The greatest measure of a company’s true value, which ultimately drives a company’s stock price, is the actual economic value created. They can demonstrate their company’s true value through their actual delivered earrings, growth, and profitability.

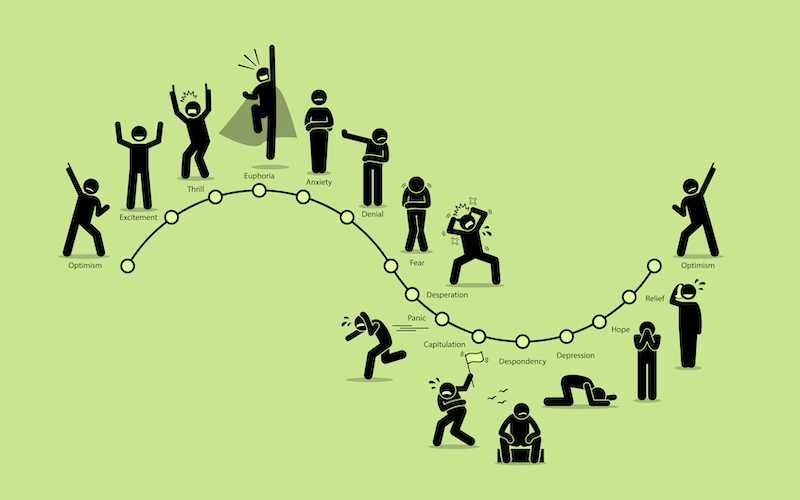

However, forecasting these factors of performance is extremely uncertain. In other words, the manner in which market participants such as professional investors feel about companies, which includes how they feel about the company’s growth and future earnings, is the ultimate driver of stock buying decisions as well as one of the primary drivers of equity prices. This is where the market sentiment comes in.

This refers to an investment theme that assists investors in taking advantage of the return opportunities which are generated by perceptions, emotions, and actions of the different market participants. It provides a forecast on how likely the price is going to make a near-term change. It thus complements investment themes that are grounded in fundamentals, taking shape over time.

Importance of market sentiment

Since one of the primary drivers of trading markets are human emotions understanding market sentiment is key. When investors trade beyond the fundamentals, the price of an instrument does not match its intrinsic value. Thus, grasping the concept of such a sentiment is one of the first steps towards conducting technical analysis.

Sentiments mainly correspond to erroneous beliefs that investors might have against some kind of objective benchmark. There are two possibilities for why these beliefs occur: individuals are correctly using the wrong information, or they are using the right information in the wrong way. Thus, sentimental investors may update their beliefs through the news about fundamentals in addition to noisy signals unrelated to the fundamentals.

How technical indicators can help in measuring market sentiment

There are several technical indicators that can help us to gauge investor sentiment, with each being unique in its own may. Technical analysts usually use more than one indicator in their analysis to get a better picture of what’s happening in the market. To understand how different technical indicators help measure sentiment, we shall look at four such indicators.

VIX- Implied Volatility Index

Introduced in 1993 by the CBOE, VIX is an index that measures the implied volatility conveyed by the option prices. When option prices, along with all other option pricing factors, are known, the implied volatility can be derived by doing a reverse calculation using a mathematical model. It is also known as the fear index, as a rising VIX is an indication of increased demand for insurance in the market. Increased volatility is generated if traders in the market feel the need to protect themselves against risk. To help determine whether the volatility is high or low, they can add moving averages to the VIX.

Put/Call Ratio

This indicator is a basic one, used popularly when finding out investor sentiment. To calculate it, simply divide the trading volume for put options by the trading volume for call options.

- A value above one will indicate bearish sentiment.

- A value below one will indicate a bullish sentiment.

The High-Low Index

The High-Low index shows us the comparison between the number of stocks making 52-week highs to those making 52-week lows. Traders usually use the indicator to a specific underlying index, such as the NYSE composite or Nasdaq 100. The rules are simple:

- When the index is above 70, stock prices are trading towards their highs. This means that investors have a bullish market sentiment.

- When the index is below 30, stock prices are trading near their lows. This means that investors have a bearish market sentiment.

Bullish Percent Index(BPI)

The BPI is a breadth indicator that is based on the number of stocks on Point & Figure buy signals. To calculate it, take the number of stocks on Point & Figure to buy signals and divide it by the total number of stocks.

- When the BPI is over 50%, it indicates a bullish sentiment.

- When the BPI is below 50%, it indicates a bearish sentiment.

Why is reading market sentiment necessary?

Reading sentiment is absolutely crucial to conduct sentiment analysis. Conducting sentiment analysis can yield many advantages to those who are using them. Some of them are mentioned below.

Forming a data-based marketing strategy

Sentiment analysis is one of the main metrics that assist in forming a marketing strategy that is data-based. It has a major impact on multiple aspects of a brand’s online presence. Analyzing the sentiment around the brand helps in understanding motivations that govern a customer’s purchasing decisions as well as the original intent behind their searches.

Providing Live Insights

The mood of a customer can change without warning as it can change at any point during a customer service interaction. Sentiment Analysis helps a company’s agents to inspect the mood of each customer on a session wise basis. There are visual indicators that assist in showing how the mood changes in real-time. Thus, agents are provided with a live insight into how a chat is going, as well as the mood of the customer.

Contributing to competitor analysis

Reading and understanding investor sentiment provides strategic information when it comes to competitor analysis. Each unique company should have certain elements of their marketing strategy that distinguish them from their peers. Thus, in other words, sentiment analysis helps brands to discover unique parts of their offering and leverage them.

Marketing Campaign Measurement

There are certain pieces of quantitative data, such as likes, shares, comments, or social media reach that contribute towards the success of one’s marketing campaign. This information should form the backbone of any marketing analysis. Sentiment analysis answers many questions related to a brand’s customer base, such as whether the audience is responding well to the brand’s messaging.

Final Thoughts

Investor sentiment is a useful metric to measure the level of bearish or bullish sentiment in the market held by traders. One can either use it as a contrarian index for entering the market or in combination with other fundamental or technical analysis tools.