What is the client sentiment indicator from IG? This article will explain this indicator in brief detail and its primary purposes for traders.

Whether new or advanced, every trader has heard of technical and fundamental analysis, but very few have heard about the third type, sentiment. Sentiment research seems like a foreign and non-essential concept in currencies but has existed for as long as technical and fundamental studies.

The ‘sentiment nerds’ should have undoubtedly heard of the IG Client Sentiment Indicator/Index in forex, one of the most prevalently used sentiment tools. The client positioning indicator is provided by IG, a publicly traded, UK-based broker with beginnings stretching from 1974.

Traders can see the percentage of IG’s clients on particular pairs who have gone long or short. Although IG claims to have just under a quarter of a million clients, despite being a fraction of all market participants, plenty of examples reflect strong correlations between the tool and what happens on our charts.

It is, therefore, a tool utilized by many traders globally. Hence, this guide will cover the index, how it works, how traders employ it (with an example), and the main benefits and drawbacks to consider.

Firstly, what is sentiment analysis in forex?

The concept of sentiment is a relatively novel method of determining directional biases in the markets by seeing how traders feel. When participants feel optimistic, you form a bullish bias; when they feel pessimistic, you form a bearish bias.

The primary avenue for determining sentiment is using an indicator showing how many traders are long versus how many are short on a specific pair. In the case of IG, this data comes directly from their active clients. One interesting feature with most sentiment indicators is their contrarian nature.

In short, when a large percentage of people are selling, the sentiment is actually bullish (and vice versa). This strange phenomenon boils down to the perceived activities between retail and institutional traders.

There’s a belief in forex that most retail investors trade against the trend by picking tops and bottoms. Experts believe the ‘smart money’ or institutional traders see this event and trade in the opposite direction.

This occurrence is particularly prevalent when the market has been moving in one direction for an extended period. You will see in a later example how this pattern happens.

How does the IG Client Sentiment Indicator work?

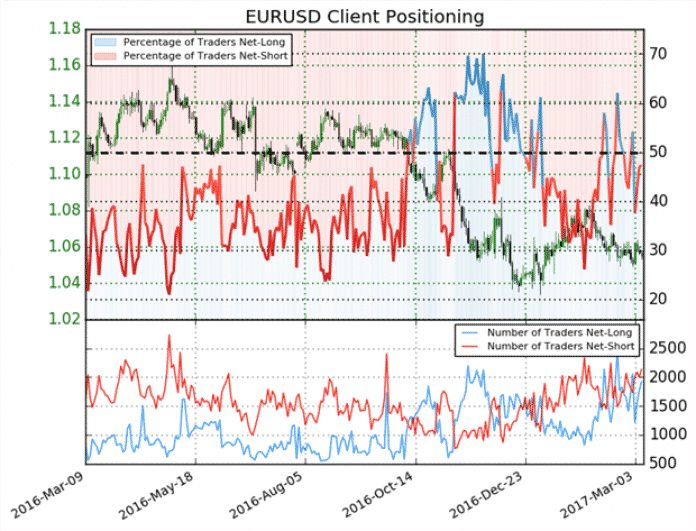

The IG client sentiment index works like most sentiment indicators. The tool is a graphical representation of client positioning or a percentage of how many clients are net-long (buying) versus net short (selling) on a particular pair.

These findings reflect the magnitude to which traders in that market/s feel optimistic or pessimistic, i.e., their sentiment. One of the good qualities of IG’s sentiment tool is they provide a concluded directional bias which also accounts for changes to the previous day.

For instance, if 57% of clients are long in a market while 43% are short, the natural inclination would be to assume bullish sentiment because of the numerical difference. While this may be true in some cases, IG’s index may conclude the trading bias as ‘mixed’ based on changes between the longs and shorts from the last day.

So, traders don’t have to scratch their heads when there isn’t a massive difference between net long and net short percentages. Overall, IG always represents the bias as either bearish, bullish, or mixed, which gives viewers a clear result to assume in their trading decisions.

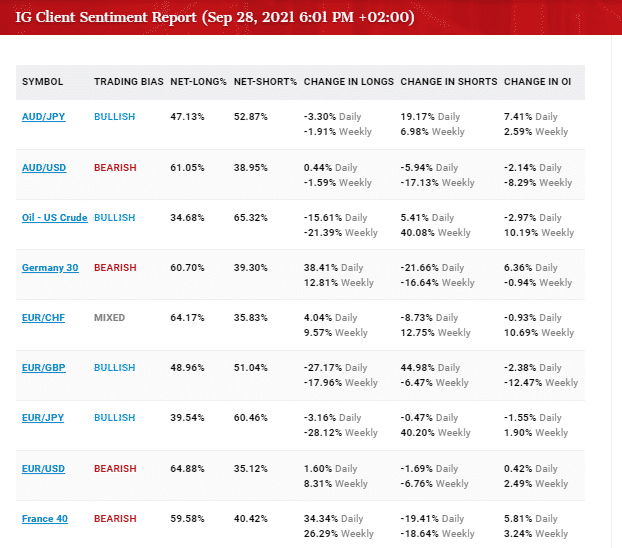

IG’s report updates once daily, and the broker provides client positioning data for a few of the most popular forex markets, crude oil, gold, silver, and a few indices. Below is the list of instruments covered in the index.

- AUDJPY

- AUDUSD

- US crude oil

- Germany 30 (DAX)

- EURCHF

- EURGBP

- EURJPY

- EURUSD

- France 40 (CAC40)

- FTSE 100 (UK100)

- GBPJPY

- GBPUSD

- NZDUSD

- USDCAD

- USDCHF

- USDJPY

- S&P 500 (US500)

- Wall Street (US30/DJIA)

- XAUUSD (gold)

- XAUUSD (silver)

You can zoom in to any market where IG provides a more detailed report, and this is where users compare the actual market direction and how it correlates to the changes in longs and shorts.

An example of using the sentiment indicator in forex

So, how can traders use IG’s client sentiment index? This indicator is best used for confirming a trend and the likelihood of its continuation. Furthermore, it helps detect any possible changes in this regard.

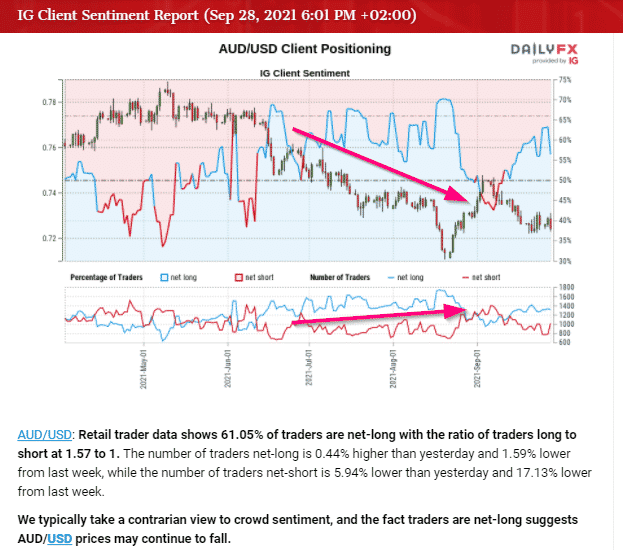

Let’s consider the example below with AUDUSD.

The data suggests about 61% of traders are presently long while the rest are short. The natural assumption would presume the overall sentiment is bullish, but this works in reverse as explained. IG suggests price may continue to fall, concluding bearish sentiment instead.

One of the key things is looking for extremes between the two figures; the larger, the better. The two arrows which trace the price direction and the blue line at the bottom (representing the number of net-long clients) show the disparity.

When more traders were going long, the market kept falling because of the perceived contrarian view. We can further see the gap between the blue line and price, hence why the sentiment is still bearish.

A potential trend change could occur when the red and blue lines converge (at the bottom), suggesting fewer buyers and more sellers are coming in. Ultimately, this is the index’s main job, observing these changes which beneficially help trend-focused traders form a solid directional bias.

Final word

While the IG’s sentiment index is free of charge and a lot easier to comprehend than other indicators of this nature, it only provides a microcosmic view of the entire forex market. Yet, unlike a tool such as the Commitment of Traders, report data updates more frequently, allowing users to react quickly to any sudden shifts in sentiment.

Still, this tool is not necessarily a leading indicator as the behaviors of buyers and sellers in currencies can change in a flash. Of course, IG is not the only broker publishing summaries of their client’s positions in the markets, though only a handful does.

IG’s client sentiment indicator is still, by far, one of the most frequently used and has proven to provide some accurate data translatable to real market movements.