly, BOP factors all transactions that a country makes with others over a given period, quarterly or yearly. It comes into being on nations recording all their international transactions involving goods, services, and assets.

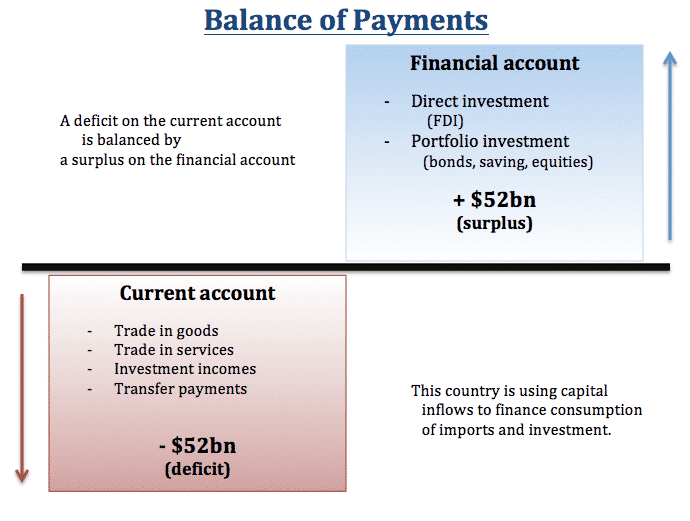

BOP= CA+KA+FA

Whereby CA is the current account referring to a record of all inflows received for goods and services plus income flow and net income flows.

The financial account (FA) includes all transactions for financial investment. It also includes net assets from abroad, portfolio investment that might consist of purchasing bonds or savings in the bank. It also includes short-term monetary flows.

The capital account includes the transfer of funds used in the buying of fixed assets such as land.

BOP Impact

Any fluctuations in the amount of inflows that a nation receives from the sale of items to other nations often influence its legal tender strength and status on the international scene. Likewise, changes in the underlying currency value can also alter the BOP on affecting the competitiveness of the nation’s goods on offer and ability to purchase other items.

Balance of payments impact on exchange ratio comes into play through its influence on supply and demand of the legal tender in question. Whenever there is no balance between imports and exports, the net effect is usually an increase in the supply or need of a given legal tender, consequently influencing its strength.

For instance, the relative exchange rate of CADEUR is influenced by the trading activities between the two economic blocks. Similarly, if Canada is selling and getting more inflows than what it is buying from Germany, there will always be a strong need for the CAD that the traders use to pay for items they are importing.

The high demand for the Canadian dollar to cater for the payments relative to supply can often lead to a spike in the CADEUR floating value. Whenever there is a strong need for a given fiat to facilitate costs, prices tend to rise, resulting in appreciation. This scenario comes into play when a country is selling more and receiving more money than it is buying from other nations.

Similarly, whenever a nation is importing more than it is selling, then it must buy more of the foreign country’s legal tender. The reduced need for a nation’s money often triggers depreciation.

Practical examples

Suppose a Canadian company wants to purchase spare car parts in Germany. The company will have to convert its Canadian dollars to euros to pay for the spare parts. Once the purchase is made, it is recorded as the BOP in the current account. The conversion that enables the transactions is known to significantly impact the currency value when many participants are doing the same.

For instance, American companies doing business abroad expect foreign entities to pay them in dollars, given the relative strength and stability of the greenback. In this case, capital inflows into the US are usually high, which often impacts the greenback value.

Whenever there is a strong need for the buck to finance transactions, the dollar is usually under pressure. High demand amid low supply is often because of the strengthening of the native legal tender.

In this case, the foreign investors often pay much more to get hold of a dollar to finance their transactions.

However, the exchange rate may not rise if other factors are also weighing on it, for instance, monetary policies passed by the Federal Reserve, such as lowering interest rates, influence fiat strength.

Therefore, the direct relation between currency value and BOP only exists whenever there is a free-floating value, not influenced by other factors. In addition, BOP does not affect currency strength in a fixed rate system.

Factors that influence balance of payment

Consumer spending on imports has a significant impact on the balance of payments, affecting currency value against other pairs. Whenever consumers spend more on imports than exports, demand for local currency declines, leading to money depreciation. In contrast, an exchange rate can appreciate whenever consumers are generating more money from what they are selling to other nations.

International competitiveness is another factor that influences BOP and is known to have an impact on fiat strength. For instance, whenever a country struggles with elevated inflation levels, a spike in item prices usually comes into play. The net effect is exports becoming less competitive given the increased prices. In this case, a nation would not be able to sell more items than it imports, translating to a drop in the underlying currency demand leading to further deprecation.

The exchange rate also has a significant impact on the balance of payments. Whenever a country’s legal tender is overvalued, it is common sense that selling will not attract strong interest, thus reducing inflows on the same. Other states would turn to cheaper alternatives leading to a reduction in capital inflows.

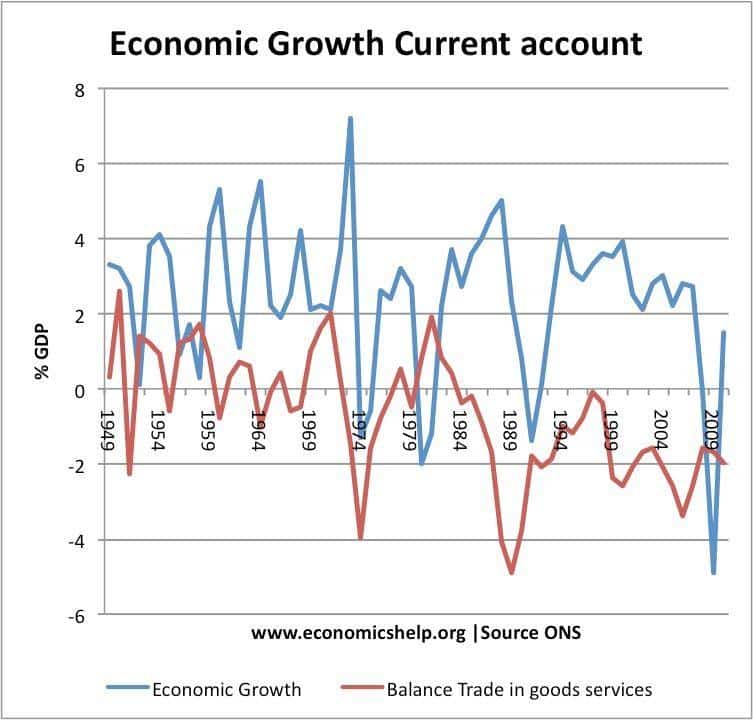

Higher GDP growth also tends to hurt BOP. Whenever a country is experiencing higher GDP growth, capital inflow tends to increase, leading to trade deficits. The net effect is usually a decline in interest of what a country is selling as they tend to be expensive relative to alternatives in the market.