Central banks play an integral role in the financial market. In times of crisis, like during the Covid-19 pandemic and the Global Financial Crisis, the market looks to central banks to intervene. During the two periods, the Federal Reserve intervened by cutting interest rates and announcing a major quantitative easing program. In this article, we will look at how the two approaches work and what tapering is.

How central bank works

To understand what tapering is, we need to look at how central banks work. For starters, a central bank is made up of several members, most of whom are economists. In the United States, members of the central bank are appointed by the sitting president and approved by the senate. This is the standard process in other countries.

The central bank has a special committee that meets several times of the year to deliberate on the state of the economy and make the appropriate decisions. The overall goal is to ensure that consumer prices are stable and that the unemployment rate is low.

In periods of economic strains, such as during the dot com bubble, the housing crisis of 2008/9, and the Covid-19 pandemic, the central bank tends to lower interest rates. By doing so, they stimulate consumer and business spending. For example, low interest rates lead to lower mortgage rates and car loans. Since consumer spending is the biggest part of the American economy, this spending leads to a more vibrant economy.

What is quantitative easing?

At times, low interest rates alone are not enough to spur spending and boost economic growth. That is why the Federal Reserve has other tools to support the economy. This tool, known as quantitative easing (QE), became popular during Ben Bernanke’s era.

QE refers to a process in which a central bank boosts liquidity in the market by buying bonds, mortgage-backed securities (MBS), and other assets. The goal is relatively simple. When the bank buys a lot of treasury bonds, it makes it cheaper for the government to borrow money to fund projects. Similarly, when it buys lots of corporate bonds, it lowers the cost of companies to borrow.

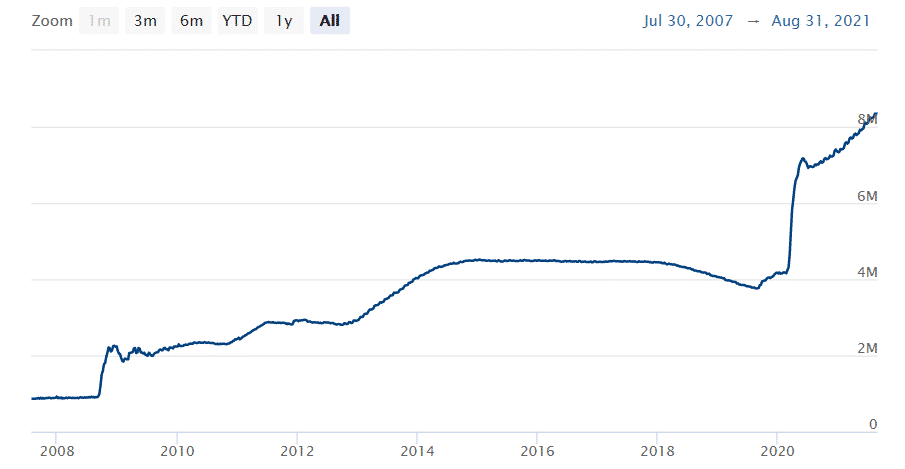

In the past few years, the Federal Reserve has boosted its asset purchases, which has, in turn, led to an expanded balance sheet. Indeed, the total assets owned by the Federal Reserve have jumped from less than $1 trillion before the Global Financial Crisis (GFC) to more than $8 trillion in 2021.

Fed balance sheet

The growth accelerated beginning in 2020 as the Fed intervened during the Covid-19 pandemic. At the time, the bank decided to pump in about $120 billion every month to the economy.

What is tapering?

A common theme about central banks is that their actions are not permanent. They typically change as the macroeconomic details change. Therefore, when the economy improves, the central bank tends to start to unwind its programs.

The first action that most central banks do is usually to slow the speed of quantitative easing asset purchases. This action is what is known as tapering.

After slowing asset purchases, the central bank then starts a process of gradually increasing interest rates. The goal of normalization is to slow the speed of economic growth and put measures in place to ensure that the bank has enough tools in case of a major economic crisis.

What is a taper tantrum?

Taper tantrum is a relatively new term that became popular in 2013 when the Federal Reserve started gradually scaling down its asset purchases. Since quantitative easing was a new thing before the pandemic, many investors became alarmed.

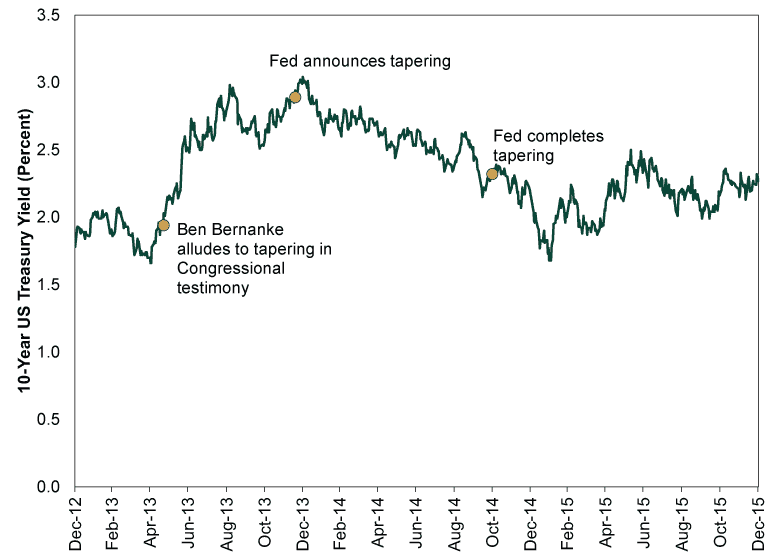

As a result, treasury bond yields started falling while stocks declined sharply. The chart below showed the performance of the 10-year yield when Ben Bernanke hinted at the need for tapering. It also shows the performance of these bonds during the tapering period.

Taper tantrum chart

The taper tantrum happened because investors believed that it was a precursor for hiking interest rates. Higher interest rates lead to a higher cost of borrowing by consumers and businesses. As a result, they slow the economy and lead to sluggish performance of the stock market.

Still, there is some consensus that another taper tantrum will not happen again. For one, the Federal Reserve has changed how it communicates with investors. After the last financial crisis, the bank adopted new communication tools known as the forward guidance. This refers to a situation where the bank informs investors in advance what it will do. Therefore, these days, the Fed meetings do not typically lead to significant market movements in stocks, bonds, and currencies.

How QE tapering works

Tapering is the opposite of asset purchases. The process starts when the Federal Reserve or other central banks tell investors that they are thinking about ending the asset purchase program. After this, the bank decides the pace of slowing these purchases.

For example, in 2020, the Bank of Canada started a large C$6 billion per month QE program. As the year came to an end, the bank slowed these purchases to C$5 billion. It then slowed the purchases to C$4 billion in April 2021.

Second, after confirming that tapering will happen, the bank starts to slowly reduce the size of the purchases. It does this by partnering with fund managers like Blackrock. This tapering is usually gradual simply because the bank wants to avoid significant shocks in the market.

Finally, tapering is usually followed by a gradual period of hiking interest rates. In theory, stocks tend to lag when the central bank starts tapering and hiking interest rates. However, in reality, stocks have done well in periods of easy money and tighter monetary policy.

Final thoughts

Tapering of asset purchases happens when the central bank starts ending its asset purchases program. It is a situation that happens when an economy is generally doing well. In this article, we have looked at how it works and what the stock market’s reaction may be like.