Introduction to double tops and bottoms

Forex traders depend on many techniques to discern the language of the market. The edge reflects the quality of a trading technique that it earns. One of those techniques is to identify and react to chart patterns. Chart patterns form every time, and there are many of them, but few are as widely used as double tops and bottoms.

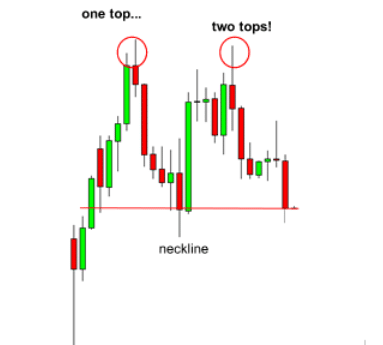

To begin with, double top forms when an uptrending price peaks at a particular resistance level. It forms the first top. From the peak, the price descends slightly and then recovers only for the movement to be blocked at the first top’s resistance level. Because tops form in an uptrending market, double tops’ formation is confirmation that the buying pressure has weakened and that a price reversal is about to happen.

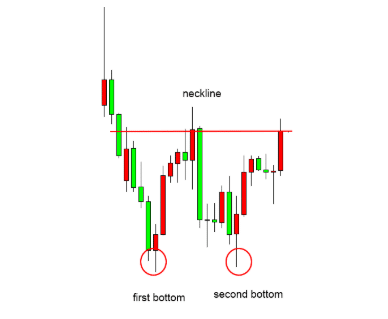

Contrarily, double bottoms form in a bearish market, which means they signal a price reversal in favor of the buyers. In a declining market, the selling pressure is higher, but the sellers wear out as buyers continue to gain ground as time progresses. In the process, the market bottoms and recovers some points before continuing to decline. Having seen what they can do, the buyers up to their activity, and they once again overpower the sellers. Now, this forms the second bottom.

Once the second bottom forms, bargain hunters will flood the market because the second bottom often confirms a price reversal. If there arises an overwhelming consensus that the market has exhausted the selling pressure, then the possibility of further selling disappears. However, traders often look for a clear breakout in the opposite direction as a confirmation.

Understanding Double Tops and Bottoms

Double tops and bottoms might seem like the most straightforward chart patterns out there but do not delude yourself. It takes some knowledge of a thing or two about chart reading to identify the formation.

For double tops, the first step is to identify two distinct peaks and whose width and height are similar. The time frame between the peaks should also be reasonable, not too small or too huge. Thirdly, confirm the support price level that should give the neckline. The identification process is the same for double bottoms only that this time you will be looking for troughs instead of peaks.

- Characteristics of double tops

We have learned how to identify double tops, but traders who cannot single out each characteristic of the chart pattern might find this an impossible task. So, read on to learn the features of double tops.

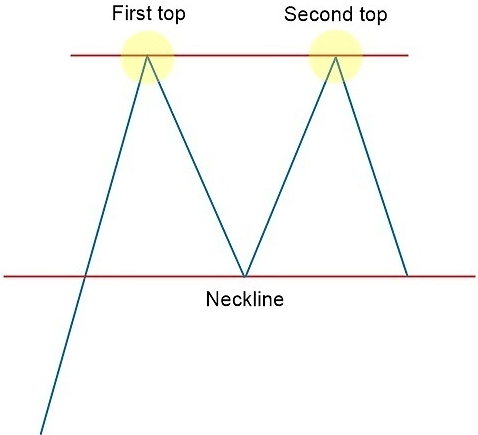

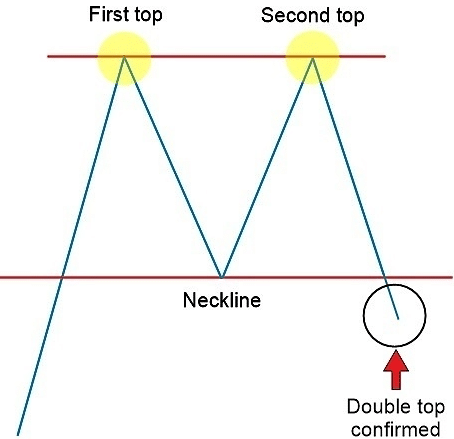

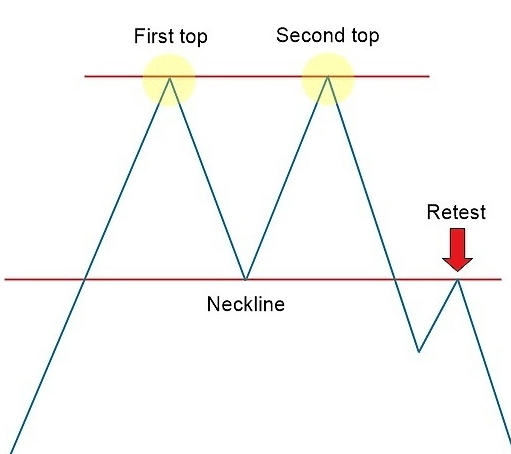

From the figures we have encountered above, one can quickly sketch out the shape of double tops. If you are unable to do it, we have made things easy by sketching a double top for you, as shown below:

As is clear from the diagram shown above, the price action made a rapid and extended move on the bullish side, but the bears quickly stopped the movement at the first stop. During the pullback, the bulls outweighed the bears at the neckline. The market advanced towards a second attempt to break past the first top. Again, the motion of the price action was blocked at the previous resistance level.

At this point, it is essential to note that many traders make the mistake of thinking that the double top is tradeable once the formation of the second top completes, far from it. The double top only becomes tradable when price action crosses the neckline. It is this confirmation you should wait for. In short, double tops herald the coming of a bear market after exhaustion of buying pressure.

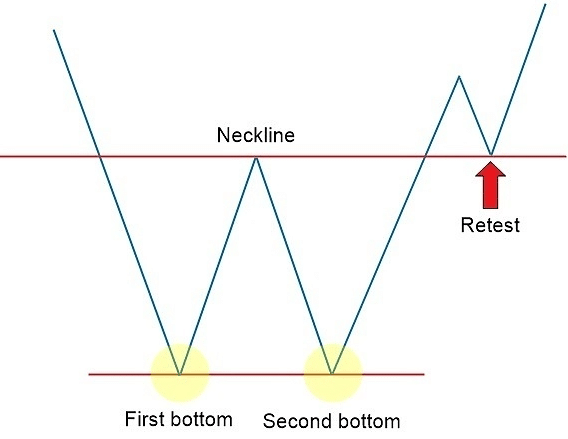

- Characteristics of double bottoms

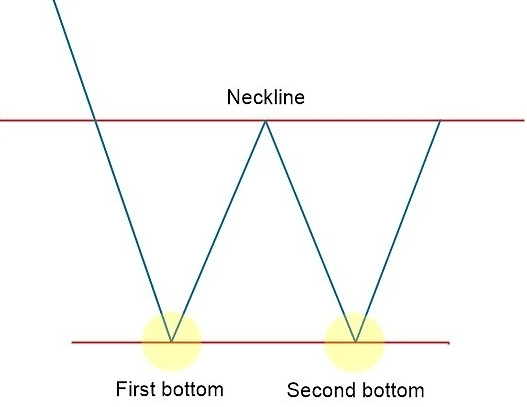

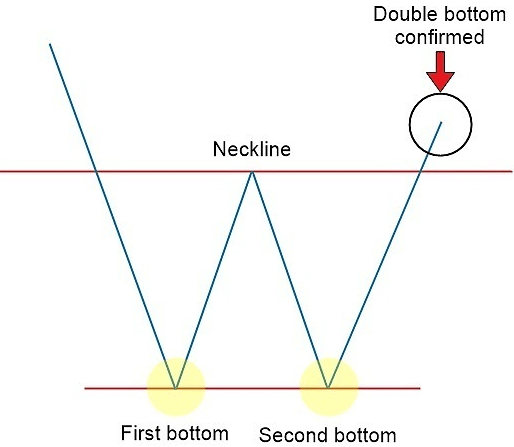

As we have already noted, double bottoms are simply the opposite of double tops. This chart pattern signals a bull market’s coming because it forms at the tail end of an extended downward movement of price action.

During a bear market, the selling pressure diminishes as more buyers join in anticipation of a price reversal. Enough buying pressure establishes a support level at the point where the market turns and begins to advance upwards. This turning point gives us the first bottom of the double bottom pattern.

But the reversal does not last for long because more sellers are convinced that they can further stretch the bear market. A new resistance level forms at the neckline. Shortly after the market bounces on the neckline and resumes the downward movement, the buyers stick their heels in, and the previous support holds, which leads to the formation of a second bottom.

Please make no mistake, and traders widely use this formation because they believe the second bottom to be a confirmation of exhausted selling pressure. Be that as it may, be advised that there is no better confirmation of a tradeable double bottom than the breaking of the neckline’s resistance level. The market’s intention is more precise about taking a turn for the upward movement once the price breaches the neckline, as shown in the diagram below.

Why are double tops and bottoms popular?

Chart patterns are an integral part of technical traders. For double tops and bottoms, the patterns are crucial when traders need to gain a more comprehensive view of the market. But this is not the only reason why they are popular. Double tops and bottoms usually form during a major or minor trend. It makes them easy to spot.

As we have seen, double tops and bottoms herald a price reversal. Hence, spotting one early and acting on it means that you will enter/exit the market earlier than investors.

Another reason double tops and bottoms are popular is the ease with which traders can incorporate fundamental analysis. Successful traders consider both the technical and fundamentals of an asset before making a trading decision. The possibility of a profitable trade is higher when technical and fundamental analysis complements each other.

Double tops and bottoms work well with fundamentals. For instance, traders can view a forex instrument’s behavior, for say, three months from both a technical and fundamental perspective. Because double tops and bottoms that form over a longer period – at least three months – are more reliable, making it easier to incorporate fundamental analysis results.

Challenges of double tops and bottoms

As with all other chart patterns, double tops and bottoms have downsides. Double tops and bottoms are simple patterns that are seemingly easy to spot. For starters, the double tops and bottoms patterns form within the area the price action reverses. It means a trader’s task is to identify the pattern when it is still actively developing. And here lies the biggest challenge.

The forex market is volatile, and sometimes the price action might take sudden and unexpected turns. We argued earlier that the best time to trade this pattern is to wait for the price to breach the neckline. But what if the double tops and bottoms are fake?

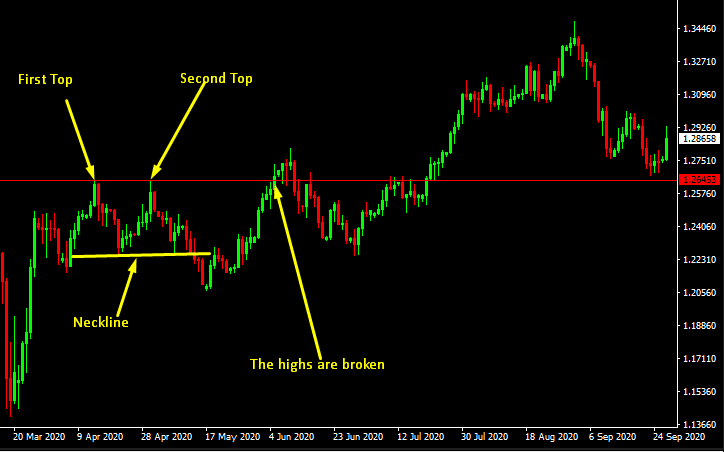

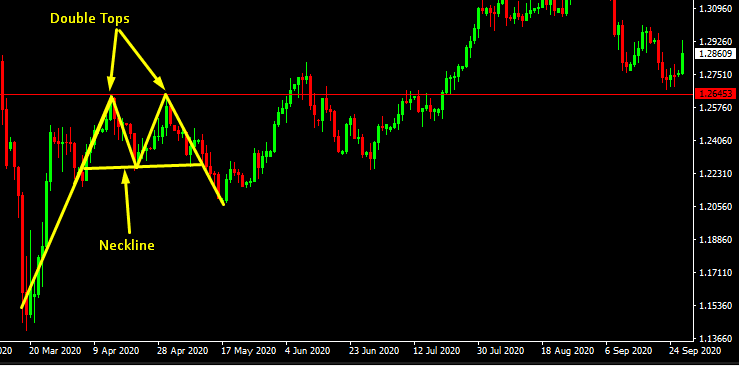

The challenge here is to confirm that the pattern is not merely a bunch of fake tops/bottoms. In the figure below, two clear tops form, but the price refuses to close below the neckline. A keen trader would have noted that this is a fake double-top and would have avoided trading the pattern. As you can see, the market intends to set into a downward move clear after closing below the neckline. However, there seems to be insufficient selling pressure to sustain the movement, and the market picks up momentum to break the resistance – at 1.26453 – one month later.

PART 2

How to trade using double tops and bottoms

Now that we have seen how double tops and bottoms form, their key characteristics, and the significant challenges, let us know how you can use the chart patterns to set up profitable trades.

Illustration 1: Trading double tops

Before we see how you can trade double tops, let us know the chart pattern in action. The figure below is a GBP/USD daily chart—a clear double-top form from late March to late May 2020.

If you were to enter the GBP/USD market using this pattern, at which point would you do so? Read on!

In the figure above, the confirmation for trading is not explicit enough, and only the risk loving traders can have the nerve to enter the market the moment the market closes below the neckline.

For more cautious traders, further confirmation is required to make a trade. Many traders want to stay out of trouble, which means they will only make a trade when evidence of a price reversal is convincing enough. Let us say you belong to this category of traders. In this case, the diagram below represents the kind of pattern you would want to see before leaping faith.

In the diagram, there is a retest of the neckline before the market continues downwards. For careful traders, this is the confirmation they need to enter the market.

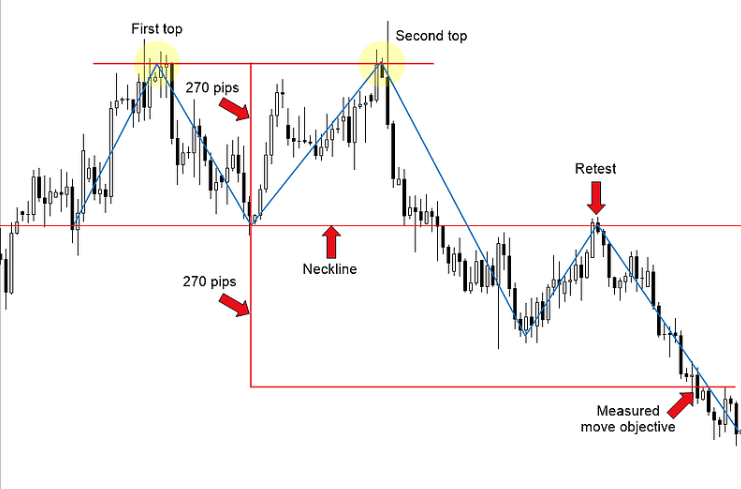

Let us see how this works out in a real-world situation. In a real-world situation, nothing is random. Even spotting a potential trading price is a product of careful calculations. One strategy that cautious traders use is to enter the market only when the price reverses for an equal amount of pips as the height of the double tops from the neckline.

In the figure below, the two peaks in the pattern are 270 pips above the neckline. Being a careful trader, you want to see the market reverse trend by the same number of pips before making a move. First, the market retests the neckline, hence passing the first test.

The second test asks to wait until the reversal approaches or covers 270 pips in a downward movement. When it finally happens, you are clear to engage! But why should this strategy work?

Many traders are like you, and they want to be sure before they commit their funds. The point marked “measured objective” in the figure below is the point where more sellers are likely to join the market. At this point, the sellers are certain that the bear market is substantial and could edge lower for longer.

Illustration 2: Trading double bottoms

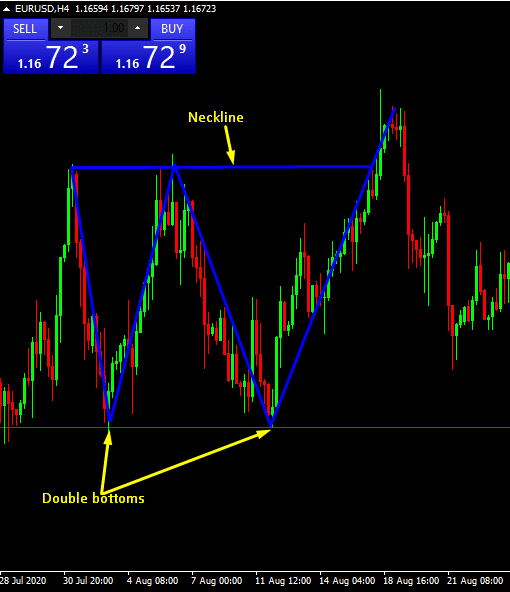

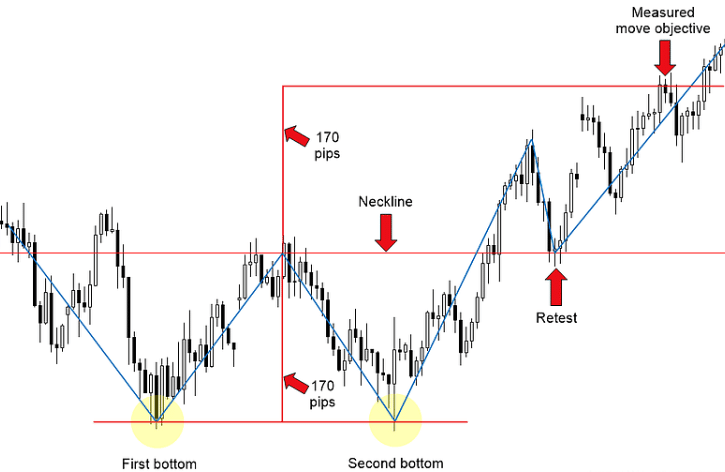

Trading double bottoms are much like trading double bottoms but in reverse. First, let us see the double bottom pattern in action. The figure below is a four-hour EUR/USD chart showing how the double-bottom pattern forms in the real world.

Trading the double bottom requires the same amount of caution that goes into trading double tops. It means that you have to wait for some confirmation before jumping into the market. Often, a retest of the neckline is an ideal confirmation, as shown in the diagram below.

To identify and trade double bottoms, one might use the “measured move” strategy, which is similar to the one employed in Illustration 1 above. The idea here is to find the price level at which the market is likely to gain more support in its quest to climb out of the trough.

It means measuring the depth of the double bottoms from the neckline (in pips) and waiting out the market until it climbs by the same number of pips before buying. In the figure below, the market’s depth from the neckline is 170 pips. The point at which you can make your move is at 170 pips up from the neckline, which is at the “measured move objective.”

Conclusion

Double tops and bottoms are easy to read, but the challenge comes when you want to trade the patterns. However, you can easily get around this challenge by waiting for the market to retest the neckline before making your move. Nonetheless, the retesting of the neckline is not enough for confirmation. Then, what you need is a strategy – which in this case is “measured move” – to help you to identify the safest price level at which to buy or sell.