Grid trading is a technique in which a specified number of sell or buy orders are placed at regular intervals above or below a set price to target gains rather than limit losses.

When the market price of a position achieves a predetermined objective and a profit is recorded, the same number of buy or sell orders are placed above or below the specified price. This creates a grid of orders for gaining profits back and forth in the shifting market.

There are two main strategies, forex grid hedge strategy and forex double grid strategy.

Grid hedge strategy

This grid hedge trading strategy is basically mechanical. Hedging is a strategy for mitigating the risks associated with a particular investment. Hedging can therefore be used to protect an asset that you own from a price change that is unfavorable. If an asset is priced in a currency other than your own, this can also be used to safeguard against foreign exchange rate swings.

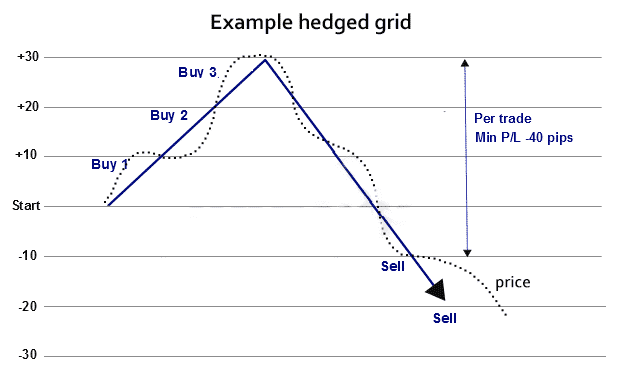

In this strategy, one must include both long and short positions. Internal hedging or loss security is a feature of this technique. The basic idea is that the profitable transactions will outnumber the unsuccessful ones.

At some point, the entire trading system should turn positive. Then we’d clear out any remaining positions and reap the benefits. The best case for this grid solution will be if the market is volatile. This is because the strategy will place many orders, taking profits as the market fluctuates.

A hedged grid is a market-neutral approach. The profit would be the same whether the market rose or fell. This trading method has the advantage of not requiring you to foresee a directional trend. That said, if your setup is correct, you can always profit in a bearish or bullish surge.

In the illustration above, you can see how the positions are managed. The orders are placed in the current trend’s direction, using a fixed risk per trade.

Example of a hedged grid in GBPUSD

Let’s look at GBPUSD, which is trading at 1.3500. We’ll use a 20-pip interval and four levels above and below the start to make the grid. There are no hard in stone rules in this approach. One can use pivot lines or any other support/resistance indications to set the levels. One can also adjust the interval and take profit orders, as well as raise or decrease the number of trades, as shown in the table below.

| Order | Buy Stop | Buy Stop | Buy Stop | Buy Stop |

| Entry | 1.3520 | 1.3540 | 1.3560 | 1.3580 |

| Order | Sell Stop | Sell Stop | Sell Stop | Sell Stop |

| Entry | 1.3470 | 1.3490 | 1.3510 | 1.3530 |

| Hedge | -50 | -50 | -50 | -50 |

In the example, if the price trends up to 80 pips, all the buy orders would be completed, but no sell order would be completed. So, the profit would be 120 pips. (20+40+60). Also, if the price trends up, the sell orders would be completed and have a profit of 120 pips.

It is advisable to set the grid as one system and close the grid once the trades have reached the profit level. In the grid, the maximum loss is 200 pips. Thus you can set 250 pips as the target for taking a profit.

Double grid strategy

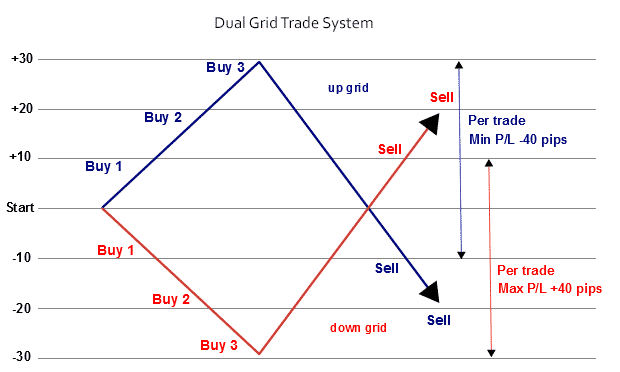

Forex double grid strategy is usually a directional up the grid with a directional down grid. The trader can be long and short at the same time with this strategy. At each leg of the dual grid, one position trades in the direction of the trend while the other trades against it. As a result, a bi-directional trading system emerges.

The fact that this technique is market-neutral is one of the features that traders like. That implies there’s no need to make predictions about how the market will move. This is one of the main benefits of this method.

Stop loss and take profit must be carefully managed in this type of grid system. The offsetting positions provide a lot of built-in hedging. In a highly trending market, the trader must still handle losing trades to avoid a large drawdown.

Example of a dual grid trade system

Consider USDCAD is trading at about 1.2700.

| Order | Buy Stop | Buy Stop | Buy Stop | Buy Stop | Buy Market | Buy Limit | Buy Limit | Buy Limit | Buy Limit |

| Entry | 1.2830 | 1.2810 | 1.2790 | 1.2770 | 1.2750 | 1.2730 | 1.2710 | 1.2690 | 1.2490 |

| Order | Sell Limit | SellLimit | SellLimit | SellLimit | Sell Market | SellStop | SellStop | SellStop | SellStop |

| Entry | 1.2730 | 1.2710 | 1.2690 | 1.2670 | 1.2650 | 1.2630 | 1.2610 | 1.2590 | 1.2570 |

The buy and sell market start at the same time because they’re both executed at the current market prices. When the market rises, the sell limit order and the buy stops are triggered. And when the market falls, the sell stops, and the buy limit is triggered.

In these tables, the grids are mirrored. It means that while one set of positions is profitable, the other is not, and vice versa. Each grid can have any number of places, ranging from two to five, ten, or more. It’s critical that both grids have the same number of positions from the same volume. Although grids with a limited number of positions are simple to use, they may not necessarily allow for flexible risk management.

Conclusion

The two strategies a trader can employ for grid trading are forex double grid strategy and forex grid hedge strategy. They are both used in volatile and directionless markets and are mainly used by people who cannot tell which way the market is likely to move. The difference between a double grid and a hedged grid system is that if there is a significant rally on the downside or upside, the former will return a loss while the latter will return a profit.