Position trading is a trading technique where investors hold on to their assets in a particular trading position for a long time. The holding period usually ranges from several months to years.

Noticeably, this strategy is easily comparable to “buy and hold,”high-profit. Still, the big difference is that position traders can hold both long and short positions, while holding on to a stock is about going long. To be a position trader means that you have to be less concerned about short-term price changes and be more concerned with long-term changes in fundamentals.

What to consider in position trading

Being a position trader does not mean holding on to your assets with no regard to market changes. Like any other approach to trading, position trading requires one to be keen on changes to both fundamentals and technical indicators.

Fundamental analysis will require you to evaluate the key support systems of the asset held and weigh whether they can hold up and help you draw a profit at the end of the investment period. This means that you have to be very selective in picking your stock and only go for the ones that promise the best returns in the long term.

On the other hand, technical analysis is a key ingredient in assessing the behavior of the stock during different economic cycles and extrapolating the potential profit margins in the future. You have to study patterns and trends and trade the stocks when they meet certain target levels according to your pre-defined analysis.

Strategies in position trading

Position traders generally go for assets whose price actions are well-defined and aren’t prone to volatility. This means that they will typically opt for stable assets with smaller but consistent price gains as opposed to those with large price swings.

1) Bollinger bands in position trading

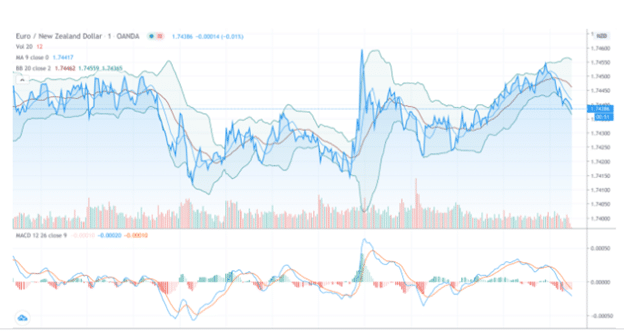

Bollinger bands are used by traders to guide them based on the deviation of the band envelope towards or away from the price candlesticks. Note that while the default period is usually a 20-period Simple Moving Average, you can tweak it to whichever period that best fits your needs.

The two bands will either move towards each other or away from each other, thereby widening or narrowing the width of the envelope.

The narrowing of these bands after consolidation usually signals a potential price breakout and possible volatility going forward. However, Bollinger bands alone may not always be adequate fool-proof indicators of price movement.

However, using them alongside other indicators such as RSI and Moving Average Convergence Divergence (MACD) may give solid backing to the resultant price action.

2) Using Moving Average Convergence / Divergence (MACD)

Moving Average Convergence Divergence (MACD) is an analysis tool that utilizes Moving Averages from two different periods, with one long and the other shorter. The periods are usually 26 days and 12 days, and traders find buying opportunities when the MACD line intersects with the signal line.

For example, in the chart below, there is a notable rise in price when the MACD crosses the orange signal line.

Note that the maximum period of analysis for MACD is 26 days, meaning that this indicator may not be the best option if you are interested in a longer period.

3) Position trading using breakouts

Breakouts refer to the movement of price action beyond the pre-defined levels of support and resistance. For position traders, breakouts present excellent opportunities to establish their positions, mainly if such breakouts result from fundamentals such as mergers and acquisitions.

The key to optimizing profits under such circumstances is to take a long position at the earliest instance of a breakout if resistance has been broken. Alternatively, you can go short if the critical support level has been breached.

Advantages of position trading

- It is less straining and relatively less stressful to traders because you are not perturbed by short-term price changes.

- If you are patient, this strategy can return high-profit margins.

- It is a time-saving strategy, unlike day trading. It allows you more time to assess other investment opportunities.

Disadvantages of position trading

- You need a lot of money to hold a position for a long time because price movements during market volatility can wipe out all the money invested if you had deposited a small amount.

- It locks up an investor’s funds over a long time, which means that you will need a lot of cash to open long positions for different assets.

- Account maintenance and operations fees can accumulate over a long time and eat up a.significant portion of your funds.

- If a trading strategy backfires, the funds invested may be consistently lost, leading to significantly large losses in the long run.

Bottom line

Position trading can be a rewarding strategy for investors. However, they should be patient and understand the cyclical movements in the assets they hold and get it right with their fundamentals and technical analysis.