Introduction

Forex is a financial market that most novel and aspiring traders need to understand. Financial literacy in forex is essential for traders to manage risks and generate profits.

Foreign exchange (forex) trading is an acquired skill that takes time and patience to grasp. Multiple online courses guide new traders on how to make money trading forex pairs.

Additionally, he needs to have brokerage experience, technical and fundamental analytical skills, and business accounting to be a broker. Such education is also necessary for a retail trader and an understanding of the global financial markets.

Trading Strategy

Forex traders have their own rules that guide the trading process. A good strategy considers different possible market scenarios, providing an action plan for a trader.

A strategy carries along with the trader’s financial management toolkit. For example, the amount of money needed by a day trader may be less than the amount required by a swing or a position trader.

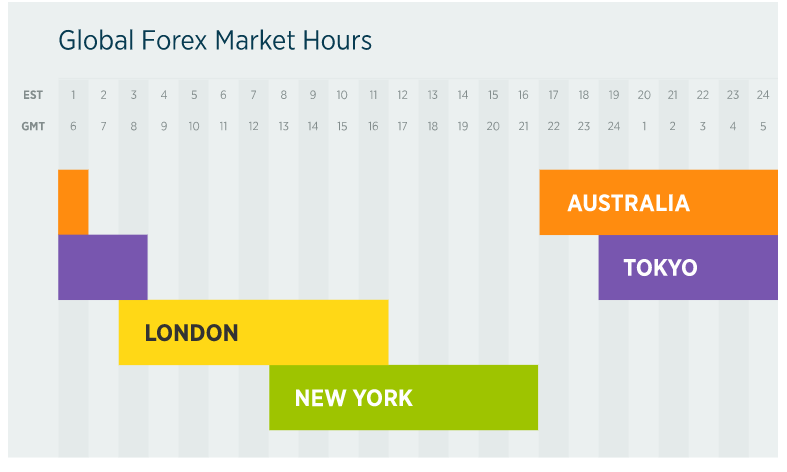

Figure 1: Market hours for global currencies

The strategy also depends on the time zones of the currencies. For day traders that do not trade overnight, it is important to understand when global markets are open or most active.

Trading techniques should be coupled with the experience and understanding of the strategy. These strategies are based on technical analysis, economic calendars (key market events likely to shake the currency exchange rates), and fundamental analysis. Money in forex is invested based on an informed perspective to mitigate losses.

Return on Investment

Performance returns in forex trading differ when we assess professionals against new traders. Professional or more experienced traders understand the driving forces behind major and minor pairs. Thus, they are able to trade based on objective evidence.

Unlike the US stock market with an annual average ROE of 10%, forex trading requires a customized approach to shifting trading strategies. Different strategies bring different returns depending on the trading capital and leverage.

Traders lacking experience may seek to invest with a brokerage firm. However, some brokers in need of clients may decide to tout unrealistic returns.

Financial education is essential as it helps the trader understand the metrics in analyzing returns. A new trader can target returns up to 4% monthly or 48% per year. The range can either increase or decrease depending on the success rates of strategies employed during trades.

To ensure success, every trader must understand the appropriate trading strategy and the average winning rate. Trading requires a comprehension of numbers. They include the trade count per day, week, or month (followed by profit or loss levels in every trade). Every strategy has performance metrics that the trader should understand.

Suppose a trader has an average monthly profit of $500. The annual returns using these metrics will be $6000 ($500 *12). If the trader’s account averages $20,000, then the annual return level will be 30%. This figure can increase as the trader gains trading experience.

Risk and reward

Risk management is perhaps the most critical requirement in forex trading. It considers the amount of money the trader is willing to lose against the amount of profit to be gained.

For example, suppose a trader intends to risk $100 on a trade, and the intended profit before getting into the trade is $250. In such a case, the ratio coefficient of the reward against the risk is 2.5 (i.e., 250/100).

Understanding the risk in trading is an essential element of forex education as it also entails understanding the success rate of the trader, average profit/ losses, and the payout rate. These details are also important when choosing brokerage firms if you choose to trade with brokers.

If out of 20 trades, you make five unsuccessful trades, then the payout rate is 75% or 0.75 (15 successful trades/ 20 total trades). Such knowledge will help to know the amount of money you should set aside as risk and the number of trades to conduct within a set period.

One fundamental aspect of risk management is that a good forex trader should know when to exit or close trades. There should be a reason behind conducting a trade. Exit the trade when the reason has been negated.

Using the stop-loss or setting the price target will help to minimize losses. As a necessity, risks should be limited to 1% of the balance in every trade to lower the losses and increase profits.

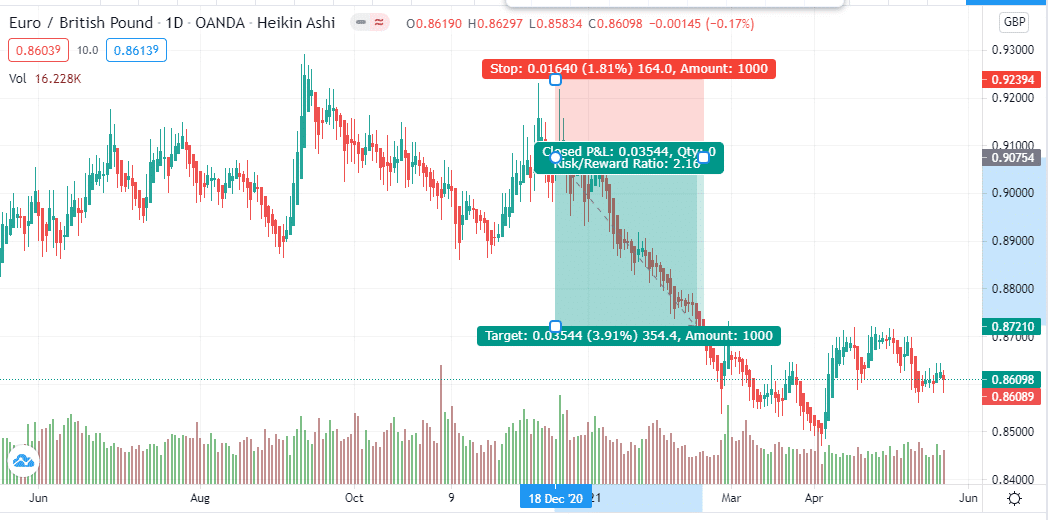

Figure 2: EUR/GBP trading pair stop-loss assessment

In figure 2, the chart shows that the trader has placed the risk/ reward ratio of 1:2.16 in the EUR/GBP pair. It means that for every risk (of $1), the trader will make 2.16 times of that if the trade is successful.

On December 18, 2020, the pair traded at 0.9075. Due to the drop in prices, the trader opted to short or sell rather than buy the pair. He put the stop loss 1.81% above the price if the pair would rise above 0.9075 against the trade.

The price of 0.9075 means that it will require £0.9075 to purchase €1. The target (profit-taking) was also placed 3.91% below the entry price at 0.8721. A drop in prices would see the trader accumulate 354.4 pips.

Conclusion

Financial education is vital in achieving forex trading success. Traders should work towards meeting their set targets and avoid making unrealistic financial goals.