One of the most vital aspects to consider while trading with an automated system in the Forex market is learning how to manage risks. Even if you spend a fortune procuring an EA containing great features and performing extremely well with archival data without proper risk management features, you can suffer from huge losses.

Remember, you can never negate risks completely, and the only way to avoid risks is not to trade. But, in order to earn profits, you must execute trades and try to manage the risks as best as you can. Here are some tips that will help you manage risks effectively while trading with your Forex EA.

Control lot size

Lot Size is defined as the volume of your trade, i.e., how many currency units you deal in for a particular trade. If the lot size is especially large, you stand to gain more profits from the transaction; however, the loss you suffer, if any, would also be greater in this case.

You should select a lot of sizes based on how much balance you have available. And, you can afford to deal with a large lot size if your balance is high. You can find out the lot size in the following ways:

- Using the developer guide for the Forex EA. When you buy an EA, you get some useful instructions along with it. These include what balance you should start trading with and what should be your lot size for that balance. This is useful, especially for rookie Forex traders.

- Backtesting the robot using the MT4 platform. By using backtesting, you can see how the risk changes when you alter the lot size.

Utilize the risk management feature

Most Forex robots have in-built capabilities for risk management. Using these, you can program the robot to alter your lot size according to the balance you have available. When the equity of your account crosses a fixed value or when there are a fixed number of trades still open, some robots can even stop the trades from continuing.

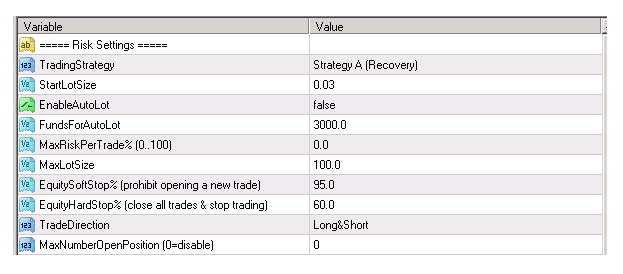

By configuring the necessary parameters, you can control your risks in a dynamic fashion. The risk settings for an automated trading system are given below.

Have a diverse portfolio

While trading using a Forex EA, you shouldn’t put all your capital into a single strategy. Diversifying your portfolio involves spreading your funds between multiple trading strategies, financial instruments, and stockbrokers. The principal advantage of doing this is that unforeseeable events do not catch you unawares.

Such events may include things like unfavorable circumstances in the market, a stockbroker who tries to swindle you or someone who has no money in their account, and a Forex robot strategy that is outdated and no longer brings in profits. While you’re attempting to diversify your portfolio, nevertheless, you should be mindful of the relation between the major currency pairs so as not to increase the risk unintentionally.

EA backtesting

It is wise to backtest your EA before you enter a live Forex market with it. Backtesting involves using archival data to see how the robot would have performed in the past. Although this does not assure you of its success in a live trading situation, it does give you the confidence to place trades with it.

You can use MT4’s strategy tester, select a particular currency pair for a timeframe of your choice, and notice the EA’s performance. Using archival data, you can find out what’s the maximum amount of risks the EA would have had to deal with. If you keep your account balance unchanged, the risk should go up in regards to the size of the lot.

You should remember that backtesting is based solely on historical data. And, even if you see some shocking results, it does not necessarily mean the same thing would be repeated in a live environment.

Micro accounts

Suppose you are testing your EA using a demo account prior to trading with it in real-time. While you are switching over from a demo account to a live one, it is best to use a micro account. You can also take this chance to judge how your EA is performing without putting in too much money and risk losing it.

Some of the EAs require you to have a minimum balance when you begin trading. Of course, there are downsides to using these accounts. The spreads are typically higher for these, and also, there is a peak balance that might have leverage attached to it.

Add Risk Management to your Forex EA

Now we have discussed the top 5 tips that will help you manage risks successfully with your Forex EA, let us take a look at how you can add a risk management feature to your robot. For this purpose, your Metatrader 4 account must have a Server EA and one or multiple Client EAs. The objective here is replicating the Metatrader account positions so that the Server EA can factor out the trades belonging to the Client EAs, thus preventing perpetually looping trade copies.

In order to set up risk management features, you need to do the following:

- Open two charts on your MT4 platform, one having the Server EA and the other having the Client EA.

- Assign a magic number to the Client EA and program the Server EA to exclude this number. This stops the Server EA from detecting duplicate trades time after time.

- Use the EA inputs to alter the risk management settings.

Summary

Thus, we have looked at how you can mitigate trading risk using a Forex Expert Advisor. In this regard, you must see yourself as someone who is not only a Forex trader but also a risk manager. You can effectively increase your chances of making profits by having adequate risk management features in place.