If you stare at any forex chart for long enough, one realizes it’s quite a jungle. Yet, technical analysts believe traders can exploit trading opportunities through identifiable and repeatable patterns amidst the chaos.

The world of chart recognition is quite vast, but one prevalently implemented and discussed pattern is the aptly-named head and shoulders. The structure of this setup visually appears like a person’s head and two shoulders, hence the namesake (no association to the shampoo company).

The head and shoulders is a bread-and-butter method of trading reversals relatively safely with simple identification guidelines, entry techniques, and profit projections.

Moreover, the pattern produces relatively consistent predictive success and appears across all markets. So, let’s explore the head and shoulders, the structure and psychology behind the setup, and the execution guidelines.

The structure of the head and shoulders

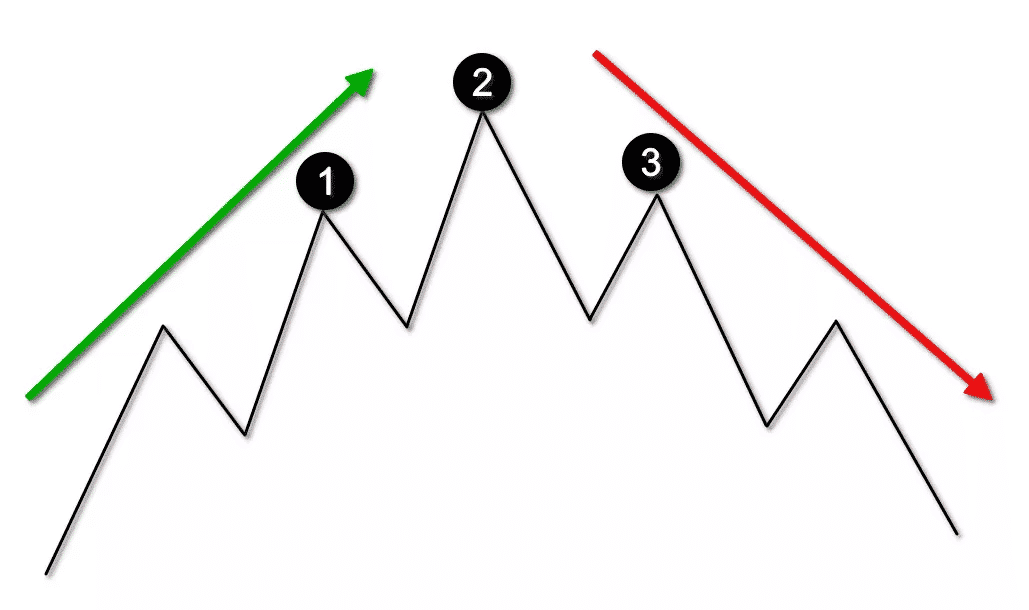

The illustration above (chart 1) is the simplest visual representation of the head and shoulders.

At its core, the pattern consists of two consecutive price peaks (the right shoulder [1] and head [2]), followed by a peak lower than the head (left shoulder [3]) but almost at equal height to the first peak.

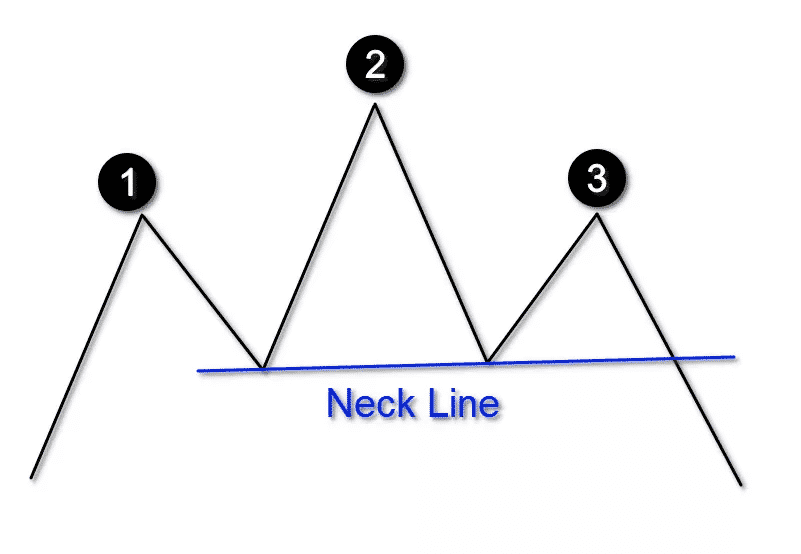

Of course, the head is the highest point of this pattern. We have a standard head and shoulders (for uptrends) and an inverse version (for downtrends). The last component of this setup is the ‘neck line’ (chart 2).

The neck line serves as the support or resistance level where traders expect a breakout. It’s worth noting that this line can be slightly inclined or horizontal. Regardless, it will always be valid provided the other components are in order.

This area is the most conservative and recommended place to enter after correctly identifying the head and shoulders. The cardinal rule of the entire pattern is always waiting for the price to break the neck line before entry.

The psychology behind the head and shoulders

As with any pattern in forex, underlying human psychology is always at play. In a standard head and shoulders pattern, the market is in an uptrend and continuously makes higher highs and higher lows, causing the left shoulder and head.

At some point, the bulls have lost steam because the right shoulder is a lower high and doesn’t follow the higher high-higher low sequence anymore. Generally, traders expect a reversal when this event happens, but in many cases, you need more confirmation.

The appearance of the right shoulder may suggest ‘late-coming’ buyers who still believe momentum is to the upside.

What makes this pattern distinct is the entry tactic that we might consider more conservative than other reversal strategies. Typically, when the price reaches the neck line, a breakout ensues.

This might be because the bulls and bears were waiting on the sidelines as the price dipped back from the right shoulder. Once the breakout happens, the market has now established the new dominant force, meaning more and more traders jump into the move.

Identification, entry, and profit projection rules with the head and shoulders

Like any setup, this pattern takes time and experience to recognize consistently on the charts. Alternatively, platforms like TradingView can perform this job for you automatically.

However, it helps to confirm the setup through manual drawing as well. Regardless, you must wait for the entire pattern to form completely.

Entry and stop loss rules

The trickiest part, as with any breakout strategy, is the entry below the neck line, where traders can experience false breakouts.

A commonly recommended tip is observing the price action. When the price approaches the neck line, you’ll want to see a candle that has a full body with no or a tiny wick.

This primarily depends on the time frame you’re using. For instance, if you’re trading the 4HR chart, you’d need to wait for the entire four hours to see the resulting candle. Generally, you can enter with market execution if the price action suggests a further decline or incline.

The more conservative option (although smarter) is waiting for the price to pull back slightly towards the neck line. Your stop loss is always at the high or low of the nearest shoulder.

Profit-taking rules

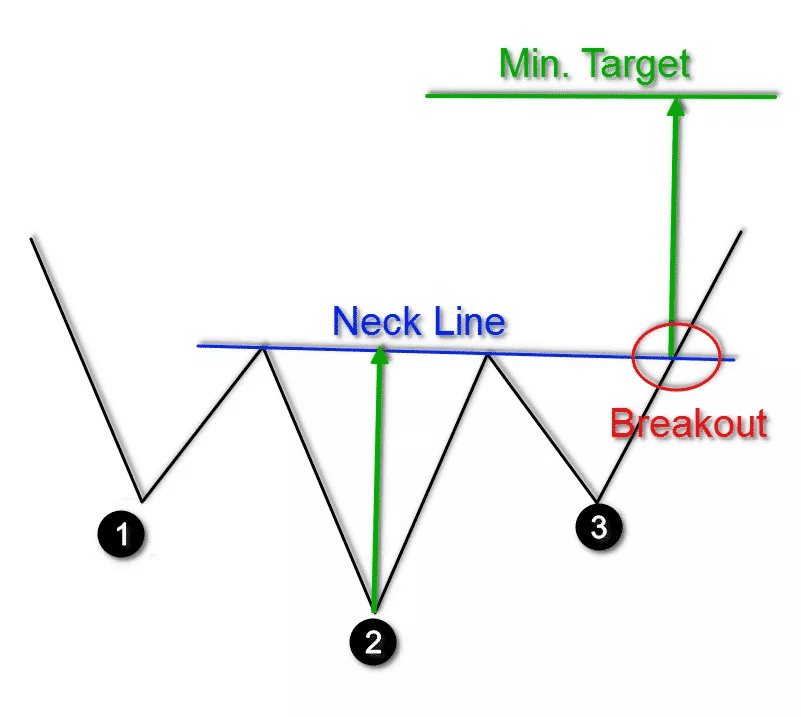

For profit targets, the rule of thumb is the distance from the head to the neck line (chart 3). As with most breakout strategies, you may find scenarios where the price travels much further.

You would need to use discretion at this point by employing several techniques such as trailing stops, manually moving your stop to a predetermined level (e.g., a Fibonacci retracement), or closing the position after a particular session.

The example in this next section will incorporate everything discussed here for a better understanding of this strategy.

A real-life chart example of the head and shoulders

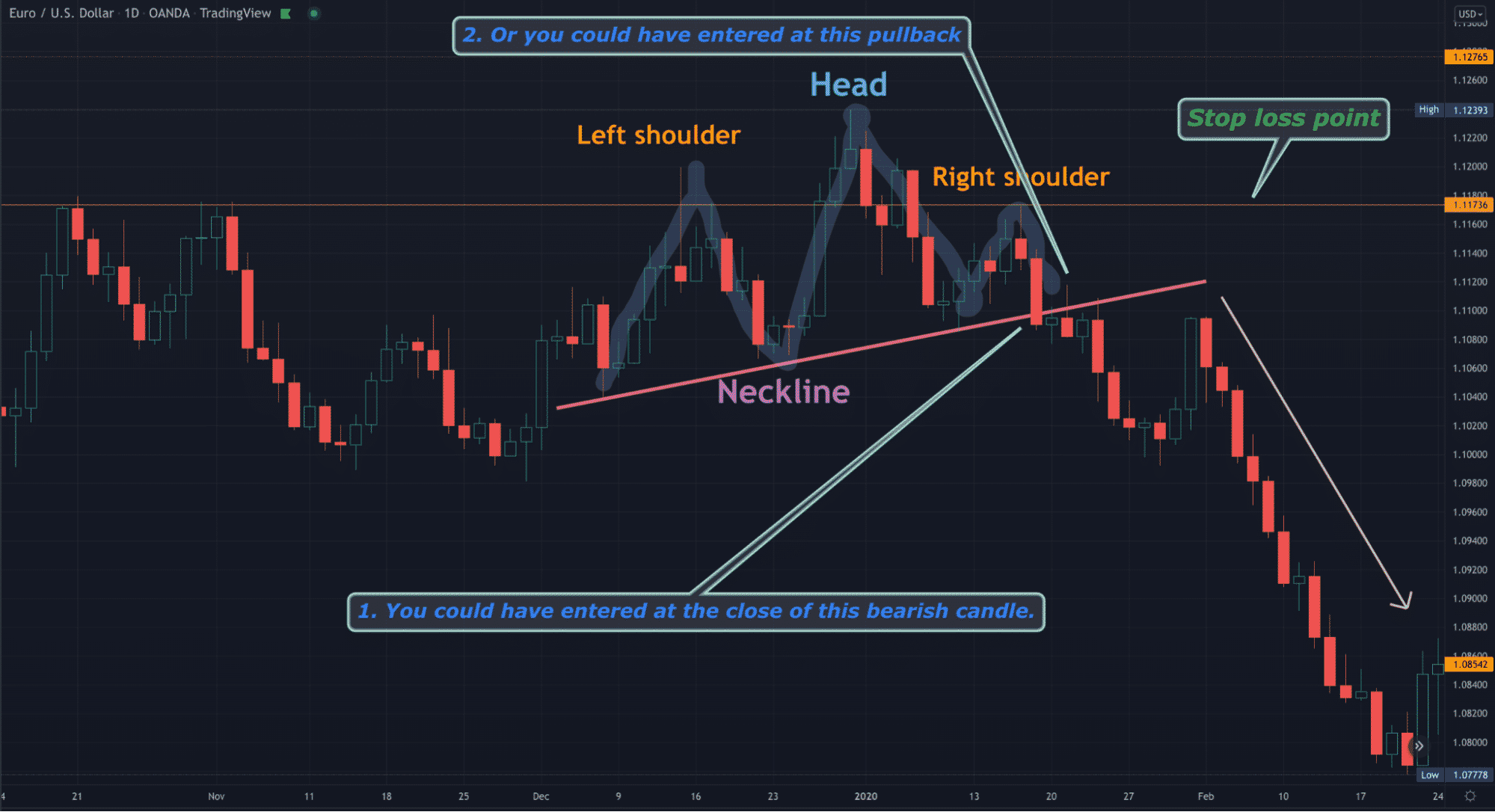

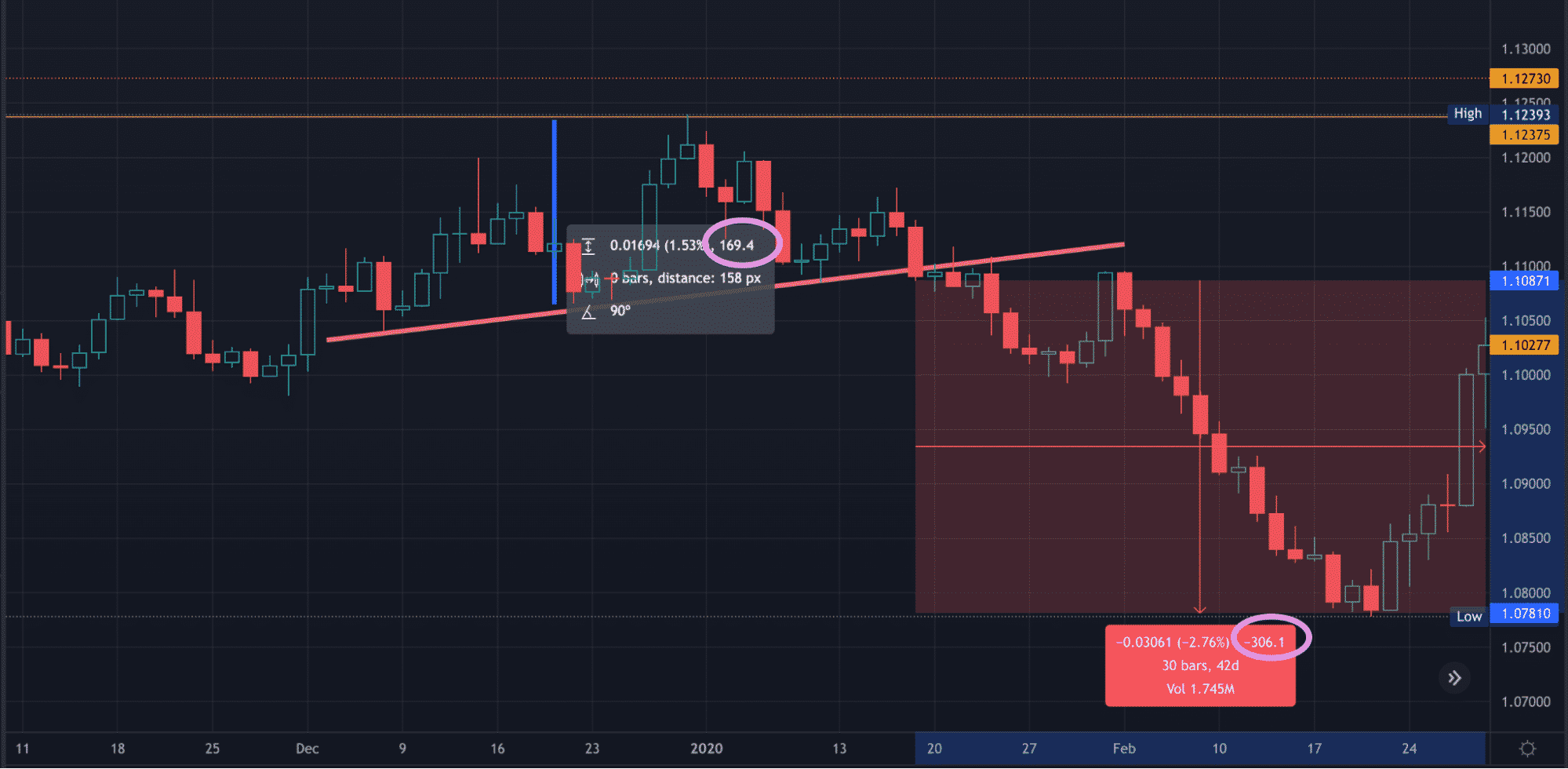

The image below shows this pattern on the EURUSD daily chart (chart 4).

We have labeled all components of this pattern, along with the stop loss area. Note that we have detailed the two entry techniques discussed in the last section.

A head and shoulders pattern on a daily chart is particularly significant due to how rare it appears. Thus, traders can expect a more significant move, which happened in this case.

In our example, the distance between the neck line and head was about 170 pips. Yet, as is evident on the chart below, the price traveled roughly 300 pips (chart 5).

Final word

Ultimately, the head and shoulders setup is visually simple to identify and comes with tried-and-tested entry and exit rules. Yet, as with any pattern, it can become highly subjective and doesn’t work all the time.

Nonetheless, to summarise, here are the main takeaways of this intriguing setup:

- You first identify the pattern by drawing each of the three points.

- Apply the neck line.

- After that, wait for a clear close of the candle below or above this level to confirm a legit breakout. You can enter after this moment or wait for a slight pullback.

- Your stop loss should go at the low or high of the nearest shoulder.

- The recommended profit target is the distance from the top of the head to the neck line. In certain scenarios, the price might not travel this far or could even exceed this point.