By the virtue of being a large and diverse market, the forex market offers opportunities to employ a number of different strategies to capture profits. Forex price movements too are dictated by a multitude of factors including macroeconomics and technical price levels. The existence of different indicators and strategies create a dilemma for a forex trader, especially a new one. Which strategy to start with? Which strategy offers the best risk reward ratio? For a new forex trader, finding a firm footing is more important than anything else. For this purpose, a strategy that offers a high success ratio with a limited downside would suit perfectly.

Arbitrage – Exploiting mispricings in the market

This is where the forex arbitrage strategy comes in. Let us first understand what arbitrage is. In the financial world, often a situation arises where two assets which are very similar have a significant price difference. Let us say for example we have two assets A and B both very similar. But A is trading at $100 and B is trading at $95. Now market forces dictate that one of these two assets are mispriced and either the price of A should fall or the price of B should rise. But we don’t know which of these would happen.

So what we can do is to go short asset A and go long asset B. So effectively, instead of betting on the price move of the individual assets, we will be betting on the difference between their prices which is $5. So no matter which asset moves, the price difference will become $0 and we will be able to lock in a profit of $5 for this trade. This is called arbitrage trading.

In practice, arbitrage trades are mainly done on stocks which have listed futures. The traders short the futures which typically trade at a higher price and go long the stock in the cash market. At the end of the futures expiry, they are able to capture the difference.

Arbitrage trading in the Forex market

In the Forex market, there are several different ways to employ the arbitrage strategy. We explore these below:

Future spot arbitrage

As discussed above for stocks, in the forex market too traders can take opposite positions in the spot and future markets if this discovers a significant pricing differential. For example if EURUSD is trading at 1.21 in the futures markets and at 1.19 in the spot market, then the trader can short the EURUSD futures and long the EURUSD in the spot market.

Cross currency arbitrage

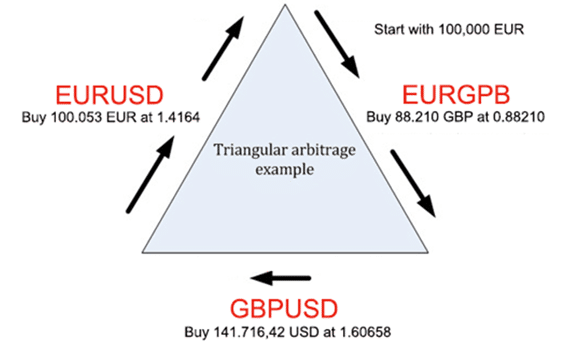

This strategy is particularly interesting because it involves different currency pairs. As we know the currency pairs reflect relative valuation of the currencies. So EURUSD trading at 1.41 essentially means that we have to pay 1.41 USD to buy 1 EUR. Similarly GBPUSD trading at 1.6 means that we have to pay 1.6 USD to buy 1 GBP.

So effectively the knowledge of the prices of these two pairs also tell us at what price EURGBP should be trading in theory. For example, based on above rates, we sell 1 EUR to get 1.41 USD in return. Then if we use 1.41 USD to buy GBP, we will receive 0.88 GBP because the prevalent rate of GBPUSD is 1.6. So if 1.6 USD yields 1 GBP, then 1.41 USD would yield 0.88 GBP. So this means that the EURGBP rate in the market should be 0.88.

But what if the rate at which EURGBP is trading at the market is different? This gives us an arbitrage opportunity. As discussed above, using three different transactions we can sell 1 EUR to obtain 0.88 GBP. Now if the market rate of EURGBP is 0.85 then we can simply buy the currency pair at this lower existing market rate. Then we can employ the above discussed triangular cross currency arbitrage trade to sell at 0.88. So basically we will earn an instant return of 0.03 cents with all our capital back with us. So we can do this trade repeatedly till the price differential stops existing or becomes insignificant.

Covered interest rate arbitrage

This arbitrage strategy involves macroeconomic dynamics. It works well when one of the legs of the currency pair is a high yielding currency such as INR (Indian Rupee) or IDR (Indonesian Rupiah). The underlying logic of this trade is quite simple.

Developed markets such as the US, the UK and the European Union have very low interest rates. That means holding the currency of these regions gives little yield. On the flip side, the borrowing rates are quite low as well and at times even negative. For example, several bonds in the EU and Japan are trading at negative rates.

On the other hand, emerging markets such as India and Indonesia offer high yields with their bonds giving returns of 6 to 7%. So one can borrow funds in a lower yielding currency such as USD or EUR and then invest those funds into higher yielding currencies like INR or IDR. Then one can easily earn the interest rate differential on this trade.

For example the USDINR is trading at 75. So I borrow $1000 at 1% rate for 1 year. So at the end of the year I have to pay back $1010. I then convert $1000 to INR 75000 and invest in Indian bonds which give 7% interest. At the end of the year I convert back the entire amount with interest which will be $1070 and pay back the loan amount of $1010 to earn an easy profit of $60.

However one major risk in this trade is that the USDINR rate might not be the same at the end of the year. To protect against this, one can simply short the USDINR to hedge against any currency movements.

Above we discussed three major arbitrage strategies for the forex market. The main advantage of these strategies are that they are less risky and have a higher success ratio.