Using the Average True Range (ATR) indicator, you can create a comprehensive trading system or point out entry and exit signals. For several years, seasoned traders have used the ATR indicator for better outcomes. Here, we shall take a look at what this indicator is and how it can help you with your trading decisions.

What is ATR?

The ATR indicator was developed to provide an accurate measurement of volatility for the commodity market. Since the prices of commodities tend to fluctuate quite often, monitoring the daily range only gives an overly simplified volatility measurement.

Due to this factor, the present peak and trough, as well as the preceding day’s closing price need to be considered in order to accurately portray the authentic volatility. Thus, the true range is the maximum of the following:

- The gap between the present peak and the present trough.

- The gap between the preceding closing point and the present high.

- The gap between the preceding closing point and the present low.

This value is then averaged over a period of a few days to get an accurate measurement of volatility, and this is known as the Average True Range.

In order to find the ATR for the present period, you need to calculate it for ‘n’ periods using this formula:

ATR = Preceding ATR (n-1) + present period’s true range

Since this formula is based on the preceding ATR, the value needs to be obtained through a separate computation. As there is no preceding value to be used for the initial Average True Range, we just calculate the true range’s average for the last ‘n’ periods.

Now there is the question of what the value of ‘n’ should be. If its value is too high, a slow volatility indicator will be obtained, and if it’s too low, the volatility measurement will be faster. Considering the trading scheme employed for a particular occasion, a value of 7 or 14 is considered ideal.

How can it help with trading decisions?

In order to determine when to enter a trade and to plot gain targets, traders need to know what distance an asset moves within a particular time period. Let us take an example of a pair that moves by $0.75 on an average each day. Now, regardless of the fact that there is no financial news release, you see the pair rising by $1.15 the following day.

If the trading range is $1.25, there has been a significant shift from the average price, and your trading scheme advises you to go long. Now, the buy signal might not be false, but because of the price shifting so much, it is a bit too optimistic to expect it to rise further. Thus, in this trade, the odds are certainly stacked against you.

As the pair has risen quite a bit and has exceeded the average price, it is plausible that it could take a dip and confine itself within the default price range. It is not a wise decision to buy when the price is close to the daily range’s peak, but you can always go short if there is a proper signal.

Conversely, if the pair’s value dips to the day’s low and you notice the price range being abnormally large, short trade signals should be taken with a pinch of salt. It is quite unlikely that the price will fall further. The price will possibly rise and remain between the default high and low for the day.

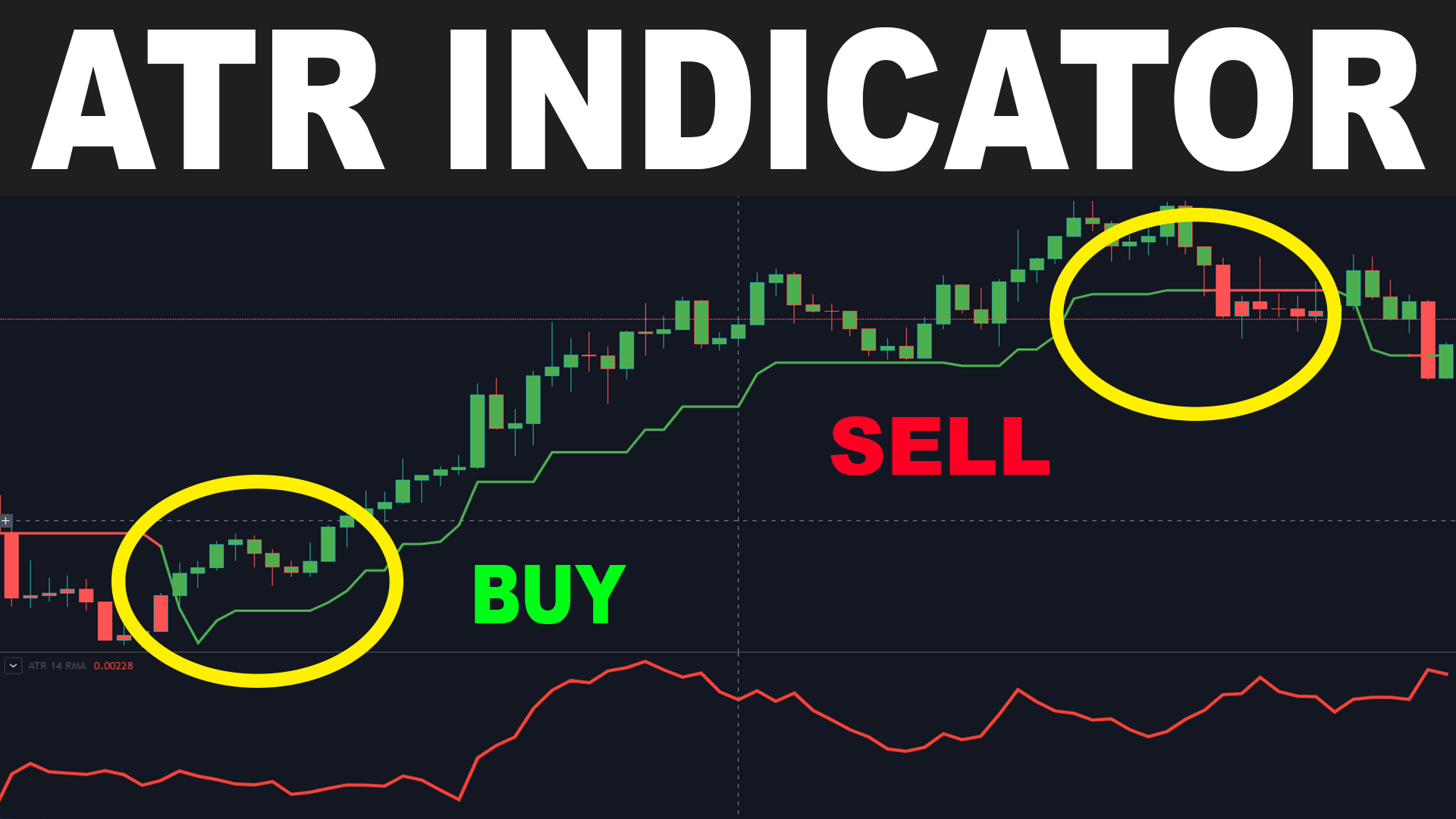

ATR exit signal

Forex merchants may generate signals by deducting the ATR value from the closing price, thus exiting the positions. When the closing point of the price is at a distance exceeding one ATR beneath the latest closing point, you can say that the market has changed its condition significantly. It is wise to close your long position at this point since the pair can go in an opposite direction or trade between compatible low and high prices for some time.

One way to make an exit is to place a trailing stop beneath the highest peak attained by the pair since you made your entry. The gap between the stop level and the highest high can be calculated by subtracting a multiple of ATR from the highest peak.

How to use the ATR indicator in trading

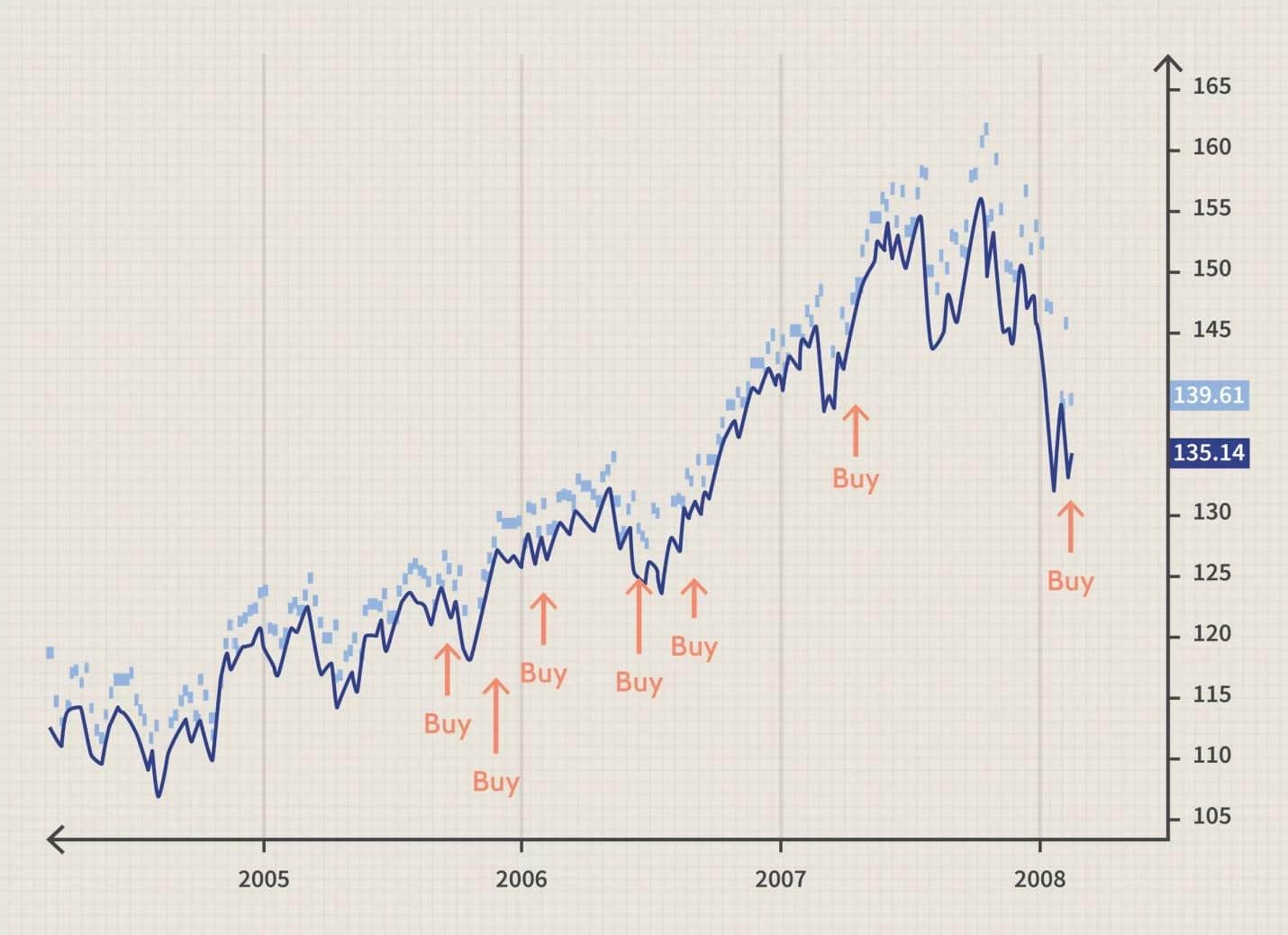

Many Forex traders make the mistake of considering a high ATR value as an uptrend signal and a low ATR value as a downtrend signal. However, in reality, this indicator does not help you find out the way in which the trend is advancing. But by monitoring the value of this indicator with respect to the trend’s direction, we can get an idea about its nature.

The above figure shows how the volatility of the Average True Range Indicator shifts as the trend enters different stages. When the trend is bullish, the ATR volatility moves lower, while the converse occurs where the trend is bearish.

When the market moves up, it moves slowly, and when it goes down, it goes down fast, and this is the reason why the ATR volatility behaves in this fashion. While using the ATR indicator for a particular pair, you should take a look at the archival ATR values. Although the ATR value may be swinging wildly, such behavior may be usual for the pair.

Summary

Now you know how the ATR indicator functions, you can use it to identify profitable trading occasions in the Forex market. Traders who invest for the long haul can use it to determine when the market volatility will rise or fall. It allows them to make prudent decisions even when the market is extremely unstable.