Why Charting Tools Are Important for Traders

Investing is a game of financial ratios. To succeed in this game, investors need the right tools to strategize and to implement those strategies. Charts are by far the most potent tool in an investor’s arsenal. From charts, traders can follow a tradeable instrument’s history, current condition, and price action trend.

Charting tools help traders gather market information and evaluate price action’s current behavior to make the right decisions. In short, charting tools make Market smiths out of novice traders.

Trading charts facilitate market analysis by helping traders to interpret market information. It is crucial, especially in the current scenario, where traders experience immense amounts and an assortment of data. Useful charts make market analysis easy and fast. In another sense, charts improve traders’ situational awareness, meaning their ability to decipher the direction and nature of the market activity is better.

What do you need to know about charts?

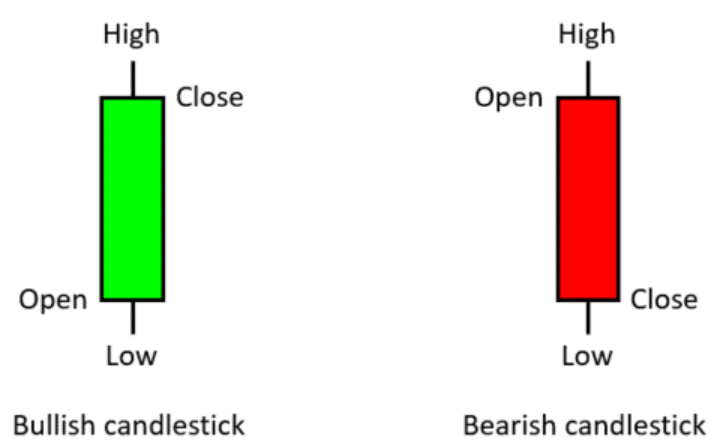

Successful use of charts and charting tools is possible only if the trader has a good grasp of types of charts and how to use indicators. Briefly, two main types of charts are useful, the line chart and the candlestick chart. However, candlestick charts are more widely used because of the enormous amount of information they show concerning price action.

A single candle shows the opening and closing price of a trading session and the sessions’ highest and lowest price. Besides, the candlestick chart specifies if the price action during the particular trading session was bullish or bearish. Contrarily, line charts connect each trading session’s closing price, meaning the information shown is minimalistic.

Figure 1: Structure of a candlestick

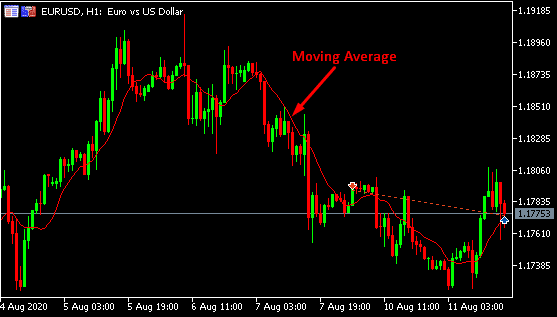

No matter the instrument (forex, stocks, or commodities), the candlestick chart shows as much price action detail as is possible. Moreover, indicators blend in well with candlestick charts. Indicators are the tools that help traders to interpret the market activity illustrated by the chart. Trend indicators such as the moving averages are more commonly used. It is because trend trading seems to be highly profitable when accompanied by a good strategy.

Figure 2: A Candlestick chart (H1).

Free Trading Charts

Even better, numerous charting software is available with which investors can use to develop trading strategies. The powerful charting software goes above and beyond what Meta Trader 4 (MT4) charts can do to provide live quotes. Furthermore, they have plenty of tools and indicators for use. The following are free charting software available to traders:

- TradingView – is perhaps the market’s most widely used web-based charting software. This stock chart is special in a way that it offers a wide range of charting tools all for free. Furthermore, the software has an easy to use interface, and it provides real-time information. It makes it ideal for both fundamental and technical analysis. The free version of TradingView is feature-rich, including three chart types, price scaling features, 50 charting and drawing tools, a stock screener function, broker support, and coverage of a broad range of markets. The paid version contains even more charting tools, as well as preventing ads. Before upgrading to the paid version, traders have a 30-day window to try the software for free.

Figure 3: 13-year chart (MN1) of the price of gold in GBP (£)

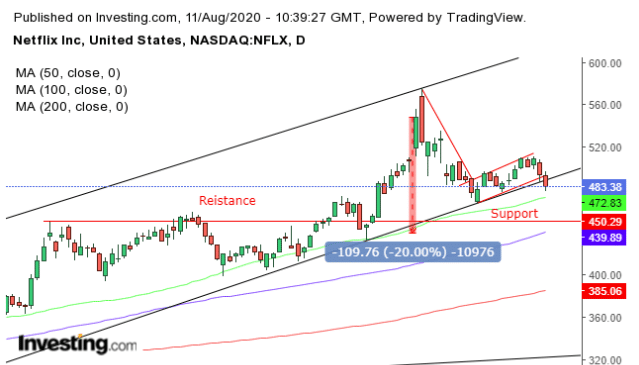

- Investing.com

It is another free charting software that only requires one to open a free account. Investing.com has one of the most extensive collections of features that traders can access for free. Users can view market data (both historical and current) of all tradable instruments. Besides the data, Investing.com provides market analysis from expert traders, live and interactive charts, and tools such as stock screener, economic calendar, dividend calendar, Fibonacci converter, and more. Premium users can access insights that spice up trading strategies.

Investing.com provides futures charts, stock charts, forex, indices, and cryptocurrency charts. Similar to TradingView, Investing.com connects users to stock, forex, and cryptocurrency brokers. The free version of Investing.com has 50+ indicators for technical analysis. Other features that come with charting software include a trading guide, financial news feature, margin, profit calculators, etc.

Figure 4: Illustration of Netflix correction using Investing.com

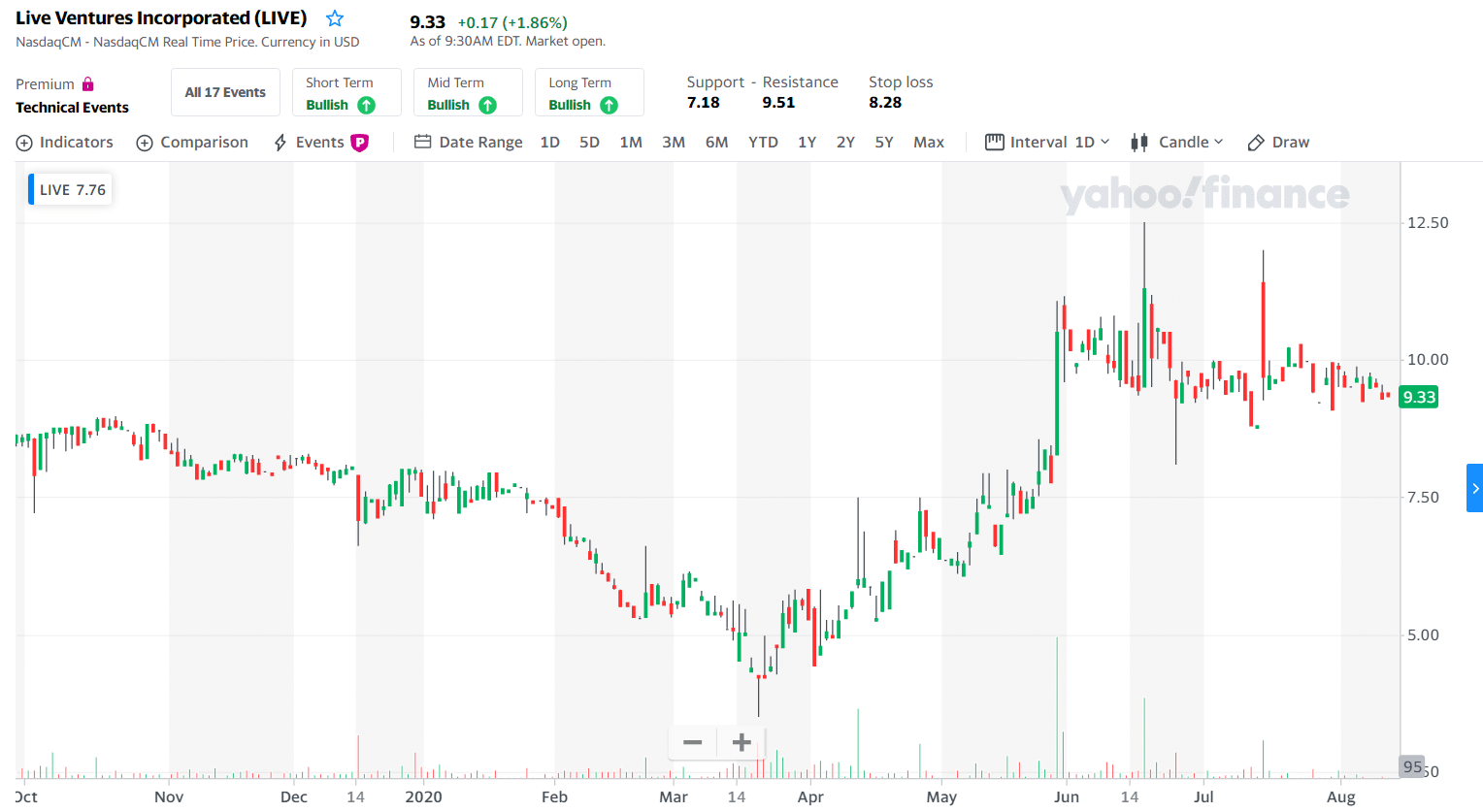

- Yahoo Finance

Yahoo Finance is not only a financial news platform but also a popular charting software. The software has the sleekest UI in the market, and it includes many features. Users can access livestock data and live quotes for a range of instruments, including commodities and futures.

This software trounces many rivals, especially when speaking about the list of instruments one can work with. Yahoo Finance has the most extensive collection of stocks, as well as their real-time quotes. In addition to an instrument screener, users can follow as many stocks as they desire.

Over the past few years, Yahoo Finance added integrating brokerage accounts, meaning users can quickly put their strategies in practice. Premium Yahoo Finance offers an even larger catalog of features, including advanced charting tools, insights, no-ads experience, and advanced data visualization tools.

Yahoo Finance

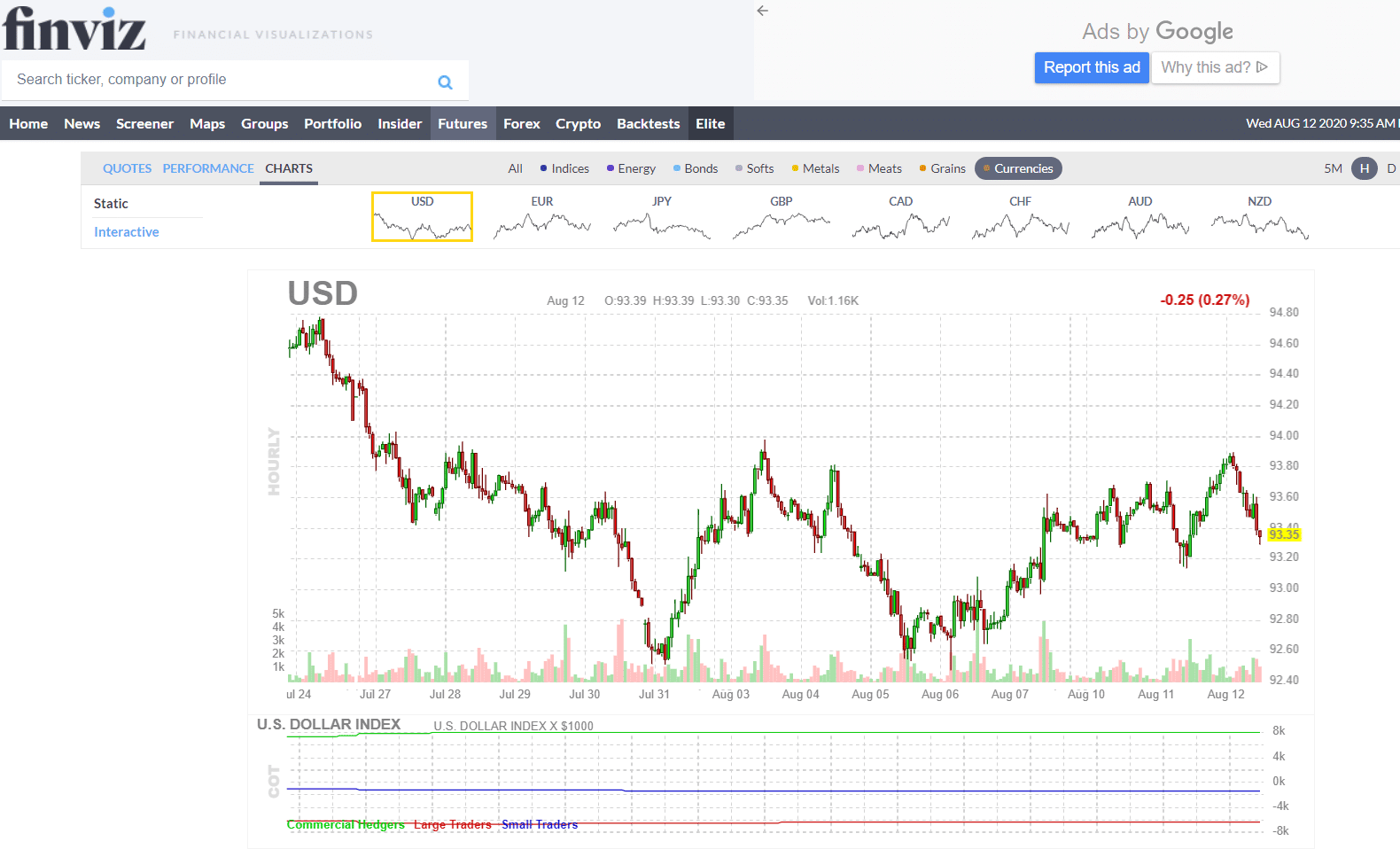

- Finviz

Finviz is a simple but powerful tool for visualizing instruments. Although it lacks the intuitive display of the three platforms discussed earlier, Finviz has one of the best visualizations for showing bearish and bullish stocks in the current trading session.

Another unique aspect of Finviz is the feature where it lists the latest incidences of insider trading. It shows the ticker, the individual/entity that sold the shares, and their relationship with the company. This information is crucial when developing a trading strategy because it enables you to anticipate the stock’s price action’s future direction.

Moreover, Finviz has a backtests feature that enables traders to test-run their ideas before implementation. This feature is available to paying users and can be used on all available charts. Paying users can also access an “Elite” feature with advanced charting capabilities, advanced backtests to determine profitability research on technical indicators, real-time market data, and access to fundamental charts.

In short, Finviz is more useful to subscribers because the free version has minimal features. For instance, free users cannot construct a portfolio using charting software. With just $24.96, subscribers can build a portfolio with a maximum of 100 tickers.

Finviz