The EURUSD is the most popular pair in the forex market. According to the Bank for International Settlement (BIS), the US dollar is the most traded currency globally. It is usually involved in 88% of all global currency trades. The euro comes second, accounting for about 32% of all forex volume. Cumulatively, the pair accounts for approximately a quarter of all currency trades on the forex market.

EURUSD pros

- Both currencies belong to the world’s largest economies and are preferred by many as their currency reserves. Additionally, there is often abundant data being released on the economies behind the two currencies, which makes their price speculation easier.

- The pair boasts high liquidity and tight spreads. This attracts many investors as it translates to increased profit margins.

- There is a large volume of traders in the market, which causes high volatility. This provides multiple chances for profit.

- Seeing as it’s the most traded pair, there is no shortage of resources on the pair, both educational and analytical material. There are also several online forums that discuss signals and trade opportunities in the pair.

Cons

- The high volatility experienced by the pair means rapid trend reversals are common. If a trader had taken positions against such a reversal, it could lead to substantial losses in just a few moments.

- As EURUSD is a major pair, most brokers will offer high leverages to their clients. In as much as this may amplify their profits, it may also amplify their losses in equal measure.

- There are thousands, if not millions, of forex robots and expert advisers trading the pair. This increases the level of competition amongst the pair’s traders.

Tips for fundamental traders

As aforementioned, there is usually no shortage of information on the economies behind our two currencies. This abundance of economic data attracts fundamental traders aplenty. This is because such information could shed light on future price moves for the pair, both short-term and long-term. For this reason, let’s look at the role of each of these currencies in the pair’s price.

The euro

In the Eurozone, the European Central Bank (ECB) is the body tasked with setting the region’s monetary policy and interest rates. Therefore, any releases from the bank are taken to heart by most investors, as they are a mirror into the state of the region’s economy.

The ECB releases a report every month detailing the standing interest rates and their stance on economic policy. Any hints on future policy tell investors how the euro will fare against the dollar. Additionally, employment data from the region also tends to have an influence on the pair’s exchange rate.

The region’s political landscape also plays a part in the pair’s pricing. Events such as the Brexit referendum and the Swiss decoupling from the euro peg drastically affect the price of the euro. Therefore, fundamental traders should keep an eye on the various economies engulfed in the Eurozone.

The US dollar

In the States, the central bank is called the Federal Reserve, or the Fed in short. The Fed releases its interest rates report eight times a year, which gives investors a peek into the state of the US economy. This tends to have a direct impact on the value of the greenback.

The US Bureau of Labor Statistics releases various employment data, such as monthly jobless claims and nonfarm payroll data. A high unemployment level weakens the dollar, while a reduction in this level is bullish for the currency.

Tips for technical traders

Timing your trades

The best time to trade this pair is when it is most volatile and liquid. This usually happens when the majority of traders are actively trading the pair. This is typical during the London and New York sessions. These sessions are active from 08:00 to 22:00 GMT.

During periods of high volatility, spreads tend to be the tightest. For optimal spreads, the best time to trade this pair is between 13:00 and 16:00 GMT. This is when the European and the New York sessions overlap. The combined volume of both markets yields the most competitive spreads.

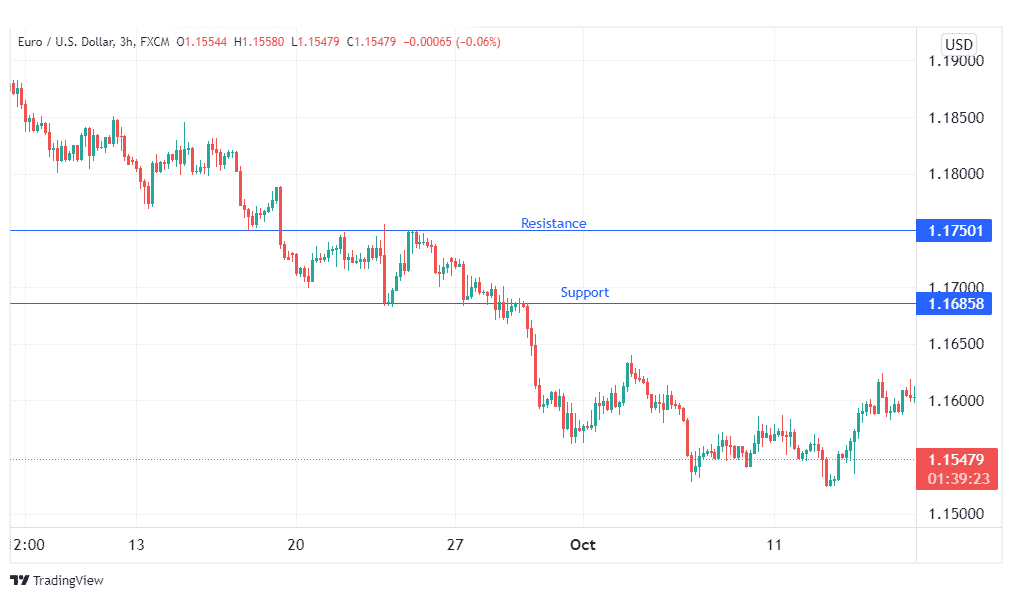

Trading breakouts

One common strategy when trading EURUSD live charts is to wait for breakouts, whether upwards or downwards. Usually, the pair is marked with consolidation periods that adhere to close resistance and support levels.

This strategy involves being patient during those periods of consolidation. Once prices stage a breakout, make your entry and place your stop loss just above or below your entry, depending on whether you’re going short or long. It would also be wise to wait for a retest of the support/resistance level before placing your trade, lest your stop loss is prematurely triggered.

The example above shows a downward breakout after a consolidation phase. This gave the opportunity for a low-risk short trade on the pair.

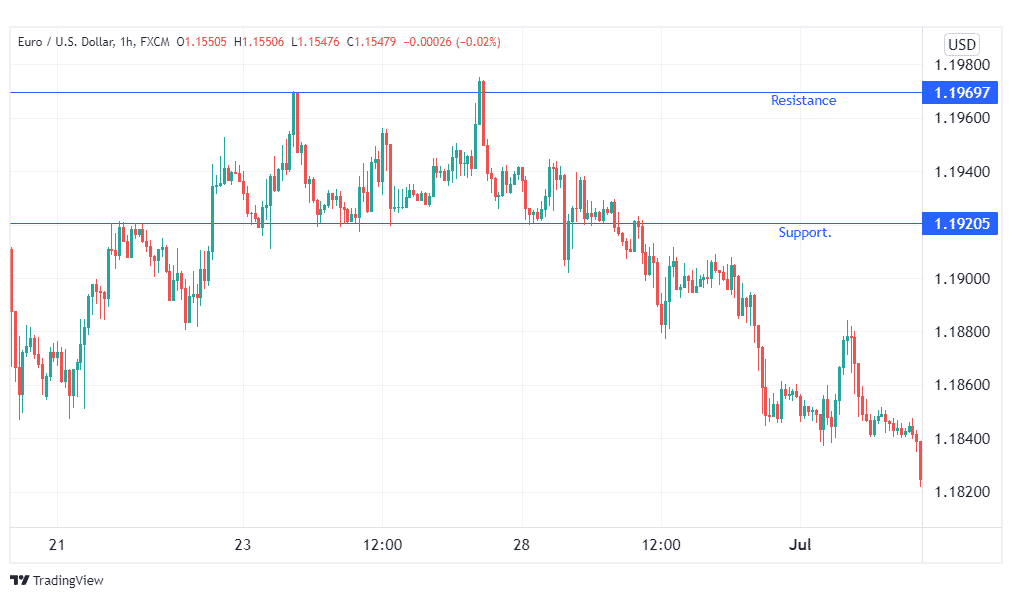

Trading ranging markets

As aforementioned, EURUSD price charts are spotted with periods of consolidation. Traders can take advantage of these periods to enter trades between these support and resistance levels. This way, they take advantage of the small profit potential offered by these ranging price moves.

The example above shows the EURUSD pair in consolidation. Traders may opt to take advantage of this by entering long trades when the price rebounds from support and short trades when the price meets resistance. For improved risk management, stop losses should be placed close to the entry points.

Conclusion

The euro and the US dollar are the currencies of two of the world’s biggest economies. It is no surprise then that the EURUSD pair is the most traded currency in the world. It boasts high volatility, huge trading volumes, high liquidity, and tight spreads. The best time to trade the pair is between 13:00 and 16:00 GMT when the London and New York sessions overlap. Traders may choose to trade ranging markets or breakouts beginning major trends.