In the forex market, prices tend to move in clearly spelled-out patterns. The structured price action provides hints of potential entry and exit points. The patterns also make it easy to calculate where to take profit and where to place a stop-loss as part of risk management plays. Measured move up is one such pattern for markets trending up.

Measured move up psychology

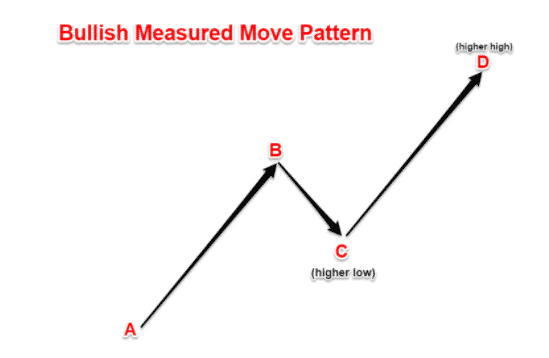

It is a three-wave pattern that comes with well-calculated moves. It is characterized by two impulses, both of which are almost the same size and take the same amount of time to manifest; thus, the measured move name.

The image above provides a clear outline of the measured move-up pattern that signals bulls are in control. It starts with the first impulse whereby bulls trigger a rally from point A to point B. At point B, consolidation kicks in due to participants taking profits or exhaustion after a strong move up.

The result is usually a consolidation phase whereby price tanks. The fact that the pullback is not deep affirms that buyers are still in control and bears are struggling to take the price lower. The formation of a higher low characterized with a pullback being less than 50% of the previous impulse (A-B) implies bulls are still in control and that a bounce-back is likely to happen.

The accumulation phase that takes place at point C results in a build-up in buying pressure as buyers who had missed out on the initial impulse join the fray. The buildup of buying pressure triggers a bounce back after the consolidation.

With the measured move up of great importance is the amount of time the price takes to move from point A to point B as well as the height. It is often expected that the impulse that occurs from point C to D will always be the same height as the distance between point A and point B.

In this case, price movement from point A to B will always be the same as movement from C-D, thus the measured sentiments. In addition, it is often expected that prices will take almost the same amount of time to move from C to D as the amount of time taken to move from A to B.

Measure move pattern structure

The first step to making use of the measured move-up pattern is to ensure that the currency pair under study is in an uptrend. In this case, there should be signs of price making higher highs in the first leg before consolidation kicks in.

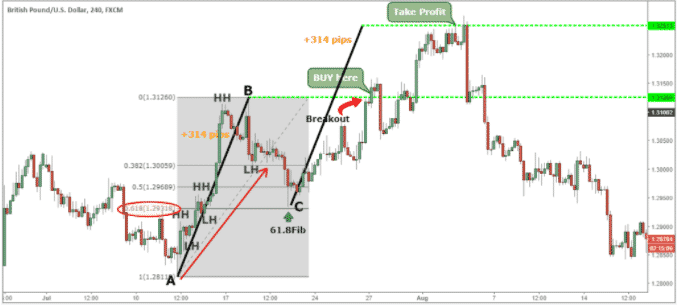

The first leg up should experience resistance at a given level resulting in a pullback. In the illustration above, the peak of the first leg is marked as point B. The retracement that occurs from point B should not be more than 61.8%. In this case, the price should only retrace slightly from point B to affirm the bullish bias is still in play.

The GBPUSD pair above clearly shows the creation of the first leg characterized by higher highs to point B considered the resistance level. The pullback that followed was less than 61.8% signaling the formation of a potential measured move-up pattern.

Entry rules

The formation of a bullish candlestick at point C above the 61.8% retracement level affirms that bulls are back in the fold and likely to overpower bears and steer prices higher. Consequently, aggressive traders tend to open long positions once a bullish signal occurs at point C. By triggering a long position at point C, one gets the opportunity to accrue significant profit as the price retraces higher.

The problem with buying at point C is that there is always the risk of the price being rejected at the strong resistance created at point B. Bears overpowering bulls at point B could trigger renewed sell-off that could see the price edging lower.

Consequently, the most conservative traders wait for the price to break above point B and hold to open a long position. A slight pullback should follow the break out from B to trigger a long position.

Take profit

Regardless of where the buy position is triggered, the take profit will always be on the same level. In this case, distance AB is measured and extrapolated on point C to determine where the price is likely to end after bouncing the pivot level.

Given that point B had 314 pips price movement, it is also expected that any move from point C to D should have the same 314 pip movement.

Risk management

Regardless of the setup, risk management is essential to shield against losses accumulation. Those who trigger a buy position at point C can place their stop loss slightly below where the uptrend started at point A

Conversely, those who trigger a position once price breaks out of point B can place their stop-loss order a few pips below the pivot at point C. Placing the stop loss order below point A, in this case, will amount to taking a much bigger stop loss should price correct and move lower.

Bottom line

The measured move-up is one of the easiest and oldest chart patterns for anyone looking to take advantage of markets trending up. The setup accrues its edge on the fact that price does not always move in one direction. Periods of exhaustion and consolidations are common occurrences, providing an opportunity to enter the market at a discount after a significant move up.

Given that it is a continuation pattern, it can be traded in all time frames. In addition, one should always ensure any movement after the consolidation is the same as the previous move before consolidation. The pullback that occurs after the first impulse should also not be more than 61.8% of the previous rally.