A bear call spread is one of the popular trading strategies among investors who are keen on investing within the margins of limited risk. It involves putting a short call whose strike price is lower while at the same time going for a long call whose strike price is higher.

Using this combination, the investor has a chance of making a profit while at the same time limiting their risks. In this case, the short call takes care of the profit while the long call covers the investor by limiting losses.

An investor’s profit margin will depend on the premium they paid. This being a bearish approach to trading, the investor will place his bet on the market trading below the strike price. However, in case the stock price goes above the strike price, the investor will count on the long call to cover their losses.

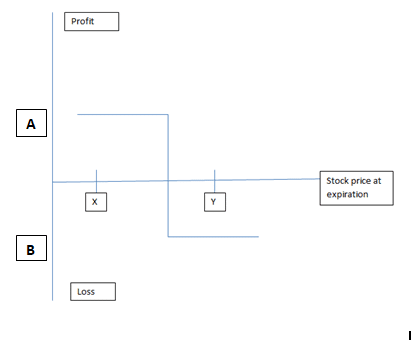

The “spread” refers to the margin between the upside of the strike price and the downside. In the chart above, Y-X will give the difference between the two strike prices. On the other hand, B-A will give us the maximum risk per share.

How much profit can you make?

This being a cautious approach to trading, the margin of gain is largely reduced. Maximum profits are returned when the stock stays below the strike price for the long call as well as the short call at the time of expiry. This creates a double-kill scenario, with the investor making money from both positions.

However, the margin of the downtrend will almost certainly be limited under normal market conditions, unless you are trading in a volatile market or unfortunate circumstances adversely affect the stock’s fundamentals.

Profit and loss margins

This strategy may at times result in a zero-sum effect or marginal losses or profits. If the expiry date comes in during an uptrend, then an investor’s losses will be covered if the closing price is at the upper strike price. If the price goes beyond the upper strike price at expiration, then the losses from the short call will be covered by the long call gains, with marginal profits made.

If the expiry date for the contract comes when the lower strike price is below the stock price then there will be reduced profits. The rule of thumb is that the profit and loss margins remain limited as long as the stock is within a short distance of either of the strike prices. Any significant movements beyond the strike price lead to an increase in the net profit.

Breakeven price

The investor will be at breakeven if the closing price of the stock at expiration is more than the lower strike price by the same margin as the discount. This results in a zero-sum result for the long call.

The effect of implied volatility

This is a phenomenon that affects the performance of options due to the effect it has on the trading behavior in the marketplace.

When implied volatility rises, it means that the price is set to follow in tow, which favors those owning the options but puts sellers at a disadvantage. If the volatility goes down, then sellers have an upper hand because they stand to make a profit when their strike price is breached.

On the other hand, option owners are disadvantaged by this. Options sellers hope for a rise in implied volatility because it raises the value of the near-the-money buy option at a faster rate than the in-the-money sell option. In addition, it also increases the chances of an upward price movement.

Advantages of bear call spread strategy

- It gives investors a chance to gain earnings from the premium, while at the same time minimizing their risk level.

- Options often reach expiration without having been exercised. With this in mind, initiators of the bear call spread have the upper hand because of the time value. They can exercise their option when the probability of profiting is higher, in as much as they can choose to let go of their options and lose the premium. The premium is a”small” risk to take compared to the profit.

- It is a flexible trading strategy, which caters to the needs of both high-risk investors and low-risk investors. This is doable by choosing widespread margins for high-risk and narrow spreads for low-risk investors.

- Its margins are friendly to investors relative to naked calls because they are comparatively narrower and lower.

The bear call spread disadvantages

- The risk levels are relatively high as compared to the potential profits, which are often marginal.

- Short call options have a risk of early assignment, which may lead to losses when the expiration comes at a time when the short option strike price is in the money. Markets are prone to dynamics that can cause a sudden upsurge in prices even at an unexpected time.

- Bear call spreads are most effective in volatile markets, which have periodic tendencies to trade below the “usual” levels. This limits the possibility of making above-normal profits using the strategy.

Bottom line

A bear call spread is an effective strategy for investors who are keen on making decent profits. It provides flexibility as to the level of risk that an investor can take, through its dynamic margins. However, the risk levels may at times be disproportionately higher than the expected profits.