Should there even be a debate between indicators and price action in forex? Understanding both of these concepts well is an integral part of mastering technical analysis. Perhaps it is possible to use both effectively for adding further confirmation and confidence in our trades.

Whether it is an extensive thread on Reddit or a video on YouTube, it seems as though forex communities divide themselves between die-hard indicators and price action masters. However, should there even be a debate over which is more superior than the other? Could we truly use one approach at the risk of missing out on crucial information?

This article will briefly look at what price action and indicators are pertaining to forex, the distinct advantages and disadvantages of each, and perhaps if there is a way to exclusively use an individual method or effectively combine the two for better results.

What is an indicator?

An indicator in forex is a programmed tool on charting software that uses a particular formula to calculate certain settings of past price movements.

Popular indicators include the likes of moving averages, RSI (Relative Strength Index), Bollinger bands, stochastics, and MACD (Moving Average Crossover Divergence), among countless others. Each of these indicators provides unique information about such features as volatility, momentum, and so on.

What is price action?

Price action is the art of studying charts using raw price data (usually with Japanese candlesticks) without the reliance on indicators. Those who religiously trade price action believe market participants’ emotions reflect through the formation of candles.

Aside from studying the inherent structure of a market by observing concepts like support and resistance and price levels, price action proponents trade well-known patterns such as shooting stars and dark cloud cover. These patterns rely on the formation of uniquely-formed candlesticks like dojis, pin-bars, hammers, etc.

Leading vs. lagging debate

One of the debates separating both spheres is that one method leads while the other lags. However, if we look at both objectively, there technically is no approach that is ‘leading’ since each relies on historical evidence to make future decisions.

The first difference between trading with indicators and price action is in how one analyses past data. Using indicators involves a more formulaic mechanism where data has been automatically calculated using historical prices and updated accordingly.

Price action relies on raw candlesticks, perhaps with other charting tools such as trend lines and classic patterns like hammers and pin bars. Therefore, both methods are still inherently lagging since none have any significant advantage over what is likely to happen in the future.

Pros and cons of indicators

Pros

- Although most indicators operate on similar principles, only a few do provide unique information that price action cannot. Indicators use mathematical formulas of price data that stretch back decades in most cases.

- This information is presented neatly without you having to scan many past charts physically. With price action, there is a limit to the data we could observe immediately without having to laboriously look at charts from several years back to gain more information.

Cons

- There are some arguments that specific indicators were made for stocks or commodities and aren’t necessarily suitable for forex since each of these markets operates differently from a technical perspective.

- When using too many indicators, our charts can become cluttered.

- Indicators lag significantly due to past evidence reliance.

Pros and cons of price action

Pros

- Price action can be used successfully in several financial markets aside from forex. As all instruments contain raw price data, the concepts of price action apply in any tradeable environment.

- This approach provides aesthetically pleasing and ‘cleaner’ charts since there are no indicators on the charts.

- Mastering price action is very beneficial to understanding the market structure, a trait that is mostly absent on indicators that rely more on mathematics than technical formations.

Cons

- As with any approach, price action is highly subjective due to the seemingly countless array of price action patterns and philosophies that exist. There are no universal rules for each sequence, leaving room for personal discretion.

- As established already, price action also lags because of past data reliance.

- While price action is critical for grasping market structure, there are features it cannot provide, such as momentum and volatility, which are also equally important concepts to master.

The solution

It may be too simplistic to exclusively use indicators or price action as we risk disregarding critical information. Though some traders religiously claim to only use price action, the number of those that truly do is tiny.

When viewing the charts, naturally, the inclination is to combine both styles. If we understand technical analysis, we have to be skilled at understanding market structure, which is where price action helps.

Basic concepts such as support and resistance and the OHLC (open, high, low, close) of candles should be the foundation of any technical analysis enthusiast. These ideas should be immediately apparent to an observer’s naked eye, telling how the markets react to particular areas.

However, price action can only take us so far where we have to start drilling down into other areas such as forecasting trends, momentum, volume, and true range. Mastery of these concepts can help us enhance our technical analysis skills. Therefore, most traders will attest to using price action and indicators skilfully together as part of their trading systems.

Combining both price action and indicators

The point of combining both methods is for confluence. It may not be wise just to trade off one signal, prompting the requirements to add confirmation to a set-up. Using indicators or price action only limits a trader from adding more confidence to an opportunity.

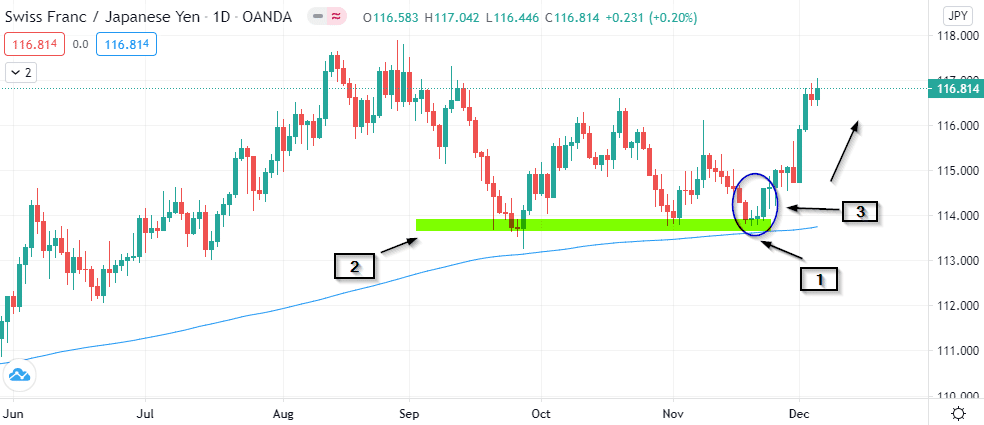

In the example below, we see how we could combine price action and indicators.

- The 200-day moving average (in light blue) was a clear indication of a strong uptrend. Using an indicator like a moving average usually helps us form a bias over whether to go long or short.

At this point, the moving average would only have told us about the trend and nothing else. By adding other confirmation factors, there is more assertiveness in the trade.

- The market was in a visible support and resistance zone (highlighted in green) over the last few months. This realization is only possible through understanding price action.

- The blue ellipse circling the candles may have been the entry signal as it would have suggested bullishness. In price action, a candle with a mostly full body, especially forming in a support and resistance zone, is taken as a sign of dominance and trend continuation.

Conclusion

It should be apparent that indicators and price action don’t have to exist in isolation since they each give us clues about where the markets are likely to go next. By adding numerous confirmation factors leveraging the strengths of both, we ensure that we are taking the best trades possible rather than just trading off one signal.